ýêîíîìè÷åñêèå íàóêè

9.Ýêîíîìèêà ïðîìûøëåííîñòè.

Ardak Issaev MSc

KBTU

Oil and Gas Sector of Kazakhstan

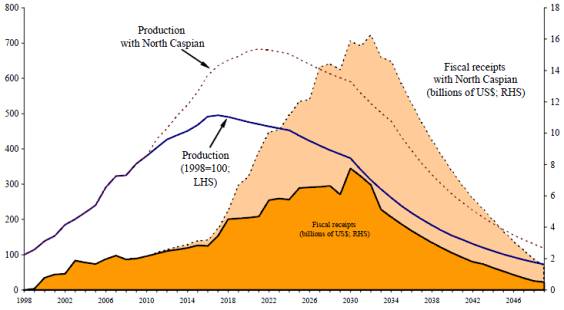

According to the country report of the

International Monetary Fund (IMF) published in 2004, most of the Caspian

region’s fields with the largest recoverable reserves belong to the Republic of

Kazakhstan. The proven and probable crude oil and gas reserves are 50-60

billion barrels and 6 trillion cubic feet, respectively; and with a current

production rate of 1.5 billion barrel per day the hydrocarbon resources will be

sufficient for the country for the next 70 years.

In addition, as per the IMF report (2004), within

next following 15 years Kazakhstan would be in the top ten oil-exporters with

the production rate of 3.5 billion barrels per day, at the same level as

Venezuela, Iran, Norway and Mexico (see Figure 1). Gas production would also

rise rapidly to 4 times more by 2010 than it was in 2004 and it was planned

that by 2020 the production rate would reach 40-60 billion cubic meters per

year. Annual income would be $12 billion per year, but with a delay for several

years because of the difficulties in the development of offshore fields. It was

predicted that a peak of crude oil production would be reached in 2014 before

falling to 2.3 million bpd in 2018.

Figure 1 –

Petroleum production outlook

Source:

International Monetary Fund, 2004

The country's major hydrocarbon reserves are found in the western region of

the country, territory of which includes Atyrau, Mangystau, and West

Kazakhstan, as well as Aktobe oblasts (Egorov et al., 2003). In the accounts of onshore fields in these

oblasts there is about half of current proven reserves, whereas the offshore

Kashagan and Kurmangazy oil fields, located in the Kazakhstani part of Caspian

Sea, are believed to contain at least 14 billion barrels (US Energy Information

Administration, 2010).

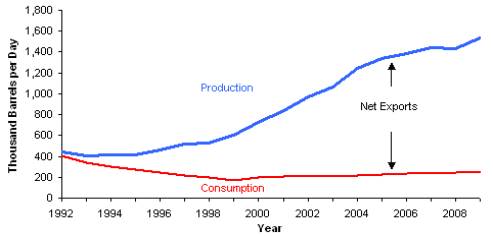

In the Figure 2 it can be seen that in 2009 oil

production in Kazakhstan was more than doubled the rate of a decade earlier,

and reached 1.54 million barrels per day, while domestic oil consumption

averaged 241 000 bbl/d during this period of time; which means that remained

volume of oil in rate of 1.3 million barrels per day were exported to the

international market. Nowadays, Kazakhstan is one of key players in petroleum exporting

sector in Central Asia with present petroleum transportation system delivering

the crude oil to world markets by pipelines to the Black Sea via Russia through

the Caspian Pipeline Consortium (CPC) oil pipeline and Atyrau-Samara Pipeline;

by barge and pipeline to the Mediterranean via Azerbaijan and Turkey through

Baku-Tbilisi-Ceyhan; by barge and rail to Batumi, Georgia on the Black Sea

(Trans Caspian Transportation System); and by pipeline to China through the

Kazakhstan-China oil pipeline (www.kmgep.com;

www.mgm.gov.kz).

Figure 2 – Oil

production and consumption in Kazakhstan, 1992-2009

Source: US Energy

Information Administration, 2010

As per of interview with Kazakhstan Prime Minister

Karim Massimov (October, 2010), the Kazakhstani government is going to

strengthen its position in the world oil trading market; and by the Government

it is anticipated to increase crude oil exporting up to 3 million barrels per

day by 2020; however, it should be taken into account that the rapid oil

production boost will require extra capacity for exporting infrastructure

system.

In 2010 it is planned to increase the oil

production rate up to 1.6 million barrels per day. Successful realization of

the plan is dependent on performance of the largest key oil producing fields of

the country. These fields are Tengiz, Karachaganak, Uzen, Mangistau, Aktobe,

the North and South Kumkol, as well as Akshabulak fields. All od these eight largest

are currently producing onshore fields, and five of them are located in the

western part of the country; the North and South Kumkol fields are situated in

the south central area, and the Akshabulak field is in the central area of the

state. In the balance of these major fields are accounted about 80% of liquids

production in the country as of 2008 (US Energy Information Administration,

2010).

Figure 3 –

Kazakhstan Oil Pipelines

Source: CIA World

Factbook, 2010

Particularly interesting project, that has a

potential to be one of the drivers of Kazakhstani Petroleum Industry in the

future, is development of offshore field – Kashagan, which is currently under

development phase. The offshore oil field is believed to be as the largest one

known outside of the Middle East and the fifth largest in the world in terms of

hydrocarbon reserves. Its location is the northern shore of the Caspian Sea

near Atyrau city. Initially, Agip Kazakhstan North Caspian Operating Company

(Agip KCO) was appointed to develop the field; however, then, in 2009, Agip KCO

was replaced by the North Caspian Operating Company (NCOC), which operational

activity includes Kashagan and other fields in the neighbouring area such as

Aktote, Kairan, and Kalamkas. The NCOC Production Sharing Agreement consists of

Total, Eni, ExxonMobil, Shell, and National Company KazMunayGas with a share of

16.8% each, ConocoPhillips – 8.4%, as well as Inpex – 7.6% (Egorov et al.,

2003; US Energy

Information Administration, 2010). The estimated field's recoverable reserves

are about 11 billion barrels of oil. Originally, it was planned to get first

oil stream in 2005, however the timetable for production start-up has then been

postponed to 2013 due to cost overruns, associated with the field's adverse

operating environment and complex geological problems. Initial production rate from

phase 1 of the project is expected at 370 000-450 000 barrels per day, with a

peak production of 1.5 million barrels per day by 2019 during phase 2 as per US

Energy Information Administration report of 2010.

In terms of Downstream/Refining Sector of

Kazakhstani Petroleum Industry, the country had a crude oil distillation

capacity of 345 100 barrels per day as of January 1, 2010 in accordance with the

Oil and Gas Journal. There are three major oil refineries located in Pavlodar,

Atyrau and Shymkent. As per Nefte Compass report an average of 232 900 bbl/d were

processed between January and September 2009 against average local consumption of

240,000 bbl/d in 2009.

Although Kazakhstan is a significant oil exporter, the

country experiences regional and seasonal oil product shortages because of

production of oil and gas resources mostly in western part of the country; and its

industrialized northern and southern regions is lacking pipeline connections with

the western petroleum rich regions. These oblasts rely on imports from neighbouring

countries such as Russia and Uzbekistan, respectively. What is more, until

recently there have not been the high levels of foreign direct investment in

the refining sector that other sectors of the oil industry have. One more

factor, which has a huge impact on petroleum products import into the country,

is low domestic prices for refined products. This factor forces oil producers

to export crude oil to international markets instead of refining it locally. As

per report of National Company KazMunaiGas, the company plans to invest up to

US $4 billion to modernize mentioned three refineries; and it expects to fully

meet domestic demand for petroleum products from its refineries by 2014 from

its own increased production of oil and condensates.

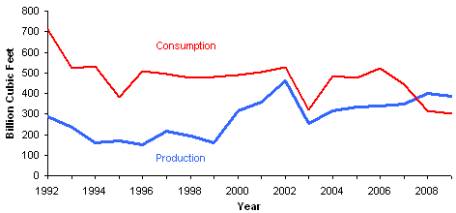

As far as natural gas production is concerned, this

sector is relied on production of associated natural gas from oil fields, and

the country currently is approaching to become a net gas exporter. Likewise oil

fields, most of natural gas resources of Kazakhstan are situated in the western

part of the country, with more than half of its all gas reserves is in the balance

of Karachaganak oil and gas field.

As can be found in Figure 4, annual production of natural

gas has been growing from 162 Bcf in 1999 to 387 Bcf in 2009. By 2009 accumulated

total gross gas production was 1.26 trillion cubic feet, and 69% of the gas

(870 Bcf) was produced, as well as remained volume (31% or 390 Bcf) was re-injected

back into oil-bearing reservoirs to enhance crude production. The two largest

natural gas producing fields – Karachaganak and Tengiz – are also the giant crude

producing fields (US Energy Information Administration, 2010).

Figure 4 – Gas

production and consumption in Kazakhstan, 1992-2009

Source: US Energy

Information Administration, 2010

There are two separate domestic natural gas distribution

networks in the country: the west one services the country's producing fields,

and the second – south one – delivers imported natural gas to the consuming

regions. The shortage of internal domestic pipelines, which may connect the

country’s natural gas-producing regions with the country’s industrial areas

and/or back lands, counteracts to the overall development of the country's

natural gas producing and distributing sectors. Southern regions of Kazakhstan are

supplied with gas from Uzbekistan delivered through the

Tashkent-Shymkent-Bishkek-Almaty pipeline, despite the country exports gas from

its North-Western part. Mainly, the gas transportation system is controlled

and managed ba KazTransGas JSC which

is a subsidiary of National Company KazMunaiGas.

Until recently Kazakhstan was mainly as a transit country

for natural gas pipeline exports from Uzbekistan and Turkmenistan to Russia and

China through Central Asia Center Pipeline (CAC), Central Asia Gas Pipeline

(CAGP), Bukhara-Uralsk Pipeline and Tashkent-Shymkent-Bishkek-Almaty Pipeline

(see Figure 5). However, in 2009, for the first time in the history of the

country gas exports exceeded imports by 134 billion cubic feet, and Kazakstan

has become a net oil exporter (US Energy Information Administration, 2010; www.kmgep.com; www.mgm.gov.kz).

Figure 5 –

Kazakhstan Gas Pipelines

Source: Kazakhstan Oil

and Gas Ministry

All in all it can be concluded that Kazakhstan

belongs to a number of countries, which have the great potential of development

due to its huge explored hydrocarbon resources. As per the explored oil

reserves the country holds the 13th place among world petroleum

producing states, as well as in terms of gas and condensate resources it is in

the 15th position. At present and future projected time, the major

sources of increasing petroleum production rates will remain already explored

oil and gas reserves of West Kazakhstan, as well as the production rate growth

from the offshore fields will allow the petroleum sector of the country to have

dominating position in the national economy within next 10-15 years.

References

Central Intelligence Agency (2011) The

World Factbook: Kazakhstan. www.cia.gov.

[15/10/2011]

Egorov O., Chigarkina O., Baimukanov A. (2003) Oil & Gas Industry of Kazakhstan: Problems of Development and

Effective Functioning. Almaty, Kazakhstan.

Energy Information Administration of the US Department of Energy (2008) Country Analysis Briefs: Kazakhstan. www.eia.doe.gov [accessed on 15/10/2011]

Energy Information Administration of the US Department of Energy (2010) Country Analysis Briefs: Kazakhstan. www.eia.doe.gov [accessed on 16/10/2011]

International Monetary Fund Report (2004) Republic of Kazakhstan. International Monetary Fund: Washington

D.C.

KazMunaiGas Exploration and Production (2011) Kazakhstan Oil and Gas Sector. www.kmgep.kz.

[accessed on 17/10/2011]

Ministry of Oil and Gas of the Republic of Kazakhstan (2011) The Oil Industry. www.mgm.gov.kz

[accessed on 16/10/2011].

Ministry of Oil and Gas of the Republic of Kazakhstan (2011) The Gas Industry. www.mgm.gov.kz

[accessed on 16/10/2011].

The Economist Intelligence

Unit (March, 2009) The country report: Kazakhstan. The Economist Intelligence Unit: London, United

Kingdom.