Sergey A. Sheludko

Odessa National Economic University, Ukraine

The principles of the foreign exchange reserves of the National bank of

Ukraine and their place in the national economy of Ukraine

An

importance of the subject of this study is caused, first of all, by the

unstable position of the Ukraine's economy in the global currency market that

is dependent on the global system wide financial crisis. Incoordinate and

inconsequent steps of the political institutions in order to develop the

domestic economy directly affect the overall situation in the country, the

standard of living and well-being of its citizens. These actions, caused rather

by the political reasons than the objective reasonability, hurt not only the

entire economy as a whole but also its specific components by demonstrating a

complete failure of the prospective analysis.

Currency

regulation, one of the instruments of which is the country's foreign exchange

reserves, is an integral part of the national economy macroeconomic management

and therefore must enforce a number of problems most of which is to maintain

sustainable economic growth. Achievement of this objective also depends on the

skilled and scientifically proven foreign exchange reserves management

(hereinafter – FX reserves) of the country the liquidity and the value of which

is beyond doubt. Thus, the role of the foreign exchange reserves in the

economic development is extremely significant.

Analyzing

the past scientific researches concerning the topic we study it should be noted

that the special attention to this problem was already paid in the middle of XX

century. Thus, among the foreign economists engaged in the problems of the

formation and managing the foreign exchange reserves should be called the works

of the following authors: R. Aliber, W. Argi, A. Ben-Bassat, I. Balabanov, C.

Blackman, S. Brady, D. Williamson, R. Clark , H. Dellas, P. Downes, M. Dooley,

B. Dyuyzenberha , S. Edwards , B. Eichengreen, A. Greenspan , M. Kelly, N.

Kiyotaki , N. Krasavina , D. Landel-Mills, T. Lettera , D. Lizondo, K.

Matsuyama, K. Mahoney, J. Murray, D. Mathewson, T. Nordman, I. Noskova, M.

Pebro, S. Petermann, K. Rikkonen, S. Roger, J. Sinci, W. Smith, M. Feldstein,

D. Frenkel, M. Khan, G. Heler, D. Healy and others.

Ukrainian

scientific thought turned to this subject just in the end of the last century.

The foreign exchange reserves have been studied in the works of the following

national authors: S. Borynets, A. Halchynskiy, G. Zadorozhniy, N. Kostin, A.

Lupin, A. Moroz, A. Nicolenko, M. Puhovkina, M. Savluk, V. Stelmah, V.

Yushchenko and others. However, their researches have different contradictory

conclusions about the most efficient ways of the foreign exchange reserves use,

differences in the theory of the nature and importance in the system of the

monetary and foreign exchange policy of the central bank. This allows us to

talk about the need for synthesis of the available scientific works and

determination of a unified approach to the definition and understanding of the

main point of the central bank foreign exchange reserves in the national

economy of the country.

Considering

the scientific approaches to the definition of “foreign exchange reserves” it

should be noted that the vast majority of authors [1, p. 47; 2, p. 326; 3, p. 33;

8, p. 57-58; 9 p. 43] defines the foreign exchange reserves as assets – in

other words, the funds which are completely controlled by the central bank.

Other scientists in their definitions use the term of “resources” presuming

that the assets in the balance are accounted as balances on the corresponding

accounts. In this case it is possible to say that the terms of “assets” and

“resources” are the similar. It allows us to make a very important conclusion

about the active nature of the central bank foreign exchange reserves – this

category of financial resources is completely controlled by its administrator

and owner – the state (represented by the central bank or other government

authority that performs the similar functions).

According

to the Law of Ukraine “On the National Bank of Ukraine”, “the foreign exchange

reserves – are the reserves of the state of Ukraine reflected in the balance of

the National Bank of Ukraine which includes assets recognized by the

international community as the international ones and designated for

international settlements” [4, p. 1]. The definition of the FX reserves in the

law describes just their way of reflection in the financial statements (NBU

balance) as the assets.

It

is also necessary to point out the differences in the terminology of the

category we study. Among the most common names, except “foreign exchange” it is

also possible to find “forex”, “gold and currency”, “official” and “international”

reserves and also “reserve assets” and “foreign-exchange holdings”. Despite the

fact that the FX reserves consist not only of gold and foreign currency, it is

reasonable to use the term of “foreign exchange reserves” for historical

reasons and because it is commonly used for scientific usage.

According

to the above-mentioned positions we can offer our own definition for the

studied category. Thus, foreign exchange reserves are the assets owned and

controlled by the state, managed by specially designated authorities, may be

used on the first demand to carry out their functions and the value and high

liquidity of which is also practically assured.

First

of all, it is necessary to characterize the qualitative composition of the

foreign exchange reserves. It is usually a combination of assets that offers an

opportunity for the central bank to provide a regulatory effect on the currency

relations and organization of the external economic activity in the country [2,

p. 330].

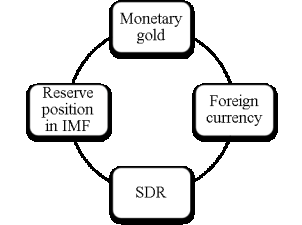

The

reserves structure directly depends on the national economic situation on the

world stage. In any case, the structure of reserves includes four main

components [5, p. 347], shown in fig. 1.

Fig. 1. Foreign exchange

reserves structure*

* Drawn up by the

author according to [1, p. 41-44].

As

shown in fig. 1, the structure of the central bank foreign exchange reserves contains

monetary gold, foreign currency, special drawing rights and reserve position in

the IMF.

Monetary

gold (stock of gold) – fine gold in the form of coins, ingots and powder of at

least 995 fine which is owned or controlled by the central bank or other public

authorities (e.g. Treasury ) [5, p. 347]. Gold reserve serves as an insurance

fund to obtain the particular foreign currency needed for the country to

maintain its international liquidity (because it is always possible to sell

gold in the world gold market). In addition, the stock of gold can be used as

collateral for the foreign loans in foreign currency.

An

important component of the foreign exchange reserves is the foreign currency

reserve that is registered on the NOSTRO accounts in the foreign banks and also

in the form of securities expressed in a foreign currency which are traded on

the international financial market. These securities include mainly treasury

bills and government bonds as the most reliable types of the stock instruments.

Securities transferred to the counterparties under securities loan operations

(issued in exchange for other securities) are included in the international

reserves while the securities for the collateral by the direct REPO

transactions are excluded from the reserves. Securities received as collateral

for the reverse REPO transactions or securities lending are not included in the

international reserves [3, p. 34]. A certain part of the foreign currency

reserves can be saved in cash in the central bank cash departments. The basic

currencies that are included in the foreign exchange reserves (and that is why

they are called the “reserve currencies”) are the following hard currencies:

U.S. dollar, euro, Japanese yen, British pound, Swiss franc and other which

bring the highest income.

Special

Drawing Rights – is a component of the foreign exchange reserves and is a

collective currency within the IMF which is shared between the member states

proportionally to their IMF quotas (according to art. XV of the IMF Statute).

The quota determines the amount of the subscription of the country to the IMF

capital, the possibility to use the Fund resources and, finally, the number of

votes that the country has in the Fund. The quota can be changed at the

suggestion of either the member state or the governing bodies of the Fund (but

only in case of approval of the corresponding state). The quotas amount of the

member countries are based on the economic value and the share in the world

economy and international trade. The terms of SDR came into force on 1 January,

1970. The main purpose of the SDR is the balance of payments regulation, the

official reserves replenishment and settlements with the IMF. SDR functionate

only at the international level as the entries on the IMF correspondent accounts

and accounts of the central banks of the IMF member states. In fact, the SDR is

a perfect IMF currency (which exists only in the form of entries on the

accounts), the exchange rate of which is based on the average currency basket.

Since 1 July, 1974 till 1 January, 1981 in the SDR basket there were 16

currencies, till 1 January, 1999 – 5 currencies (U.S. dollar, Japanese yen,

German mark, French franc and British pound). Since 1 January, 1999 up to date

– 4 currencies (U.S. dollar, euro, Japanese yen and British pound) [5, p.

587-588]. SDR basket is reviewed every 5 years.

Finally,

the last foreign exchange reserves component is the reserve position in the IMF

– the amount of the reserve share of a country in it and loans to it from the

IMF. Some authors [8, p. 59; 9, p. 44] incorrectly interpret this asset just as

the country's quota in the Fund because the reserve position is only 25 % of

the quota [1, p. 41]. Reserve quota share is the part of the contribution of

the state to the IMF that is paid in SDR or other hard currencies. And credit

position of the state in the IMF is the loans granted by the state under the

additional loan agreements [3, p. 38]. Getting by the government of the loans

from the IMF is carried out by purchasing of the foreign currency in exchange

for the national one.

We

should consider the structure of the NBU foreign exchange reserves in

1994–2013. (table 1).

Table 1

Structure of the NBU

foreign exchange reserves in 1994-2013*

|

As of 01.01: |

Foreign exchange reserves |

||||

|

Total, mln. USD |

Among them: |

||||

|

Monetary gold, % |

Foreign currency, % |

SDR, % |

Reserve position in IMF, % |

||

|

1994 |

166,0000 |

2,6506 |

97,3494 |

0,0000 |

0,0000 |

|

1995 |

664,4000 |

2,0620 |

70,7556 |

27,1824 |

0,0000 |

|

1996 |

1068,9000 |

1,7120 |

84,7881 |

13,4999 |

0,0000 |

|

1997 |

1971,6000 |

0,5884 |

96,0032 |

3,4084 |

0,0000 |

|

1998 |

2358,8000 |

0,7504 |

96,2354 |

3,0142 |

0,0000 |

|

1999 |

792,9000 |

3,9854 |

73,0105 |

23,0042 |

0,0000 |

|

2000 |

1093,6000 |

4,3160 |

89,6763 |

6,0077 |

0,0000 |

|

2001 |

1475,4000 |

8,3842 |

74,8001 |

16,8158 |

0,0000 |

|

2002 |

3089,5000 |

4,3405 |

87,5320 |

8,1275 |

0,0000 |

|

2003 |

4629,0000 |

5,9408 |

93,4327 |

0,6265 |

0,0000 |

|

2004 |

7068,0000 |

3,5512 |

96,3073 |

0,1556 |

0,0000 |

|

2005 |

10042,3800 |

2,2043 |

97,6405 |

0,1552 |

0,0001 |

|

2006 |

18582,4300 |

2,3477 |

97,5768 |

0,0754 |

0,0000 |

|

2007 |

22388,4600 |

2,3284 |

97,6118 |

0,0598 |

0,0000 |

|

2008 |

31841,5800 |

2,4268 |

97,5542 |

0,0190 |

0,0000 |

|

2009 |

28821,8400 |

2,6021 |

97,3042 |

0,0936 |

0,0001 |

|

2010 |

25285,5700 |

3,7539 |

95,9967 |

0,2493 |

0,0001 |

|

2011 |

35138,9800 |

3,3196 |

96,6574 |

0,0230 |

0,0001 |

|

2012 |

31364,1100 |

4,9442 |

94,7332 |

0,3243 |

0,0001 |

|

2013 |

24651,9600 |

7,7282 |

92,2343 |

0,0374 |

0,0001 |

* Calculated by

the author according to [6; 7, p. 533-534].

As

shown in the Table 1, during the analyzed period the foreign exchange reserves

structure had some changes but the general trend of the foreign currency

domination over the other components remained. Thus, in 1994 the share of this

component was 97.35 % but in a year it fell down to 70.76 % – this is due to

the introduction of SDR in 1995 which at once occupied almost one-third of the

total index. Till 1998 the assets valued in foreign currencies began to increase

their own share again on the background of reducing the SDR share, and in early

1999 the past situation repeated: SDR increased to 23%. In 2000-2001 there were

fluctuations in SDR and foreign currency shares and since 2002 the share of

foreign currency assets began to rise again. In 2005 there was a historic

maximum of 97.64 %. This situation war remaining for 2005-2008 and since 2009

the foreign currency share began to steadily decrease (small increase to the

level of 96.66 % was in 2011) and in early 2013 was 92.23 %.

The

share of monetary gold which in 1994 was 2.65% reduced to the level of 0.59% in

1997, showed growth in 1998-2001 and reached its historical maximum of 8.38%.

During 2002-2007 the share of gold with minor fluctuations was decreasing and

in 2007 was only 2.33%. However, starting from 2008, the index began to rise

again and in 2013 was 7.73%.

The

SDR component appeared in the foreign exchange reserves structure in 1995 and

at once occupied a significant share – 27.18% and till 2002 was nonuniformly

decreasing by demonstrating significant values in 1996 (13.5%), 1999 (23%) and

2001 (16.82%). Since 2003 until today, the SDR share is less than 1% and

demonstrates insignificant fluctuations.

Reserve

position of Ukraine in the IMF during the analyzed period has very low values

of about 0.0001%. For the first time this index appeared in the foreign

exchange reserves in 2005 but it has not significantly affected the structure

of these assets.

Table 2

NBU foreign exchange

reserves dynamics in 1994-2013*

|

As of

01.01: |

Foreign exchange reserves |

|||||||||

|

Total amount |

Among them: |

|||||||||

|

mln. USD |

Rin,

% |

Monetary gold |

Foreign currency |

SDR |

Reserve position in IMF |

|||||

|

Total,

mln.

USD |

Rin,

% |

Total,

mln.

USD |

Rin,

% |

Total,

mln.

USD |

Rin,

% |

Total,

mln.

USD |

Rin,

% |

|||

|

1994 |

166,0 |

– |

4,4 |

– |

161,6 |

– |

0,0 |

– |

0,0 |

– |

|

1995 |

664,4 |

400,2 |

13,7 |

311,4 |

470,1 |

290,9 |

180,6 |

– |

0,0 |

– |

|

1996 |

1068,9 |

160,9 |

18,3 |

133,6 |

906,3 |

192,8 |

144,3 |

79,9 |

0,0 |

– |

|

1997 |

1971,6 |

184,5 |

11,6 |

63,4 |

1892,8 |

208,8 |

67,2 |

46,6 |

0,0 |

– |

|

1998 |

2358,8 |

119,6 |

17,7 |

152,6 |

2270,0 |

119,9 |

71,1 |

105,8 |

0,0 |

– |

|

1999 |

792,9 |

33,6 |

31,6 |

178,5 |

578,9 |

25,5 |

182,4 |

256,5 |

0,0 |

– |

|

2000 |

1093,6 |

137,9 |

47,2 |

149,4 |

980,7 |

169,4 |

65,7 |

36,0 |

0,0 |

– |

|

2001 |

1475,4 |

134,9 |

123,7 |

262,1 |

1103,6 |

112,5 |

248,1 |

377,6 |

0,0 |

– |

|

2002 |

3089,5 |

209,4 |

134,1 |

108,4 |

2704,3 |

245,0 |

251,1 |

101,2 |

0,0 |

– |

|

2003 |

4629,0 |

149,8 |

275,0 |

205,1 |

4325,0 |

159,9 |

29,0 |

11,5 |

0,0 |

– |

|

2004 |

7068,0 |

152,7 |

251,0 |

91,3 |

6807,0 |

157,4 |

11,0 |

37,9 |

0,0 |

– |

|

2005 |

10042,4 |

142,1 |

221,4 |

88,2 |

9805,4 |

144,0 |

15,6 |

141,7 |

0,0 |

– |

(table

2 breakover)

|

2006 |

18582,4 |

185,0 |

436,3 |

197,1 |

18132,1 |

184,9 |

14,0 |

89,9 |

0,0 |

40,0 |

|

2007 |

22388,5 |

120,5 |

521,3 |

119,5 |

21853,8 |

120,5 |

13,4 |

95,5 |

0,0 |

100,0 |

|

2008 |

31841,6 |

142,2 |

772,7 |

148,2 |

31062,8 |

142,1 |

6,0 |

45,1 |

0,0 |

250,0 |

|

2009 |

28821,8 |

90,5 |

750,0 |

97,1 |

28044,9 |

90,3 |

27,0 |

446,9 |

0,0 |

300,0 |

|

2010 |

25285,6 |

87,7 |

949,2 |

126,6 |

24273,3 |

86,6 |

63,0 |

233,5 |

0,0 |

100,0 |

|

2011 |

35139,0 |

139,0 |

1166,5 |

122,9 |

33964,4 |

139,9 |

8,1 |

12,8 |

0,0 |

100,0 |

|

2012 |

31364,1 |

89,3 |

1550,7 |

132,9 |

29712,2 |

87,5 |

101,7 |

1258,7 |

0,0 |

100,0 |

|

2013 |

24652,0 |

78,6 |

1905,2 |

122,9 |

22737,6 |

76,5 |

9,2 |

9,1 |

0,0 |

100,0 |

* Calculated by

the author according to [6; 7, p. 533-534]. Rin – rate of increase.

According

to the analysis of the foreign exchange reserve structure the largest share has

foreign currency and this share is close to 100% that means that this component

has a crucial importance in the use of reserves. Next in importance is the

monetary gold. Although it did not show a significant share (was not exceeding

10%) its share remained at the same level. The SDR share was nonuniformly

fluctuating but for over the last 10 years has not played a significant role. A

similar statement applies to the reserve position in the IMF. The next step in

the NBU foreign exchange reserve study is the analysis of their dynamics in

terms of the components (Table 2).

As

shown in the Table 2, the foreign exchange reserves changes were characterized

by the significant nonuniformity. Thus, in 1994-1998 the reserves total amount

increased from 166 million USD to 2358.8 million USD.

After

decreasing in 1998 to a level of 792.9 million USD in early 1999, during

2000-2008 the reserves were only increasing and reached in 2008 the amount of

31841.6 million USD. Another decreasing in 2008 till the level of 28821.8

million USD changed by gradual growth in early 2009 and in 2011 the foreign

exchange reserves reached its historical maximum of 35139 million USD. However,

starting from 2012 and until now there has been a sharp reduction and as of

01.01.2013 the reserves amounted only to 24652 million USD.

It

should be noted owing to which components there were changes in the total

volume: an increase in 1994-1998 was mainly caused by the increasing of the

foreign currency volume. The first decreasing (1999) was accompanied by a

reduction of the above-mentioned component on the background of growth of SDR

and monetary gold. The next period of growth (2000-2008) is caused by

increasing both of the foreign currency and monetary gold and also by a new

component that appeared in 2005 (reserve position in the IMF) but the volumes

of SDR were just reducing. The change of the reserves level in 2009 occurred

due to the decline of the gold and foreign currency volumes and a simultaneous

increase of the SDR. The positive trend of 2010-2011 was characterized by

corresponding changes in two of the four indicators (excluding SDR and reserve

position in the IMF). Finally, the reduction since 2012 is due to a reduction

of all indexes except monetary gold (which has slightly increased).

There

are the following ways to use the foreign exchange reserves that are defined in

the Law of Ukraine “On the National Bank of Ukraine”: sale of the currency on

the financial markets for monetary policy purposes, including exchange rate

policy and also transactions with foreign currency, monetary metals and other

reserve assets [4, p. 48]. These provisions of the Law are not perfect because they

do not specify on which financial markets – internal or external – can be

carried out the sale of the currencies. The law does not allow the foreign

exchange reserves to be used for loans, guarantees and other commitments to

residents and non-residents of Ukraine [4, p. 48].

Thus,

despite the fact that there is no a unified definition of “foreign exchange

reserves” we managed to give a common approach of the modern economists to this

category. In addition, we have adduced the typical FX reserves components,

described their economic nature and analyzed the structure and dynamics of the

NBU foreign exchange reserves.

In

summary, from the conducted research it follows that the foreign exchange

reserves of the country play a significant role in its national economy. Their

importance especially increases in times of unstable economy, financial,

currency and other crises, restructuring of economy and transition to new

patterns of business relationship in the country.

Reference

list:

1.

O. Butuk. Monetary and financial

relations [Text]: tutorial/ O. Butuk. – Ê.: Znannya, 2006. – 349 p.

2.

O. Dzyublyuk. Monetary policy

[Text]: textbook / O. Dzyublyuk. – Ê.: Znannya, 2007. – 422 p.

3.

B. Lapchuk. Monetary policy [Text]:

tutorial / B. Lapchuk. – Ê.: Znannya, 2008. – 212 p.

4.

On the National Bank of Ukraine

[Electronic resource]: Law of Ukraine as of May 20, 1999 ¹79-XIV. – Access

mode: http://zakon2.rada.gov.ua/laws/show/679-14

5.

L. Ryabynyna. Money and credit

[Text]: tutorial / L. Ryabynyna. – Ê.: Centre of educational literature, 2008.

– 602 p.

6.

State of international reserves and

foreign currency liquidity [Electronic resource] / – Access mode:

www.bank.gov.ua/doccatalog/document?id=46944

7.

The central bank and monetary policy

[Text]: Textbook / Joint authorship.: À. Moroz, M. Puhovkina, M. Savluk

etc.; By edition of Dr.sc.oec, professor. À. Moroz and Ph.D. in Economics,

associated professor M. Puhovkina. – Ê.: KNEU, 2005. – 556 p.

8.

T. Shemet. Theory and practice of

the foreign exchange rate [Text]: tutorial / By edition O.Rogach. – Ê.: Lybid,

2006. – 360 p.

9.

V. Yushchenko. Currency regulation

[Text]: tutorial / V. Yushchenko, V. Mishchenko. – Ê.: Znannya, 1999. – 359 p.