Syzdykova

E.Zh. – candidate of economic sciences

Kassenova

D.I. - master of economic science

Koshmagambetova

K.D. - master student

Academician

Y.A.Buketov Karagandy State University

Financial prediction and

it’s methods

In modern conditions managing decisions should be made only after a careful

analysis of available information. For example, a bank or a board of directors

of a corporation should decide investing money into a project only after

careful calculations, coupled with forecasts of market conditions, determining

return on investment andappraising the possible risks. Otherwise, it may

surpass its competitors, who can better assess and predict the prospects for

development.

To solve problems associated with data analysis in the presence of random

effects, there is a powerful apparatus of Applied Statistics, part of which is

a statistical method of forecasting. These methods allow the identification of

patterns on the background of chance, to make informed predictions and assess

the likelihood of their implementation.

Forecast is a scientifically based description of the possible states of

the objects in the future, as well as alternative routes and timetables to

achieve this state. The process of developing forecasts is called prediction

(Greek Prognosis - foresight, prediction).

Forecasting must respond to:

• What is likely to expect in the future?

• How to change the conditions to achieve a specified, finite state

projection of an object?

Forecasts that respond to the questions of the first type, called the

search forecasts, the second type – regulatory forecasts. For example, the aim

is to provide each family with a separate apartment with an improved layout.

Normative forecasts show investment and the time within which this task would

be accomplished.

Depending on the prediction object there areseparate forecasts for the

scientific, technical, economic, social, political and military purposes, etc.

However, this classification is conditional, since mainlybetween these

forecaststhere are many forward and backward linkages. The need to determine

final practical prediction purposes involves determining the desired type of

prediction. Type of forecast is determined by two factors:

- Forecasting horizon and

-Hierarchical level of the indicator topredict.

By the time horizon forecasts are divided into short (1-2 cycles ahead of

time), medium (3-5 cycles) and long (more than 5 strokes ahead of time).

By the level of the indicator topredictthey are divided into macro-, meso-

and micropredictions. Everything related to the prediction of parameters

describing the activities of firms, companies and enterprises related to the

micro level. Meso (regional and sectoral levels) and macropredictionsare used

to describe the external environment.

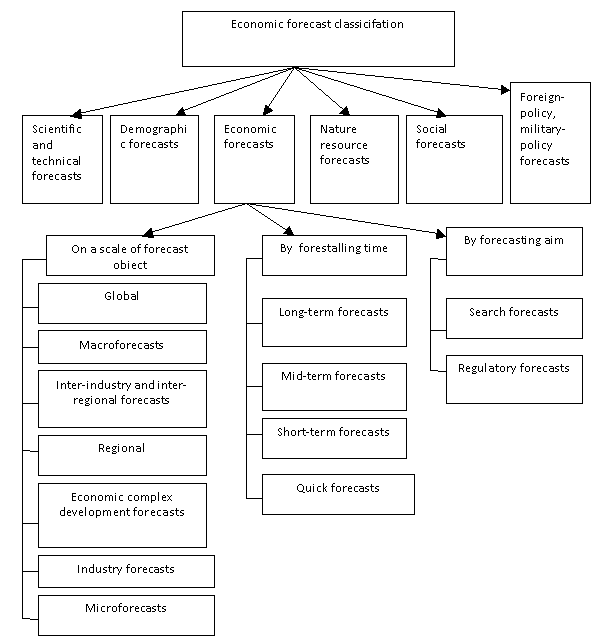

Classification of economic forecasts is shown in Figure 1.

After studying Figure 1 we see that economic forecasts differ on the

following criteria: the magnitude of the object prediction of lead time, for

purposes of forecasting.

Construction of forecast and the related construction and experimental

check (verification) probabilistic-statistical model is usually based on the

simultaneous use of two types of information:

- A priori information about the nature and essence of the content of the

phenomenon represented, usually in the form of some theoretical laws,

restrictions, and hypothesis;

- Source of statistical data on the process and results of functioning of

the phenomenon or system.

It should be emphasized that in reality, a businessman, head of the company

may of coursesuccessfully run business and do not use methods of constructing

mathematical models of forecasting. However, in the competitionusing these

techniques provides a businessman and his business at times no less significant

competitive advantages than conquesting of a certain market share or getting

the best loan.

Figure 1. Classification of economic

forecasts

Figure 1. Classification of economic

forecasts

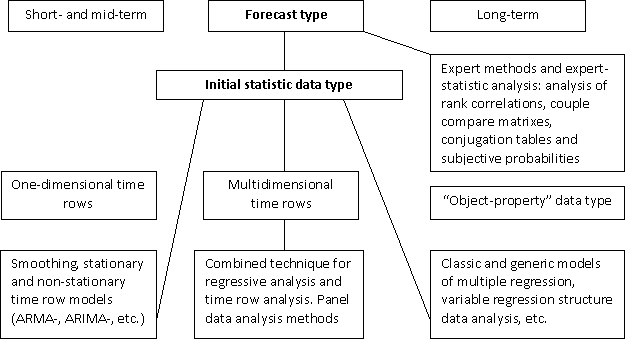

Most practical interest of course representthe short-term and operational

forecasts. Mathematical methods and models used in problems of stochastic

analysis and forecasting in business can relate to the various branches of

mathematics: a regression analysis, time series analysis, formation and

evaluation of expert opinions, simulation, systems of simultaneous equations,

discriminant analysis, logit and probit models, the unit of logical decision

functions, the dispersion or covariance analysis, rank correlations and

contingency tables, etc. However, they are all united by the fact that

represent different approaches to solving the central problem of multivariate

statistics and econometrics - the statistical study of dependency problems,

which, again, is the basic problem of statistical analysis and forecasting in

business. The

scheme of choosing the forecasting mathematical tools is shown in Figure 2.

Figure 2. The

scheme of choosing the forecasting mathematical tools

Thus, the prediction is a multistage process involving goal setting,

information, processing, assessment and analysis, identification of prospects

and the probability of the forecast. At all stages of the forecasting a close

alignment with the objectives and tasksmust be ensured, i.e. with the strategy

of economic development, while in some cases on the basis of our stated goals

are projected path and its achievements, in other cases, the forecast is

carried out to determine the achievable, responsive to the needs of society

goals.

References:

1.

Aivazian S.A., Mkhitaryan V.S. Applied statistics and the foundation of econometrics.

- Moscow: UNITY, 2008.

2. Hanke

J. and Reitsch A. Business Forecasting. - N.Y.: Prentice-Hall, Englewood

Cliffs, 2005.