Sulyaeva

Yulianna

PhD in Philosophy, Petrova Yulia Andreevna

Rostov State University of Economics (RIPE)

The economic behavior of firms in

the conditions of perfect competitiveness and pure monopoly.

Monopoly – is an exclusive right on production, trade or other

activity owned by one person, group of people or state [1]. By its nature,

monopoly – is a “power”, which undermines the competitiveness of the natural market. Absolute

monopoly spreads

through the world economy,

which means a complete

exclusion of free market competition.

The problems of monopolization of the commodity markets call too much attention today as among

professionals and as among general population. The success of economic reforms

largely depends on the

weighed regulatory system of the state of monopolistic processes and

competitive relations. There are different kinds of monopoly: natural, legal

and artificial; those

exist in different countries and in different historical periods of the

economy [1].

It can

be said that a monopoly – is a union of entrepreneurs, who "throw off money into the general basket", forming a

solid authorized capital. Monopolists actually make out "copyrights"

on manufacture and sale of their products, in violation of which follows

serious sanctions. Organizing the general management of their factories and

department stores, the monopolists are the most powerful company with a high

turnover of finance and goods at high prices, allowing them to control the

market of the country, while small firms do not stand the competition and go

bankrupt. [2].

Analyzing the economic behavior of the firm in the conditions of perfect

competitiveness and pure monopoly, has allowed us to identify some major

economic impact of monopoly power.

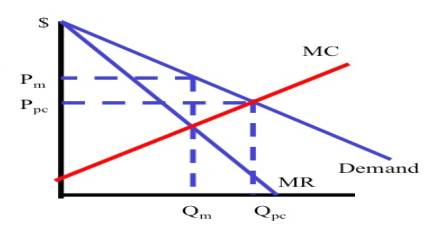

1. In

terms of pure monopoly, the firm sells at a better prize less products at the

same expenses and demand, then in pure competitiveness. This can be shown

graphically (Fig. 1). Assume that we are talking about the same industry, which

produces certain and similar products.

In

the first case, a large amount of small firms operate in this industry, which

are independent from each other, i.e. industry is quite competitive. Then the

equilibrium price will be determined by Pc

at the point of intersection of the graphs of market value and sectoral offers

– the point Mc.

Fig.1. The definition

of price and the volume of output in industry competitive dynamics in the

conditions of pure monopoly.

The

curve of market supply in the industry will be determined, as we have

established in the preceding paragraph, by adding the horizontal segments

schedules of marginal expenses MC separate competitive companies (above the

minimum A YC).

Consequently, when the monopolists select optimal output, ensuring their

maximum gross profit, not enough effective allocation of economic resources

occurs, from the point of view of society (P < MC). It is profitable for the

monopolists to restrict sales by implementing fewer products, but at a higher

price, that is, they can use fewer resources for the production of these

products than necessary to society.

2.

Pure monopoly promote increases inequality in the distribution of income in

society as a result of the monopolistic market power and the establishment of

higher prices for the same cost than under perfect competitiveness for getting

monopoly profits.

3.

Price discrimination can be used by monopolists in terms of market power when

different prices are assigned to different buyers. Such a possibility is

connected with the situation when buyers are able to purchase monopolists’

goods at a higher price than P,", it is called – “solvent demand”. At the same time there

are buyers who aren’t able to pay the price P, " for products, but can

purchase for a lower price. [3].

Of

course, the best example of price discrimination is not in industries that are

not working on the production of goods but on rendering of services. It is because of

realization of goods for lower prices could lead to following resale for higher

prices [4]. Anyhow,

products of human services are less suitable or even unsuitable for resale, for

example, provided transport service or generated electricity.

Price

discrimination is widely spread in Russia and is used in a number of industries

in the sale of products of various types: electricity, transport services,

telecommunication services, utilities, etc. All this contributes to the profit mark-up of

the monopolist that allows him to sell the part of his products at a higher

price for buyers, who are able to pay. All this leads to the growth of product release, because of

sales at lower prices and less solvent customers by expanding the

market.

Literature

1.

Savchenko V.E. “State business in a

market economy” JSC “NPO "Economy"”, 2000.

2.

Atkinson, Scott E., and Robert

Halvorsen. “The Relative Efficiency of Public and Private Firms in a Regulated

Environment. Journal of Public Economics 29 (April 1986): 281-294.

3.

Robert Philips, Pricing and Revenue

Optimization. Stanford University Press, (2005): 74

4.

http://web.mit.edu/14.271/www/hio-pdic.pdf