Ýêîíîìè÷åñêèå íàóêè/4.

Èíâåñòèöèîííàÿ äåÿòåëüíîñòü è ôîíäîâûå ðûíêè

Doctor of Economics

Sergey N. Yashin

Nizhny Novgorod State

Technical University n.a. R.Y. Alekseev, Russia

Ph.D. in Economic Egor

V. Koshelev

Lobachevsky State

University of Nizhni Novgorod, Russia

Sergey A. Makarov

Nizhniy Novgorod Management Institute of the Academy

of Public Administration under the President of the Russian Federation, Russia

EQUITY RISK MANAGEMENT USING

SYNTHETIC STRADDLES

Equity

risk management primarily implies managing a portfolio of shares and bonds

owned by an investor. In spite of availability of all kinds of financial instruments

reducing such risk, this problem has not yet been fully resolved. One type of

such financial instruments includes derivatives issued for primary (classical)

securities. The reason for which investors continuously develop new financial

instruments reducing equity risk consists in the fact that most derivative

securities require quite an exact prediction of prices for basic assets, i.e.

primary securities. Despite rather a high mathematical exactness of securities

price variance forecasts, their results are to a large extent dependent on

subjective qualities of experts. For that reason, prices for derivative

securities as well as prices for combinations of different securities during

portfolio construction cannot fully reflect actual future changes in their

rates, and these estimates are in many respects of subjective nature.

On the

other hand, investors also make their forecasts which enable them to form their

own opinion on to what extent prices for derivative financial instruments

correspond to their visions of future investment opportunities. That is why,

investors will always go after new options of combining primary securities

using their own methods to reduce their risks. In this regard, it should be

noted that investors have their own visions of the presence and magnitude of

such risks.

One of

the classical derivative financial instruments is an option. Conventional

construction of an option contract implies determination of a striking price. A

striking price means a price to be paid for a basic asset (share) at exercising

the option. Those options that already circulate in the securities market have

their own striking price. It cannot be changed. However, an investor may disagree

that a striking price will really reflect the actual market price per share as

of the time of exercising the option. Certainly, this is the cause of buying or

selling options in the market. But at the same time, an investor faces the

following controversy:

An

option having a certain striking price has a corresponding market price which

is dependent both on the risk related to a specific share and the striking

price. But in view of respective future share price fluctuations, these

fluctuations will in future actually occur not relative to the striking price,

but relative to the actual anticipated share price if the forecast has been

made precisely enough.

This

controversy contributes to investors' going after new combinations of primary

securities which to a greater degree reflect future forecasts according to estimates

of the same investors.

Under

such conditions, we propose a model for constructing a combination of synthetic

options (synthetic straddles) which will enable investors to reduce their equity

risks.

Synthetic

instruments are such instruments that are created by combining other

instruments in such a way as to reproduce the aggregate money flows created by

real instruments.

In case

of a straddle, an option buyer purchases (or sells) both a put option and a

call option for one and the same basic asset (share) with the same striking

price and the same expiration date. In such straddle, an option buyer pays the

seller an amount equivalent to the value of the two options (call and put).

In such

a manner, let us build a synthetic straddle, i.e. a call-put option with the

same striking price using a binomial model [2]. The Black-Scholes model, which

is regarded as a classical model, cannot be used for this purpose for the

reason that a synthetic straddle provides for investor's combining a share

under review and a risk-free bond in its portfolio, whereas the Black-Scholes

model contains a risk-free interest rate only, but no risk-free bond.

For

convenience of further considerations, let us introduce certain designations:

![]() - current market

price per share;

- current market

price per share;

![]() - current anticipated

price per share;

- current anticipated

price per share;

![]() - six-month growth

rate of current anticipated price per share in case of its increase;

- six-month growth

rate of current anticipated price per share in case of its increase;

![]() - six-month growth

rate of current anticipated price per share in case of its decrease;

- six-month growth

rate of current anticipated price per share in case of its decrease;

![]() - anticipated price

per share in six-month period in case of its increase;

- anticipated price

per share in six-month period in case of its increase;

![]() - anticipated price

per share in six-month period in case of its decrease;

- anticipated price

per share in six-month period in case of its decrease;

![]() - anticipated price

per share in twelve-month period in case of its two-fold increase;

- anticipated price

per share in twelve-month period in case of its two-fold increase;

![]() - anticipated price

per share in twelve-month period in case of its increase in six-month period

and decrease in another six-month period;

- anticipated price

per share in twelve-month period in case of its increase in six-month period

and decrease in another six-month period;

![]() - anticipated price

per share in twelve-month period in case of its decrease in six-month period

and increase in another six-month period;

- anticipated price

per share in twelve-month period in case of its decrease in six-month period

and increase in another six-month period;

![]() - anticipated price per share in twelve-month period in case

of its two-fold decrease;

- anticipated price per share in twelve-month period in case

of its two-fold decrease;

![]() - synthetic straddle

striking price in twelve-month period;

- synthetic straddle

striking price in twelve-month period;

![]() - synthetic call

option price;

- synthetic call

option price;

![]() - synthetic put

option price;

- synthetic put

option price;

![]() - synthetic straddle

price;

- synthetic straddle

price;

![]() - synthetic straddle

price in six-month period in case of an increase in anticipated price per share;

- synthetic straddle

price in six-month period in case of an increase in anticipated price per share;

![]() - synthetic straddle

price in six-month period in case of a decrease in anticipated price per share;

- synthetic straddle

price in six-month period in case of a decrease in anticipated price per share;

![]() - synthetic straddle

price in twelve-month period in case of two-fold increase in anticipated price

per share;

- synthetic straddle

price in twelve-month period in case of two-fold increase in anticipated price

per share;

![]() - synthetic straddle

price in twelve-month period in case of an increase in anticipated price per

share in six-month period and a decrease in another six-month period;

- synthetic straddle

price in twelve-month period in case of an increase in anticipated price per

share in six-month period and a decrease in another six-month period;

![]() - synthetic straddle

price in twelve-month period in case of a decrease in anticipated price per

share in six-month period and an increase in another six-month period;

- synthetic straddle

price in twelve-month period in case of a decrease in anticipated price per

share in six-month period and an increase in another six-month period;

![]() - synthetic straddle

price in twelve-month period in case of two-fold decrease in anticipated price

per share;

- synthetic straddle

price in twelve-month period in case of two-fold decrease in anticipated price

per share;

![]() - number of a

six-month period;

- number of a

six-month period;

![]() - current market

value of risk-free bond;

- current market

value of risk-free bond;

![]() - six-month risk-free

interest rate (six-month yield to maturity of risk-free bond);

- six-month risk-free

interest rate (six-month yield to maturity of risk-free bond);

![]() - anticipated price

per risk-free bond in six-month period;

- anticipated price

per risk-free bond in six-month period;

![]() - anticipated price

per risk-free bond in twelve-month period;

- anticipated price

per risk-free bond in twelve-month period;

![]() - number of shares

circulated at present time (

- number of shares

circulated at present time (![]() );

);

![]() - number of bonds

circulated at present time (

- number of bonds

circulated at present time (![]() );

);

![]() - number of shares held

in six-month period (

- number of shares held

in six-month period (![]() ) in situation

) in situation ![]() ;

;

![]() - number of bonds

held in six-month period (

- number of bonds

held in six-month period (![]() ) in situation

) in situation ![]() ;

;

![]() - number of shares

held in six-month period (

- number of shares

held in six-month period (![]() ) in situation

) in situation ![]() ;

;

![]() - number of bonds

held in six-month period (

- number of bonds

held in six-month period (![]() ) in situation

) in situation ![]() .

.

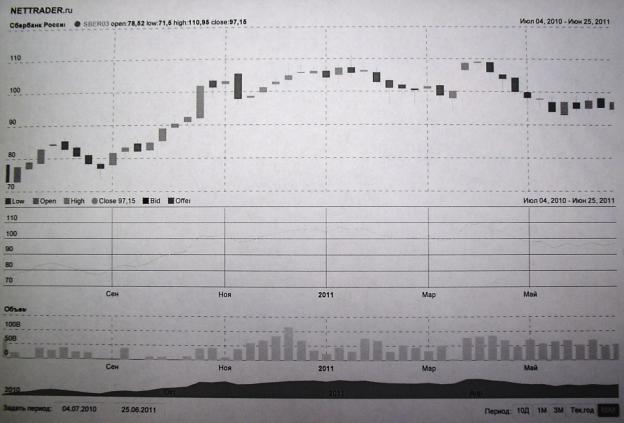

With a

view to illustrating a model construction, let us consider ordinary shares of

Sberbank of Russia. According to information [5], the market value dynamics of

these shares for a twelve-month period is of the nature as shown in Figure 1

and Table 1.

Volume Sberbank of Russia: Set period: Current year 10D Period: May May March March November November September September July 4, 2010 – June 25,

2011 July 4, 2010 – June 25,

2011

Figure 1. Price Behavior of Sberbank of Russia

Ordinary Shares (RUB)

Table 1. Price Behavior of Sberbank of Russia Ordinary

Shares (RUB)

|

Date |

4.07.10 |

11.07.10 |

18.07.10 |

25.07.10 |

1.08.10 |

8.08.10 |

|

Price |

72.82 |

77.27 |

80.51 |

83.34 |

84.53 |

83.57 |

|

Date |

15.08.10 |

22.08.10 |

29.08.10 |

5.09.10 |

12.09.10 |

19.09.10 |

|

Price |

80.98 |

78.81 |

76.33 |

81.38 |

83.36 |

83.21 |

|

Date |

26.09.10 |

3.10.10 |

10.10.10 |

17.10.10 |

24.10.10 |

31.10.10 |

|

Price |

84.38 |

88.04 |

89.9 |

91.67 |

102.55 |

99.74 |

|

Date |

7.11.10 |

14.11.10 |

21.11.10 |

28.11.10 |

5.12.10 |

12.12.10 |

|

Price |

103.05 |

97.45 |

98.67 |

101.24 |

103.12 |

104.87 |

|

Date |

19.12.10 |

26.12.10 |

2.01.11 |

16.01.11 |

23.01.11 |

30.01.11 |

|

Price |

106.35 |

106.44 |

104.05 |

107.23 |

105.19 |

107.4 |

|

Date |

6.02.11 |

13.02.11 |

20.02.11 |

27.02.11 |

6.03.11 |

13.03.11 |

|

Price |

103.39 |

99.15 |

100.91 |

98.77 |

101.1 |

98.62 |

|

Date |

20.03.11 |

2.04.11 |

9.04.11 |

16.04.11 |

23.04.11 |

30.04.11 |

|

Price |

99.14 |

108.1 |

108.42 |

106.17 |

103.63 |

99.91 |

|

Date |

7.05.11 |

14.05.11 |

21.05.11 |

28.05.11 |

4.06.11 |

11.06.11 |

|

Price |

96.43 |

97.69 |

95.44 |

96.6 |

95.66 |

98.32 |

|

Date |

18.06.11 |

25.06.11 |

|

Price |

96.23 |

96.35 |

The apparent trend in Sberbank of

Russia share price represented by the numerical values in Table 1 and the graph

in Figure 1, despite its general positive dynamics, makes it impossible to obtain

an unambiguous statement as to what extent it will be preserved in future. In

addition, it is not clear whether it will maintain the mean value of share

price fluctuations measured, for instance, by using mean-square deviation

relative to the general trend in share price increase determined, for instance,

by using an equation of linear regression. It is also rather difficult to

determine expressly whether the mean value of share price fluctuations will

remain unchanged in future, or it will be subject to change, i.e. decrease or

increase.

All the specified issues make it

difficult to build classical options reflecting the share price variations to a

greater or lesser extent. Let us resolve such problem by constructing synthetic

straddles.

Using

the figures from Table 1, it is possible to form linear regression of a share

value:

![]() ,

,

where ![]() - price of Sberbank of Russia ordinary share, and

- price of Sberbank of Russia ordinary share, and ![]() - number of a month

starting from 0, i.e. from the date of 4.07.10.

- number of a month

starting from 0, i.e. from the date of 4.07.10.

Let us take a planning time-frame

equal to twelve months. According to the formed regressional relationship, the

striking price as of 25.06.12 will be K,

which corresponds to ![]() RUB.

RUB.

In

doing so, we will adjust our position in the portfolio six months from the

present time, i.e. from the date of 25.06.11 which corresponds to the month of ![]() .

.

In our

binomial model, we assume that the anticipated price per share ![]() RUB determined as of

25.06.11 based on the regression obtained will either grow by 50% (rate

RUB determined as of

25.06.11 based on the regression obtained will either grow by 50% (rate ![]() ) or remain unchanged (rate

) or remain unchanged (rate ![]() ) in the nearest year. Such price variation limits are

selected in accordance with potential yearly inflation rates in Russia.

) in the nearest year. Such price variation limits are

selected in accordance with potential yearly inflation rates in Russia.

Now we

can determine the six-month rate i of

anticipated price growth:

![]() ,

, ![]() ,

,

consequently, ![]() .

.

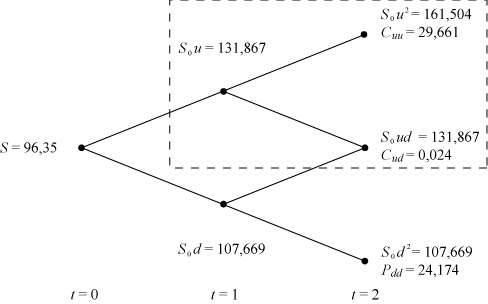

As a result, the price of the share

under review for the year then ended will change so as shown in Figure 2. It

should be noted that at the moment we use in our calculations the current market

price per share ![]() as of 25.06.11. Moreover,

the situations

as of 25.06.11. Moreover,

the situations ![]() and

and ![]() are identical.

are identical.

Figure 2. Sberbank Shares Price in Binomial Model

As a risk-free interest rate in

Russia, one may use, for instance, a refinancing rate which accounts for 8.25%

from 3.05.11. However, if we wish to use a risk-free bond in our portfolio,

then it is required to pick up a governmental bond having similar yield to

maturity. This may be, let us say, the OFZ-26205 bond having the yield to

maturity of 8.28% and the real market value of ![]() RUB as of 24.06.11

[4].

RUB as of 24.06.11

[4].

Then we

can find the six-month yield to maturity ![]() :

:

![]() ,

, ![]() ,

,

and ![]() RUB and

RUB and ![]() RUB.

RUB.

In our example, we build a synthetic

option (straddle) which enables its holder either to buy or sell the share

(call-put option) at the end of two six-month periods at the striking price of ![]() RUB. An option that

may be selectively used as a call option or a put option promises at the time

of

RUB. An option that

may be selectively used as a call option or a put option promises at the time

of ![]() contingent money

flows as follows:

contingent money

flows as follows:

![]() ,

,

![]() ,

,

![]() ,

,

![]() .

.

With the figures from our example,

this means that

![]() ,

, ![]() ,

, ![]() .

.

At the moment of ![]() , the call and put option generates neither income nor

expense as it belongs to the European type, which means

, the call and put option generates neither income nor

expense as it belongs to the European type, which means

![]() .

.

To exercise a synthetic option ahead

of time (American option) is irrational since the adjustments in our position ![]() result in

determination of the initial portfolio structure

result in

determination of the initial portfolio structure ![]() , consequently, they are necessary. Otherwise, if we now invest

funds in a portfolio which will not be eventually used, we will sustain damages

in future.

, consequently, they are necessary. Otherwise, if we now invest

funds in a portfolio which will not be eventually used, we will sustain damages

in future.

Then let us set up and solve three

equation systems. In doing so, we sort of move backward in time.

1) Let

us examine Figure 2 and focus our attention to the section highlighted with a

dotted line. Let us suppose that we are at the time point of ![]() , and share prices increased up to

, and share prices increased up to ![]() . In this situation, we may be convinced that the share

prices at the time point of

. In this situation, we may be convinced that the share

prices at the time point of ![]() will either increase

up to

will either increase

up to ![]() or decrease to

or decrease to ![]() . At the same time, this means that the call-put option will

generate money flows either in the amount of

. At the same time, this means that the call-put option will

generate money flows either in the amount of ![]() or in the amount of

or in the amount of ![]() .

.

Then it

is necessary, in view of the current conditions, to construct a portfolio

consisting of a share and a bond, which will at the time point of ![]() generate exactly the

same money flows as the call and put option, namely,

generate exactly the

same money flows as the call and put option, namely, ![]() and

and ![]() . If we further consider that the bond at the time point of

. If we further consider that the bond at the time point of ![]() is quoted at the

price of

is quoted at the

price of ![]() , and one period later, it will provide guaranteed return

flows in the amount of

, and one period later, it will provide guaranteed return

flows in the amount of ![]() , then the equation system for determining structural variables

of an equivalent portfolio will be as follows:

, then the equation system for determining structural variables

of an equivalent portfolio will be as follows:

or with the

specific figures from our example:

wherefrom we obtain

the solutions ![]() and

and ![]() .

.

2) The second equation system implies

that the share price ![]() will drop down to the

value of

will drop down to the

value of ![]() . With this provision, the equivalent portfolio should be formed

so that it could take on the value of

. With this provision, the equivalent portfolio should be formed

so that it could take on the value of ![]() at the time point of

at the time point of ![]() while the share price

remains unchanged, and in case of an increase in the share price – the value of

while the share price

remains unchanged, and in case of an increase in the share price – the value of

![]() . Consequently, we obtain as follows:

. Consequently, we obtain as follows:

or with the

specific figures from our example:

which results in

the following solutions: ![]() è

è ![]() .

.

3) Using the both first equation

systems, we have determined the structure of an equivalent portfolio that we

should select for the convenience of duplicating our option at the time point

of ![]() . Naturally, in order to acquire such portfolio at a certain

time point, it is required to make payments. However, since the call-put option

itself causes neither expense nor income at the end of the first period, these

payments should finance (secure) themselves. Therefore, we should select shares

of the securities in the portfolio at the time point of

. Naturally, in order to acquire such portfolio at a certain

time point, it is required to make payments. However, since the call-put option

itself causes neither expense nor income at the end of the first period, these

payments should finance (secure) themselves. Therefore, we should select shares

of the securities in the portfolio at the time point of ![]() in such a way that

any income related to it at the time point of

in such a way that

any income related to it at the time point of ![]() be actually as high

as any expenses required at this time point. This means as follows:

be actually as high

as any expenses required at this time point. This means as follows:

The left-hand member of the first

(second) formula describes return flows from holding the share and bond at the

time point of ![]() provided that the

share price has increased (decreased). The right-hand member contains income

that is required to finance contingent equivalent portfolios at the time point

of

provided that the

share price has increased (decreased). The right-hand member contains income

that is required to finance contingent equivalent portfolios at the time point

of ![]() . In view of the data from the example and the intermediate

results for the structural variables of the equivalent portfolio, this means as

follows:

. In view of the data from the example and the intermediate

results for the structural variables of the equivalent portfolio, this means as

follows:

which will finally

lead to the solutions: ![]() è

è ![]() .

.

Having these figures, we know for sure

what should be done today (![]() ) and later (

) and later (![]() ) so as, through buying and selling shares and bonds, to pose

ourselves in a position that is by no means different from acquiring the

call-put option as related to anticipated money flows. The price of a portfolio

acquired today is as follows:

) so as, through buying and selling shares and bonds, to pose

ourselves in a position that is by no means different from acquiring the

call-put option as related to anticipated money flows. The price of a portfolio

acquired today is as follows:

![]() ,

,

and this figure, so

long as the capital market is free of any arbitrage, should exactly align with the price of ![]() which an investor

will reasonably agree to pay for the call-put option (synthetic straddle).

which an investor

will reasonably agree to pay for the call-put option (synthetic straddle).

Using Table 2, it is possible to

confirm that our solution actually has the desired property of duplicating the

call and put option. We sell without any coverage at the time point of ![]() shares to the number

of 0.573477, and at the same time we buy 0.80453 bonds. Today, this is

connected with net expenses in the amount of 22.382 RUB. Let us consider for

instance what will happen if the share price goes up at the end of one period.

Selling the share without any coverage will bring us to incur expenses in the

amount of

shares to the number

of 0.573477, and at the same time we buy 0.80453 bonds. Today, this is

connected with net expenses in the amount of 22.382 RUB. Let us consider for

instance what will happen if the share price goes up at the end of one period.

Selling the share without any coverage will bring us to incur expenses in the

amount of ![]() RUB, while due to

holding the bond, we will earn income in the amount of

RUB, while due to

holding the bond, we will earn income in the amount of ![]() RUB. Thus, the

balance on income turns out to be equal to

RUB. Thus, the

balance on income turns out to be equal to ![]() RUB. However, we

should concurrently purchase 1 share and sell 1.261776 bonds. That is why, to

purchase the share, we undertake expenditures in the amount of 131.867 RUB,

while the bonds sold without any coverage bring us income in the amount of

RUB. However, we

should concurrently purchase 1 share and sell 1.261776 bonds. That is why, to

purchase the share, we undertake expenditures in the amount of 131.867 RUB,

while the bonds sold without any coverage bring us income in the amount of ![]() RUB. The balance on

expenses turns out to be equal to

RUB. The balance on

expenses turns out to be equal to ![]() RUB, so income and

expenses become quite equal at the time point of

RUB, so income and

expenses become quite equal at the time point of ![]() . No matter how the share price changes in the second period,

due to the bonds sold without any coverage, we incur expenses in the amount of

. No matter how the share price changes in the second period,

due to the bonds sold without any coverage, we incur expenses in the amount of ![]() RUB. If the share

price increases, we will, through selling the share, obtain 161.504 RUB; if,

conversely, the share price remains unchanged, then our profit will only be

131.867 RUB. In the first case, the balance on income happens to be equal to

29.661 RUB, and in the second case – 0.024 RUB. These values are exactly the

same as the money flows which may be expected by a holder of the call-put

option at exactly the same share price behavior.

RUB. If the share

price increases, we will, through selling the share, obtain 161.504 RUB; if,

conversely, the share price remains unchanged, then our profit will only be

131.867 RUB. In the first case, the balance on income happens to be equal to

29.661 RUB, and in the second case – 0.024 RUB. These values are exactly the

same as the money flows which may be expected by a holder of the call-put

option at exactly the same share price behavior.

Table 2. Duplicating a Call-Put Option

|

Number of Assets |

Payments at a

Time Point |

||||||

|

|

|

|

|||||

|

|

|

|

|

|

|

||

|

|

55.255 |

-75.623 |

-61.746 |

0 |

0 |

0 |

0 |

|

|

-77.637 |

80.788 |

80.788 |

0 |

0 |

0 |

0 |

|

|

0 |

-131.867 |

0 |

161.504 |

131.867 |

0 |

0 |

|

|

0 |

126.702 |

0 |

-131.843 |

-131.843 |

0 |

0 |

|

|

0 |

0 |

107.455 |

0 |

0 |

-131.605 |

-107.455 |

|

|

0 |

0 |

-126.497 |

0 |

0 |

131.629 |

131.629 |

|

|

-22.382 |

0 |

0 |

29.661 |

0.024 |

0.024 |

24.174 |

After the current value of a synthetic

straddle becomes known, it is required to determine whether one should buy or

sell the straddle just now in order to gain profits a year later (at ![]() ).

).

Expected straddle profitability is

dependent on the fluctuation of the basic share price. In our example, these

are shares of Sberbank of Russia. The straddle will bring profits if the shares

are very unstable, but it will yield losses if the price is relatively stable.

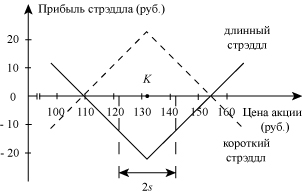

The payment schedule (solid line in Figure 3) shows what fluctuation should be

so that the long straddle should bring profits.

Gain on

straddle (RUB) long straddle short straddle Share price (RUB)

Figure 3. Payment Schedules for a Synthetic Straddle

If at the time of the option

expiration Sberbank's share price is 131.843 RUB, then both call and put

options will end "in the money". Neither option will bring profits,

that is why it will never be exercised, and an investor will incur losses in

the amount of 22.383 RUB.

However, if a favorable situation

occurs, and Sberbank's shares increase in price, for instance, up to 161.504

RUB at the time of the option expiration, an investor will exercise the call option

and earn profits in the amount of ![]() RUB per share. If

taking into account the option value of 22.383 RUB, the investor will earn

RUB per share. If

taking into account the option value of 22.383 RUB, the investor will earn ![]() RUB per share holding

the straddle position. If an unfavorable situation occurs, and the shares sell,

for instance, only at 107.669 RUB at the time of the option expiration, then

the investor will exercise the put option, buy the shares for 107.669 RUB and

resell them to the option seller for 131.843 RUB obtaining income in the amount

of

RUB per share holding

the straddle position. If an unfavorable situation occurs, and the shares sell,

for instance, only at 107.669 RUB at the time of the option expiration, then

the investor will exercise the put option, buy the shares for 107.669 RUB and

resell them to the option seller for 131.843 RUB obtaining income in the amount

of ![]() RUB. In view of

expenses for acquiring the straddle position in the amount of 22.383 RUB, the

investor's profits will be

RUB. In view of

expenses for acquiring the straddle position in the amount of 22.383 RUB, the

investor's profits will be ![]() RUB per share. In

such a manner, a long straddle results in a loss if Sberbank share price is

between

RUB per share. In

such a manner, a long straddle results in a loss if Sberbank share price is

between ![]() RUB and

RUB and ![]() RUB at the time of

the option expiration, but it will yield profits if the share price happens to

be beyond these limits.

RUB at the time of

the option expiration, but it will yield profits if the share price happens to

be beyond these limits.

Consequently, the long straddle

transaction at the time point of ![]() will be only carried

out by those investors who believe that Sberbank's shares will be more unstable

than the fluctuation expectations reflected in the option prices.

will be only carried

out by those investors who believe that Sberbank's shares will be more unstable

than the fluctuation expectations reflected in the option prices.

Investors who believe that Sberbank's

share prices will be less unstable than it was reflected in the option prices

will sell straddles, and this means that they will take on a short straddle position.

The payment schedule for short straddles for Sberbank share options having the

striking price of ![]() RUB and a one-year

maturity period is shown with the small-dotted line in Figure 3. The profit

shaping scheme is exactly opposite to that described above: the straddle seller

earns profits when the share prices are more or less close to the striking

price, but suffers losses when there is a material deviation from it.

RUB and a one-year

maturity period is shown with the small-dotted line in Figure 3. The profit

shaping scheme is exactly opposite to that described above: the straddle seller

earns profits when the share prices are more or less close to the striking

price, but suffers losses when there is a material deviation from it.

Under such circumstances, it is

required to select share price limits at ![]() in respect to which

one should make a decision on what type of synthetic straddles should be built

– a long one or a short one. Such limits at

in respect to which

one should make a decision on what type of synthetic straddles should be built

– a long one or a short one. Such limits at ![]() may be set using a

double standard deviation calculated using the following formulas.

may be set using a

double standard deviation calculated using the following formulas.

1) Average market price per share:

![]() ,

,

where ![]() - market price per

share,

- market price per

share, ![]() - number of epoch of

observation,

- number of epoch of

observation, ![]() - total number of

observations,

- total number of

observations, ![]() - market price per

share at

- market price per

share at ![]() -th epoch of observation.

-th epoch of observation.

2) Unbiased estimator of theoretical

variance:

![]() .

.

As a result, we can find the standard

deviation ![]() .

.

For Sberbank shares, let us calculate

a standard deviation using the figures from Table 1, then let us compare it

with the synthetic straddle price at the time point of ![]() . Finally, we obtain as follows:

. Finally, we obtain as follows:

![]() .

.

Thus, it may be concluded that a

synthetic straddle covers estimated share fluctuation in a twelve-month period

determined by future double standard deviation. Then it is more reasonable for

an investor to build and use in future a short synthetic straddle. This means

that it is required to take actions exactly opposite to the actions described

in Table 2, i.e. to form and adjust the structure of an equivalent portfolio in

such a way that Sberbank of Russia share and OFZ-26205 bond fractions have

signs opposite to the signs obtained in Table 2. This will result in money

flows opposite to those presented in the same table. Using such strategy, an

investor will earn profits on the synthetic straddle a year later.

Consequently, the presented model of

building and using synthetic straddles enables an investor to significantly

reduce its individual equity risk related to its own basic assets, i.e. shares.

This model may be also used to manage other basic assets, such as precious

metals, agricultural commodities (wheat, rice), etc.

References:

1. Brigham E.F., Gapenski

L.C. Intermediate Financial Management. 4th ed. Fory Worth; Philadelphia; San

Diego; New York; Orlando; Austin; San Antonio; Toronto; Montreal; London;

Sydney; Tokyo: The Dryden Press, 1993, vol. 1, pp 245 – 272.

2. Kruschwitz L.

Finanzierung und Investition. R.Oldenbourg; Verlag; Munchen; Wien: R. Oldenbourg

Verlag, 1999. S. 148 – 155.

3. Yashin S.N., Yashina N.I., Koshelev E.V. Innovation and investment companies

financing. Nizhniy Novgorod: VGIPU, 2010, pp 144 – 156.

4. http://quote.rbc.ru/exchanges/demo/micex.1/intraday.

5. http://stocks.nettrader.ru/stocks/securities/list?%5C_init.