Ýêîíîìè÷åñêèå íàóêè /

6.Ìàðêåòèíã è ìåíåäæìåíò

Ãàâåíêî Î.Î.

ñòóäåíòêà ôàêóëüòåòó ýêîíîìè÷åñêèõ íàóê, ñïåöèàëüíîñòü

«Ôèíàíñû è êðåäèò», ×åðíîìîðñêèé ãîñóäàðñòâåííûé óíèâåðñèòåò èì. Ï. Ìîãèëû

WORKING CAPITAL MANAGEMENT: THEORETICAL

FOUNDATION

The world economy is

rapidly changing. Rapid technological changes along with the increasing global

competition give managers more responsibility for conducting their activities.

One of the most controversial management decisions is profit and working

capital management which plays a significant role in the growth and survival of

profit. The issue of decision making can be seen in all areas of finance, and

working capital management is not an exception. The management of working

capital is divided into two groups: asset management implementation and

management of the debt. Balance in current assets and current liabilities is so

important that decisions about one greatly influences the other Working capital

management is the management of short-term financing requirements of a firm. This

includes maintaining optimum balance of working capital components –

receivables, inventory and payables – and using the cash efficiently for

day-to-day operations. Optimization of working capital balance means minimizing

the working capital requirements and realizing maximum possible revenues. Efficient

working capital management increases firms’ free cash flow, which in turn

increases the firms’ growth opportunities and return to shareholders. Even

though firms traditionally are focused on long term capital budgeting and

capital structure, the recent trend is that many companies across different

industries focus on working capital management efficiency.

There is much

evidence in the financial literature that present the importance of working

capital management. Results of empirical analysis show that there is

statistical evidence for a strong relationship between the firm’s profitability

and its working capital management efficiency. However the measures of working

capital management efficiency vary across different industries. The study gives

significant evidence that issues of working capital management are different

for different industries and firms from different industry sectors adopt

different approaches to working capital management. Firms follow an appropriate

working capital management approach that is favorable to their industry. Firms

in an industry that has less competition would focus on minimizing the receivable

to increase the cash flow. For firms in industry where there are large numbers

of suppliers of materials, the focus would be on maximizing the payable.

In order to raise

capital for an investment, managers could easily dispose of liquid current

assets, adopting an aggressive working capital policy, such as pressuring for

lower levels of inventory and decreasing customer credit terms.

Another factor affecting company decisions

regarding working capital level could be related to the conflict of interests

between managers and shareholders. In companies with a low level of monitoring

and few instruments to discipline management decisions, managers might decide

not to invest in projects with a positive net present value, or they might even

decide to invest in projects with a negative net present value.

The working capital meets the short-term financial a business enterprise

requirements. It is the investment required for running day-to-day business. It

is the result of the time lag between the expenditure for the purchase of raw

materials and the collection for the sales of finished products. The components

of working capital are inventories, accounts to be paid to suppliers, and

payments to be received from customers after sales. Financing is needed for

receivables and inventories net of payables.

The proportions of

these components in the working capital change from time to time during the

trade cycle. The working capital requirements decide the liquidity and

profitability of a firm and hence affect the financing and investing decisions.

Lesser requirement of working capital leads to less need for financing and less

cost of capital and hence availability of more cash for shareholders. However

the lesser working capital may lead to lost sales and thus may affect the

profitability.

Minimizing inventory

may lead to lost sales by stock-outs. The working capital management should aim

at having balanced, optimal proportions of the working capital management

components to achieve maximum profit and cash flow.

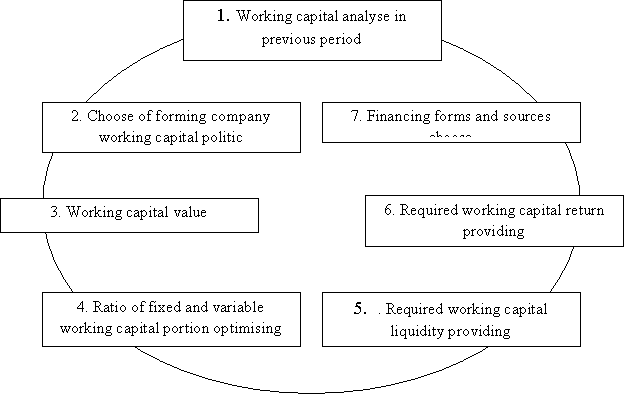

Necessary is not only comprehensive and consistent, but flexible formation

mechanism, working capital amount optimization and replenishment (see Fig. 1.).

Mechanism of current assets was developed from sources […]

This approach to the

working capital management of agricultural companies is quite effective as

current assets most liquid assets of the company, which are subject to various

financial risks. Therefore, the more quickly and effectively be made by

management, the more financially-secure would venture.

To improve the working capital management

quality and its efficiency use necessary is develop a whole measures system

implemented in the internal and the external environment of the enterprise.

These measures cover virtually all industrial phases and commercial process,

affecting many business aspects: technology, design, scientific, technical,

organizational, planning, accounting, and other motivational.

Figure 1: Working capital managing mechanism

Source: Own elaboration, based on […]

Working capital sources for

the company are their own assets, borrowed and involved funds. In particular,

on agricultural companies most common sources are: share capital (fund),

deductions from income to special purpose funds, earmarking and turget income,

stable liabilities increase. The funds amount allocated for replenishment of

current assets, depending on the expected profit rate and the borrowing

possibility, as well as other internal and external factors.

Working capital formation

should be based on developed at the time by economists, researchers formation

principles of continuity, connectedness management, timely decision making,

orientation to achieve strategic objectives, information accuracy, rationality

and optimality.

While managing the working capital, two main characteristics

should be kept in mind: short life span; swift transformation into other current

asset form.

Each constituent of current asset has comparatively

very short life span. Investment remains in a particular form of current asset

for a short period. The life span of current assets depends upon the time

required in the activities of procurement; production, sales and collection and

degree of synchronisation among them. A very short life span of current assets

results into swift transformation into other form of current assets for a

running business. These characteristics have certain implications:

1. Decision regarding management of the working capital has to be taken

frequently and on a repeat basis.

2. The various components of the working capital are closely related and

mismanagement of any one component adversely affects the other components too.

3. The difference between the present value and the book value of profit is

not significant.

The assessment of the working capital

should be accurate even in the case of small and micro enterprises where

business operation is not very large. Working capital has a very close

relationship with day-to-day operations of a business. Negligence in proper

assessment of the working capital, therefore, can affect the day-to-day

operations severely. It may lead to cash crisis and ultimately to liquidation.

An inaccurate assessment of the working capital may cause either

under-assessment or over-assessment of the working capital and both of them are

dangerous.

The main feature of circulating assets

is their high liquidity and hence the possibility of operational covering the

debts from returns, of making investments and keeping a liquid reserve in the

account and in the safe. There is a report specific for each company between

sales (turnover) and the assets necessary to achieve them.

Starting from the ratio of sales (turnover) and the

assets necessary to achieve them, but also from the analysis of working capital

indexes, necessary working capital and net treasury, one can identify three

politics of management operating cycle with different effects on profitability

and risk:

1. Offensive/aggressive/attack policy (WC < WCN)

2. Defensive/ protective/prudential policy (WC >

WCN)

3. Balanced/ optimal policy (WC = WCN)

Offensive policy is promoted by those

managers who want to achieve a high turnover with minimum stocks implied. In

this case, permanent capital absorbed in these physical or financial assets

generates a working capital inferior to circulating assets during the year and

for covering the deficit of working capital the company always calls on

treasury credits. The strategy of funding the required working capital based on

short-term bank loans involves some inconvenience. Thus, resorting to

short-term loans over the medium and long term can lead to cost savings, but

triggers the risk of insolvency in the case of resources’ insufficiency and the

need to call on other short term loans for financing current activity, showing

a certain risk concerning the credit terms (higher interest rates, inability to

renew loans, etc.). Under these circumstances, funding required working capital

through short-term loans, better adapted to company’s needs, may be more risky,

the arbitrage between long-term and short-term actually relying on the

anticipation of interest rate changes.

For these reasons, this policy can be judged as being a risky decision

because the company depends on the bank’s decisions

concerning loans and interest. However, if the profitability is higher than the

interest, this policy of the working capital is acceptable because it appears

the positive effect of obligation.

Protective defensive policy is practiced

by conservative leaders who aim to achieve a high turnover with high stocks and

liquidities. For any increase in turnover, managers are concerned about the

adequate increase of stocks that ensure the continuity of exploiting activity

(current and safety stocks). Financing the financial necessary of the

exploitation is carried out especially from permanent resources (working

capital) ensuring the company’s solvency, but in the same time assuming a

higher cost of resources in relation to that of short-term bank loans, but also

a coverage of loans’ renewal risk and of interest increase rate; in other

words, although the policy is costly and less profitable, it is more

conservative.

Balanced policy has a neutral effect,

because it is based on the principle of harmonization between the duration of

temporal immobilization of circulating assets and the exigibility of

liabilities meant to cover the financing needs in terms of minimizing financing

costs and the risks the company is facing. Balanced policy is recommended

because it keeps working capital at the average level of circulating assets

fluctuations, this being the minimum required level of the working capital. If

this strategy is used, during the peak of activity, the company calls on

short-term loans, and when there is a gap in activity appears an excess of

liquidities in the working capital that can be used for various short-term

investments. This policy is considered an equilibrium policy providing the best

development of profitability and liquidity financial objectives: the

diminishing of “lazy” reserves will increase profitability and reducing the

short-term loan applications will increase the ability to pay, respectively the

company’s financial autonomy. “Lazy” reserves are determined by the progressive

growth of the net treasury, also determined by the progressive growth of the

working capital, reserves which, in the absence of a profitable investment,

have a high opportunity cost.

Consequences of under

assessment of working capital:

- Growth may be stunted. It may become difficult for the enterprise to

undertake profitable projects due to non-availability of working capital.

- Implementation of operating plans may become difficult and consequently

the profit goals may not be achieved.

- Cash crisis may emerge due to paucity of working funds.

- Optimum capacity utilisation of fixed assets may not be achieved due to

non-availability of the working capital.

- The business may fail to honour its commitment in time, thereby

adversely affecting its credibility. This situation may lead to business

closure.

- The business may be compelled to buy raw materials on credit and sell

finished goods on cash. In the process it may end up with increasing cost of purchases

and reducing selling prices by offering discounts. Both these situations would

affect profitability adversely.

- Non-availability of stocks due to non-availability of funds may result

in production stoppage.

- While underassessment of working capital has disastrous implications on

business, overassessment of working capital also has its own dangers.

Consequences of over

assessment of working capital:

- Excess of working capital may result in unnecessary accumulation of

inventories.

- It may lead to offer too liberal credit terms to buyers and very poor

recovery system and cash management.

- It may make management complacent leading to its inefficiency.

- Over-investment in working capital makes capital less productive and may

reduce return on investment.

Inventory management includes all types of stocks. For

effective working capital management, inventory needs to be managed

effectively. The level of inventory should be such that the total cost of

ordering and holding inventory is the least. Receivables management is also

very important part of working capital management. Given a choice, every

business would prefer selling its produce on cash basis. However, due to

factors like trade policies, prevailing marketing conditions, businesses are

compelled to sell their goods on credit. In certain circumstances, a business

may deliberately extend credit as a strategy of increasing sales. Extending

credit means creating a current asset in the form of ‘Debtors’ or ‘Accounts

Receivable’. Investment in this type of current assets needs proper and

effective management as it gives rise to costs such as: cost of carrying

receivable (payment of interest); cost of bad debt losses.

Each business should project expected sales and

expected investment in receivables based on various factors, which influence

the working capital requirement. From this it would be possible to find out the

average credit days using the above given formula. A business should

continuously try to monitor the credit days and see that the average credit

offered to clients is not crossing the budgeted period. Otherwise, the

requirement of investment in the working capital would increase and, as a

result, activities may get squeezed. This may lead to cash crisis.

Cash is the most liquid current asset. It is of vital importance to the

daily operations of business. While the proportion of assets held in the form

of cash is very small, its efficient management is crucial to the solvency of

the business. Therefore, planning cash and controlling its use are very important

tasks. Cash budgeting is a useful device for this purpose.

Conclusion

Effectively managing working capital there is possibility

not only to stabilize the financial situation, but also fast enough to achieve

positive results in the financial recovery operation. Companies’ financial

recovery development strategy must include the working capital management principles

as the most mobile part of the property. To

explain the essence working capital phenomenon there are a number of

definitions presented in the scientific and academic literature. They can be

divided according to the approach to determine the nature working capital

material component. Most appears is determine in which current assets are

considered as a material property set that values and businesses that cater to

the current economic process and consumed within one operating cycle.

The companies ability for continuously operate in

longer period depends on how firms deal with investment in working capital

management. The optimal working capital management could be achieved by firm

that manages the trade off between profitability and liquidity. Similarly

investment in current assets should be just adequate, neither in excess nor

deficit because excess investment increases liquidity but reduces profitability

as idle investment earns nothing and inadequate amount of working capital

threaten the solvency of the firm because of its inability to meet its

obligation. It is taken into consideration that the working capital needs of

the firm may be fluctuating with changing business activities which may cause

excess or shortage of working capital frequently and prompt management can control

the imbalances. This aspect points to the need of arranging funds to finance

current assets. It means that whenever there is a need for working capital,

financing arrangement should be made quickly. The financial manager should have

the knowledge of sources of the working capital funds as well as investment

avenues where idle funds can be temporarily invested.

References:

1.

Àðìñòðîíã Ì. Ñòðàòåãè÷åñêîå óïðàâëåíèå ÷åëîâå÷åñêèìè

ðåñóðñàìè // Ì. Àðìñòðîíã – Ì. : ÈÍÔÐÀ – Ì, 2002 – 210c.

2.

Áàçàðîâ Ò. Óïðàâëåíèå ïåðñîíàëîì // Ò. Áàçàðîâ – Ì. : ÞÍÈÒÈ, 2003 –

216ñ.

3.

Äîáðûíèí À. ×åëîâå÷åñêèé êàïèòàë â òðàíçèòèâíîé ýêîíîìèêå: ôîðìèðîâàíèå,

îöåíêà, ýôôåêòèâíîñòü èñïîëüçîâàíèÿ. // Äîáðûíèí À – ÑÏá. : Íàóêà, 1999 – 192c.

4.

Äÿòëîâ Ñ. Îñíîâû òåîðèè

÷åëîâå÷åñêîãî êàïèòàëà. // Ñ. Äÿòëîâ,

Ñïá. ÓÝÔ, 2010 – 170ñ.

5. Smith J. Human resource management: From theory to practice //

J. Smith, N.Y., 2012 – 240p.

6. Thomson R. Capital management // R. Thomson, London, Hodder and

Stoughton, 2012 – 98p.