Ýêîíîìè÷åñêèå íàóêè/ 10.Ýêîíîìèêà

ïðåäïðèÿòèÿ

Shynara Jumadilova, Nurlan Sailaubekov

Kazakh National Technical University after K.Satpaev,

Kazakhstan

International Business Academy, Kazakhstan

Capital Structure Management of Oil and Gas Company

Nowadays, one of the main tasks of economic development is occupation of

stable positions of the enterprises in domestic and international markets. Financial and economic sustainability of the enterprise is the company's ability to operate in a changing

internal and external environment, while maintaining a constant solvency and

investment attraction [1]. Therefore,

indicators of capital structure should be considered in evaluating and

analyzing the financial and economic sustainability of the enterprise.

Capital structure ratios: shareholders’ equity ratio; liabilities as percent of shareholders’ equity;

debt ratio; fixed assets as percent of shareholders’ equity; working capital as

percent of current assets; working capital as percent of shareholders’ equity; liquidity

of working capital; working

capital ratio; long-term liabilities as percent of fixed assets; relation of working capital to inventory; relation

of accounts receivable and current liabilities.

Therefore, indicators for capital structure ratios calculation are: ShE – shareholders’ equity; TA – total assets; CL – current liabilities; FA

– fixed assets; WC – working capital; CA – current assets; C&MS – Cash and marketable

securities; LTL – long-term liabilities; I – inventory; AR – accounts

receivable.

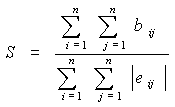

Evaluation of financial and economic sustainability, or the proximity

evaluation of the actual and regulatory indicators relations in terms of their

growth is calculated as follows:

,

,

where: S - evaluation of financial and economic sustainability of the

enterprise; n - number of indicators in the regulatory model; i, j – the

sequence numbers of indicators in the regulatory model; bij - the

element of the matrix of matches of the actual and standard ratios growth

rates; eij - the element of the matrix of ratios relations between

the growth indicators.

Sustainability evaluation varies from 0 to 1. The closer the evaluation

sustainability to 1, the more the regulatory relationships between the

indicators are satisfied.

We use a regulatory model for evaluation of the financial leverage. This

regulatory model was made on the basis of capital structure ratios. It is as

follows [2]:

Table 1 – The Regulatory Model for Evaluation of the Financial Leverage

|

Indicators |

ShE |

TA |

CL |

FA |

WC |

CA |

C&MS |

LTL |

I |

AR |

Amount |

|

ShE |

0 |

1 |

1 |

1 |

-1 |

0 |

-1 |

1 |

0 |

0 |

6 |

|

TA |

-1 |

0 |

-1 |

0 |

-1 |

-1 |

-1 |

1 |

0 |

-1 |

7 |

|

CL |

-1 |

1 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

-1 |

6 |

|

FA |

-1 |

0 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

0 |

4 |

|

WC |

1 |

1 |

1 |

1 |

0 |

1 |

-1 |

1 |

1 |

0 |

8 |

|

CA |

0 |

1 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

0 |

4 |

|

C&MS |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

0 |

8 |

|

LTL |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

0 |

0 |

-1 |

8 |

|

I |

0 |

0 |

0 |

0 |

-1 |

0 |

-1 |

0 |

0 |

0 |

2 |

|

AR |

0 |

1 |

1 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

56 |

The database in this study is financial statements of JSC

MangistauMunaiGas.

At present JSC

MangistauMunaiGas is one of the largest oil and gas companies of Kazakhstan and

provides more than 8% of production in the country [3].

In Table 2, calculated the actual growth rates based on the consolidated

financial statements of MangistauMunaiGas.

Table

2 - Growth Rates of Financial Leverage Indicators

|

Indicators |

years |

∆2009 /2008 |

∆2010 /2009 |

||

|

2008 |

2009 |

2010 |

|||

|

ShE |

941052 |

1214893 |

1530896 |

1,58 |

1,26 |

|

TA |

2116871 |

1873900 |

2037959 |

1,09 |

1,09 |

|

CL |

973843 |

301753 |

268655 |

0,38 |

0,89 |

|

FA |

1323801 |

1137355 |

1192390 |

1,05 |

1,05 |

|

WC |

-382750 |

77538 |

338506 |

1,25 |

4,36 |

|

CA |

793070 |

736545 |

845568 |

1,14 |

1,15 |

|

C&MS |

81748 |

109759 |

309248 |

1,65 |

2,81 |

|

LTL |

201976 |

357253 |

238408 |

2,17 |

0,67 |

|

I |

161783 |

60857 |

76367 |

0,46 |

1,25 |

|

AR |

285151 |

248559 |

308440 |

1,07 |

1,24 |

On the basis of the consolidated financial statements is created a

matrix of actual growth rates of financial leverage indicators (tables 3 and 4).

Table

3 - Matrix of Actual Growth Rates for the Base Period

|

Indicators |

ShE |

TA |

CL |

FA |

WC |

CA |

C&MS |

LTL |

I |

AR |

|

ShE |

0 |

1 |

1 |

1 |

1 |

0 |

-1 |

-1 |

0 |

0 |

|

TA |

-1 |

0 |

1 |

0 |

-1 |

-1 |

-1 |

-1 |

0 |

1 |

|

CL |

-1 |

-1 |

0 |

0 |

-1 |

0 |

-1 |

-1 |

0 |

-1 |

|

FA |

-1 |

0 |

0 |

0 |

-1 |

0 |

-1 |

-1 |

0 |

0 |

|

WC |

-1 |

1 |

1 |

1 |

0 |

1 |

-1 |

-1 |

1 |

0 |

|

CA |

0 |

1 |

0 |

0 |

-1 |

0 |

-1 |

-1 |

0 |

0 |

|

C&MS |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

-1 |

1 |

0 |

|

LTL |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

|

I |

0 |

0 |

0 |

0 |

-1 |

0 |

-1 |

0 |

0 |

0 |

|

AR |

0 |

-1 |

1 |

0 |

0 |

0 |

0 |

-1 |

0 |

0 |

Table

4 - Matrix of Actual Growth Rates for the Reporting Period

|

Indicators |

ShE |

TA |

CL |

FA |

WC |

CA |

C&MS |

LTL |

I |

AR |

|

ShE |

0 |

1 |

1 |

1 |

-1 |

0 |

-1 |

1 |

0 |

0 |

|

TA |

-1 |

0 |

1 |

0 |

-1 |

-1 |

-1 |

1 |

0 |

-1 |

|

CL |

-1 |

-1 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

-1 |

|

FA |

-1 |

0 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

0 |

|

WC |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

0 |

|

CA |

0 |

1 |

0 |

0 |

-1 |

0 |

-1 |

1 |

0 |

0 |

|

C&MS |

1 |

1 |

1 |

1 |

-1 |

1 |

0 |

1 |

1 |

0 |

|

LTL |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

-1 |

0 |

0 |

-1 |

|

I |

0 |

0 |

0 |

0 |

-1 |

0 |

-1 |

0 |

0 |

0 |

|

AR |

0 |

1 |

1 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

Conformity of the actual relations with the regulatory model for the periods

under consideration is: 34 for the base and 52 for the reporting period. Consequently,

generalized evaluation of financial and economic sustainability on financial

leverage indicators is: ![]() -

for the base period and

-

for the base period and ![]() -

for the reporting period.

-

for the reporting period.

Then we identify factors of sustainability growth. The factors of

sustainability growth are the indicators, which impact on the overall

evaluation of the financial leverage in the reporting periods, as well as to

evaluate the impact degrees of these factors. This requires the factorial

analysis of financial leverage evaluation.

Table

5 – Factor Analysis of Financial and Economic Sustainability on Financial Leverage

Indicators in the Reporting Period

|

Indicators |

¹ |

Conformity |

Deviations |

Impact on |

||||

|

2009 |

2010 |

2010 |

Increase of

sustainability |

Value of

sustainability |

||||

|

absolute |

% |

absolute |

% |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

9 |

10 |

|

ShE |

1 |

4 |

6 |

0 |

0,0357 |

5,88 |

0 |

0 |

|

TA |

2 |

4 |

6 |

1 |

0,0357 |

5,88 |

0,0179 |

4,55 |

|

CL |

3 |

4 |

5 |

1 |

0,0179 |

2,94 |

0,0179 |

4,55 |

|

FA |

4 |

3 |

4 |

0 |

0,0179 |

2,94 |

0 |

0 |

|

WC |

5 |

6 |

7 |

1 |

0,0179 |

2,94 |

0,0179 |

4,55 |

|

CA |

6 |

3 |

4 |

0 |

0,0179 |

2,94 |

0 |

0 |

|

C&MS |

7 |

7 |

7 |

1 |

0 |

0 |

0,0179 |

4,55 |

|

LTL |

8 |

0 |

8 |

0 |

0,1429 |

23,53 |

0 |

0 |

|

I |

9 |

2 |

2 |

0 |

0 |

0 |

0 |

0 |

|

AR |

10 |

1 |

3 |

0 |

0,0357 |

5,88 |

0 |

0 |

|

Total |

34 |

52 |

4 |

0.32 |

52.94 |

0.07 |

18.18 |

|

Conclusion

Most

indicators’ dynamics improved during reporting period. At the same time

indicators TA, CL, WC and C&MS declined. Their common impact on increase of

sustainability made up 0.32 or 53%. Total evaluation of financial and economic

sustainability on financial leverage indicators in 2010 is 0.93.

In

order to satisfy regulatory matrix is necessary to:

1.

Increase CL to 22%;

2.

Increase C&MS for 56% or reduce WC on 36%.

References:

1.

Sh. Jumadilova. The economic content of the financial sustainability of the

enterprise under modern conditions / / Bulletin of KazNU. econ. ser. - ¹1 (83).

- 2011. - pp. 46-50

2.

N. Sailaubekov. Methods of analysis of complex economic and financial

activities of the enterprise based on dynamic standard / /Bulletin of the Turan

University. -¹ 3 (39)- 2008. - pp. 64-66

3.

Official site of JSC MangistauMunaiGas / / http://www.mmg.kz/