3rd course PhD student Ishuova Zh.Sh.

Al Farabi Kazakh National University

Construction

of DSGE model with not absolutely flexible prices and by the National Bank of

Kazakhstan acting according to a Taylor rule

Dynamic stochastic

general equilibrium models for the monetary policy analysis are widely used

among central banks. These models are used to discuss central banks’ behavior

in different economic development scenarios [1]. We model the Kazakhstan’s economy as a small open

economy represented by the unit interval. Since the economy is of measure

zero, its domestic policy decisions do not have any impact on the rest of the

world. Next we describe in detail the problem facing households and firms

located in Kazakhstan’s economy. Variables with an i ϵ [0, 1]

subscript refer to economy i, one among the continuum of economies

making up the world economy.

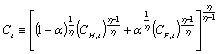

A typical small open economy

is inhabited by a representative household who seeks to maximize ![]() , where Nt denotes hours of labor, and Ct

is a composite consumption index defined by

, where Nt denotes hours of labor, and Ct

is a composite consumption index defined by  , where CH,t is

an index of consumption of domestic goods given by the CES function

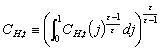

, where CH,t is

an index of consumption of domestic goods given by the CES function  , where j ϵ [0, 1] denotes the good

variety. CF,t is an index of

imported goods given by

, where j ϵ [0, 1] denotes the good

variety. CF,t is an index of

imported goods given by  , where Ci,t is,

in turn, an index of the quantity of goods imported from country i and

consumed by domestic households. It is given by an analogous CES function

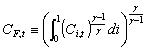

, where Ci,t is,

in turn, an index of the quantity of goods imported from country i and

consumed by domestic households. It is given by an analogous CES function ![]() . Notice that parameter ε>1 denotes the elasticity of substitution between

varieties (produced within any given country). Parameter α ϵ [0, 1] is related to the degree of home bias in

preferences, and is thus a natural index of openness. Parameter η>0 measures the

substitutability between domestic and foreign goods, from the viewpoint of the

domestic consumer, while measures the substitutability between goods produced

in different foreign countries [2]. To estimate the model we use quarterly data

for the period from 1992Q1 to 20012Q4. We choose the following seven observable

variables: real GDP, short-run real interest rate, a measure of core

inflation computed by the National Bank of Kazakhstan, the real exchange

rate, nominal exchange rate devaluation, real wages and labor input. We also utilize

series on oil imports and the real price of oil. We discuss the effects of an oil shock – an increase in the real

price of oil – on different domestic variables. We present some impulse–response functions

generated under the preferred model and we compare the outcome with the one

that would have been obtained under different policy rules, and under flexible

wages and prices.

. Notice that parameter ε>1 denotes the elasticity of substitution between

varieties (produced within any given country). Parameter α ϵ [0, 1] is related to the degree of home bias in

preferences, and is thus a natural index of openness. Parameter η>0 measures the

substitutability between domestic and foreign goods, from the viewpoint of the

domestic consumer, while measures the substitutability between goods produced

in different foreign countries [2]. To estimate the model we use quarterly data

for the period from 1992Q1 to 20012Q4. We choose the following seven observable

variables: real GDP, short-run real interest rate, a measure of core

inflation computed by the National Bank of Kazakhstan, the real exchange

rate, nominal exchange rate devaluation, real wages and labor input. We also utilize

series on oil imports and the real price of oil. We discuss the effects of an oil shock – an increase in the real

price of oil – on different domestic variables. We present some impulse–response functions

generated under the preferred model and we compare the outcome with the one

that would have been obtained under different policy rules, and under flexible

wages and prices.

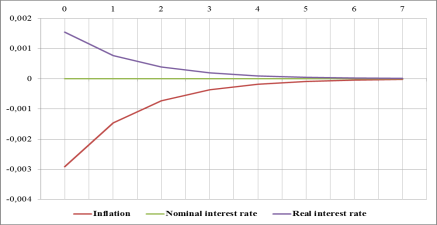

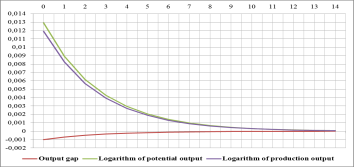

Figure 1. Reaction of interest

rates and inflation on the interest rate shock

In the first version of

monetary policy is assumed that the National Bank will apply the following

parameters of monetary rules: ϕπ=2.5 and ϕy=1. It means that the interest rate will increase by 1.5% if inflation exceeds

its target by 1%.

Figure

2. Reaction of the output gap and its components on the technology shock:

Nominal

interest rate, as opposed to the real, after the shock almost unchanged. It is

increased only by 0.01%. Although the initial shock is 1%, this leads to

deflation and the formation of a negative output gap, and hence to the

necessity reducing the interest rate of the National Bank (see figure 1–2). Comparing the analysis of consequences of monetary

policy options for the Republic of Kazakhstan with data for the Russian

Federation and Republic of Belarus in the works of Ivashchenko [3] and

Drobyshevsky [4], we can conclude that monetary policy in the Republic of

Kazakhstan meets the standards adopted in the leading countries: a clear

anti-inflation policy is evident (a growth in inflation by 1 percentage point

results in a rate increase of 0.75%).

References:

1.

Poghosyan

K. and G. Barseghyan. DSGE model of open economy with sticky wages and prices

(the case of Armenia) [Electronic resource]

// CIS Research Network. – URL: http://www.eerc.ru/Selected/Fall_2011/Poghosyan_Proposal.pdf.

2. Galí J. and T. Monacelli. Monetary Policy and Exchange Rate

Volatility in a Small Open Economy // NBER Working paper ¹8905. –2002 – pp. 1–43.

3. Ivashchenko A.S. Impact of monetary shocks on macroeconomic dynamics

[Electronic Res.] // URL:

http://mmaetst.narod.ru/archieve/251110_seminar_ai.pdf.

4. Drobyshevsky S.M., Trunin P.V., Kamenskih M.V. Analysis of the rules of

monetary policy of the Bank of Russia in 1999-2007. // Institute of the Economy

in transitional period. Working paper ¹127. – 2009. – 88p.