Ýêîíîìè÷åñêèå íàóêè/10. Ýêîíîìèêà

ïðåäïðèÿòèÿ

A. Chernyavs’kyy

Department of

special constructions of DPSK Ltd.

Resource approach in civil engineering economics

Development of civil construction is an indicator of overall social and

economic evolution of society. Construction in its turn can stimulate multiplication

effect and exert positive influence on employment, overage salary level,

development of trade and services sector.

Research of capital and floating assets, human resources (together with

investing process) plays major role in construction economics. Theoretic works

on capital and floating assets are basic foundations for optimization of

financial and material flows. Timeliness of research in the field of

construction economics is determined by growing competition in the construction

services market.

Economics of construction in general is many-sided area of knowledge. At

least three approaches on essence of capital and floating assets can be mentioned.

The first point of view is based on interpretation of building sector as

a social and economic system. L. Chistow [4] takes resource approach stand and

considers capital and floating assets to be financial and material resources in

construction cycle.

The position of A. Asaul [1] and V. Chernyak [3] falls in categories of real estate economics. Capital and

floating assets are strongly connected with development of real estate investment.

Real estate appraisal is the key question.

The third approach is remarkable for its breadth of views. V. Buzyryow [2] uses

methods of accounting and housing property management to describe capital and

floating assets structure and trends.

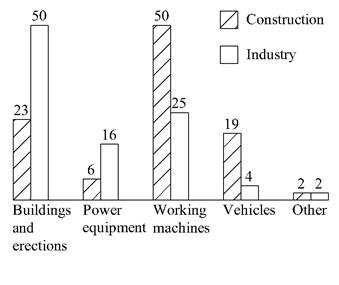

Depending on ultimate objective of research, capital assets can be grouped

by:

1) using in production process (productive or nonproductive);

2) effect on objects of labour (active or

passive part of capital assets);

3) functionality (buildings and erections, power equipment, working

machines etc.).

Fig. 1. Structure of capital assets in building sector

(in comparison with industry), %

The main measures of capital assets objects actual life time increasing

include providing maximum possible scientific and technical achievements in

designed object and timely modernization of object using optimum criteria and limitations.

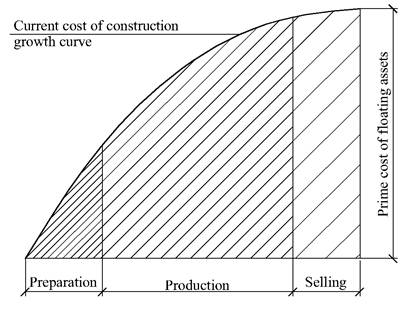

Structure of material floating assets can be characterized by the

following percent ratios: 20-35% at preparation stage, 60-70% at production

stage and 5-10% at selling stage.

Fig. 2. Material floating assets at different stages

of circulation

Structure of floating assets depends on:

- cost of material resources at preparation stage;

- duration of being of material resources at preparation stage;

- type of current cost of construction growth curve at all stages;

- cost of construction works;

- duration of production stage in turnover cycle;

- duration of selling stage.

Methods of acceleration of floating assets turnover include resources

cost reducing and straightening of current cost growth curve at preparation

stage.

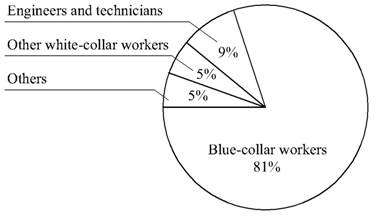

About 10-20% of human resources in European

countries are employed in building sector.

Structure of blue collar workers is as follows:

- common labors – 41%;

- constructions erectors – 26%;

- mechanization experts – 19%;

- transportation workers – 7%;

- drivers – 2%;

- others – 5%.

Fig. 3. Approximate structure of human resources in

building sector

There is notable growth in percentage of mechanization

experts and constructions erectors. This trend is supposed to continue due to technological

progress.

World labor market is formed by human

resources exporting and importing. The major centers of labor migration include

- nearby 40% of all builders in

- from 86 to 92% of all human

resources in

References

[1] Asaul A. (2007) Economics of real estate. Piter,

[2] Buzyryow V., Chekalin V. (2001) Economics of housing property. INFRA-M,

[3] Chernyak V. (2007) Economics and

management at enterprises (construction). KNORUS,

[4] Chistow L. (2001) Economics of

construction. Piter,

[5] Endres A.,

[6] Yatsenko

A. Dubyniuk Y. (2005) International markets of

resources. CNL, Kyiv.