Investigation of

privatization and re-privatization processes in the

transition economy of Ukraine

Privatization of State Property has become one of the

cornerstones of social and economic reforms in Ukraine. Her role in shaping the

foundations of a market economy, the creation of a critical mass of effective

private owners is undeniable. However, the task of privatization often narrowed

to purely fiscal and inconsistency and lack of transparency of privatization

processes, their significant politicization provide the basis for a mixed

assessment by experts, politicians, civil society, creating conditions for

political confrontation, which ultimately prevents the formation of correct

privatization strategy.

Especially at this point is to find effective

approaches to solving the problem of improving the efficiency of the

privatization process and the search for effective social contract, which will

allow taking into account the interests of all parties.

A prolonged period of privatization in transition

economies Ukraine connected with the problem that initially is chosen economic

policy of the state, not by a clear position of the state is not defined rules

for other facilities management and there was no synchronization privatization

and defining strategic objects determine the time and conditions of

privatization. [1]

From the perspective of system analysis and informed

decision making for the implementation of the privatization process to apply

modeling approach. This means that a decision on the formation and

implementation of privatization policies need to visit the appropriate

mathematical model on which the decision will be made.

This paper demonstrated a model of privatization in

the form of a system of ordinary differential equations of order 1. For

calculation based on ratings trajectory forecasts and key variables of the

process. In addition, the software used for the forecast for the next three

steps.

Thus, in the transition from one species to another

property the following problems occur: a significant decline in production

resulting in a stop or full stop operation of manufacturing plants, accompanying

this recession inflation (which can go into hyperinflation), a significant

increase in unemployment, the general decline of social security population and

living standards in general, and the deterioration of almost all other

macroeconomic indicators. Solution of these problems should find its place in

the decisions and plans of the government that decides to implement the

privatization process.

It is clear that privatization should be done at a

certain finite time interval synchronized with the solutions of other problems

of the transition process. It is important to prevent production decline below

a certain critical level, which provides an acceptable level of welfare and

curb unemployment at a level acceptable to the socio-political point of view.

Another objective of privatization may be due to the accumulation of capital

privatization with a view to future use for the development of production in

the new environment and reduce the budget deficit.

Thus, analysis of the privatization process as a

process control shows that the output of this process are the following

variables:

- The total volume of production (for a separate

branch for several industries or the national economy as a whole);

- Appropriate to the socio-political point of view,

the unemployment rate;

- The amount of capital accumulated from the sale of

state-owned enterprises to new owners.

As a control input variables can select the number of

enterprises subject to privatization per unit time (eg quarterly, half-year or

year) and the number of enterprises that are brought to market privatization.

The first variable we call the speed of performance or speed of privatization.

The third group of variables that affect the process

of privatization, are so-called perturbation, i.e. the input values

that are most often affecting the process (which we are going to

manage) and is usually difficult or unmanageable manageable. This group

comprises the following factors:

- General macroeconomic instability that affects all

socio-economic processes in the country and is virtually uncontrollable factor;

- The impact of foreign creditor relies on a decision

taken by the government and parliament; this factor has its advantages, but

overall the state will have to ultimately accept credit, loans, and interest

and not always favorable to the decision of the national economy, which is

especially painful for the country as unstable transitional period;

- A rapid change in the legal framework of

privatization that leads to chaos and illegal actions on the part of those who

sell, and by those who buy the company;

Obviously, the list of negative factors could

continue, but just how difficult it can be seen in the model to take into

account their impact. Therefore, further analysis will limit ourselves to some

generalized integrable perturbation as a Gaussian random process.

Privatization plans as a whole can be seen as a

function of time at a certain time interval, which depends on the speed of

privatization and variable number of enterprises that are brought to market

privatization in the current time. In this case it is important to find a speed

of privatization and the current number of enterprises in the privatization

market that will ensure compliance with other parameters within specified boundaries.

In the process of transformation from state to private

ownership in any industry can be divided into the following three groups of

enterprises that affect the progress of the privatization plan:

- Enterprises remaining in state ownership;

- Companies that are transformed into private

ownership at the beginning of the time period in question;

- Entities that pass into private ownership during the

time period in question.

It is obvious that the second and third group of

enterprises play a decisive role in the formation of key macroeconomic

indicators of the sector and the whole economy in transition.

In developing the model also relies that the volume of

production at enterprises that were privatized at the beginning of the period

remaining for simplicity the same as in state enterprises, but with fewer

employees. And the volume of production at enterprises of the third group may

be different from the first two groups.

As a result of the privatization of state-owned

enterprises of the workers released from work and, as the experience, the

percentage of released can reach almost 100%. Despite the fact that the workers

of state enterprises find work in the second and third groups, this leads to a

significant growth rate, which may be open or hidden. Thus, one of the key

variables of the mathematical model must be current employment in the

privatization process.

Since privatization inevitably accompanied by a

decline in production due to quantitative and restructuring of the industry,

the second variable that must be considered is the current volume of products

within this industry. Third base, you need to enter in the model is the amount

of capital that is accumulated from the sale of businesses.

To construct the model is necessary to consider a

number of variables that characterize the flow of this process at the industry

level. In the process of constructing mathematical models will comply with the

methodology proposed in [13]. In order to describe the dynamics of PE, we

introduce the following variables:

![]() number of enterprises

that are brought to market at the beginning of the privatization implementation

of the transition from state to private ownership;

number of enterprises

that are brought to market at the beginning of the privatization implementation

of the transition from state to private ownership; ![]() current number of enterprises that are

brought to market further privatization at time

current number of enterprises that are

brought to market further privatization at time ![]() ; introduction of this variable due to both

economic and socio-political reasons;

; introduction of this variable due to both

economic and socio-political reasons; ![]() period of time during which must be made

privatization of the industry;

period of time during which must be made

privatization of the industry; ![]() number of enterprises privatized unit time

(month, quarter); it is obvious that

number of enterprises privatized unit time

(month, quarter); it is obvious that  number of firms privatized in the time

interval

number of firms privatized in the time

interval ![]() ;

;

![]() current volume of products produced by

private enterprise;

current volume of products produced by

private enterprise; ![]() number of workers employed at a private

company, the company is the second group (for simplicity, it is assumed that

the number of workers in all private enterprises the same, that does not affect

the generalization of the results);

number of workers employed at a private

company, the company is the second group (for simplicity, it is assumed that

the number of workers in all private enterprises the same, that does not affect

the generalization of the results); ![]() number of workers employed at a state

enterprise;

number of workers employed at a state

enterprise; ![]() performance of the

state enterprise privatization at the beginning of the period (assumed constant

throughout the period);

performance of the

state enterprise privatization at the beginning of the period (assumed constant

throughout the period); ![]() productivity per worker of state enterprises;

productivity per worker of state enterprises;

![]() productivity per worker private enterprise;

productivity per worker private enterprise; ![]() current number of enterprises that are

created in the private sector at a time

current number of enterprises that are

created in the private sector at a time ![]() ;

;

![]() number of workers at a private company, which

is created in the process of privatization;

number of workers at a private company, which

is created in the process of privatization; ![]() performance of a single private company,

which is created in the privatization process;

performance of a single private company,

which is created in the privatization process;![]() total number of employees in state enterprises at the beginning of the period

of privatization;

total number of employees in state enterprises at the beginning of the period

of privatization; ![]() Total current employment in the field at time

Total current employment in the field at time

![]() ;

;

![]() rate of change of total current employment in

the field at time

rate of change of total current employment in

the field at time ![]() ;

;

![]() number of workers who have become unemployed

as a result of privatization;

number of workers who have become unemployed

as a result of privatization; ![]() number of workers who have become unemployed

as a result of privatization without public enterprises that are brought to

market further privatization during

number of workers who have become unemployed

as a result of privatization without public enterprises that are brought to

market further privatization during ![]() ;

;

![]() number of private enterprises that are

created by the labor of state-owned enterprises to be privatized;

number of private enterprises that are

created by the labor of state-owned enterprises to be privatized; ![]() number of private enterprises that are

created by the labor of state-owned enterprises to be privatized without those

state enterprises that additionally submitted for privatization during

number of private enterprises that are

created by the labor of state-owned enterprises to be privatized without those

state enterprises that additionally submitted for privatization during ![]() ;

;

![]() function of the current volume of production

for enterprises of all types of property;

function of the current volume of production

for enterprises of all types of property; ![]() the rate of change of the current volume of

production for enterprises of all types of property;

the rate of change of the current volume of

production for enterprises of all types of property; ![]() current unemployment caused by the transition

to a new form of ownership;

current unemployment caused by the transition

to a new form of ownership; ![]() initial cost of a state enterprise

privatized;

initial cost of a state enterprise

privatized; ![]() current gains of one state enterprise; while

gains on a range of public

current gains of one state enterprise; while

gains on a range of public ![]() is

is  ;

assigned as the function

;

assigned as the function ![]() can be predicted based on previous experience

of privatization;

can be predicted based on previous experience

of privatization;

![]() current amount of revenue from

the sale of state-owned enterprises; Thus, the total amount of proceeds from

the sale of state-owned enterprises in the interval

current amount of revenue from

the sale of state-owned enterprises; Thus, the total amount of proceeds from

the sale of state-owned enterprises in the interval ![]() is

is ![]() , and taking into account the state-owned enterprises,

further submitted to the market, total revenue will

, and taking into account the state-owned enterprises,

further submitted to the market, total revenue will

![]() . (1.1)

. (1.1)

Be it ![]() variable that describes the part of the

workers who left the privatized state enterprises and found employment in

private enterprises established in the privatization process. The absolute

value of the number of workers who find work in the new private enterprises

with growth time

variable that describes the part of the

workers who left the privatized state enterprises and found employment in

private enterprises established in the privatization process. The absolute

value of the number of workers who find work in the new private enterprises

with growth time ![]() ,

calculated by the product

,

calculated by the product ![]() .

Note that this value increases the total current employment

.

Note that this value increases the total current employment ![]() .

difference

.

difference ![]() describes the number of workers who are

exempt from state enterprises. If

describes the number of workers who are

exempt from state enterprises. If ![]() ,

,

then the manpower requirements for new private enterprises (third group)

will be fully met by workers who lose their jobs in state enterprises due to

their privatization. On the other hand, if there is a less likely situation, ie

![]() ,

,

then the needs of the third group in the labor force will be met by the

unemployed in the first two groups. Thus, we can write the following

relationship: ![]() that a coefficient

that a coefficient ![]() is

is

![]() ,

(1.2)

,

(1.2)

where![]() .

.

Write an expression that

describes the amount of workers who lose their jobs as a result of

privatization of state enterprises in some elemental spell ![]() :

: ![]() .

This value reduces the total current employment

.

This value reduces the total current employment ![]() .

Thus we can write the following equation for the rate of change of current

employment:

.

Thus we can write the following equation for the rate of change of current

employment: ![]() or

or ![]() ,

and taking into account (1.2) we obtain

,

and taking into account (1.2) we obtain ![]() . (1.3)

. (1.3)

Consider the structure of the differential equation to

describe the rate of change of the current production volume in the industry.

Increase in volume production in the second group of enterprises is

characterized by the product ![]() ,

and a decline in production at enterprises of the first group can be written

expression

,

and a decline in production at enterprises of the first group can be written

expression ![]() .

Increase in volume production at enterprises of the third group by time period

.

Increase in volume production at enterprises of the third group by time period ![]() can be described by the following equation:

can be described by the following equation:

![]() .

(1.4)

.

(1.4)

Thus, the rate of change of the volume of production in the industry as

a whole is described by the following differential equation:

![]() . (1.5)

. (1.5)

Combining equation (1.1) (in differential form), (1.3) and (1.5), we

obtain a system of equations describing the process of privatization of the

industry on condition that they produce the same products before and after

privatization: ![]() , (1.6)

, (1.6)

![]() ,

(1.7)

,

(1.7)

![]() .

(1.8)

.

(1.8)

Note that the current unemployment

rate can be calculated by the expression

![]() . (1.9)

. (1.9)

A number of potential businesses you can create by attracting

unemployed, calculated by the expression ![]() . (1.10) The

resulting system of equations can be used to find the optimal (with respect to

some chosen criterion) values of variables

. (1.10) The

resulting system of equations can be used to find the optimal (with respect to

some chosen criterion) values of variables ![]() for the period of

time designated for privatization. Obviously, for the formulation of the

optimization problem it is necessary to impose restrictions on some variables.

for the period of

time designated for privatization. Obviously, for the formulation of the

optimization problem it is necessary to impose restrictions on some variables.

Note that the function ![]() (speed of the privatization process) must be

piecewise continuous. One of the possible strategies of the privatization

process is the simultaneous privatization of the entire set of the industry

that are brought to market privatization. However, this strategy is

unacceptable to the socio-political and economic point of view because it has

the following disadvantages: the rapid and uncontrolled growth of unemployment,

a significant decline in production, the low probability of finding the

necessary investments for a rapid transition to private ownership and further

expansion of production volumes. It is therefore necessary to find a speed of

privatization, which would optimize the values of the key

variables. Limit the speed of privatization have the form

(speed of the privatization process) must be

piecewise continuous. One of the possible strategies of the privatization

process is the simultaneous privatization of the entire set of the industry

that are brought to market privatization. However, this strategy is

unacceptable to the socio-political and economic point of view because it has

the following disadvantages: the rapid and uncontrolled growth of unemployment,

a significant decline in production, the low probability of finding the

necessary investments for a rapid transition to private ownership and further

expansion of production volumes. It is therefore necessary to find a speed of

privatization, which would optimize the values of the key

variables. Limit the speed of privatization have the form

,

(1.11)

,

(1.11)

and a fixed number of enterprises to be privatized  .

If you set the level of unemployment through

.

If you set the level of unemployment through ![]() ,

then the final time

,

then the final time ![]() share of employment in the area should not be

less than

share of employment in the area should not be

less than ![]() on the amount of labor that is released. On

this basis, we can write the expression for employment at the end of the term

privatization

on the amount of labor that is released. On

this basis, we can write the expression for employment at the end of the term

privatization  ,

(1.12)

,

(1.12)

and a simplified version with a fixed number of enterprises ![]() ,

that are brought to market privatization

,

that are brought to market privatization

![]() . (1.13)

. (1.13)

Thus the launch of the privatization process must be defined with the

following values: ![]() .

For more complicated version when the number of enterprises to be privatized,

is variable, it is necessary function

.

For more complicated version when the number of enterprises to be privatized,

is variable, it is necessary function![]() .

Restrictions on the proceeds from the sale of businesses

.

Restrictions on the proceeds from the sale of businesses ![]() .

(1.14)

.

(1.14)

The initial conditions for the basic variables are:

![]() .

(1.15)

.

(1.15)

A mathematical model of the process of privatization, restrictions on

the variables and initial conditions can make the formulation of the

optimization problem.

Find an (optimal) speed ![]() implementation of the privatization process,

which is described by a mathematical model

implementation of the privatization process,

which is described by a mathematical model ![]() , (1.16)

, (1.16)

![]() ,

(1.17)

,

(1.17)

![]() ,

(1.18)

,

(1.18)

![]() (1.19)

(1.19)

that maximizing the

total production![]() ,

,

![]()

Where ![]() class of piecewise continuous functions over

the planned privatization period with restrictions

class of piecewise continuous functions over

the planned privatization period with restrictions

,

, ![]() .

.

formulation of this

optimization problem is assumed that the market is made privatization a fixed

number of enterprises ![]() ,

which does not change throughout the period of implementation of the process,

ie

,

which does not change throughout the period of implementation of the process,

ie ![]() ,

, ![]() . An alternative formulation of the

optimization problem is an option, complicated by the fact that the market for

enterprises, which are made for sale, can be expanded during the period

. An alternative formulation of the

optimization problem is an option, complicated by the fact that the market for

enterprises, which are made for sale, can be expanded during the period ![]() .

.

Consider possible alternative solution to the problem for model (1.17) -

(1.19) using Lagrange multipliers. Instead of restricting  Add additional variable

Add additional variable ![]() with boundary conditions

with boundary conditions ![]() and

and ![]() .

.

![]() is the current number of privatized

enterprises. By writing the Hamiltonian for this problem

is the current number of privatized

enterprises. By writing the Hamiltonian for this problem  (1.28)

(1.28)

![]() ,

,

where ![]() ;

;

![]() introduced as a measure that is maximized;

introduced as a measure that is maximized; ![]() can be interpreted as the shadow price of

production area;

can be interpreted as the shadow price of

production area; ![]() describes the dynamics of employment and

describes the dynamics of employment and ![]() dynamics of privatization market. Conjugated

variables

dynamics of privatization market. Conjugated

variables![]() ,

determined by the following differential equations:

,

determined by the following differential equations:

![]() Where

Where ![]() ; (1.29)

; (1.29)

![]() (1.30)

(1.30)

The terms transversality

![]() ;

;

![]() (1.31)

(1.31)

The terms transversality ![]() .

Thus, we can write that

.

Thus, we can write that![]() ;

;

;

;

![]() .

.

![]() And

And ![]() terms transversality

terms transversality ![]() ,

,

![]() ,

, ![]() ,

, ![]() .

If

.

If ![]() ³

³

![]() , so

, so ![]() we can get

we can get

![]() ,

(1.32)

,

(1.32)

Where![]() .

.

If ![]() - growing bent function, then there exists a

unique solution of (1.32) defined for each point in time

- growing bent function, then there exists a

unique solution of (1.32) defined for each point in time ![]() thus a necessary condition is also sufficient

for optimality.

thus a necessary condition is also sufficient

for optimality.

In order to get inputs for the model developed software that uses data

from past years and forecasts the number of public companies that can be of

privatization in these periods. To analyze the operation and was elected a

number of times based on 15 values, ie, during the years of the

privatization process in Ukraine.

Table 5.1 summarized the characteristics of mathematical models built

for the privatization of group A, and features the same stepper projections

calculated in these models.

Table 5.1

|

Type of model |

characteristics of the model |

Specifications forecast |

||||

|

|

|

DW |

RMSE |

MAPE |

Theil Coefficient |

|

|

AR(1) |

0,875844 |

157593,1 |

0,859390 |

192,7309 |

36,96071 |

0,202947 |

|

AR(3) |

0,920181 |

68897,81 |

1,827690 |

68,82119 |

19,98405 |

0,077099 |

|

AR(6) |

0,984161 |

1481,658 |

2,024068 |

12,12040 |

6,491308 |

0,024747 |

|

ARMA(1,1) |

0,932531 |

85639,42 |

2,304531 |

61,66583 |

16,12263 |

0,050405 |

|

ARMA(2,1) |

0,965990 |

38180,54 |

1,970234 |

81,16433 |

12,84269 |

0,074889 |

|

multiple autoregressive |

0,758138 |

319088,5 |

0,920338 |

150,9703 |

33,96408 |

0,128580 |

Simulation results are presented in Table 5.1 indicate

that all models except the first and last are suitable for modeling as Theil

coefficient is measured in hundredths fate. The best model can be considered AR

(6) and the set of regression of logarithms of data.

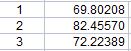

Predict the data for the next 3 years and will

demonstrate in Table 5.2

5.1's represent the graph, what is the difference

between the known and predicted data.

0

0

Figure 5.1 - Prediction 3 years AR (6)

Consequently, the graph shows that the AR (6) predicts

fairly close privatization in transition economies Ukraine and we can get

input.

The paper analyzes current privatization processes,

methods and models to describe the process of privatization. And the algorithm

of solving the problem of privatization. We consider the optimal model for our

country to nearest privatization process proceeded normally and performed two

functions; the state budget was increased and filled with employment. A

mathematical model of the process of privatization in the form of differential

equations of the first order. The model is used to solve the optimization

problem of transformation of ownership at branch level.

Literatura:

1) Government Privatization History, Examples, and

Issues. Commission on Government Forecasting and Accountability [electronic

resource]. - Mode of access:

http://cgfa.ilga.gov/Upload/2006Gov_Privatization_Rprt.pdf

2) Oxford Development Studies. Vol.32, ¹4, December

2004 [electronic resource]. - Access http://www.tandfonline.com/doi/pdf/10.1080/1360081042000293353#.U3qax_l_vu4

3) FederalAid Facility Privatization Act [electronic

resource]. - Mode of access:

http://beta.congress.gov/bill/104th/housebill/1907/text

4) Economics of Transition [electronic resource]. -

Mode of access:

http://lnu.edu.ua/faculty/ekonom/Economics/publish/Ek_Ukr_10/R_1.pdf

5) Chepinoha VG Economics: a textbook / VG. Chepinoha

// - K .: Yurinkom Inter, 2011.-656s.

6) L. Geiger Makroýkonomycheskaya Theory and

perehodnaya Economy; [Trans. from English. L.zorina] - M .: INFRA-M, 1996.

7) The essence of the cause and tenedentsiyi

privatization in the context of global economic growth: the institutional

aspect / GA Kramarenko, AE Black // Academic Review. - 2013. - ¹2 (39). -

S.13-20.

8) Privatization in a market economy / N.H.Panchenko

// Actual problems of economy. - 2006. - ¹5 (59). - S.18-20.

9) The experience of privatization in the UK to

Ukraine / P.H.Perova, A. Chubukov // Actual problems of economy. - 2006. - ¹4

(58). - S.14-16.

10) Pashaver O. Privatization and re-privatization in

Ukraine after the "Orange" revolution / Pashaver OI, Verkhovodova LT,

AheyevaK.M. - K.: Millennium 2006 - 106s.

11) Bidyuk PI Analysis chasovyz series / Bidyuk PI, VD

Romanenko, Tymoshchuk AL - By: Polytechnic University, 2010 - 317 p.

12) Grover R. Management nedvyzhymostyu

Mezhdunarodny'j uchebnûykurs - M.: VSHPP, 2007 - 375s.

13) Bidyuk PI Analysis and mathematical modeling of

economic processes of transition / Bidyuk PI, Polovtsev O. -K: PLAB-75, 1999 -

209s.

14) on transition process [electronic resource]. -

Mode of access:

http://library.nulau.edu.ua/POLN_TEXT/KOMPLEKS/ET/KURS/OSNOVA_ET/TEST/LEKC_5.htm

15) Bydyuk PI Analysis and modeling processes

ekonomycheskyh perehodnoho period / Bydyuk PI, Polovtsev AV // Problems of

Control and Informatics. -1998. - ¹5. - s.138-146

16) Kovalev VV Management fynansamy: Textbook.

Textbook. - M.: FCO Press, 1998 - 356 p.

17). McGowan Kenneth L. Value Based [electronic

resource]. - Mode of access: http://www.privatizationbarometer.net/PUB/

Delivery for Public Owners. Paper presented NL / 4/9 / PB_Report_2011.pdf to

the National Society of Professional

18) Privatization Barometer, Policy paper by the

Reason Foundation [Electro, nnyy resource]. - Mode of access: http: //

September 2000. - P. 38.