Psychology and Sociology / 14.

Personnel management

Postgraduate student Ivanova A.À.

Russian

Presidential Academy of National Economy and Public Administration (Orel

Branch), Russia

Formation of a control system of corporate social responsibility of a

commercial bank in the Russian Federation: the human resource aspect

Corporate social

responsibility has a special place in the banking sector. Due to the increasing

crisis of banking systems around the world, the consequences of which have

spread to the global financial space, many banks have realized the need to

create a control system that can not only maintain the effectiveness of the

functioning of the banking system in the short term, but also to ensure its

effective development in the long term.

To do this, you must actively

put into practice the activities of banks principles of corporate governance

and corporate social responsibility that will systematize processes regulating

banking activity, regulate interaction with stakeholders to ensure effective IT

support management decision-making, improve information transparency of the

results of banking activities, to restore confidence in the banking system, to

ensure the implementation of the development strategy of the banking system.[1]

Social responsibility of a

commercial bank - is responsible for the bank's social results from management

decisions and banking through transparent and ethical behavior that contributes

to sustainable development (balanced social - economic development and

environmental protection, including health and well-being of society as a

whole, and clients, shareholders and staff in particular); takes into account

the expectations of stakeholders (partners, customers, employees); comply with

the applicable legislation and consistent with international norms of behavior

and international financial reporting standards; fully integrated into the

activities of the bank, is constantly used in internal and external relations,

aimed at increasing the efficiency of banking operations and quality control;

conducive to improving the reputation and image of the bank, building corporate

identity, enhance corporate culture and promotes social responsibility

institute of banking.

Accordingly, corporate

governance - a system and process relationships, as well as a set of

principles, rules and procedures of interaction between the owners

(shareholders), the board of directors, management and other stakeholders

inside and in the external environment of the company.

Thus, CSR is becoming a de

facto part of the corporate governance threading entire internal system of

management and external communications of the organization. And among the main

tools of social responsibility in corporate governance can be identified, at

least the following:

• Mission and Values, Code of

Ethics.

• The company's strategy,

including the goal of sustainable development (economic, environmental and

social).

• The concept of non-financial

risk management and stakeholder engagement.

• Activities on CSR and

sustainable development.

• Social (Sustainable

Development) reporting.

• Communication (PR, Internet

and Intranet, multi-sectoral partnerships).

Typically, the world's leading

companies create with their boards of directors, special committees on CSR,

sustainable development and risk management. Often these issues are also

committees for personnel and social policy.[2]

Formation of a control system

of corporate social responsibility in a commercial bank due to a number of

stimulating factors, among which the activity of civil society, increased

competitiveness, access to financing in the international market, risk, legal

requirements and the requirements of their parent banks (investors).[3]

In order to justify the

presence of CSR commercial banks select the subject and object of the system.

The subject of social

responsibility Commercial Bank acts directly the bank itself, performing

different roles: member of civil society, a service provider, employer,

investor, investment object, party competition, the participant social development.

The object of social

responsibility Commercial Bank has a complex structure, which can include

stakeholders and the objects of their interest:

1) the business structure

(employees of client companies, partners, investors, lenders, customers, competitors,

business community);

2) public authorities;

3) community (local community,

various social groups, community organizations, NGOs);

4) environment.

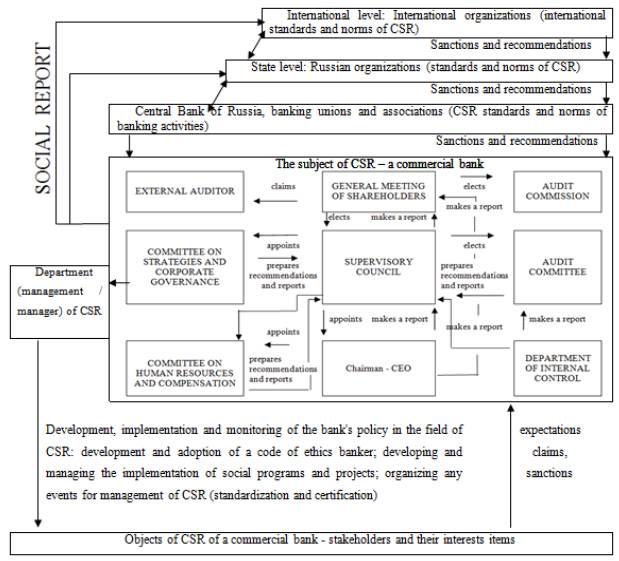

Based on the above, the

control system of social responsibility of a commercial bank in the general form

can be represented (figure 1):

Figure 1 - The management

system of social responsibility Commercial Bank

As we can see, the system of

CSR in a commercial bank - a system based on constant interaction with the

bank's stakeholders.

Unfortunately, the problem of

formation of a control system of corporate social responsibility in the banking

sector has not yet become a subject of serious and in-depth study on the part

of researchers and professionals.

The effective functioning of

the banking system in Russia prevents the current state of the labor market. On

the market today there is practically no offer of free labor resources

necessary for many specialties, non-traditional planned economy (stock deal,

trust and leasing operations, audit, and so on), and the offer of ordinary

performers with an average level of training far exceeds the demand for them.

On the other hand, only in the stage of formation are structures that provide

the participants of the market a wide range of additional services - specialized

consulting firms, centers of professional selection and training, employment

services target.[4]

Rightly assume that the

support of CSR in the company are all its staff, without exception - from the

accountant to the director. But there are people who are engaged in the

activity of the company in this direction professionally. Despite the fact that

every year a growing number of educational institutions, introducing into the

curricula of social responsibility, the majority of staff in charge of charity

and philanthropy companies are "immigrants" from other disciplines,

such as marketing or human resource management.

The indisputable fact is that

the development and strengthening of CSR practices at Russian enterprises will

enhance the role of management in the activity of the modern economic entity.

Modern conditions of the economy became the basis for the establishment and

implementation of enterprise manager for CSR.

CSR Manager - is a specialist

who uses a creative approach to process management, and provides motivational

impact on workers. Currently, there is a shortage of facilities professionals

such as CSR Manager. In this context, issues relating to the role of manager of

CSR in the activities of a modern company is very relevant and timely.[5]

However, it is still

"difficult to talk about adequate perception of CSR manager. Necessary to

expand the range of public companies who build their activities according to

international standards, understanding the need for a professional approach and

focus on the implementation of CSR principles of structural divisions of the

company, embedding CSR in corporate governance on the part of senior

management. Then we can talk about real demand from the business community on

CSR manager". [6]

Despite the fact that every

year a growing number of educational institutions, introducing into the

curricula of social responsibility, the majority of staff in charge of charity

and philanthropy companies are "immigrants" from other disciplines,

such as marketing or human resource management. Experts believe that the ideal

applicant for this position must be visionary and be able to think

strategically, properly prioritize and formulate plans to communicate freely

with different categories of employees and target groups, motivate staff to

participate in social activities carried out by the company.[7]

Today, many banks have not

only strives to organize implement its social responsibility, but also commit

to engage its individual specialists. However, the "ready"

professionals in this field in the Russian market there is little, so the

responsible thing is trusted by professionals from other areas.

Russia is only beginning to

explore the experience of Western countries in the training of corporate social

responsibility. Despite the absence of this specialty in the registry, an

increasing number of universities and business schools, paying attention to CSR

and sustainable development. Among the leaders in this area can be named

MIRBIS, GSOM, Financial University under the Government of the Russian

Federation, HSE, MGIMO, Moscow State University, State University of

Management, European University at St. Petersburg, Moscow School of Management

Skolkovo.

General labor supply in the

banking sector is limited mainly by two segments: the market of graduates of

specialized educational institutions to meet the needs of employers in the

natural renewal of their personnel; market temporarily available workforce in

the face of professionally trained and have some experience in practice of bank

employees, including not only a relatively small direct unemployed as part of

the staff of other banks are not satisfied with their current position and

ready to change jobs.

Thus, the characteristic

features of the element of the labor market infrastructure are the obligatory

presence of vocational training at any level; consequent understanding of their

high social status and the corresponding requirements for the employer; full

understanding not only of purely professional functions, but also the specifics

of banking, consequently, additional obligations in relation to the employer;

conscious awareness of the need for ongoing professional development as the

only guarantee of a successful career.

Authoritative American

organizations FootprintTalent and WAP Sustainability, which specialize in CSR,

conducted a large-scale study to identify the ideal image of a specialist in

social responsibility. To this end, 254 were interviewed Director General of

the HR-departments and other top managers of leading companies.

The most important knowledge

that identified respondents are familiar with the methods of improving the

production process, such as LEAN and Six-Sigma, a basic understanding of

business development and sales process, skills and ability financial reports to

budget expenses, basic knowledge of environmental protection and public health.

Boston College Center for

Corporate Citizenship (BCCC) also identified a number of key knowledge and

skills, which should have a specialist in social responsibility. They were

treated: the ability to implement corporate citizenship, taking into account

social and business interests to get the value for both the company and

society, skills in building mutually beneficial and trusting relationships with

internal and external stakeholders, the ability to communicate within the

company and outside it, the ability to implement strategy through the

development of executive initiatives knowledge to establish and monitor the

implementation of short-term and long-term goals and performance indicators.

What else should be able to

'social' manager? To influence others, 59.1% of respondents believe, to

motivate others (39.8%), writing texts (38.9%), to manage the processes and the

time (32.5%).

What is really an expert on

corporate social responsibility? A detailed portrait of the manager creates all

the same BCCC. Thus, the majority of experts in CSR (93%) - came from other

industries, mainly from communications: 24.2% for the "native" is the

industry PR, to 22.6% - corporate communications, to 23.9% - Marketing.[8]

Thus, CSR Manager at a

commercial bank must have the above characteristics, which should be combined

with the personal characteristics of the banking professional staff members,

namely, as a rule, economic education, a high level of theoretical and

practical knowledge of banking, banking information technologies, sustainable

positive attitude towards profession and loyalty to the bank's corporate

culture.[9]

Thus, the formation of

corporate social responsibility implies that banks that accept the principles

of social responsibility, undertake to implement mechanisms of social

responsibility in their internal procedures and rules, and the management of

corporate social responsibility in a commercial bank is a complex multifaceted

process and requires the highest level of professionalism of bank employees.

At the same time, the

financial market in general, and mainly in the retail banking sector acute

shortage of qualified personnel, especially middle managers, which creates

additional obstacles to CSR management of commercial banks.

This problem takes time to

"growing" of specialists in CSR-oriented specificity of banking

activities, as well as on the establishment of the institute of CSR in Russia.

References:

1.

Corporate social responsibility in the banking sector. International

business magazine "Sustainable Business» http://csrjournal.com/korporativnaya-socialnaya-otvetstvennost-v-bankovskoj-sfere.

2.

Social responsibility in corporate governance. Portal "Business and

Society. CSR.

"http://www.b-soc.ru/theory-and-practice/materials/material/research/32

3.

The international environmental and social standards in

ensuring the social responsibility of financial institutions / L.P. Gulyaeva, J.S.

Tkachenko // Labour and Social Affairs. - 2010. - ¹10. p. 145.

4.

E. Balakireva. Problems of recruitment to a commercial bank //

"Personnel. Human Resource Management », N 9, September 2006.

5.

Ochnev M., A. Kazeeva, E. Batrakova. The role of the manager of

corporate social responsibility in the activities of a modern company. The

magazine "Kontentus." ¹1. - 2014. http://kontentus.ru/

6.

How to become a professional in the field of CSR. Portal

"Business and Society.CSR."http://www.b-soc.ru/theory-and-practice/materials/material/corpsocotv/85.

7.

Manager of CSR: What is it? Business e-journal in the field of CSR and

sustainable development "Sustainable Business»

http://csrjournal.com/3680-menedzher-po-kso-kakoy-on.html.

8.

Manager of CSR: What is it? Business e-journal in the field of CSR and

sustainable development "Sustainable Business» http://csrjournal.com/3680-menedzher-po-kso-kakoy-on.html.

9.

Social portrait of the banker. AA Ravens // Proceedings of the

Saratov University. 2013. 8. T. Ser. Sociology. Politics, vol. 1. p. 54.