The assistant of Jurisprudence Chair, Belousova O.A.

Amur State University (Birobidzhan Branch), Russia

The co-relation of the minimum rate of labour

payment and the cost-of-living adjustment in the Russian Federation

Employment of population and labour market are connected with such

categories as labour resources, labour force, supply and demand on labour

force, sales of work force, and payment for labour.

In its turn, work force is a specific ware; its countervalue mostly

depends on the expenses on support of workers viability, their training,

education and reproduction of moral, psychophysical and intellectual abilities.

In periods of economic crisis release the workers and the rise in unemployment

levels are fixed on the labour market, and, consequently, effective consumer

demand for hired labor falls. Under such conditions, the rate of labour payment

decreases sharply, it often is not able to provide a

dignified human existence. To save manpower, most states set the minimum rate of labour payment (further, MRLP) providing cost-of-living for their citizens.

The International Labour Organization has repeatedly brought up a

problem of establishing the minimum rate of labour payment, in this sphere a

number of Conventions and Recommendations were adopted, however, Russia has not

ratified any of the international acts, but later many of their acts were

included in the legislation of the Russian Federation.

The first act, in which raising the minimum rate of

labour payment for domestic workers and employees was provided, was the Decree

of the Central Committee of the Communist Party of the Soviet Union, Council of

Ministers of the USSR and All-Union Central Council of Trade-Unions Central

Committee, dated from 12 December, 1972 No. 842 [1], this document set the

minimum rate of labour payment at 70 rubles per month.

Due to the increase in retail prices in 1991, the

Supreme Soviet of the RSFSR adopted the Law of the RSFSR “On improving social

guarantees for workers” [2]. From 01 October 1991 was established the new

minimum rate of labour payment not less than 180 rubles a month, it did not

include extra payments, bonuses, and premiums and other incentive payments.

With the adoption of the Constitution of the Russian Federation in 1993, the

Russian citizens are guaranteed the right to remuneration not lower than the

MRLP adjusted by the Law [3, p. 7, 37].

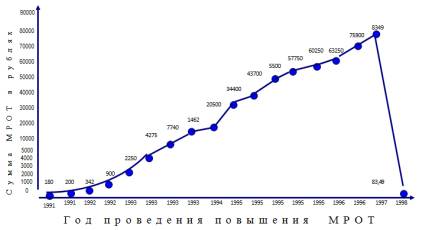

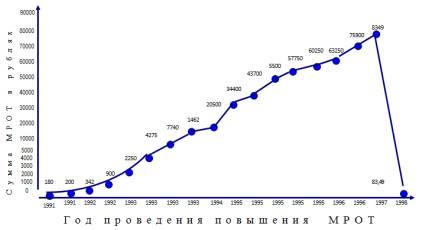

But

rising inflation forced systematically to review the amounts the MRLP, so, they

increased twice in 1991, 1992, in 1993 - 4 times, and in 1994 only once, but in

1995 in the 5 times, 1996 – twice, 1997 – once (a total amount is 17 times over

7 years in the period from 1991 to 1997).

Figure 1. The growth of

the minimum rate of labour payment in the Russian Federation in the period from

1991 to 1998

The

results of financial policy and measures taken by the state, have not led to

decrease in intensity on labour market, the position of workers was compounded

with universal laying-off of workplaces and a huge growth of a number of the

unemployed. Work force as a ware has been devaluing, the employer stopped to

pay (or delayed it for months) wages, directing monetary funds on providence

and expansion of an existing property or purchase new one.

In 1997 the nation's leadership took cardinal decisions which were to

stabilize economy in Russia. Denomination of ruble and its substitution began

in 1 January, 1997, as a result the value of the MRLP was restated in the ratio

1000 rubles in money of the old sample for 1 ruble in new money [4].

In 1997 the law “On the cost-of-living adjustment in the Russian

Federation” was adopted [5]. According to the named law and on the basis of the

adopted laws “On consumer goods basket in the Russian Federation” [6] and the

Government Resolutions of the Russian Federation “On adoption of the Methodical

recommendations for determination of the consumer goods basket for the basic national

socially-demographic groups of the population in the Russian Federation and in

the constituent entities of the Russian Federation» [7] since 2000 the

Government of the Russian Federation determines the national cost-of-living adjustment quarterly, the consumer goods basket and the data of the Federal executive

authorities concerning statistics of the level of consumer costs of food,

non–foods, services and expenses on obligatory payments.

As a

result, the situation on the labour market has gradually been stabilizing, old

enterprises begin to regenerate and new ones open, the demand for labour power

increases in the field of business production. Inflation has been stopping, the

MRLP raised only once from 1998 to 2000 (in 2000).

In 2000, the Federal law “On the minimum rate of

labour payment” was adopted in which the primary purpose of the MRLP is stated:

for regulating of labour payment and for determining the level of benefits in

the period of temporary invalidity and benefits for compensation of harm for

the injury caused by the injury, occupational disease or other illness

associated with execution of labour duties» [8, art. 3].

From February 1, 2002, the

new Labour Code of the Russian Federation (further LC RF) [9], came into legal

force. There is a definition of the MRLP in Part 2 Article 129 of the present law.

“The MRLP is a size of monthly

wages determined by the Federal law for work of an unskilled worker, who

completely fulfilled the norm of work time while carrying out simple work under

normal working conditions”.

On the basis of previously

adopted legal acts compensational, additional incentives and social benefits

are not included into the MRLP. The law-maker by Part 1 of Article 133 of LC RF

ensured that MRLP is set at the same time throughout the Russian Federation

Federal by the law and it cannot be lower than the cost-of-living adjustment of workforce. However, the cost-of-living adjustment

has always been higher than the MRLP [10].

Table

1

The ratio of the minimum

rate of labour payment and the cost-of-living adjustment in the Russian

Federation in the period from 2000 to 2011

|

Ãbefore |

The period of changes |

The average cost-of-living

adjustment in the RF (rub.) for workforce |

The size of the MRLP (rub. a

month) |

The ratio of cost-of-living

adjustment and the MRLP (higher) |

The percentage off the MRLP and

cost-of-living adjustment (%) |

The interest rate differential of

cost-of-living adjustment and the MRLP (%) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

2000 |

H1 |

1261,14 |

83,49 |

≈ 15,11 |

≈ 6,62 |

93,38 |

|

H2 |

1378 |

132 |

≈ 10,44 |

≈ 9,58 |

90,42 |

|

|

2001 |

H1 |

1574 |

200 |

≈ 7,87 |

≈ 12,71 |

87,29 |

|

H2 |

1684,5 |

300 |

≈ 5,62 |

≈ 17,81 |

82,19 |

|

|

2002 |

H1 |

1912,5 |

Average 375 |

5,1 |

≈ 19,61 |

80,39 |

|

H2 |

2022,5 |

450 |

≈ 4,49 |

≈ 22,25 |

77,75 |

|

|

2003 |

H1 |

2278 |

450 |

≈ 5,06 |

≈ 19,75 |

80,25 |

|

H2 |

2329,5 |

Average 525 |

≈ 4,44 |

≈ 22,54 |

77,46 |

|

|

2004 |

H1 |

2545 |

600 |

≈ 4,24 |

≈ 23,58 |

76,42 |

|

H2 |

2659,5 |

600 |

≈ 4,43 |

≈ 22,56 |

77,44 |

|

|

2005 |

H1 |

3214 |

720 |

≈ 4,46 |

≈ 22,4 |

77,6 |

|

H2 |

3295 |

800 |

≈ 4,12 |

≈ 24,28 |

75,72 |

|

|

2006 |

H1 |

3678,5 |

Average 950 |

≈ 3,87 |

≈ 25,8 |

74,2 |

|

H2 |

3711,5 |

1100 |

≈ 3,37 |

≈ 29,64 |

70,36 |

|

|

2007 |

H1 |

4054,5 |

1100 |

≈ 3,69 |

≈ 27,13 |

72,87 |

|

H2 |

4263,5 |

2300 |

≈ 1,85 |

≈ 53,95 |

46,05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

2008 |

H1 |

4889,5 |

2300 |

≈ 2,13 |

≈ 47,04 |

52,96 |

|

H2 |

5051,5 |

2300 |

≈ 2,2 |

≈ 45,53 |

54,47 |

|

|

2009 |

H1 |

5552 |

4330 |

≈ 1,28 |

≈ 77,99 |

22,01 |

|

H2 |

5591 |

4330 |

≈ 1,29 |

≈ 77,45 |

22,55 |

|

|

2010 |

H1 |

6013 |

4330 |

≈ 1,39 |

≈ 72,01 |

27,99 |

|

H2 |

6263 |

4330 |

≈ 1,45 |

≈ 69,14 |

30,86 |

|

|

2011 |

H1 |

Average 7004,5 |

Average 4376,83 |

≈ 1,6 |

≈ 62,49 |

37,51 |

|

|

H2 |

Average 6751 |

4611 |

≈ 1,46 |

68,3 |

31,7 |

Analyzing the data of the table, it may be noted that,

despite the denomination of the ruble in 1998 [4], the MRLP in 2010 was less

15.11 times the cost-of-living

adjustment, this difference has declined sharply until December

2002, and in the first half of 2003, has begun to increase again. At the of end

of 2003 and the beginning of 2004, at the end of 2007 and beginning of 2008,

the difference between the MRLP and cost-of-living adjustment has been markedly

diminishing. Does it say about the growth of people well-being in these

periods?

Answering this question, the following facts should be

observed: first, the periods are connected with political events in the country

(presidential elections); second, in 2007, the abolition of Part 2 of Article

129 of the LC RF [11, Part 1 of Article 2], which contained a definition of the

MRLP. The abolition of the MRLP automatically included compensation, incentive

and welfare payments in it.

Formally the MRLP in 2007 increased more than twice,

but income of population did not. The Constitutional Court of the Russian

Federation [12] delivered a judgment that the abolishing of the rules

determining the MRLP did not lead to abolishment of the constitutional right of

citizens to receive the MRLP in the amount defined by the Federal law.

Therefore, if the previous MRLP was equal only to a salary of unskilled workers,

nowadays it is equally for all – both the skilled and non-skilled workers, and

includes both the salary and all the allowances.

Thus, formally, the MRLP

grows, the difference between it and the cost-of-living adjustment decreases,

but if we study carefully why it happens and whether the actual incomes of

population grow, the answer is unequivocally, that welfare is a fiction,

legitimized by the State. With the abolition of the MRLP definition all have

equal opportunities to receive almost equal to the cost-of-living adjustment

the MRLP, and nobody can have less than 4611 rubles – a janitor and a

Professor, a worker who lives in the southern and northern parts of our

country. And no matter what entitled to the MRLP cannot fulfill their

constitutional responsibilities for the upbringing of children and maintenance

of parents because the MRLP is not calculated on a non-working family members.

It is more important, that workers are able to perform another constitutional

duty to pay taxes, which, after deduction of the MRLP is just over 4 thousand

rubles, which is more than 1.5 times lower than the subsistence minimum (6751

rubles).

The study gives grounds to

the following conclusions: the State, establishing the MRLP by the law below

the cost-of-living adjustment systematically violate the lawful rights of

citizens referred to Paragraph 1 of Article 133 of the LC RF. It appears that

the legislator should take into account in future average cost-of-living

adjustment in setting the MRLP for the country.

Regulatory legal acts

1.

The Decree of Central Committee of

the Communist Party of the USSR, the Council of Ministers of the USSR and the

All-Union Central Trade Union Council dated from 12 December, 1972 No 842

"About increasing of the minimum rate of labour payment of workers and

public servants with simultaneous increasing of tariff rates and official

salary of average paid categories of workers busy in production spheres of the

national economy" (with amendments and additions).

2.

The law of the RSFSR dated from 19

April, 1991 No 1028-1 "On increasing of social guarantees for

workers".

3.

The Constitution of the Russian

Federation (adopted by nation-wide vote 12 December, 1993) (with the

amendments, stipulated by the Laws of the Russian Federation on amendments to

the Constitution of the Russian Federation as for 30 December, 2008 No 6-FCL,

30 December, 2008 No 7-FCL).

4.

President’s

Decree as for 04 August, 1997 No 822 "On changing of

notional amount of Russian monetary symbols and scale of prices".

5.

The Federal law as for 24 October,

1997 No 134-FL (ed. from 24 July,2009) "On the cost-of-living adjustment in the Russian

Federation".

6.

The Federal law as for 20 November,

1999 No 201-FL "On the consumer goods basket in the Russian

Federation".

7.

The Decree of the Government of the

Russian Federation dated from 17 February, 1999 No 192 “On adoption of the

Methodical recommendations for determination of the consumer goods basket for

the basic national socially-demographic groups of the population in the Russian

Federation and in the constituent entities of the Russian Federation».

8.

The Federal law as for 19 June, 2000

No 82-FL (ed. from 29 April, 2002) "On the minimum rate of labour

payment". – "Russian paper", No 118, 21 June, 2000,

"Official Gazette of the Russian Federation", 26 June, 2000, No 26,

ar. 2729.

9.

The Labour Code of the Russian

Federation dated from 30 December, 2001 No 197-FL (ed. from 01 July, 2011)

(with amendments and additions come into effect from 02 July, 2011).

10. Reference information: “The

minimum rate of labour payment in the Russian Federation”. [Electron resource]: System

Consultant Plus. URL:

http://www.consultant.ru/online/ base/?req=doc;base=LAW;n=15189;page=esse

11.

The Federal law as for 20 April,

2007 No 54-FL (ed. from 22 June, 2007) "On amendment to the Federal law

"On the minimum rate of labour payment" and other legislative acts of

the Russian Federation”.

12.

The Decree

of the Russian Federation dated from 17 December, 2009 No 1557-Î-Î "On

refusal to refusal to accept for consideration a complaint of the citizen

Barahtenko Maria Nikolaevna concerning violating of her constitutional rights

by the Federal law “On amendment to the Federal law

"On the minimum rate of labour payment" and other legislative acts of the Russian

Federation”.