P.h.D. Kryuchin

O.V., Kryuchina E.I.

Tambov State University

named after G.R. Derzhavin

The currency exchange rates prediction

and artificial neural networks

The prediction of

financial time series is an actual problem of economics because changing cost of

shares and currency exchange rates influences different economic parameters.

For a long time it is assumed that financial time series are random but in the

1980s the theory of deterministic chaos appeared. This theory predict that

there are many hidden conformities in financial time series.

The deterministic

chaos theory suggests that a financial time series is a dynamic system. There

is a group of parameters for such a system which characterizes the system

condition and allows to calculate system values at every point of time from

initial values by special convention (is defined by the following function of

system evolution ![]() ) [1]. Here

) [1]. Here ![]() is group of parameters characterize system

condition, L is lag space size

(number of previous series values used to calculate the value of the

current value),

is group of parameters characterize system

condition, L is lag space size

(number of previous series values used to calculate the value of the

current value), ![]() are manager parameters,

are manager parameters, ![]() is the system evolution function. The

currency exchange rates system condition is characterized by time series

is the system evolution function. The

currency exchange rates system condition is characterized by time series ![]() . Here

. Here ![]() is currency exchange rates at time

is currency exchange rates at time ![]() . For simulating

the time series it is necessary to discover the function

. For simulating

the time series it is necessary to discover the function ![]() and the parameter

and the parameter ![]() from function

from function ![]() . The flavor of

function

. The flavor of

function ![]() is unknown so in simulation this function is

changed to approximate function F which is defined for minimum

difference between empirical currency

is unknown so in simulation this function is

changed to approximate function F which is defined for minimum

difference between empirical currency ![]() and forecast currency

and forecast currency ![]() in equation

in equation ![]() . Here c is discharging

coefficient which defines the length of the forecasting period. So the target

of forecasting currency exchange rates is to detect the parameters F, L

and c by minimizing the value

. Here c is discharging

coefficient which defines the length of the forecasting period. So the target

of forecasting currency exchange rates is to detect the parameters F, L

and c by minimizing the value ![]() .

.

One of the most

often used strategies is direction detecting. So at the current time ![]() it detects the next direction of change and

calculates value at time

it detects the next direction of change and

calculates value at time ![]() . This calculated

value is

. This calculated

value is ![]() . Then the

difference of the values at points

. Then the

difference of the values at points ![]() and

and ![]() is compared to swap value

is compared to swap value ![]() . The swap value is

point

. The swap value is

point ![]() around radius in which all operations are

unprofitable. If constraint

around radius in which all operations are

unprofitable. If constraint ![]() is executed then the operation will be open.

If new value

is executed then the operation will be open.

If new value ![]() is greater than current value

is greater than current value ![]() then a buying operation is recommended

othersize a selling operation. So it is necessary to define one of three

conditions:

then a buying operation is recommended

othersize a selling operation. So it is necessary to define one of three

conditions:

To solve this task

it is possible to use different methods, for example technical or neural

network analysis. This analysis has not limitation of the character of the

input information. This may be a time series or information about behavior

other market factors. For example, artificial neural networks (ANN) are

actively used by institutional investors (such as large pension funds etc.)

which work with a large amount of information and which need to make allowances

one currency to other. The difference to technical analysis (based on general

recommendations) is the possibility to find optimal factors (for currency pair

quotations forecasting) and to use them in forecasting [2-3].

The aim of this

paper is to predict exchange rates between Euro and US dollar using an

artificial neural network. To achieve this aim, several tasks have to be

solved. These tasks are the training of ANN structure witch consider time

series of currency pair €/$ quotations, the

check of ANN-model adequacy based on this structure, the forecasting result of

technical and neural networks analysis comparison and to formulate a corollary

about the possibility to use ANN for predication.

ANNs are

mathematical instruments which are computer models of biological neural

networks, which can be trained using log-normal observations and can be used

with information dearth or its noisiness. This instrument is very flexible and

this property allows to consider different log-normal red observations using

the change of structure and of manager parameters of model [4].

Training ANNs is

reduced to minimizing the inaccuracy function ![]() . Here

. Here ![]() are weight coefficients.

are weight coefficients.

The ANN which

simulates currency pair quotations series are formulated using the algorithm

defined in [5]:

·

The

lag space size L is searched. This value defines the number of input neurons

in the ANN. Usually this value lies in the band (8; 16) [6].

·

The

type of structure of ANN is selected. The numbers of neurons in hidden layers

and the number of hidden layers are defines by the configuration of the

structure.

·

The

value of the number of the discharging.

·

The

optimal number of pattern lines count are calculated. This value is defined by

the structure size and the number of weighs. If there are N quotations

then the number of pattern lines is N-L [7].

·

For

pattern building the quotation values at time points ![]() are calculated.

These values are

are calculated.

These values are ![]() .

.

·

The

input pattern (X) and output pattern (D) are formulated

·

Weight

coefficients are changed using a gradient algorithm of the steepest descent

[8].

There are not

monosemantic methods of searching of the lag space and the discharging values

searching because each method has advantages and disadvantages. For the

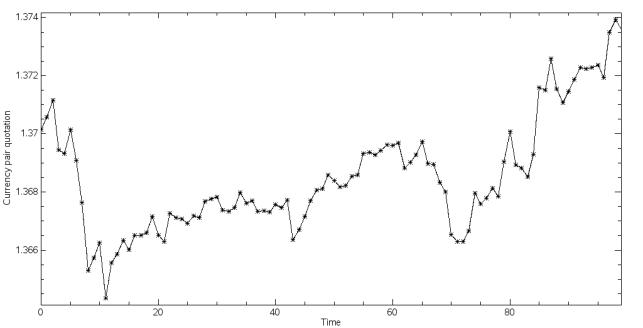

exchange rates used in this paper €/$ witch series are showed in picture 1 it sets parameter L whose

time series is show in figure 1, and c taken the values 15, 30, 60 and

120 minutes (standard periods witch used in trade strategies).

Pic. 1. Quotations

of currency pair.

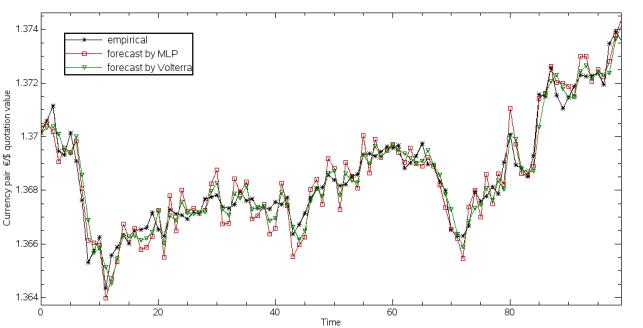

Pic. 2. Quotations

of currency pair (real and predicating).

Literature

1.

Кузнецов С.П. Динамический хаос. // Москва,

1994. – 274 с.

2.

Бэстенс Д.Э. ван ден Берг В.М. Вуд Д.

Нейронные сети и финансовые рынки: принятие решений в торговых операциях. //

Москва: ТВЦ. 1997. – 236 с.

3.

Вострокнутова. А.И. Модели прогнозирования

курсов акций российских нефтяных компаний // Извесия Санкт-Петербургского

университета экономики и финансов. \textnumero3), СПб. 2000. –

C. 126-144.

4.

Зенкова Н.А. Моделирование на основе

аппарата искусственных нейронных сетей как метод исследования в психологической

науке. // Вестн. Тамб. ун-та. Сер. Естеств. и техн. науки. Тамбов: 2009. Т. 14,

Вып. 3. – С. 577-591.

5.

Крючин О.В, Арзамасцев А.А. Прогнозирование

котировок валютных пар при помощи искусственной нейронной сети. // Вестн. Тамб.

ун-та. Сер. Естеств. и техн. науки. Тамбов: 2009. Т. 14, Вып. 5. – С. 591-596.

6.

Козадаев А.A.

Предварительная оценка качества обучающей выборки для искусственных нейронных

сетей в задачах прогнозирования временных рядов. // Вестн. Тамб. ун-та. Сер.

Естеств. и техн. науки. Тамбов: 2008. Т. 13, Вып. 1. – С. 99-100.

7.

Крючин О.В, Козадаев А.С. Арзамасцев А.А.

Паралельные алгоритмы обучения искусственных нейронных сетей и их использование

для прогнозирования массы выловленной креветки в Индийском океане. // Вестн.

Тамб. ун-та. Сер. Естеств. и техн. науки. Тамбов: 2010. Т. 15, Вып. 5. – С.

185-190.

- Osowsky S. Sieci neuronowe w ujeciu algorytmicznym // Warszawa. 1996.