THE IMPACT OF MONETARY POLICY OF THE CENTRAL BANK ON

THE DEVELOPMENT OF THE MONETARY SYSTEM OF RUSSIA

A.V. Grishanova

A. I. Shmyreva Ph.D

Novosibirsk state University of Economics and

management "NINH"

At the present time there is a

change of the monetary system of the Russian Federation, through the

implementation of the Central Bank of Russia special monetary policy.

Before turning to the analysis of

the economic environment prevailing in the Russian economic space, it should

focus on the principles of monetarism, which have been studied and introduced

by the founders of this teaching - M. Friedman, A. Meltzer, K. Brunner.

Monetarism simulates economic system

that meets the following requirements:

1) to optimize own wealth individuals should have a free choice between

different forms of wealth;

2) the national wealth should bring the total income;

3) the dominance

of free competition in the market of goods, resources, and all other goods

included in the national wealth.

Currently in Russia there is the

dominance of monopoly prices for energy carriers, transport services,

infrastructure [1]. Wages in these sectors is due to the corporate benefits

companies, other income countries.

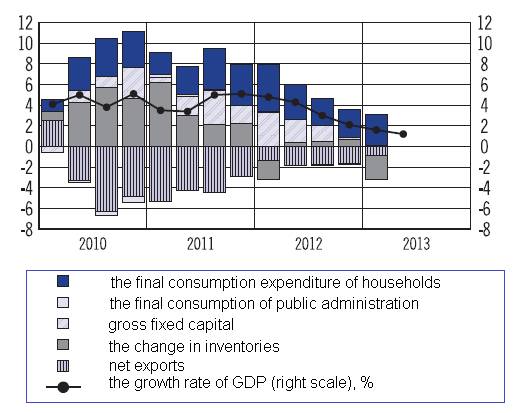

For a long time,

the Russian economy showed steady increment of GDP, as presented in figure 1.

Fig1. The

structure of GDP growth over the elements used in 2010-2013, %

However, based on the data of the

chart presented in figure 2, published by the CBR, we can conclude that in the

present economic growth practically stopped, and inflation according to

Rosstat, for it is the year 2013 was 6.6%.

Fig.2. The actual

rate of inflation, expressed through the annual index of consumer prices (CPI)

in 1991-2012, %

Thus, it turns out that the system of

state regulation of the economy cannot provide a sustainable, dynamic and

balanced economic development that can be caused by contact one of the

"traps", which is subject to the following dogmatic rules of monetary

policy.

Under the monetary policy refers to

the activities of the state in foreign exchange and monetary spheres aimed at

realizing its interests in relations with other States, supranational and

sub-national government and municipalities, legal entities and natural persons

[2].

Among the main goals of the monetary

policy in developed countries are not only maintaining the stability of the

exchange rate and the overall price level (i.e. avoiding high inflation), but

also stimulate economic development, growth of employment and incomes. The goal

of the monetary policy of the Russian Federation implemented by the state

program and setting targets for socio-economic development in specific periods

and taking a complex of measures for achieving them linked to time and provided

material and financial resources.

Based on the data of annual indexes of

growth of consumer prices, the actual rate of inflation systematically exceed

the upper bounds of predicted rates, causing an increase in the balance of

payments. This leads to the strengthening of the national currency, the ruin of

the manufacturing industry and the shift in employment in the service sector,

which is an obvious sign of "Dutch disease". This effect is received

its name after the opening of the Netherlands natural gas fields in 1959, the Growth

of export of gas has led to increased inflation and unemployment, decline in

exports of manufacturing industry and the growth rate of income in the 70's the

Growth of oil prices in the mid 70's and early 80's caused a similar effect in

Saudi Arabia, Nigeria, Mexico. The sharp increase of export revenues from

extractive sectors of the economy leads to additional inflow of foreign

currency into the country. In the end, the nominal rate of the national

currency is growing, and foreign - falls. To solve this problem, the state may

use the exchange rate by buying foreign currency, but this leads to growth of

money supply and inflation [3].

The most effective treatment of

"Dutch disease" is to provide the government and the Central Bank to

enterprises loans; substitute attracted the recent foreign loans. The

implementation of this operation opposed to one of the rules of monetary

policy, according to which the funds of the Stabilization Fund can only be used

for repayment of external debt. However, from a macroeconomic point of view,

the replacement of foreign loans to Russian companies financing is similar to

repayment of external debt. In the project of the Central Bank of the Russian

Federation from September 25, 2013 it is noted that "the Bank of Russia

intends to continue to increase the flexibility of the exchange rate and by

2015 to complete the transition to a floating exchange rate regime, which will

allow avoiding possible conflict objectives of monetary policy".

The main factors that can change the

conditions of functioning of the exchange rate channel of the transmission

mechanism is to further liberalization of currency regulation, internal and

external convertibility of the national currency while maintaining the free

float, more substantial integration into the world system of economy, the

increase in the share of exports in GDP due to the increase of export not only

natural resources but also competitive end products of processing of high-tech

goods.

In the project of the Central Bank of the

Russian Federation "Basic trends of the unified state monetary policy for

2014 and the period to 2015 and 2016 years", approved by the Board of

Directors of the Bank of Russia, says that by 2015 the Bank of Russia plans to

complete the transition to inflation targeting regime, under which the price

stability is recognized as a priority objective of monetary policy. In

addition, the inherent characteristics of the new regime are ad quantitative

targets on inflation, the decisions primarily on the basis of the forecast of

economic development and the dynamics of inflation".

If there developed working channels of the

transmission mechanism becomes possible to use more flexible inflation

targeting regime, implying the use of operational tools of the Central Bank in

order to achieve quantitative benchmark inflation. The attractiveness of this

method is as follows:

1) enter the

nominal anchor of the monetary system, the most adequate obtaining price

stability, if the latest achievement is recognized as the ultimate goal of

monetary policy;

2) set clear to the public the criteria of activity of the monetary

authorities, transparency of political processes and the stabilization of

inflation expectations;

3) there is flexibility in the choice of monetary policy instruments that allow

the bodies of monetary regulation to use the ways of achievement of targets

that may be better adapted to the specific situation in the macroeconomic

environment.

______________________________

1. Ershov M.V. The formation of the industrial policy priorities and mechanisms

for their implementation. //Russian economic journal. 2006. ¹1

2. Fetisov G.G. Monetary

policy and development of the monetary system of Russia in conditions of

globalization: national and regional aspects.//M: Economy. 2010. 492 p.

3. Davydova L.V.

Development trends of the national monetary system: theory and practice/ / L.V.

Davydova, N.V. Tulikov ; Acad. state service. - Orel, 2010. - 194 p.