Åêîíîì³÷í³ íàóêè / Åêîíîì³êà ï³äïðèºìñòâà

ÓÄÊ

681.513.54

Fadyeyeva

I.G.

Ivano-Frankivsk national technical university of oil and gaz

ON

BICRITERIAL OPTIMIZATION OF WELL-DRILLING

SELF-COST

It is known [1,2], that one of the most

general and universal criterion of well-drilling process optimization is the

minimum of cost-price of 1m of drilling. Statistics [2] testifies, that now for

the drilling of one deep borehole (over 4000m) the

The

analysis of results of well-drilling in

Formulation of the problem. Drilling of a borehole includes the choice

of equipment, drilling method, geometrical size of the well, type of chisel,

quality and quantity of the washing liquid and technological parameters, such

as axel loading on chisel and its rotation speed. There is also a demand for

organization of drop-and-lifting operations forecasting of emergency and

completition of the well.

Problems

of well-drilling optimal control could be devided into problems which are to be

solved at the optimal project planning stage and those ones to be solved during the well-drilling process.

The second group of problems is most

difficult and important, since the efficiency of drilling enterprise’s activity

much depends on them. As numerous investigations show, succesful handling of

these problems make it possible to decrease well-drilling costs by 25-30%. At

the same time the development of the new drilling technique does not

significantly influence the decreasing of costs.

Adaptation

of technological parameters, quality and quantity of the washing liquid and

chisel’s type can be performed in accordance with fhe chosen optimality

criterion. In general case these criteria are devided into economical,

technical and technological, and informational ones. The economical criteria are the more preferable for deep oil and gas

well-drilling, because the costs-prise is one of the deciding indicators of

this process.

The most important economical criterion is the well-drilling cost-prise Bc. It includes material

expences, expences for chisels, pipes, usage of equipment and organizational

and technological elements, as well [2].

Cost-price Bc

![]() ,

(1)

,

(1)

where x=(T, H) and S is the feasible region (H

may be divided into N stages).

The

most important technological

criterion is the drilling time T

leading to the following task

![]() ,

(2)

,

(2)

with x and S as above.

From a technological point of view T can be divided into three components

at i-th drilling stage, namely

drilling time tδi,

drop-and-lifting operations time tcni

and auxiliary operations time tbi

(including replacement of chisel, waching of the borehole, and other control

and supporting activies). Hence, we get

![]() . (3)

. (3)

The drop-and-lifting time tcni is defined as

,

(4)

,

(4)

where Hi

is the depth of the borehole at the end of ith

stage; vi is the average

speed of drop-and-lifting.

Because  , where hk

is the width of stage and then we get from (4)

, where hk

is the width of stage and then we get from (4)

.

(5)

.

(5)

Up to

now, the well-drilling process is optimized by choosing costs or time as objective function imposing

restrictions or the other indicator. Often, the cost-price Bc is preferred, because it takes into account not only

technical indices, but economical ones, as well. However, the “one-criterial”

approach is not always most suited, because it may lead to loss of information

or it even may hide desirable compromiss solutions. Thus, we are led to

multicriterial optimization tasks. This also illustrated by Fig.1 where for

sake of completeness the whole algorithm of well-drilling optimization is

given.

As one can see, there are three control levels in the drilling process (indicated by roman numerals). Problems of well-drilling control at technological level I (chisel’s trip) is solved as bicriterial crisp optimization with objective functions Bc (min) and speed of chisel’s trip Vp (max). At stage III we are faced with the performance criteria profit PR (max), costs of well-drilling Bcb (min) and well-drilling time Tpr (min). The problem under consideration is settled at stage II, namely drilling of the borehole till projected depth.

As already mentioned we are faced with the following bicriterial

optimization task

![]() . (6)

. (6)

The

feasible region S is given by

(7)

(7)

In

Section III we discuss some details concerning this kind of optimization. For basic notions, theorems and

methods we refer to [5].

Fig.1 Algorithm of well-drilling multicriterial

optimization

Results. We

tooke for investigation 3 models: retrospective model, crisp operative model

and fuzzy operative model.

Retrospective model. The criteria

are based on retrospective analysis of

experimental data gathered from borehole SPAS-101 located in the Carpathians in

the

![]() ,

(8)

,

(8)

with Ti

= tδi + tcni + tbi in accordance with (3). Here, we have N=45. Drilling time tδi is given by such meaning:

. (9)

. (9)

The auxiliary operations time is

constant: tbi = 1 hour.

The other quantities in (9) are as following (i = 1,…,45): relative wearout

of the chisel ![]() =0,02+(i-1)·0,022 [1/h]; initial drilling speed

=0,02+(i-1)·0,022 [1/h]; initial drilling speed ![]() [m/h] (see

Table 1): drop-and-lifting speed vi=250 [m/h].

[m/h] (see

Table 1): drop-and-lifting speed vi=250 [m/h].

Table 1.

i

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

|

|

0.75 |

1.154 |

1.333 |

1.714 |

1.2 |

1.074 |

1.5 |

0.923 |

1.333 |

2 |

1.714 |

2.4 |

|

13 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

21 |

22 |

23 |

24 |

25 |

26 |

|

4.285 |

4 |

1.5 |

1.09 |

1.2 |

1.714 |

1.2 |

1.714 |

1.764 |

2.22 |

2 |

2.5 |

1.714 |

1.25 |

|

27 |

28 |

29 |

30 |

31 |

32 |

33 |

34 |

35 |

36 |

37 |

38 |

39 |

40 |

|

2 |

1.333 |

2.4 |

2 |

1.875 |

1.333 |

2 |

1.714 |

1.333 |

1.5 |

1.333 |

0.857 |

1.5 |

2 |

|

41 |

42 |

43 |

44 |

45 |

|

1.741 |

1.2 |

2.4 |

1.714 |

1.578 |

(10)

(10)

with the next meaning i Bci![]()

(11)

(11)

with Ti

as in (8).

Here, we have :

specific

cost of drilling unit work Bo=82 [1/h];

cost of the

chisel Bg=6425.4 [units].

(During the optimization we omitted the constant

factor ![]() ).

).

Crisp operative model. In

opposite to the above model we now consider models permitting operative

control. This means that

we are able to control the process by the axial loading on the chisel Pi and rotation speed ni in each segmentation i. It turns out that the above

introduced values hi, T and Bc depend on these technological parameters. Here, N=15 proved to be sufficient for

modelling the process.

Again, (8)–(9) is valid with

. (12)

. (12)

The overall costs are given by

![]() ,

(13)

,

(13)

where the costs of segment i reads as

![]() (14)

(14)

with

. (15)

. (15)

Here [3],

![]() . (16)

. (16)

Coefficients k, kj , α, αj ,β, βj (j=1,2) depend on the geological properties and are a result from regression analysis. Their numerical values are listed up in Table 2.

Table 2.

|

k |

k1 |

k2 |

α |

α 1 |

α 2 |

β |

β1 |

β 2 |

|

0.006 |

25 |

1 |

0.4 |

0.05 |

0.15 |

0.25 |

0.1 |

0.15 |

The ![]() are the same as in Table 1, but only every third value is

accounted. The feasible set S now

reads as

are the same as in Table 1, but only every third value is

accounted. The feasible set S now

reads as

. (17)

. (17)

Fuzzy operative model. In reality, however, drilling conditions (physical and mechanical properties of rocks and chisel, washing liquid and drilling column properties) may change, thus leading to parameter uncertainties. The latter may have dynamic, stochastic and/or nonstochastic character [3]. To estimate the latter, often experts statements are available. Here, we are faced with the typical situation that the specific costs Bci for ith segment are given as a rule-based system with nonstochastic uncertainties, namely

if Ti

is ![]() and hpi is

and hpi is ![]() then Bci is

then Bci is ![]() ; j = 1,…, M. (18)

; j = 1,…, M. (18)

Here, ![]() (k = 1,2,3) is a linguistic expression like “small”, “medium”,

“big”, etc., whereas M means the

number of rules. The complete rule base is given in the following matrix (where

indeces “i” are omitted for

simplicity).

(k = 1,2,3) is a linguistic expression like “small”, “medium”,

“big”, etc., whereas M means the

number of rules. The complete rule base is given in the following matrix (where

indeces “i” are omitted for

simplicity).

|

hp T |

VS |

S |

M |

B |

VB |

|

VS |

VB |

B |

VS |

VS |

VS |

|

S |

VB |

B |

S |

S |

VS |

|

M |

VB |

B |

M |

S |

VS |

|

B |

VB |

B |

B |

S |

S |

|

VB |

VB |

VB |

B |

B |

B |

VS – “very small”, S – “small”, M – “medium”, B – “big”, VB – “ very big ”.

Since fuzzy sets theory has proved to be a powerful

tool for modeling such kind of uncertainties and statements, we decided to

model the linguistic expressions by fuzzy sets. The rule base is tackeled as Takagi-Sugeno system.

Though the current inputs are crisp (real numbers) the result will be fuzzy due

to the fuzziness of the outputs. Hence, we applied a defuzzification

procedure to get numerical outputs [3].

Denoting the fuzzy sets (and somehow loosely speaking their membership functions, as well) in the jth rule by ![]() and

and ![]() we obtain for current

crisp inputs

we obtain for current

crisp inputs ![]() the corresponding

input evaluation as

the corresponding

input evaluation as

![]() , (19)

, (19)

where t

means a suited triangular norm (we took the product).

The current output ![]() will be obtained

(applying fuzzy arithmetic) as weighted mean over all rule output, i.e.

will be obtained

(applying fuzzy arithmetic) as weighted mean over all rule output, i.e.

![]()

, (20)

, (20)

where the denominator is assumed to be positive.

It is well-known that ![]() is a fuzzy number as

well. For optimization we need, however, a crisp output, that is we have to

defuzzify

is a fuzzy number as

well. For optimization we need, however, a crisp output, that is we have to

defuzzify ![]() . The level sets of any fuzzy number

. The level sets of any fuzzy number ![]() are closed intervals

on the real axis [4,6,7]. Denote them by

are closed intervals

on the real axis [4,6,7]. Denote them by ![]() for

for ![]() we can defuzzify

we can defuzzify ![]() by suited integral

means, e.g.

by suited integral

means, e.g.

, (21)

, (21)

where the existence of the Rieman integral in (21) is

ensured by the monotonicity of ![]() .

.

Hence, now our model for the overall costs becomes

(22)

(22)

with use of (19)-(20).

Results of optimization. All three models were investigated w.r.t. their bicriterial Pareto optims whereby the compromise function was used. As optimization method we applied Powell’s Direction Set Method [8], which is fairly efficient without using derivatives. Restriction (7) was taken into account as penalty.

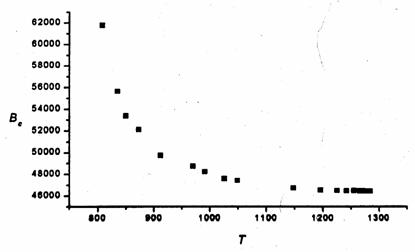

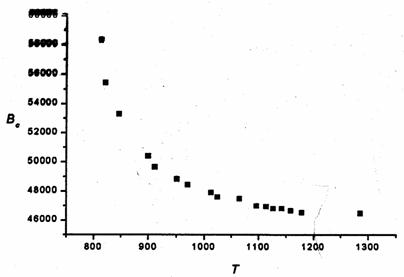

Retrospective

model. First we took α

uniformly distributed as shown in Fig.2

Fig.2 Pareto

set for the Retrospective model (uniformly distr. α)

One

sees that for T >1200 there is an

undesired accumulation of points. That is why the Pareto curve was approximated

by the following rational function [4]

with the coefficients

a =17427,85; b =

-7232071,5; c = -4207299e+9; d = 0,37878;

e = -147,213; f

= -106855,6.

The

corresponding α were determined

and we obtained the following Pareto set:

One realizes that the distribution is improved (far from being

ideal). The corresponding Pareto points are listed up in the below table (for

shortage of space we do not itemize the 45-dimensional solution vectors).

Fig.3 Pareto set for the model

Table 2.

|

i |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

T |

814 |

822 |

847 |

900 |

912 |

951 |

971 |

1013 |

1025 |

|

Bc |

58316 |

55432 |

53283 |

50393 |

49644 |

48819 |

48436 |

47905 |

47590 |

|

i |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

|

T |

1065 |

1096 |

1114 |

1127 |

1142 |

1159 |

1179 |

1186 |

|

Bc |

47464 |

46985 |

46935 |

46800 |

46796 |

46647 |

46511 |

46470 |

From

the decison-makers viewpoint most interesting seem to by points 4 ands 5,

because they indicate some break: onthe left-hand side we gain a lot for Bc with only small losses

w.r.t. T. Right from these points the

gain for Bc becomes rather

small while we have to note a greater loss of T.

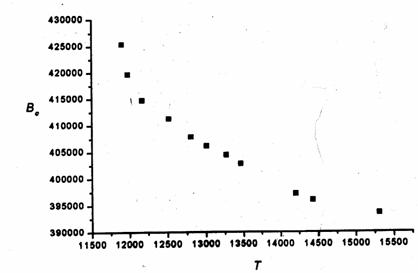

Crisp operative model. Here we had to allow with more numerical difficulties due to the high nonlinearity of the functions involved. Hence, a smaller number of Pareto solutions was obtained .

The corresponding data are contained in the

following table (again the solution vector of

dimension 30 is omitted).

Fig. 4 Pareto

set for the crisp operative mode

Table 3.

|

i |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

T |

11907 |

11986 |

12173 |

12522 |

12807 |

13010 |

13272 |

|

Bc |

425376 |

419672 |

414701 |

411259 |

407867 |

406148 |

404424 |

|

i |

8 |

9 |

10 |

11 |

|

T |

13468 |

14206 |

14429 |

15311 |

|

Bc |

402774 |

397144 |

395988 |

393535 |

Obviously, the neighbourhood of point 3 seems to be worth being investigated further.

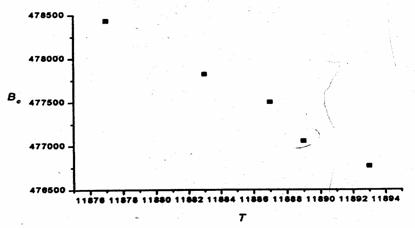

Fuzzy operative model. The situation is

analogical to the previous one.

Fig. 5 Pareto

set for the fuzzy operative model

Notice, anyhow, that the evaluated

set of drilling time T is narrowed in

comparison with the crisp model what is due to the information submitted by the

experts.

Table 4.

|

i |

1 |

2 |

3 |

4 |

5 |

|

T |

11877 |

11883 |

11887 |

11889 |

11893 |

|

Bc |

478435 |

477821 |

477503 |

477054 |

476767 |

Here, point 4 is most interesting from the decision makers view point.

Summary.

In opposite to the classical approach of decision making in well-drilling that is based on objective

function, the method presented here enable to exploit the derived models in a

more efficient way w.r.t. finding “good solution”, i.e. preferable parameters for controlling the

process. With the help of the Pareto set one is able to determine compromisses

which are more satisfactory from user’s

point of view because the behaviour of drilling time and costs (w.r.t.

optimality) can be taken into account

simultaneously, The fuzzy model, however, turns out to be too coarse for final

decision making. Hence, a finer and more sophisticated partition of the time

and segmentation universums and the costs, as well, seems to be advisable to

get a more sensitive response function.

References

1. Maric V.B., Criganivsciy E.I., Dovgoc V.E., Gouc R.Y. Actual problem of roll-bit. Exploration and development of oil and gas deposits.–2003.–V. ¹2(7) .– P.109-113.

2. Furness R., Wu C., Ulsoy A. Statistical analysis of the effect of feed, speed and wear on hole quality in drilling. I Manufect SciEng ,1996.– P.367-375.

3. Chygur I, Fadyeyeva I, Sementsov G.. Application of fuzzy logic for the simulation of drilling tools wear process and short-term forecasting of well-drilling cost. Proc.10th Zittau Fuzzy Colloquium, Sept.4-6, 2002.–P. 173-177.

4. Das I., Dennis J.E. A closer look at drawbacks of minimizing weighted sums of objectives for Pareto set generation in multicriteria optimization problems. Price Univ., Houston, Texas. Working Paper, 1996.–12 p.

5. Ester J.. Systems Analysis and Multicriterial Decision Making (in German) VEB Verlag Technik, Berlin, 1987.

6.

Eschenamer H.,

7.

Koski I.. Multicriteria Truss

Optimization. Multicriteria Optimization in Engineering and in the Sciences.

Edited by Staler W..

8.

Press W.H. et al., Numerical

Recipes in