Ñîâðåìåííûå èíôîðìàöèîííûå

òåõíîëîãèè/1. Êîìïüþòåðíàÿ èíæåíåðèÿ

cand. tech. sci. Semakhin A.M.

Kurgan State University,

Russia

DUAL MODEL

OF INFORMATION SYSTEM

The theory of a

duality of problems of linear programming has great value in the theoretical plan

and represents the big practical interest. On the basis of the theory of a

duality the algorithm of the decision of problems of linear programming - a

dual simplex a method and effective methods of the analysis of models is

developed /1/.

Let's develop mathematical

model of linear programming and we shall carry out symmetric structural

transformation of conditions of a direct problem to a dual problem. We shall

define the optimum decision and we shall lead the analysis of dual model.

The direct

mathematical model is formulated as follows: from among the firms, rendering

services satellite Internet in territory of the Russian Federation, preliminary

selected by the average expert estimations, it is required to choose the

provider satellite Internet with the maximal size of the net present value

(NPV) and satisfying to financial restrictions.

The mathematical

model of a choice of the optimum investment project satellite Internet in a

general view is represented as follows:

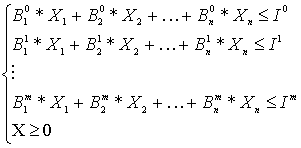

![]()

under restrictions (1)

where ![]() is a target parameter, unit of

measurement;

is a target parameter, unit of

measurement;

![]() is investment

expenses of i project in j period of time, million. roubles;

is investment

expenses of i project in j period of time, million. roubles;

![]() is available means of

financing in j period of time, million. roubles;

is available means of

financing in j period of time, million. roubles;

![]() is a share of financing of the

investment project;

is a share of financing of the

investment project;

![]() is a number of the

investment project;

is a number of the

investment project;

![]() is a number of the

period of time, year.

is a number of the

period of time, year.

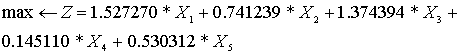

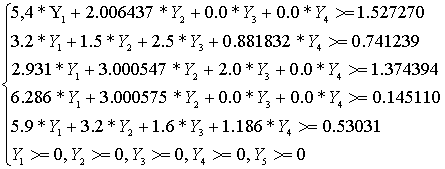

After calculation of

parameters the mathematical model of a choice of the optimum investment project

satellite Internet looks like:

under restrictions (2)

The dual model is

developed by rules.

1. To each

restriction of a direct problem there corresponds a variable of a dual problem.

2. Each variable

direct problem there corresponds restriction of a dual problem.

3. The matrix of

factors of system of restrictions of a dual problem turns out from a matrix of

factors of system of restrictions of a direct problem transposing.

4. The system of

restrictions of a dual problem enters the name in the form of inequalities of

opposite sense to inequalities of system of restrictions of a direct problem.

5. Free members of

system of restrictions of a dual problem are factors of function of the purpose

of a direct problem.

6. The dual problem

is solved on a minimum if criterion function of a direct problem is set on a

maximum and on the contrary.

7. As factors of

criterion function of a dual problem free members of system of restrictions of

a direct problem serve.

8. If a variable of

direct problem ![]() , that i condition of system of restrictions of a dual problem is an

inequality, if

, that i condition of system of restrictions of a dual problem is an

inequality, if ![]() - any number i the condition of

a dual problem represents the equation.

- any number i the condition of

a dual problem represents the equation.

9. If j the parity

of a direct problem is an inequality, a corresponding estimation j a resource -

variable ![]() , if j the parity represents the equation a variable of dual problem

, if j the parity represents the equation a variable of dual problem ![]() - any number /1/.

- any number /1/.

Let's lead

symmetric structural transformation of a direct problem to return according to

rules. In a general view the dual model will enter the name as follows.

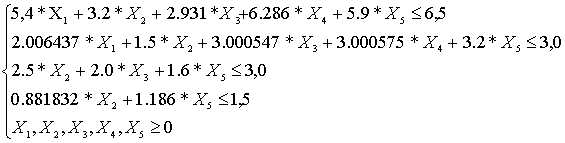

![]()

under restrictions (3)

Where ![]() -pure current cost of monetary

streams, million roubles.;

-pure current cost of monetary

streams, million roubles.;

![]() -Investment expenses

of i-th project in j-th period of time, million roubles.;

-Investment expenses

of i-th project in j-th period of time, million roubles.;

![]() - available means of

financing in j-th period of time, million roubles.;

- available means of

financing in j-th period of time, million roubles.;

![]() A-estimation of money resources

of financing in j the period of time;

A-estimation of money resources

of financing in j the period of time;

![]() -Number of the

investment project;

-Number of the

investment project;

![]() - number of the

period of time, year.

- number of the

period of time, year.

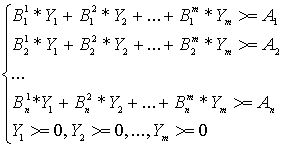

The dual

mathematical model with numerical parameters of factors looks like.

![]()

under restrictions (4)

The optimum decision of a dual problem is

presented in table 1.

Table 1

The optimum decision of a dual problem

|

Variable |

Size of variables |

Dual estimation |

Extremum of criterion function |

|

|

0,1768 |

6,0000 |

2,00526 |

|

|

0,2853 |

0,0000 |

|

|

|

0,0000 |

2,3881 |

|

|

|

0,0000 |

1,5000 |

|

|

|

0,0000 |

1,0376 |

|

|

|

0,2526 |

0,0000 |

|

|

|

0,0000 |

0,3060 |

|

|

|

1,8225 |

0,0000 |

|

|

|

1,4259 |

0,0000 |

The bottom and top borders of intervals of

stability of the optimum decision to change of factors of criterion function

are presented in table 2.

The bottom and top borders of intervals of stability of the optimum

decision are resulted in change of the right parts of restrictions in table 3.

The bottom and top borders of intervals of

stability of the optimum decision are resulted in change of the right parts of

restrictions.

Results of the lead researches have allowed

to draw following conclusions.

1. The optimum decision of a direct problem

of a choice of the project satellite Internet defines the list of financed

projects and shares of financing.

2. The decision of a dual problem defines

optimum system of estimations of the resources used for realization of

projects.

Table 2

Factors of criterion function of dual model

|

Number of the subitem |

Variable |

The minimal value

of factor |

Reference value of factor |

The maximal value factor |

|

1 |

|

2,9305 |

6,5000 |

8,0740 |

|

2 |

|

2,4152 |

3,0000 |

5,2824 |

|

3 |

|

0,6119 |

3,0000 |

+ |

|

4 |

|

0,0000 |

1,5000 |

+ |

Table 3

Values of the right parts of system of restrictions of dual model

|

Number of the subitem |

Free member of

the right part of restrictions |

The minimal value

of the right part of restrictions |

Reference value

of the right part of restrictions |

The maximal value

of the right part of restrictions |

|

1 |

|

1,0265 |

1,5273 |

2,5321 |

|

2 |

|

- |

0,7412 |

0,9938 |

|

3 |

|

0,8290 |

1,3744 |

2,2840 |

|

4 |

|

- |

0,1451 |

1,9676 |

|

5 |

|

- |

0,5303 |

1,9562 |

References:

1. G. P. Formin.

Mathematical Methods And Models In Commercial Activities.: Textbook – M.:

Finansy I Statistika, 2001. – 544 p.