Ýêîíîìè÷åñêèå íàóêè/6.Ìàðêåòèíã è ìåíåäæìåíò

Graduate

student Korovina V.D.

Perto Mohyla Black Sea State University, Mykolayiv,

Ukraine

STRATEGIC PLAN PREPARATION ON THE BASIS OF FINANCIAL STABILITY

INDICATORS

The

major problem of every enterprise operating in the market, is to ensure the

survival and further development. Strategy development is the most efficient

and smart way to do it, thus it is possible to consider all alternatives, chose

the best one and to create an efficient monitoring system. Strategic plan

should certainly be based on reliable financial indicators. It should be

emphasized that stability indicators should be primarily considered while

planning, as they show enterprise’s

position in the market, competitive strengths and weaknesses, and areas that

should be paid attention to. This issue is not considered at the appropriate

level by Ukrainian scientists though it would enable domestic enterprises to

develop more intensively.

The

paper investigates financial stability indicators’ influence on enterprise’s

development and strategic plan preparation, suggests the system of stability

indicators calculation which is recommended for strategic planning.

Special

attention to the analysis of enterprises’ financial condition and financial stability

insurance in the market economy paid M. Bilyk [1], O. Pavlovsky, N. Prytuliak,

N. Nevmerzhitsky, N. Davydenko [2] has developed effective methods

for assessing financial stability, O. Zagorodny, V. Seredynskoyi [3]

and I. Burdenko [4] examined in detail enterprises’ financial

stability diagnostics. V. Kovalenko, [5] studied financial stability

strategic management. It should be noted that most literature is devoted to

concept of strategic management application, and it is not fully taken into

account financial stability indicators analysys.

Strategic

management is considered as an organizational management that relies on human

potential as the basis of organization, directs production to consumer demand,

provides flexible control and timely changes in the organization, according to

changes in the external environment, and can achieve competitive advantage,

allowing the organization to survive and achieve its long-term goals. Strategic

management as the system becomes effective only when applied at all levels of

the organization.

Based

on the researches of scientists the structure of strategic management includes:

environmental analysis in which the organization operates; mission formation

and goal setting organization; optimal strategy choice; strategy

implementation; strategy assessment and control. In order to achieve continuous

growth of business enterprise should build its own development strategy. Business

Strategy is considered as the process of development direction formation on the

basis of new goals, matching internal capabilities with enterprise

environmental conditions and the development of measures to ensure their

achievements.

The

types of strategies are classified according to the certain criteria that are

presented in table 1.

STRATEGIES

TYPES

Table 1

|

# |

Criteria |

Strategies types |

|

1 |

Depending on

development scale |

- total (general) strategy; - auxiliary (supporting) strategies. |

|

2 |

Depending on

activities |

- marketing; - production (operating); - financial; - investment; - strategy of other areas and activities. |

|

3 |

Depending on

resources’ type |

- formulation and manpower use strategy; - core strategy and logistics; - strategy of equity capital; - strategies to attract debt capital |

|

4 |

Depending on growth

rates |

- accelerated growth strategy; - limited growth strategy; - strategy of status conservation; - reduction strategy. |

|

5 |

Depending on ways to ensure development |

- concentrated development strategy; - diversified development strategy; - integrated development strategy. |

Financial

stability is one of a sustainable enterprise characteristics. It is conditioned

by economic environment stability in which the company operates. It depends on

operational results, enterprise’s active and effective response to changing

internal and external factors. There are the following types of economic

stability: internal; external; hereditary; general; financial.

The

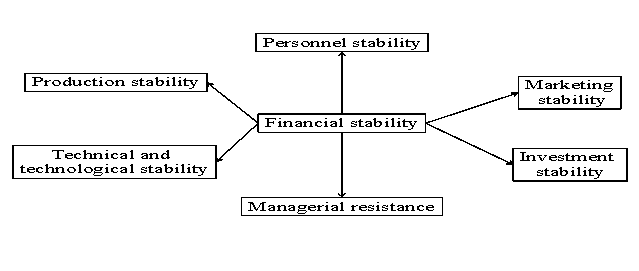

main economic viability component is financial stability (Picture 1), due to

which the company is able to provide marketing and personnel stability, promote

industrial and technical and technological stability, support investment

stability, improve the efficiency of the management.

Picture 1. Financial stability influence on

enterprise’s economic viability

Financial

stability of the company - it is the main component of the overall company’s

sustainability that is the subject of financial management, company’s business

activities and describes the state of financial resources as provision of

proportional, balanced development while maintaining solvency, creditworthiness

in risk tolerance.

In

financial stability analysis procedures which most contribute to its

effectiveness should be used. Analytical methods may include modalities, rules

and measures to the most appropriate performance. In financial stability

analysis method - is a combination of analytical methods and rules of business

research aimed at studying the different objects of analysis, to help get the

most complete assessment of financial stability and profitability.

Enterprise’s

financial condition, its resilience and stability depend on the results of its

industrial, commercial and financial activities. If manufacturing, financial

and general strategic plans are successfully executed, it positively effects the

financial condition of the company. Stable financial position is the result of

competent, skilled strategic management of an enterprise.

The

most convenient and highly understandable methodology of financial stability

calculation is proposed by Bilyk M.D. According to this methodology is possible

to target real conclusions and to develop effective proposals to draw up a

strategic plan for the company.

Financial

stability analysis of the company's activities is implemented through the

calculation and assessment of such factors:

•

financial autonomy coefficient;

•

financial dependence coefficient;

•

financial risk coefficient;

•

maneuverability equity ratio;

•

factor structure covering long-term investments;

•

long-term fundraising ratio;

•

financial independence capitalized sources coefficient.

The

company may have different financial stability, which is divided into four

types (Table 2).

FINANCIAL

STABILITY TYPES Table 2

|

Financial stability type |

Description |

|

Absolute stability |

High solvency: the

company is not dependent on loans |

|

Normal stability |

Normal solvency:

efficient use of borrowed funds, high yield production activities |

|

Unstable state |

Violation of solvency:

necessary to attract additional sources |

|

Crisis |

Insolvency –

bankruptcy stage |

Effective

management strategies development is possible as a result external and internal

environment analysis. Financial condition indicators using is crucial in

assessing the internal environment. Financial stability determining the of the

enterprise directly affects the strategic plan preparation. Only factors management,

that ensure the financial stability of the company, provide an opportunity to

build a strategy aimed at sustainable development and reduces risks. Financial

stability is an important characteristic of financial and economic activity in

a market economy. If the company is financially stable, it has an advantage

over other companies of the same profile and investments in obtaining loans,

selecting suppliers and selection of qualified personnel. Stable financial

position is the result of competent, skilled strategic management of business

enterprises. The financial stability of the enterprise is the key to stable

operation and development.

Therefore,

the company should build its own development strategy to achieve continuous

growth of business and most efficient operation. Selection and implementation

of management strategy depends on the economic situation of the enterprise,

which is possible if the analysis of the external and internal environment.

Using indicators of financial condition is crucial in assessing the internal

environment, and the definition of enterprise financial stability directly

affects the development of strategic management. Only management factors that

ensure the financial stability of the company, provide an opportunity to build

a strategy aimed at sustainable development and reduces risk.

Literature

1.

Bilyk M.D. (2005) Financial analysis:

Tutorial, KNEU, 592 p.

2.

Davydenko N.M. (2009) Corporate enterprises’ financial stability in

agricultural sector, Visnuk KNEU,

Vol. 2, p. 50-58.

3.

Zagorodna O, Seredinska V. (2010) Enterprises’ financial condition and

stability diagnosis, Visnuk KNEU,

Vol. 3, p. 20-24.

4.

Burdenko I.M. (2008) Trade enterprises’ financial stability and its providing

in transforming economy conditions, Visnuk

ODEU, Vol. 2, p. 40-45.

5.

Kovalenko V.V. (2010) Financial stability strategic management of the banking

system: methodology and practice, Symu, DVNZ “YABS NBU”, 228 p.