Amanzhayev D. G.

Institute of Management and Finance at

Kyiv National Taras Shevchenko University

graduate student of "Finance and Credit"

01001,

Ukraine, Kyiv, str. University, b.39, f.616

CLASSIC MODELS OF MORTGAGE LENDING

With the development of financial instruments, mortgage lending has

become an integral part of socio-economic development.

There are two main systems of mortgage regulation: continental European

and Anglo-American.

At this time in the world were formed following the classic model of

mortgage lending [1, p. 91]:

1. Truncated-open

(England, Denmark, Spain).

2. Balanced-autonomous

(Germany).

3. Extended-opened

(U.S.).

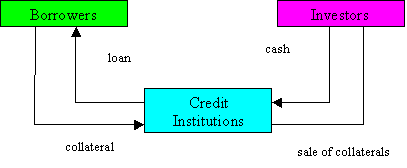

The most simple system of mortgage lending should be considered

open-truncated model (Fig. 1). Providing long-term loans to the population, the

bank in this model draws resources from various sources, including interbank

loans, targeted credit lines, accounts and customer deposits, debt securities

and funds from the sale of mortgage securities.

Fig. 1. Truncated open-circuit model of mortgage

lending [1, c. 92]

The disadvantages

of this model include: dependency model of market-level interest rates, lack of

solid standards for mortgage lending, a limited number attractive credit.

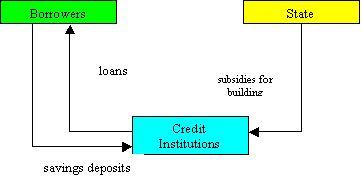

Balanced-autonomous

or savings and loan model (Fig. 2) mortgage lending - a balanced, autonomous

model of mortgage-based savings and loan principle of operation of the type

"budoschadkas."

Building societies office being

closed financial structure begins its activity with the formation of capital

and is based on his own source of funds for lending. All cash funds (own and involved) are used only for conducting

statutory activities, that is going to finance housing construction and the

issuance of mortgage loans [2, p. 30].

Fig. 2. Scheme of

balanced-autonomous model of mortgage lending

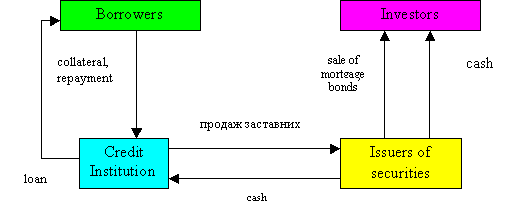

Extended-open

model (Fig. 3) involves the use of two-tier market model. Bank issues a

mortgage borrower in exchange for a commitment for a certain period of monthly

transfer to the bank a fixed amount.

Fig. 3. Scheme

extended-open system of mortgage lending [3, p. 129]

This obligation secured by the mortgage borrower's

home, received. Bank sells a loan to one of the mortgage agencies, while also

transferring the obligation to provide credit. Agency shall reimburse the bank

paid money to the borrower, and bank transfers received from the borrower's

monthly payments except their profit (margin) in the agency. The value of

monthly payments, that is a bet on which the agency agrees to purchase mortgage

loans, the agency sets on the basis of requirements for investors to return

financial instruments.

List of sources:

1. Разумова А.В. Анализ моделей

ипотечного кредитования, сложившихся в мировой практике, и возможности их

применения на ипотечном рынке Украины // Економічний простір. № 20/1, 2008. –

С. 90 – 98.

2. Іванілов О.С.,

Тітенкова М. В. Іпотечне кредитування у країнах Західної Європи, США та України

// Фінанси України. – 2007. – №4. – С.28– 35.

3. Susan Hudson-Wilson. Modern

real estate portfolio management. – NY: Frank J. Fabozzi Associates New Hope,

Pensylvania, 2000, 239 p.

4.

The

Global Competitiveness Report: 2010-2011, 2009-2010, 2008-2009, 2007-2008.

World Economic Forum [электронный ресурс]. Режим доступа: URL: www.weforum.org