Economic nauki/13. Regional Economy

PhD in Economics Kiyatkina E.P.

Samara State

University of Architecture and Civil

Engineering, Russia

Formation

of prospective mechanisms for attracting the residential construction

investments

One of the main directions of the reforms, being carried out in

residential sphere, is the elaboration of the mechanism for the housing

programme implementation using both

budget and off-budget financial resources. This mechanism is based on the

optimization of structure of housing fund and residential construction. It is

obvious that the necessary changes of unfavourable existing tendencies of

residential sphere development are so great,

that they exceed the adaptive abilities of the existing control system

of urban functioning and development.

There were a lot of different attempts to create and implement various

forms of residential sphere investment, both on the federal and regional

levels, during the exchange relations development in Russia. A fair quantity of

methodological approaches was worked out in national and foreign scientific

works to organize long-term crediting in the residential sphere. As a rule, the

majority of methods require an amendment of existing regional (or federal)

legislation or establishment of new business and non-business corporations.

Complex representation of existing mechanisms and tools of construction

investment and home purchasing, their advantages and disadvantages can be

represented in the following table, which includes the current and prospective

mechanisms for attracting the residential construction investments taking into

account advantages and disadvantages with reference to consumer groups of population depending on income level.

Table

1 – Analysis of current and prospective mechanisms for attracting the

residential construction investments

|

Advantages |

Disadvantages |

Consumor groups income RUB /month per man |

|

Housing bonded debt (HBD) |

||

|

State guarantees. The price

of a bond is fixed on basis of construction costs and indexed as on the

valuation changes of construction. Focus on wide sections of the consumers

and investors. Possibility of bond

and mortgage programmes joint operation. |

Inadequate legal

and financial guarantees of the Russian Federation for today’s efficient

functioning of the mentioned scheme.

Low bond yield means low appeal for prospective investors and doesn’t ensure broad involvement of means

in construction. Bond indexing doesn’t give view of the situation at the

financial market. |

Over 2000 |

|

It covers primary and

secondary housing markets. Protection

of bondholders’ interests from the impact of inflation. Weak dependence on budgeted investment. There

are no age and place registration limits.

There is no need in warrantors, income declaration, and insurance. |

Absence of the reinvestment

mechanism. Long-term kind of accumulation of money for the purchase of

housing habitation. Complicate and

labour intensive organizational mechanism.

Budget limits. |

|

|

Mortgage lending |

||

|

Market

mechanism of housing habitation

crediting is realized. The possibility of transition to the classical form of

mortgage credit lending, employment of credit and financial market. High qualification of credit operation

performing. It is possible to register the housing habitation under the

ownership of the loan-subscriber at once.

|

Terms of credit are out of

reach for the majority of population Dependence on budgetary investment.

Problematic character of application

of recovery against mortgaged property. The organizational and methodological

scheme is worked out poorly. Borrowers’ extra expenses (insurance,

evaluators, realtors and notary

services). |

Over 3500 |

|

Shared construction |

||

|

It

attracts the population to invest in construction. Progress payments for the

housing. The possibility of buying housing habitation at the primary market

with better consumer qualities. There is a an organizational mechanism. |

Housing is affordable for highly paid categories of people. High

probability degree of delay in construction and rise in price for housing.

Failure to comply the undertaken obligations by building companies. The

mechanism of insurance against risks isn’t worked out enough. There is legal

insecurity of investors. |

Over 5500 |

|

Regional programme with the use of budgetary funds |

||

|

State guarantees of housing for vulnerable social groups. Housing

purchase without appearance of money obligations. The organizational

mechanism is worked out in detail. |

The restriction

of suggested housing types. Orientation to

unprovided-for layers of society.

Strong dependence on fill rate of the local budget . Bureaucratized

system of organizational mechanism realization. |

Less 2000 |

|

Commercial apartment building |

||

|

It is possible to buy a comfortable

housing. Habitation since conclusion of agreement. Follow-up buying-out of the

housing is possible. |

It doesn’t stimulate the

housing market, doesn’t involve other housing programmes and secondary

housing market. Privatization is impossible. |

More 4000 |

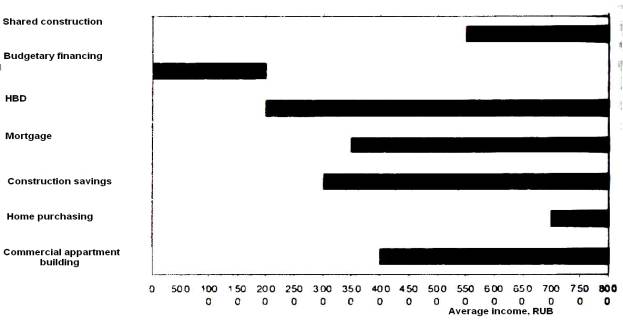

Fig. 1 - Stratification of construction investments

mechanisms and home purchasing in terms of average income of the population

Fig. 1 - Stratification of construction investments

mechanisms and home purchasing in terms of average income of the population

The following conclusions were made according

to the results of the carried out analysis:

1.

Neither of these mechanisms of construction investment and housing

purchase can separately claim to solve the housing problem. Each of them has

its obvious advantages and disadvantages. These mechanisms are orientated to

different social groups and different conditions of their realizations. Thus,

these mechanisms are not mutually exclusive but they supplement each other. The

HBD mechanism is the most accessible for implementation, because it covers

almost all payable groups of population.

2.

For solving housing problem in regions it is necessary to consider all

mechanisms of construction investment and housing purchase as a whole uniform

system with their significance ranking for each specific territory. In

addition, the regional particularities of socio-economic and national

development must be considered. At the present time, there isn’t such system

approach in regional housing policies and executive authorities don’t pay due

regard to this question.

Creating specialized housing investment funds

with state participation

can be an efficient form of big capital formation. The conditions, that

ensure inflow of these funds, can be high yield (exceeding or at least

comparable with the deposit interest of trading banks) and first-rate payback

guarantees (Ministry of Finance of the Russian Federation warranty, etc.).

Another variant is the emission of specialized high-yielding government

securities and further market of their large and small blocks with introduction

of tax remissions on income. Such form of obtaining funds provides with direct

links of money resources of population with investment in construction sector,

excepting intermediary activity of banks which presupposes the contribution of

fractions of revenue in form of bank margin.

However, working out and development of such

mechanisms must be based on economic and mathematical planning and numerical

experiments with the use of the worked out models.

Literature:

1. Assaul A.N., Batrak

A.V. Corporate structure in regional

investment and construction complex. Moscow, 2006. – 168 p.

2. Arsenova E.V., Kryukova O.G. Economics of

organizations (enterprises): reference book in schemes. Moscow, Finances and

statistics, 2009.