Экономические науки/10.Экономика

предприятия.

Usanov A.Yu.

Department of Economic Analysis

FGOBU VO "Financial

University under the Government of the Russian Federation».

Financial analysis of the

enterprise, its value, the nature and objectives

The

financial condition of the company is a

complex concept, the financial credit relations arising from enterprises in

difficult conditions of the Russian tax climate with different interests in the

regulation of profits, capital increase and property valuation share price,

dividend policy, increasing the value of the enterprise[1].

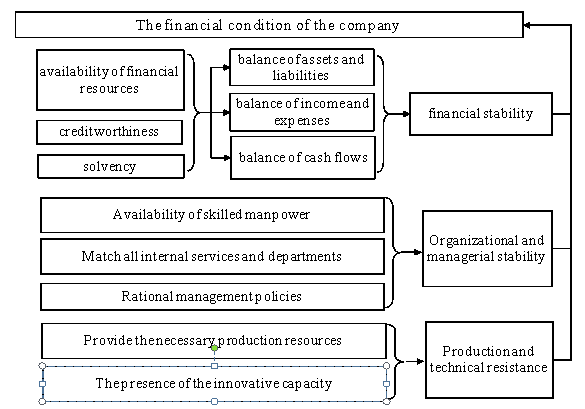

Figure

1 - Components of the financial condition of the company[2]

Financial

companies are based on three main types of sustainability: financial,

managerial and technical production.

Production

and technical sustainability is a set of tools and objects of labor used in the

production process, in an amount necessary for expanded reproduction, taking

into account their degree of wear.

Organizational

and managerial stability is characterized by the relevant internal services and

all parts of the organization, the right choice of the legal form that is

suitable for the organization and rational management of internal and external

policies of the organization.

The

most important among the components of the financial condition of the company

is financial stability.

Financial

stability is an economic category which expresses a system of economic

relations in which the company generates effective demand, which can create a

balanced raising loan obtained by the

own sources of active investment and growth of current assets, to create

financial reserves to take part in the formation of the budget[3].

As

well financial stability should be seen as the ability of a business entity to

operate and develop, maintain balance of their assets and liabilities in the

changing internal and external environment, ensuring its continued solvency and

investment appeal within the boundaries of the acceptable level of risk. This

concept of financial stability should be seen through the relationship between

the company's solvency ratio analysis and capital structure. This will

determine the balance of assets and liabilities and the level of risk of

financial dependence, which is the company.

Thus

the financial condition of the company is its inherent property to resist the negative impact of factors

in the course of its operation and development by achieving and maintaining

financial stability, ensuring the preservation of all the primary features of

the enterprise system including its structural integrity.

Since

the financial analysis of the company is an integral part of the economic analysis,

its essential element, it focuses on its goals and objectives.

In

modern literature financial analysis of a company is classified according to

various criteria.

Classification

of the financial analysis of the enterprise is essential to a proper

understanding of its contents and objectives.

The

most common ways of classifying financial analysis of the company are presented

in Table 1.

Table

1 - Classification of the financial analysis of the company[4]

|

Classification sign Type of analysis |

Type of analysis |

||

|

Members analysis |

External |

Internal |

|

|

The analyzed manufacturing enterprise |

Production |

Finance |

|

|

The temporal aspect |

Preview (perspective) |

The subsequent

(retrospective) |

|

|

Operational (situational) |

Total (final) |

||

|

Facility management |

Facilities Management Feasibility, economic and financial, economic and

social, economic and statistical, marketing, etc. |

||

|

Methods of studying the object |

Comparative, diagnostic, factor, marginal, Economics and Mathematics,

Economics and Statistics, functional and cost, stochastic, deterministic |

||

|

Coverage of the studied units |

Solid |

Selective |

|

|

The content of the program |

Integrated |

Thematic |

|

The content of

activity is largely determined by the purpose, objectives and interests of

users of information which are different.

The

main purpose of the financial analysis of the enterprise is an objective and

reasonable assessment of its current and future financial condition obtained on

the basis of a certain number of key informative indicators (parameters)

allowing to give an objective and accurate picture of its financial condition,

the possible rate of economic development and financial results and parameters

of efficiency of financial and commercial activity.

The

objectives of the financial analysis of the company:

· the identification of changes in indicators of financial condition;

· identification of factors affecting the financial condition of the

organization;

· evaluation of quantitative and qualitative changes in the financial

condition;

· assessment of the financial situation of the company on a certain date;

· definite trends in the financial condition of enterprises.

The

main objectives of the financial analysis of the company realized in the

implementation of successive stages:

· preliminary (common) analysis of financial condition;

· assessment of financial stability;

· assessment of liquidity and solvency;

· evaluation of business and market activity;

· evaluation of financial results and profitability of the organization;

· diagnosis and prediction of potential bankruptcy of the financial

condition of the organization.

As a

result in the course of these stages of the financial analysis of the company the

following results can be obtained:

·

timely and objective assessment of the financial

condition of the company, identification of "bottlenecks" in its

financial and business activities and study of the causes of their formation;

·

assessment of the possibility

of bankruptcy of the enterprise;

·

identification of the

factors and causes of the state of progress;

·

identification and

mobilization of reserves to improve the financial condition of the company and

increase the efficiency of all its business activities;

·

preparation and

justification for the proposed management decisions in order to improve the

financial condition of the company;

·

identification of

trends in the development of the enterprise on the basis of forecasting its

financial condition.

The accuracy

and completeness of the financial analysis of the company allows to assess

progress and the required level of financial stability, solvency and liquidity,

to establish the optimum size of inventories, accounts receivable and accounts

payable, the feasibility of investments in real and financial assets[5].

Effective

organization of financial activity is impossible without the ability to analyze

the economic processes taking place. If the analytical work is built correctly,

the company is able to respond quickly to possible adverse circumstances.

Financial analysis of the company designed to identify the strengths and

weaknesses of the financial and economic activities of the organization.

Thus

the financial analysis of the company is an important stage in the development of its financial strategy

and tactics, it makes possible to set

the parameters of deviation from the industry average and more powerful

competitors[6].

References

1.

Ефимова,

О. В. Анализ финансовой отчетности / О. В. Ефимова, М. В. Мельник. – М.:

Омега–Л, 2009. – с. 83

2.

Ковалева, А.

М. Финансы фирмы / А.М. Ковалева, М. Г. Лапуста, Л. Г. Скамай. – М.: Инфра–М,

2009. – с. 32

3.

Комплексный

экономический анализ хозяйственной деятельности. Ионова Ю.Г., Усанов А.Ю.,

Фефелова Н.П. учебно-методическое пособие для бекалавров направления подготовки

080100.62 Экономика/ Москва, 2013

4.

Кочетков Е.П. Финансовая устойчивость предприятия и ее оценка для

предупреждения банкротства / С.Е. Кован, Е.П. Кочетков // Экономический анализ:

теория и практика – 2009. – № 15 (144). - С. 52-60

5.

Павлова, Л.

Н. Финансовый менеджмент: Учеб. пособие. – 2–е изд., перераб. и доп. / Л. Н.

Павлова. – М.: ЮНИТИ–ДАНА, 2011. – с. 126

6.

Савицкая,

Г. В. Анализ хозяйственной деятельности предприятия: Учебник. – 4–е изд.

перераб. и доп. / Г. В. Савицкая. – М.: ИНФРА–М, 2011. – с. 79