Economic

sciences/4. Investment activity and stock markets

Postgraduate

Kateryna Lagutina

Taras

Shevchenko National University of Kyiv, Ukraine

Newest trends of M&A market in Ukraine

Mergers and acquisitions are integral processes of modern economy.

Companies worldwide are in the situation of choice of two different development

models: 1) systematic growth by expanding own production capacity, 2) active

growth by mergers and acquisitions of other companies. The first model is more

conservative, the second one – is associated with greater risk, but it can

significantly increase the financial potential of the company.

First of all it is viable to articulate the basic concepts such as

“merger” and “acquisition”. In economic science mergers and acquisitions (M&A)

is a general term for a group of financial transactions purpose of which is to

join companies into one entity for obtaining competitive advantages and maximizing

the value of the newly formed company in long term [1].

The consequences of typical merger are: cessation activities of one

or all companies, creation of a new legal entity, transfer of all assets and

liabilities between companies, automatic turning of shareholders of the seller and

the buyer into the shareholders of new company, exchange shares of companies

that cease their activities to the shares of successor [3].

In terms of current post-crisis recovery of the economy

backgrounds for the expansion of M&A market are growing. Assets of

companies during the crisis were impaired, so now they can be bought at prices

below market. At the same time the possibilities to capture property

(unfriendly "hostile" takeovers) become easier. Mergers and

acquisitions in crisis bankruptcy of selling companies are also simplified. In

this case, after the establishment of corporate control additional share issue

is carried out, that assumes participation of new owners and investors.

M&A-market is the most effective when its participants are

open (public) joint stock companies. Law of Ukraine "On Joint Stock Companies",

which entered into force on 29.04.2009, legally started the transition in the

domestic economy from open and closed to the public and private joint stock

companies.

An important component of the mechanism of mergers and

acquisitions is selection of program of their implementation. It is essential

to distinguish between, firstly, the process of developing a program of merger

(acquisition), and secondly – the process of implementing this program. In the

process of developing a program of merger (acquisition) the company, which

absorbs, must pre-estimate the value of cash flows from future merger. The

purchasing company should also evaluate what effect this merger will have to

the desired level of income (profit rate), if it happens. The absorbing company

should decide how to pay for the merger – in cash, in some other way or by stock

of securities. Evaluating the profit from the merger, the management of both

companies, which absorbs and is absorbed, and all shareholders must agree how

to allocate this income. Analysis required for this assessment can be very

complex.

Best practices in preparation for the merger and acquisition are

now sifting of international and domestic experience, involving legal and

financial advisors, searching for successful political and economic moment etc.

[4] In the absence of transparent and complete information on state of

M&A-market and stock market adequate preparation for the acts of mergers

and acquisitions is impossible.

While developing the program of merger (acquisition) buying company

identifies potential target company, assesses assets (shares) of the target

company. In

most cases, this assessment on undeveloped stock market as in Ukraine is

accompanied by the use of insider information on the state of target company. During

the assessment buying company identifies potential synergies, the level of

managerial efficiency in the target company and others. It is believed that the

main purpose of assessment in conditions of the Ukrainian economy is to reveal

hidden discount to market value of the target company, that is, determining how

this company is underestimated by the market. In real situations that arise in

mergers, buying company often seeks the services of consulting firms to assist

in assessing the value of the target company.

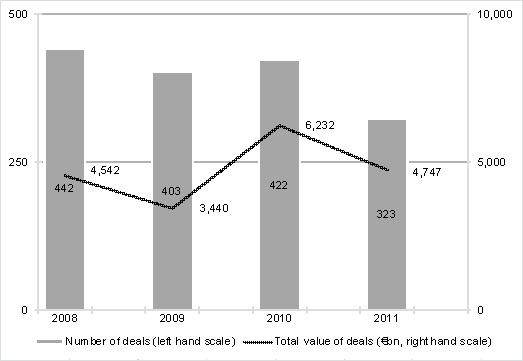

As the statistics illustrate, in 2011 the volume of reported M&A

deals in Ukraine was at its lowest since 2008, and the total value of those

deals – although higher than the lowest point in 2009 (when the economic crisis

was at its worst) – was significantly lower than in 2010 [2].

Deals by Value and Volume in Ukraine (2008-2011)

Some significant cross-border transactions took place in 2011, not

the least of which was the nearly €1 billion privatisation of Ukrtelecom, the

state-owned fixed line telephone monopoly, by EPIC.

Top 5 M&A Deals in Ukraine (2011)

|

Target Company |

Industry |

Deal Type |

Buyer |

Country of Buyer |

Deal Value (€m) |

|

Ukrtelecom |

Telecom & IT |

Privatisation |

EPIC |

Austria |

950 |

|

Azot |

Manufacturing |

Acquisition (95.63%) |

Group DF |

Ukraine |

580 |

|

Donetsk ElectroMetallurgical Works |

Manufacturing |

Acquisition (100%) |

Mechel Steel Group |

Russia |

410 |

|

Severodonetsky Azot |

Manufacturing |

Acquisition (100%) |

Group DF |

Ukraine |

370 |

|

Nadra Bank |

Finance & Insurance |

Acquisition (89.97%) |

Dmitry Firtash; Ivan Fursin |

Ukraine |

304 |

Although a fair amount of the other transactions that occurred

could technically be classified as cross-border, by far the majority of all

transactions in 2011 were in fact among Ukrainian and/or Russian buyers and

sellers, whether acting through their foreign holding companies or locally [2].

Renewal of business activity in Ukraine is connected with the

increase in liquidity that has taken a significant impact on financing mergers

and acquisitions. In the market of corporate M&A loan bank capital is widely

used as well as financial market instruments that have become cheaper and more

accessible. The main trend of M&A

market in Ukraine is associated with increased liquidity of financial markets

and increasing access to capital.

Up-to-date trends in institutional development of M&A market

in Ukraine are determined by mismatch between the traditional means of

accumulating financial resources in the process of mergers and acquisitions,

and new specific financial motives of their implementation; between civilized

instruments of distribution and redistribution of financial resources between

entities through mergers and acquisitions, and atypical forms of their

realization (with the active participation of offshore business, significant

influence of government structures); between the need of ensuring transparency

of intents of participants of mergers and acquisitions, and expansion of

non-transparent forms and methods of redistribution of ownership rights and control

on financial flows in the domestic corporate sector, between the need in

expanding the role of stock market in the implementation of mergers and

acquisitions, and low investment attractiveness of shares of Ukrainian

companies.

References:

1. Depamphilis D. Mergers, Acquisitions, and other

Restructuring Activities. 1st ed. / D. Depamphilis. – San

Diego: Academic Press, 2001. 643 p.

2. Emerging Europe: M&A Report 2011. CMS and

Emerging Markets Information Service (EMIS) DealWatch, 2012; http://www.securities.com/tag/emerging-europe-report#page=page-1.

3. Gaughan P.A. Mergers, Acquisitions, and Corporate

Restructurings. 3nd ed. / P.A. Gaughan. – John Wiley & Sons, 2002. 612 p.

4. Robinson S. The Mergers and Acquisitions Review.

Fourth edition / S. Robinson. – Law Business Research Ltd. London, 2010. 520 p.