Ganna Reshetova,

Postgraduate student in Finance

Taras Shevchenko National University of Kyiv

INVESTMENT OPPORTUNITIES IN FRONTIER MARKETS:

THE CASE OF UKRAINE

Scientific Advisor: Associate Professor Tetiana Hryshchenko, PhD

Under

running integration processes, economic globalization and financialization, the

frontier markets have become increasingly relevant in the world economy.

Foreign direct investments have grown six-fold, mainly driven by intra-regional

transactions. As the economies of these rapidly developing countries continue

to open up to global investors, this trend is expected to further accelerate.

As level of investments remains to rise, economies of frontier markets should

continue increase their weight, not only in the global economy but also in

terms of allocation to investors’ portfolios.

Frontier markets became the third

generation of global equity exposure

characterized by wide range of investment opportunities due to earlier stage of

life-cycle development comparing to both developed

and

emerging markets.

Exposure to frontier

markets

increases the breadth and diversity of

investing, over the capability provided by emerging

markets enhancing total return potential driven by active growth and providing

significant

benefits from the traditional asset

classes diversification. Specifically, frontier

markets are quite small, but

often lower priced than emerging markets,

which themselves trade at a P/E

discount to the developed economies.

Globalisation as

well as financialization are creating real multidimensional growth

in frontier markets – the emerging markets of

tomorrow.

Fledgling

frontier markets have a relatively low correlation with global peers, offer

high growth potential and, currently, attractively low valuations relative to

mainstream emerging counterparts. The very nature of the frontier markets means

the earliest stage of financial system development in particular country, which

is defined by low level of capitalization and liquidity along with limited

access for overseas investors.

Due

to foreign investor participation in developed and emerging markets,

diversification benefits and some extent alpha potential have declined. Hence, money

managers and sell-side strategists identify frontier markets as increasingly

attractive area for equity investments.

The

investment rationale is based on the following:

- High growth and return potential based on benefits from the structural

development of these pre-emerging economies and market;

- Potential for high alpha, because of

low sell-side research coverage in assessing these attractive

early-stage investment opportunities and institutional ownerships within these

markets segments are relatively low;

- Diversification benefits for clients and investors through asset

allocation based on low return correlation with developed markets. Diversification

allows spreading the risk across various asset classes and/or countries.

Historically, frontier markets have been among the least correlated to other

equity classes globally, making them attractive from an asset allocation point

of view. Frontier equities have exhibited much lower correlations with global

equities than mainstream emerging markets have. The additional diversification

opportunity is low correlated with commodity indices.

Due to Broad

Market Index for May 2012, Standard & Poor's classified Ukraine as a

country with frontier market with adjusted market capitalization of 2.88

billion dollars [2]. Frontier markets (FMs) are investable but have lower

market capitalization and liquidity than the more developed emerging markets.

The frontier equity markets are typically pursued by investors seeking high,

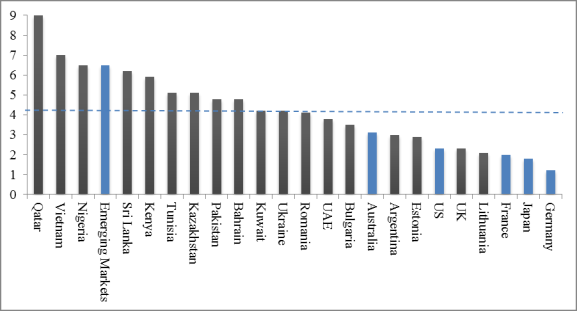

long term returns and low correlations with other markets. Figure 1 shows the

evidence of great growth potential for Ukrainian economy relatively to emerging

markets as well as developed ones. Comparing to developed economies of Germany,

Japan, France etc., Ukrainian market shows great potential in future growth. On

the other hand, the potential is not fully realized according to more than 6%

GDP growth in emerging markets. It means that the cost of investing into

economies of frontier market is much lower.

Figure 1. Expected GDP

growth rate in 2010-2015 [3].

In spite of

attractiveness of investing into frontier markets, systematic risks of such

economies should be considered. Frontier market investments are typically

perceived as being of higher risk than developed or emerging peers. This

systematic risk could be divided into two groups:

Group 1. Sovereign risk:

- Political instability and limited democracy.

- Protectionism and capital control.

- Early stages of the financial system development.

- Dependence on natural resources provides greater risk in certain

economic conditions.

Group 2. Structural

risk:

- High volatility of returns and extreme price movements.

- Markets can have differing levels of accessibility for participant

and/or investors.

- The costs of investing are high, trading infrastructure may be

inadequate and transparency is low.

- Limited fiscal or monetary tools to handle increasing inflation.

The case of

Ukraine shows the great impact of geopolitical decisions on economic situation

in the country. Due to irrational basis of decision-making financial

environment relies mostly on invers’ expectations. Creating the strong

background for profitable investing, the cost of capital is underestimated by

mentioned sovereign and structural risks.

As a result, considering investment opportunities, the key basic factors

are important for overseas investor:

-

Access

to frontier markets not included in developed or emerging

markets, largely untapped by institutional investors;

-

Opportunity

for early-stage investments in fast-growing economies;

-

Low

correlations with US and non-US developed equities;

-

Locally

driven economies result in low intra-market correlations among frontier market

countries [4].

The implication

of a country being labeled as frontier is that, over time, the market will

become more liquid and exhibit similar risk and return characteristics as the

larger, more liquid developed markets. The main advantage of investing in

frontier markets is a great potential of fast transaction into developed

economy.

References

1. Investing in Frontier Markets // HSBC Global Asset Management: https:// www.emfunds.us.assetmanagement.hsbc.com/investing-in-emerging-markets/content/investing-in-frontier-markets.fs

2. MSCI Frontier Markets Indices // http://www.msci.com

3. What are frontier markets? // Russell Investments, 2 Forum, March 2011: http://www.russell.com/AU/_pdfs/capital-markets-reserach/forum/2011-March

-What-Are-Frontier-Markets.pdf.

4. Why invest in Frontier Markets now? // Silk Invest Report: http://www.silkinvest.com/why-invest-in-frontier-markets-now#sthash.bGak26

cH.dpuf