Risks and its

Management after Financial Crisis in Kazakhstan

According to

the vice-president of “Akmola Stroi” financial crisis brought many changes in

this industry”. The manager in “Sembol construction” said that crisis is “a

risk for some of companies, but for another it is the opportunity”. Crisis had

two effects: construction stopped, many companies go bankrupt and many workers

lose their jobs, however for managers of construction companies that survived

this was an opportunity for growth. “We become more wise and prudent” said the

manager of “Akmola Stroi. Before to start any project they carefully analyse

it. For example, now they are carefully observing the economy of neighbour

country Russia, because they procure materials from that country. They with

awareness sign any contracts or agreements and try to take under consideration

and negotiate any incompliance in advance. Contract is conventional method to

minimize risks. After financial crisis such risk as currency fluctuation become

very significant since economies of Kazakhstan and neighbour countries around

become unstable. For instance, financial crisis brought such event as

devaluation of national currency “Tenge”. Because of that event many companies

lose lots of money. Now this kind of risks construction companies try to

minimize through financial instrument such as “Hedging”. According to Buzzle

Hedging is a financial instrument such as options, futures and swaps that are

used to minimize risks which arise from changes of the price of one currency

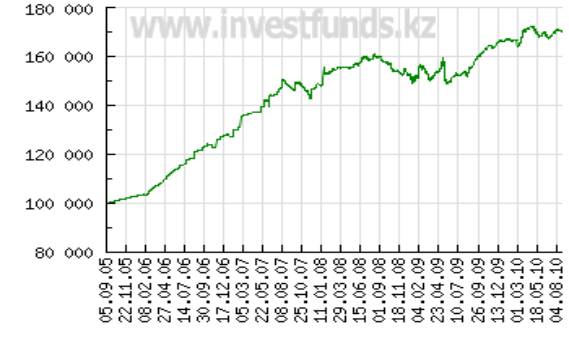

against another. For example, graph 4.1 shows how price of US Dollar is

appreciating against national currency of Kazakhstan “Tenge”. For example, when

one party wants to buy another currency and he thinks that currency which he

wants to buy will appreciate against his currency. To minimize the effect of

those changes he can buy futures, options or swap contracts. These contracts

will give right to buy a currency at initial rate.

After crisis

all prises decreased. Precisely, prices for materials decreased, but in the

same time the prices for housing also decreased, consequently now construction

companies make less profit than they did before crisis. Managers state that now

for some buildings if it is too risky but return is huge companies make joint projects,

by that way they divide risk for two parties. Because of financial crisis

demand for housing sharply decreased. This significantly hit companies.

Managers of the companies state that it was impossible to foresee this

financial crisis. However, even this event significantly affects construction

companies technical risks in residential construction industry mostly stay the

same, except demand for housing and economic risk like currency fluctuations.

Graph 4.1

Tendency of Currency “Tenge” against US Dollars

Adopted from www.investfunds.kz

According

to Kahkonen and Artto (1997) risk identification is the most critical and

important step in project risk management process. During the secondary

research it were identified various risks associated with constructions.

Mainly, they were based on the research of Kahkonen and Artto (1997) and

El-Sayegh (2008). Risks identified by El-Sayegh (2008) are presented in the

table 5.1.

Table 5.1. Most significant risks in construction industry

|

Risk |

|

1. Inflation and

sudden changes in prices |

|

2. Owners’

unreasonably imposed tight schedule |

|

3. Subcontractors’

poor performance and management |

|

4. Delay of material

supply by suppliers |

|

5. Change of design

required by owners |

|

6. Owners’ improper intervention

during construction |

|

7. Shortage in

manpower supply and availability |

|

8. Delays in approvals |

|

9. Lack or departure

of qualified staff |

|

10. Shortage in

material supply and availability |

The table

5.2 presents the most significant risks identified in residential construction

industry in Kazakhstan. Basically, these risks, as it was stated by respondents

were before financial crisis and after. However, after financial crisis some

risks become more significant than others. For instance, risk like currency fluctuations

or changes of prices for materials are risks that become more significant after

financial crisis. According to respondents these risks depend to internal and

external economic condition and out of manager’s control.

Table 4.1

List of the most Significant Risks Identified in Kazakhstan Market

|

1 |

Corruption |

|

2 |

Financial |

|

3 |

Change of materials price |

|

4 |

Change of design after work has started |

|

5 |

Logistics risk |

|

6 |

Communication problems |

|

7 |

Poor quality of workers |

|

8 |

Delays in materials delivery |

|

9 |

Architectural risks |

|

10 |

Weather conditions |

In comparison of risks written in

literature review and research findings it can be said that they are similar.

Risks like change

of materials price and inflation and sudden changes in prices,

delays

in materials delivery and delay of material supply by suppliers, change of

design after work has started and change of design required by owners are

mainly same.

Risk like corruption

plays very important role in the industry. It directly affects the success of

the construction projects. As it was stated by Macomber

(2001) there are three types of risk that affect success of a project, they are

financial risk, schedule risk and quality risk. Risk of corruption

significantly affects all three aspects of project. For example, the money that

was prepared to finance a project will go for corruption. This affects quality

because managers will procure fewer materials for construction. Also this will

affect duration of the construction project because a company will have to hire

fewer workers. For instance, if according to El-Sayegh’s (2008) most

significant risk can be change of materials or inflation, in this country the

most significant risk is corruption.

Also those risks

identified in Kazakhstan construction companies can be classified according to

El-Sayegh’s (2008) Classification of Risks (see figure

2.1). Risks like corruption and communications with government can be

classified to political risk. Change of materials price, currency fluctuations

and decreased demand for apartments can be arranged to economic risk. A weather

condition in the city of Astana is natural risk. Change of design, delays with funding to contractors can be

classified to owner’s risks.

In comparison with the risks

stated by Kahkonen

and Artto (1997) it can be said that in addition to risks associated with

owners it can be added corruption and problems with funding. Kahkonen and Artto

(1997) argue that risk of defective design can

be transferred to architect or engineer, however according to manager of

“Sembol Constructions” company they face risk with architects. When an

architectural firm do not possess enough experience they face risk that a

project will be submitted late or with defections.

References

·

How to analyse qualitative data, available at

URL: http://www.emeraldinsight.com.ezproxy.stir.ac.uk/research/guides/methods/qualitative.htm accessed 27th of July

·

Geography

of Kazakhstan, available at URL: http://expat.nursat.kz/?3295 accessed on 14th of August

·

How to conduct

interview, Anon., n.d , available at URL: http://www.emeraldinsight.com.ezproxy.stir.ac.uk/research/guides/methods/interviews.htm accessed on accessed 27th of July

·

Economy watch, USA Construction Industry, available from

URL: http://www.economywatch.com/sector-watch/us-construction.html accessed on 23rd of July.