Экономические науки /15 Государственное регулирование экономики

D.T. Jarikbaeva, associate professor, PhD doctor

S.S. Masakova, associate professor, candidate of economic sciences

Narxoz University, Almaty, Kazakhstan

FORMATION OF AN EFFECTIVE MECHANISM OF MONETARY REGULATION IN

KAZAKHSTAN: A RETROSPECTIVE ANALYSIS

Economic regulation as an instrument of the state's economic policy has

received its formation and development in connection with the emergence of such

a phenomenon as the economic crisis. In turn, monetary regulation as one of the

types of economic regulation was a response to the strengthening of economic

interconnections of national markets, through the development of the

institutions of the central financial regulator, affecting not only money and

money circulation, but also the financial market as a whole. We are talking

about the authorities - the central banks of states, various ministries and

departments that have in their arsenal special tools and tools that have

relevant characteristics.

In Kazakhstan, which survived the transit phase of economic development,

the so-called monetary authorities have increased the world experience in

regulating the use of these funds in the conditions of reform, when tasks such

as ensuring the stability of the national currency, the effective functioning

of the credit and banking system, and, in general, Development of the system of

settlements and payments. The implementation of these tasks and the achievement

of the goals of economic development through monetary regulation is due to the

effectiveness of the methodology for the use of basic tools and the development

of specific instructions for the application of this methodology. Together,

these methods and methods, as well as instructional materials under various

factors and conditions, represent a monetary regulation mechanism that

determines the rules and criteria for the activity of monetary authorities

depending on the selected goals of economic policy. At the same time, it is

obvious that flexibility is an important characteristic of the monetary

regulatory mechanism, ensuring that it is the main factor for the development

and stable functioning of money circulation, the banking system and, in

general, economic activity. In addition, flexibility contributes to the

effectiveness of various instruments in the coordination dimension, as well as

the achievement of the objectives of commodity-money balance and economic

stabilization.

In this connection, it should be noted that, both in general and in

methods, all instruments of economic regulation can be divided into measures of

direct and indirect impact, and methods of monetary regulation are also

subdivided, and depending on the economic situation, the relevant element of

the mechanism is put into effect. At the same time, the effectiveness of the

mechanism is based on the use of money supply as payment and settlement means

and maintenance of money demand.

In Kazakhstan these tasks were solved in stages and during this process

the mechanism as well as its interconnection with the fiscal mechanism,

including within the framework of improving the country's legislation, was

improved.

Within the framework of this

article, three stages of improving the mechanism of monetary regulation are

singled out:

1) the actual formation

(1991-1999), which took place in the conditions of transition to market

relations, namely the processes of privatization, liberalization and the

emergence of market competition.

2) Operation (2000-2007) in

relatively favorable conditions, when there were positive trends in the world

economy and world commodity markets, as well as stabilization of the economic

situation in the country, as a result of reforms, both in the real sector and

in the financial sector of the state.

3) Measures to improve the

effectiveness of the monetary mechanism (2008-2016), due to the crisis that

affected virtually all areas of the national economy, due to global financial

crises.

After

gaining independence in 1991, Kazakhstan faced the task of changing the

functioning of the economy, in connection with the transition from a planned

system to market principles: privatization, liberalization of pricing, and the

creation of a competitive environment were required.

The collapse of the USSR, the disruption of the economic ties that

existed before, led to a deep crisis in the first half of the 1990s in

virtually all spheres of the country's economy. In early 1992, measures were

taken to move to market pricing, conducted in the absence of a competitive

environment, price liberalization in 1992 led to hyperinflation, a

deterioration in the financial condition of enterprises, a reduction in

production, a drop in real incomes and stagnation in the entire economy. The

annual economic recession in 1991-1995 averaged 9.3%. Almost the payment

turnover between the enterprises was destroyed, the amounts of non-payments

reached significant volumes. The task of providing the necessary funds for the

economy was solved by the National Bank by providing loans to enterprises,

banks and the Government to finance the budget deficit, which affected the

preservation of high inflation rates. To overcome the crisis, it was required

to conduct a tight monetary policy, which was possible only after the

introduction of the national currency. In April 1993, the Law of the Republic

of Kazakhstan "On the National Bank of the Republic of Kazakhstan"

was adopted, according to which the main objective was to ensure internal and

external stability of the national currency of the country. In November 1993,

the national currency, the tenge, was introduced,

which allowed for an independent monetary policy.

When implementing monetary policy, the National Bank began using

classical instruments: lending to banks, setting an official refinancing rate

and minimum reserve requirements, conducting operations in the foreign exchange

market.

The measures taken by the National Bank helped to reduce inflation from

60.3% in 1995 to 1.9% in 1998. In 1996-1999, the average annual production

growth was 0.75%. The National Bank promoted the development of the

infrastructure of the monetary and financial markets. The system of electronic

over-the-counter market of government securities began to operate, allowing

real-time sales transactions.

In 1996, the National Bank started short-term repo operations against

security of government securities of the Ministry of Finance of the Republic of

Kazakhstan, which allowed it to effectively regulate banking liquidity.

In 1998-1999 as a result of the unfavorable situation in the world

prices for oil and non-ferrous metals, as well as significant devaluation of

the national currencies of the countries trading partners of Kazakhstan, the tenge significantly strengthened in real terms. This

reduced the competitiveness of Kazakh goods and had a negative impact on the

pace of economic growth.

To prevent negative consequences on the economy of the country, since

April 5, 1999, Kazakhstan has switched to the regime of a freely floating

exchange rate of the national currency. As a result, the supply of foreign

currency in the domestic foreign exchange market increased, which contributed

to the stabilization of the foreign exchange market and the financial sector.

Inflation in 1999 was 17.8%. In the conditions of stabilization of the

situation in the economy, the monetary policy was somewhat relaxed. The

refinancing rate in 1999 was phased

out from 22% to 18%. The

banks' mandatory reserve requirements remained unchanged at 10% of the total

deposit liabilities of the bank, except for the period from April 5 to 18,

1999, when the level of minimum reserve requirements was temporarily reduced to

5%.

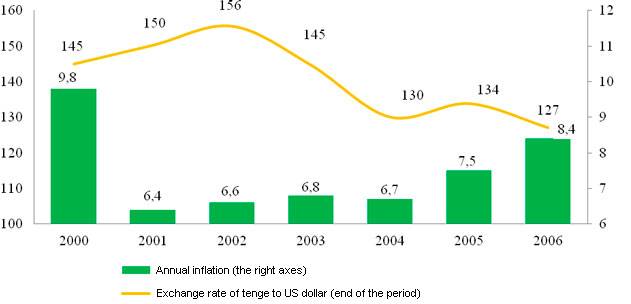

The macroeconomic environment in Kazakhstan in the period from 2000 to

2006 developed under the influence of favorable internal and external factors.

Positive trends in the world financial and commodity markets, as well as the

consistent implementation of socio-economic reforms had an impact on the

stabilization of the macroeconomic situation in the country. In 2000-2006,

inflation was maintained at 6.4% -8.4%, while the average annual real GDP

growth was 10.3%.

The growth of the Kazakh economy was greatly facilitated by the

investment activity of domestic and foreign capital. There was a favorable

pricing environment for domestic exports (oil, gold, zinc, copper, lead and

grain) against the backdrop of domestic macroeconomic stability. As part of the

easing of monetary policy in the period 2000-2003, the refinancing rate was

phased out from 18% to 7%, the overnight rate from 27% to 8%, the repo rate

from 23% to 19% . In 2000, the norm of mandatory reserves of banks was

gradually reduced from 10% to 6%. The easing of monetary policy led to an

increase in lending to the economy by banks and an increase in the supply of

money. The annual growth in the volume of bank loans to the economy for

2000-2003 averaged 66.8%, the money supply - 37.5%. At the same time, inflation

fell from 9.8% to 6.8%.

Since 2004, the National Bank has begun to define the basic guidelines

of monetary policy for three years ahead with an annual refinement of

parameters. Achieving macroeconomic stability made it possible to carry out

forecasts and develop strategic directions for a longer period, taking into

account the situation in the economy and financial markets.

The period from 2004 to 2006 was characterized by high growth rates of

the economy. The volume of bank loans from 2000 to 2006 grew 17 times. At the

same time, the growth in lending, based on significant external borrowing by

banks, has also caused Kazakhstan's vulnerability to foreign economic

conditions.

Lending to the economy was disproportionate to the structure of the

economy, which led to excessive lending to certain sectors of the economy and

the emergence of "bubbles". Against the backdrop of the limited

choice of financial instruments for investing free cash funds, the subjects of

the economy were keenly interested in their profitable investment. The

placement of free cash resources in real estate has become especially

attractive. As a result, mortgage lending and equity construction increased

significantly, which triggered a rise in property prices.

The high inflow of foreign capital, the excess liquidity on the domestic

market, the growth of the state budget expenditures contributed to the increase

in inflationary pressures in the economy of Kazakhstan since 2005. In 2006, for

the first time since 2001, inflation exceeded the level of 8%.

The intensification of inflationary processes in the economy determined

the adoption of measures to tighten monetary and credit policy, that is, an

increase in the rates for monetary operations and the withdrawal of excess

liquidity.

When carrying out the foreign exchange policy, the floating exchange

rate regime of the tenge was maintained, which

presupposed its formation depending on demand and supply in the domestic

foreign exchange market. Significant inflow of foreign currency due to the

growth of prices for major export goods, as well as an increase in external

borrowing of banks, contributed to the strengthening of the tenge

since 2002 (Figure 1).

Figure 3 - Dynamics of inflation and the exchange rate in 2000-2006 years

The tendency to strengthen the tenge has led

to an increase in the volume of foreign exchange interventions by the National

Bank. Despite the fact that the National Bank sterilized the purchase of

foreign currency, operations in the foreign exchange market contributed to the

growth of liquidity in the market. This reduced the effectiveness of measures

to regulate inflation.

In order to limit excessive credit activity of banks due to significant

foreign borrowings, in July 2006, changes were made to the mechanism of minimum

reserve requirements. To curb inflation, the National Bank also took measures

to strengthen the regulatory impact of official rates. In 2000-2006, Kazakhstani

banks attracted significant borrowings from foreign markets. This contributed

to the economic growth of the country, but at the same time increased the

vulnerability of the financial sector to external shocks. In addition, this led

to a gradual acceleration of inflationary processes. Monetary policy in this

period was multidirectional: if in 2000-2003 the National Bank eased monetary

policy to support the economy, then in 2004-2006 the National Bank tightened

monetary policy in order to overcome inflationary pressures in the economy.

The functioning of the financial system of Kazakhstan in 2008 - 2011 was

influenced by the development of crisis phenomena in the world economy. In the

general economic aspect, it should be noted that the current conjuncture of

prices for the main exports of Kazakhstan under the influence of the

manifestations of the crisis consequences of 2008 made the monetary policy less

effective.

Kazakhstan today is going through not the best of times, and regarding

the policy pursued by the government to regulate the business cycle, too,

everything is not clear. Over the past ten years, there have been many changes:

the first tenge devaluation in 2008, the aggressive

intervention in the banking sector in 2009, the inflation surge in 2010 and

2014, the restructuring of the institutional system of the financial sector in

2011, the "financial" initiatives for IPOs, the second devaluation In

2013, the third devaluation in 2015, the use of methods of inflation targeting,

etc. It should be noted that the repeated devaluation of the tenge in Kazakhstan was partly due to the reduction of tenge liquidity in the economy and the slowdown in business

activity due to the dollarization of deposits and assets, although the

Government has taken and is taking measures to dedollarize

the economy. In particular, for currency (dollar) loans and deposits the most

unprofitable rates. At the same time, due to mass conversion of deposits from

foreign currency in tenge, excessive tenge liquidity accumulated in banks and from the second

quarter of 2016 the money market began to function in the conditions of

structural surplus of tenge liquidity. Therefore, in

order to limit inflationary processes, the National Bank carried out operations

to seize liquidity [1].

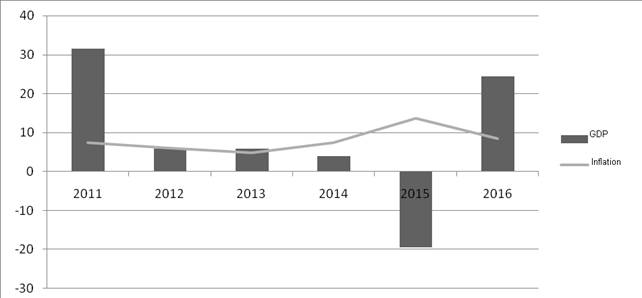

As we see, all these methods of regulation were

designed to stabilize the national economy, to protect it from more severe

shocks. At the same time, the free floating of the tenge,

which has manifested itself especially in recent times, and measures to reduce

inflationary pressures have had little effect on the performance of the

national economy (Figure 2).

The National Bank of the Republic of Kazakhstan, on

its application, seeks to reduce its participation in the foreign exchange

market in order to increase the flexibility of the tenge.

This means that with a drastic change in the economic situation, a sharp and

significant fall in world prices for energy resources and their retention at

this level for a long time, as well as devaluation in the countries that are

the main trading partners of the Republic of Kazakhstan, a sharp change in the tenge's exchange rate is possible.

Regardless of the scenario of economic development,

monetary policy measures are aimed at keeping the level of annual inflation in

the range of 6-8%. The increase in excess money supply, which stimulates

inflationary pressures, is mitigated by the growth of sterilization operations

of the National Bank.

However, the tightening of monetary policy as a whole

was one of the factors of the positive growth in GDP in 2016. In the short

term, the regulator managed to rectify the situation somewhat (Figure 2).

Figure

2 - Dynamics of GDP and inflation in the Republic of Kazakhstan, 2011-2016.

Naturally, all these measures reflect

the volatility of the real economy. The republic was faced with a lack of clear

coordination between the real economy and monetary policy. As a result, the

adjustment of monetary policy did not proceed smoothly, without jumps, without

the devaluation of the confiscatory nature and extreme rates, namely as

described above. The need for "surgical intervention" arose because

of the delay in the necessary actions at the level of macroeconomics and

guarantees that the process of depreciating the tenge

will not continue, at least until the balance in macroeconomics is reached.

References:

1. Sembieva

L.M., Alina G.B., Kulyibekova

A.M. Perspektivyi i protivorechiya

novoy denezhno¬-kreditnoy politiki Kazahstana// Vestnik KazNU, 2016. # 3. S.64-70.

2. Denezhno-kreditnaya politika Respubliki Kazahstan do 2020 goda [Elektronnyiy resurs]. URL:

http://www.nationalbank.kz (Data obrascheniya:

14.04.2017).