Economics. Investment activity and

capital markets.

Post-graduate,

Bogach Dmitry

National

Mining University

Analysis

of changes in the structure of modern stock markets, their dynamics and

interdependence

Over the last decade, the global economy is determined

by a number of new trends. These primarily include the technological revolution

caused by the widespread use of computers and new method of communication which

led to radical changes in production, trade and especially in the financial

sector, especially in the equity markets. To develop investment strategies,

improving the management of the stock market and rationalization of interaction

is necessary to understand the trend’s changes in the structure of capital

markets and their dynamics.

The current stage

of development of economic ties across the world is characterized by

significant changes in the global investment process. Regularity and large

scale movement of investments between domestic and international stock markets

give a rise to a new phenomenon in the field of international investment -

financial globalization, which leads to changes in the structure of markets and

the emergence of distinct relationships between their main indicators. Only

understanding trends in change of market structure can provide a reliable

estimate of their condition. The aim of the study is to describe the changes in

the structure of modern stock markets and dynamics of their development.

The globalization of financial markets , the

development of computer and telecommunications technologies have exacerbated

competition , resulting in stock exchange have to carry out large-scale

investments in new technologies in order to improve competitiveness by offering

new services to attract new companies - issuers of new members and a broad

range of investors.

Recently, as the facts show, a number of exchanges

have changed their organizational - legal form in order to strengthen internal

architecture to compete with other international markets. There is a tendency

of transition from form of associations and organizations which governed by

special regulations, to joint-stock company type, as the result their

membership base framework have become more open and diverse.

Research different markets, organized by Members of

the International Federation of Stock Exchanges, show that their activity is

concentrated mainly on traditional stocks and bonds. Not surprisingly, 98% of

exchanges form the equity markets, 82% - bond markets. Thus, revenues of stock

exchanges consist principally from exploiting common stock products - stocks

and bonds. Markets of derivatives - yet under-represented, especially given

tremendous development in the world trading of futures and options since the

mid 80’s.

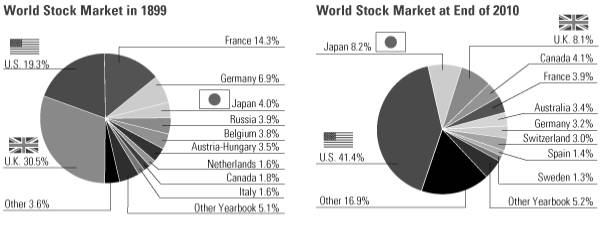

Structure of capital which is involved in the equity

markets over the last century, was distributed, mainly, to the U.S. market

(fig.1).

Figure

1. Changes in structure of capital which is involved in the equity markets 1899

to 2010.

The largest stock market - the U.S. market, which

faces some challenges, in particular, such as increased competition from other

market parties, including private trading systems and the Internet. This

external pressure forcing exchanges to adapt its internal structure to changing

influences.

Currently the stock market was struck by a deep crisis. It was

caused by a complex of both objective and subjective factors. The world

continues to operate many exchanges and trade organizations, whose future is

now very uncertain. Unlike the stock market, which in one form or another will

operate fate trade organizations may be more dramatic. At this stage the

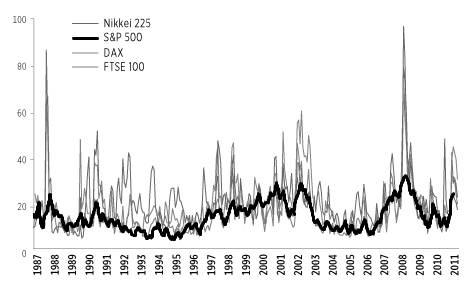

currency factor is increasing in the operations of global stock markets. The

instability currencies rates of leading Western countries have a significant

impact on the movement of financial flows between the markets of the U.S.,

Western Europe and Japan. Currently, there is virtually synchronous rise or

drop in the national securities markets of different countries (fig. 2), which

can lead to increase the scale and duration of oscillation cycles of rates

movement.

Figure

2. Comparison vibrations major stock markets around the world.

Synchronicity in motions of rates is provided by

information transparency of national stock markets, high speed information

transfer, a significant amount of cross-border securities transactions, the

increased role of institutional investors, the openness of national stock

markets on which active role is played by foreign participants who act as

issuers and investors.

Under conditions of high volatility, the financial

risks of economic agents are repeatedly increasing. To determine the most

stable market, researchers should perform a comparison of levels of volatility

major stock markets (Figure 3). From figure 3 we can see that the most stable

is the U.S. stock market. It is the most capacious market and factors which can

destabilize it, arise in the global economy very rare. Therefore, the

development of models for the management of investment portfolios should be

based on the U.S. stock market.

Figure

3. Comparison of the volatility of major stock markets in the years 1987-2011

The U.S. stock market serves mainly domestic investors

and issuers. Share of non-residents in the U.S. market is much lower than in

any other national stock market. The impact on the situation on the U.S. stock

market provides state of the U.S. economy.

The U.S. stock market is dependent on the inflow of

foreign capital. From the inflow of foreign capital into the U.S. market

depends on the position of the dollar in world currency markets. Due to the

huge deficit of trade balance and balance of payments deficit on current

account, for the balance of supply and demand of the dollar on the world

currency market, daily more than 1 billion of

foreign capital should come to the U.S. market.

World stock market develops in cycles. Globalization

of equity markets increases their interdependence. At the national stock

markets there is almost synchronous rise or fall rate of securities. The depth

of the drop in stock price is determined by their overvalued rate. Development of new technologies leads

to blurring of geographical origin of the different market members. These

features should be used when developing investment strategies based on market

neutrality. Because of the stability and liquidity indicators should be used

U.S. markets , then further consideration should be based market Nyse, Nasdaq

and CME.

In

the future, as continuation of the investigation, perhaps consideration of

national stock markets as a global, and finding of new interdependencies

between the stock market, commodity market and derivatives in modern

conditions.

Concluding the review of trends in changing patterns

of stock markets should be noted that the situation prevailing at the time is

unique. The role and scope of the stock markets have become unprecedentedly

high. The structure becomes more complex in terms of participants and used

tools, transactions in the market becomes extremely rapid. As a result, a

comprehensive analysis of structural changes of stock markets in a globalizing

world economy and its main trends and dynamics is defined.

Literature:

1. Alekhine B., Securities Market, UNITY-DANA, 2004.

2. Schetinin V., Economic diplomacy, Moscow, 2001.

3. Bychkov A., The world market for securities:

institutions, tools and infrastructure, Dialog-MGU, 1998.