Economic Sciences / 10.

Economy enterprises.

Post-graduate

student, Golovach K. S.

Zhytomyr National Agroecological University, Ukraine

ALTMAN MODEL FOR AGRICULTURAL ENTERPRISES

The economic crisis caused by the imperfection and

failure of the banking system was a precursor to serious problems solvency of

enterprises. A number of

companies avoided bankruptcy only because of their restructuring through mergers

and acquisitions. Until now, a significant number of insolvent enterprises of

real sector generates a wave of failures.

Using the analysis of the financial

condition of the organization it is possible to identify problem areas that can

lead to the insolvency of the company and the subsequent bankruptcy. Thus, the

purpose of the analysis of the financial condition of the enterprise is the

identification and prevention of adverse effects of its activities.

There are various methods of

assessment of bankruptcy. One of the most popular methods - a solvency analysis of a enterprise.

It is carried out

with a purpose - to determine whether the company is able to meet its

obligations.

Solvency analysis is impossible to

be made using disparate indicators of financial and economic activity and

liquidity, built on the basis of financial statements. The most objective are

the factor discriminant analysis models of bankruptcy. [1]

Altman innovation lies in the selection of indicators

and, more importantly, the weights (coefficients), which in the formula are

multiplied by these indicators and in the evaluation of the resulting values. His

conclusions Altman made

based on an analysis of American companies for a number of years. In addition, there are different models

for companies whose shares are publicly traded, and for non-public companies.

Because of industry characteristics,

different economies, different countries, Altman model should be used with

caution, without placing great hopes on it. It is recommended to draw

conclusions about the financial situation of the organization and the

likelihood of bankruptcy not only on the basis of this indicator, but also on

the results of the analysis of a wider range of indicators.

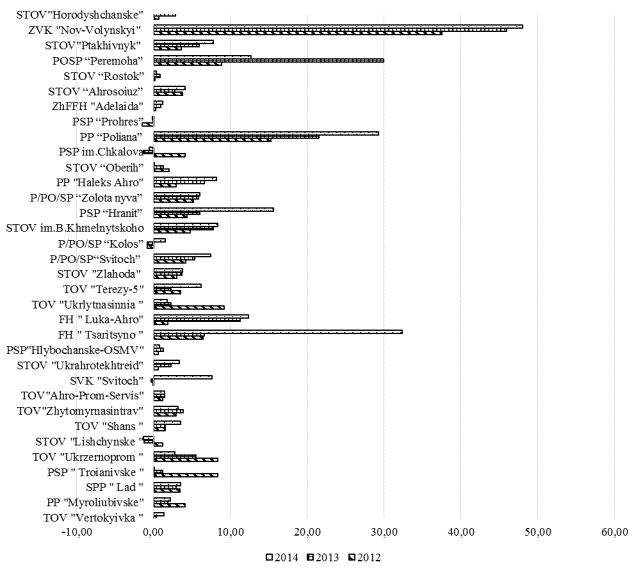

Altman's model with five factors,

designed for the agricultural enterprises of Zhytomyr region is shown in Fig.

1.

Fig. 1. Altman model for agricultural

enterprises of Zhytomyr region

According to the results of the

evaluation, taking into account the key performance characteristics for the

z-count value, which is less than 1.23, determines the failure of the

enterprise. This group includes in the first place economic entities, which

values of the index is negative, that`s why they include - STOV

"L³schinske" PSP ³m. Chkalova, PSP "Progres", SVK

"Svitoch". Also, financially stable enterprises from the researched

entities include CPP "Lad", TOV "Shans", TOV "Zhitomirnas³ntrav"

SVK "Svitoch" STOV "Ukragrotehtreyd" FH

"Tsar³tsino" FH "Luke-Agro" and others. The majority of

enterprises according to the Altman assessment are developing steadily and have

prospects for effective development.

However, the key limitation of this

method is the classical probability - the characteristics of the general

population of events. Considering the separate enterprise, we describe the

probability of its ratio to the total group. Nevertheless, the uniqueness of

every enterprise is that, it can survive under very faint chances, and, of

course, vice versa. Individuality of the enterprise destiny pushes a researcher

to look at the enterprise closely, decrypt its uniqueness, and to diagnose and

describe the differences.

Therefore, the model estimates of

the probability of bankruptcy by Altman is the most common discriminant score. However,

in most cases, it brings uncertain results and the likelihood of its estimation

is approximately 70% (especially for the national enterprises). Therefore, many

scientists attempted to adapt this model to the realities of the present to

build a universal model for the long term.

References:

1.

Financial

statements of agricultural enterprises in Zhytomyr region for 2012-2014. / Hd.

Exercise. agribusines. development of the state. Administration of Zhytomyr.

region. - Zhytomyr, 2012-2014 years.

2.

Altman

E. Financial Ratios, Discriminant Analysis and the Prediction of Corporate

Bankruptcy. / E. Altman // Journal of

Finance. – 1968 – 9. – 589-609

pp.

3.

Popov

V. B. analysis models

forecasting the likelihood of bankruptcy of enterprises / V. B.

Popov, E. S. Kadurov // Scientists note Taurian National University them. VI

Vernadsky. Economics and management. - 2014 - Vol 27 (66), ¹ 1. - P. 118-128.