Ñîâðåìåííûå èíôîðìàöèîííûå òåõíîëîãèè/1. Êîìïüþòåðíàÿ èíæåíåðèÿ

cand. tech. sci. Semakhin A.M.

Kurgan State University,

Russia

MATHEMATICAL

MODEL OF INFORMATION SYSTEM IN COMPLETE STATEMENT OF THE PROBLEM

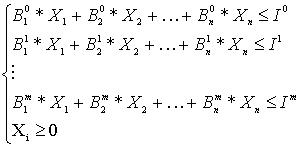

In case of deficiency of resources the

mathematical model has the inadmissible decision and the system of restrictions is

not compatible. For elimination of a problem formulate a

problem in complete statement. In mathematical model add a new variable /1/.

The mathematical model of a choice of the

project satellite Internet looks like corporate information system

![]()

under restrictions (1)

where ![]() is a target parameter, unit of

measurement;

is a target parameter, unit of

measurement;

![]() is investment

expenses of i project in j period of time, million. roubles;

is investment

expenses of i project in j period of time, million. roubles;

![]() is available means of

financing in j period of time, million. roubles;

is available means of

financing in j period of time, million. roubles;

![]() is a share of financing of the

investment project;

is a share of financing of the

investment project;

![]() is a number of the

investment project;

is a number of the

investment project;

![]() is a number of the

period of time, year.

is a number of the

period of time, year.

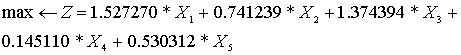

Let's assume, that

the total share of financing should be not less sizes ![]() .

.

The mathematical

model in this case looks like

under restrictions (2)

Table 1

The optimum decision of mathematical model in complete statement of a

problem

|

Variable |

Size

of variables |

Dual

estimation |

Extremum

of criterion function |

|

|

0,4838 |

0,0000 |

0,85 |

|

|

1,0982 |

0,0000 |

|

|

|

0,1279 |

0,0000 |

|

|

|

0,0000 |

0,1083 |

|

|

|

0,0000 |

0,2086 |

|

|

|

0,8547 |

0,0000 |

|

|

|

0,0000 |

0,0779 |

|

|

|

0,0000 |

0,0395 |

|

|

|

0,0000 |

0,0766 |

|

|

|

0,5316 |

0,0000 |

|

|

|

0,0000 |

0,5000 |

|

|

|

|

|

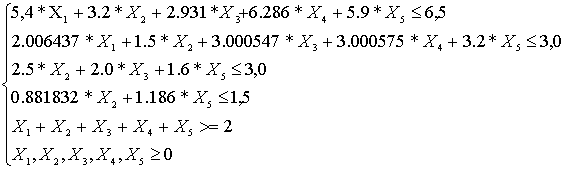

The mathematical

model has the inadmissible decision since the system of restrictions is incompatible.

Pass to mathematical model in complete statement. Enter the additional variable

![]() , defining a share of financing, which can be executed at available

means of financing.

, defining a share of financing, which can be executed at available

means of financing.

The mathematical

model in complete to statement of a problem looks like

![]()

under restrictions (3)

Table 2

The optimum decision of a problem

|

Variable |

Size

of variables |

Dual

estimation |

Extremum

of criterion function |

|

|

0,4838 |

0,0000 |

0,99 |

|

|

1,0982 |

0,0000 |

|

|

|

0,1279 |

0,0000 |

|

|

|

0,0000 |

0,1259 |

|

|

|

0,0000 |

0,2426 |

|

|

|

0,9938 |

0,0000 |

|

|

|

0,0000 |

0,0906 |

|

|

|

0,0000 |

0,0459 |

|

|

|

0,0000 |

0,0890 |

|

|

|

0,5316 |

0,0000 |

|

|

|

0,0000 |

0,5814 |

|

|

|

0,0000 |

-0,5814 |

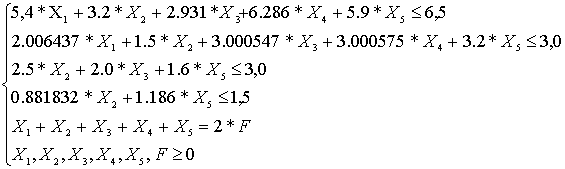

The optimum

decision of mathematical model in complete statement of a problem is resulted

in table 1.

Projects 1, 2 and 3 are financed. Shares of financing 0,4838, 1,0982, 0,1279

accordingly.

The final share of financing makes 85 %. We shall increase scheduled

value of a total share of financing ![]() on 0,85 and we shall substitute

in complete model. The optimum decision is resulted in table 2.

on 0,85 and we shall substitute

in complete model. The optimum decision is resulted in table 2.

Variable ![]() is approximately equal 1. We

shall replace in mathematical model (2) in the fifth restriction the right part

on 1,7 and we shall find the optimum decision. The optimum decision is resulted

in table 3. Projects 1, 2 and 3 are financed. Shares of financing 0,4979, 1,0702

and 0,1318 accordingly. Projects 4 and 5 are not financed. The maximal value of

criterion function (net present value) 1,7349 million roubles is equal.

is approximately equal 1. We

shall replace in mathematical model (2) in the fifth restriction the right part

on 1,7 and we shall find the optimum decision. The optimum decision is resulted

in table 3. Projects 1, 2 and 3 are financed. Shares of financing 0,4979, 1,0702

and 0,1318 accordingly. Projects 4 and 5 are not financed. The maximal value of

criterion function (net present value) 1,7349 million roubles is equal.

Table 3

The optimum decision of a problem

|

Variable |

Size

of variables |

Dual

estimation |

Extremum of criterion

function NPV, million roubles |

|

|

0,4979 |

0,0000 |

1,7349 |

|

|

1,0702 |

0,0000 |

|

|

|

0,1318 |

0,0000 |

|

|

|

0,0000 |

2,0675 |

|

|

|

0,0000 |

1,6790 |

|

|

|

0,0000 |

0,2490 |

|

|

|

0,0000 |

0,4667 |

|

|

|

0,0608 |

0,0000 |

|

|

|

0,5562 |

0,0000 |

|

|

|

0,0000 |

0,7584 |

The mathematical

model in complete statement of a problem allows to define the greatest possible

percent of financing at available money resources.

References:

1. Kochkina E.M., Radkovskaya

E.V. Methods Of Research And Modelling Of National Economy. - Ekaterinburg,

Publishing house Ural State Economic University, 2001. - 93 p.