Candidate Amirov A.Zh.

D.t.s. Beisenbi M.A.

Bachelor of computer science Sergeyeva A.O.

Karaganda state technical university

Economic parameters of

mining-and-metallurgical cluster of central Kazakhstan and their

characteristics analysis

A

strategic aim of the social-and-economical development of the Republic of

Kazakhstan is its entering the number of 500 most competitive countries of the

world. The base of the RK competitiveness at the world and inner market

accounting vast territories and large population is the cluster system which

permits to concentrate and realize efficiently all the competitive advantages.

Cluster

is a network industrial group of close, interconnected geographically companies

and associated organizations, acting jointly in a certain type of business and

characterized by the common lines of activities and interrelations with each

other [1].

The

base of fixing positive results achieved by Kazakhstan and further economic

development there must become a support on cluster structures which ensure

competitiveness of modern countries in the world economic space. The base of

such structures is a network of economic subjects which, cooperating and at the

same time competing with each other work on the base of

innovation-and-information technologies [2], use labor force with modern skills

and competences, function in the conditions of the developed transport

communication system, have modern channels of distribution, control their

market positions at inner and outer markets.

Historically formed industrial specialization of a number of Kazakhstan

regions the shaped preconditions of forming a competitive advantage in the

world labor division. It is represented in the global economics by ferrous and

non-ferrous metallurgy [2]. Thanks to the obviously expressed specialization

which was sometimes criticized as a structural disproportion, this or that

region concentrates efforts on the output of a certain spectrum of

products.

In 1999 to 2006 in economics of the Karaganda region the share of metallurgical

complex in industrial production volume

was 78,9%. The principal economic subjects of this sector of industry

are such large companies as JSC

“Arcelor Steel Temirtau” (ferrous metallurgy, main production in Temirtau) and

LLC “Kazakhmys Corporation” (production of non-ferrous metals, main production

in Zhezkazgan and Balkhash). Within 11 months these corporations are actively

forming vertical technological complexes, buying as the property power

producing, coal mining and other, mainly connected technologically industrial

objects.

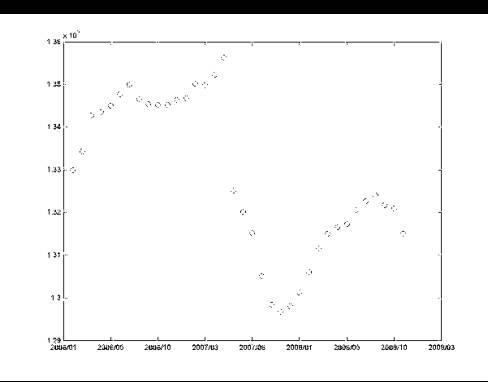

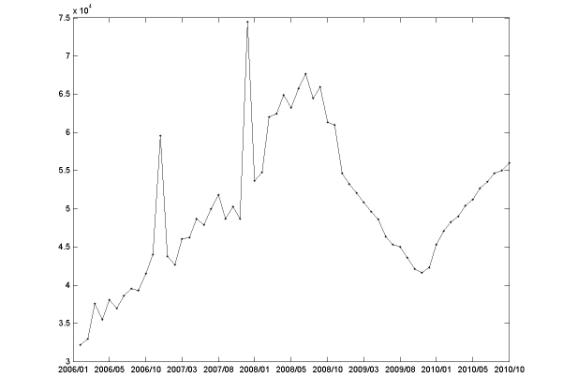

One of the criteria of the cluster growing in

economy and in practice is the growth of the number of employees in this

business structure. To mark out a common tendency of the development there was

built a trend which smoothed out the difference between the values and reflects

more obviously the development tendencies (Figure 1).

Figure 1 – Dynamics of the number of employees

in the

mining-and-metallurgical cluster, persons

As you see, the demand for the labor force is beginning to fall in the

period from September of 2008. In November 2008 there is necessary to dismiss

20% of workers.

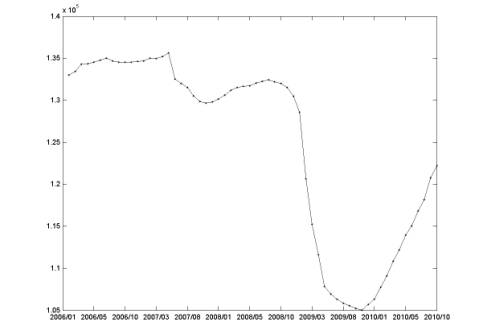

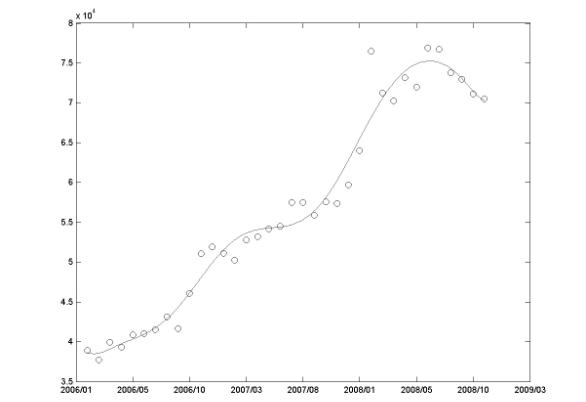

According to the 11-th degree polynomial obtained: y = -3.93*10-9*x11

- 8.24*10-7*x10

+ 7.45*10-5*x9

- 3.79*10-3*x8

+ 0.12*x7 - 2.41*x6 + 31.2*x5 – 253.42*x4

+ 1237.18*x3 – 3430.18*x2 + 5248.90*x + 130136.94 –

and existing statistical data, by the expert commission of the Research

Institute of regional development there was made a forecast describing the

dynamics of the number of the mining-and-metallurgical cluster employees

(Figure 2).

In the forecast made it’s obvious that till the end of 2009 there will

take place workers discharges.

Only from the beginning of 2010 there will take place a gradual leaving

the crisis, the number of employees in the mining-and-metallurgical cluster

will increase.

In spite of the demand decreasing for the labor force and workers

discharges, the demand for highly qualified personnel is about 300 persons. It

is one of the main problems of enterprises which are in the structure of the

mining-and-metallurgical cluster. Personnel deficit in working specialties is

explained by the reasons:

-

Lack of professional technical schools (PTS) specialized in training

necessary specialists (6 in the Karaganda region);

-

Obsolete material technical base of PTS;

-

Non-prestige state of working specialties among entering students.

The structure

of the presented necessity is shown in Figure 3.

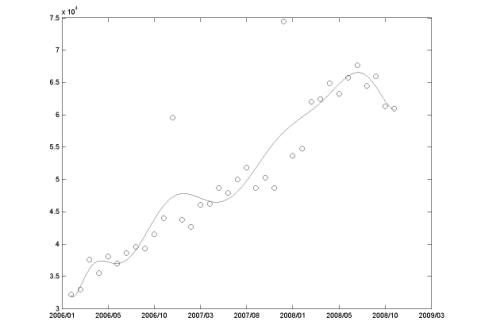

In Figurer 4 there is presented the dynamics of changing an average

month nominal salary of workers at large and middle, as well as small

enterprises of mining industry of the cluster which do not exercise

entrepreneur activity, in the period from 2006 till 2008. As it is seen from

the graph, from September 2008 the level of the average nominal salary is

beginning to decrease.

Figure 2 – Forecast of the

dymanics of the employees number

in he mining-and-metallurgical cluster, persons

Figure 3 – Structure of the demand for

personnel in terms

of working specialties, %

The expert commission also made a forecast describing the dynamics of

changing the average month nominal salary of workers at large and middle, as

well as small enterprises of mining industry of the cluster which do not

exercise entrepreneur activity (Figure 5).

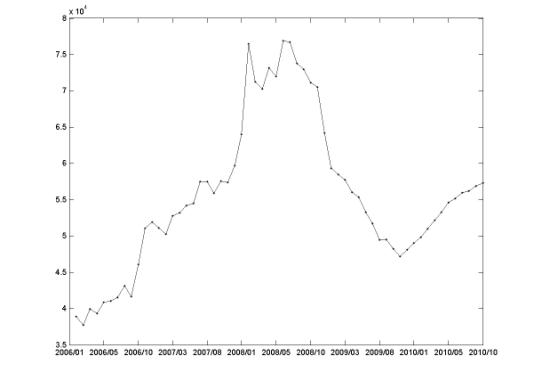

A stable growing of the average month nominal salary till August 2008 is

observed at large and middle as well as small enterprises of processing

industry which do not exercise entrepreneur activity (Figure 6). The highest

level of such a salary was 76494 tenges in February 2008.

As in mining industry, to obtain the coefficients of the polynomial for

the dynamics of the workers’ month average nominal salary changing at large,

middle and small enterprises of processing

industry which do not exercise entrepreneur activity, there was used the method

of the least squares.

The 11-th degree polynomial describing the dynamics of the workers’

month average nominal salary changing at large, middle and small enterprises of

processing industry which do not exercise

entrepreneur activity (Figure 7) has the form: y = 2.56*10-9*x11

- 4.79*10-7*x10

+ 3.74*10-5*x9

- 1.56*10-3*x8

+ 3.67*10-2*x7 – 4.36*x6*10-1

+ 9.33*10-1*x5 + 37.95*x4 - 446.60*x3

+ 2113.61*x2 - 3949.83*x + 40936.61.

Figure 4 – Dynamics of changing the average month

nominal salary of workers at large and

middle, as well as small enterprises of mining industry of the cluster which do

not exercise entrepreneur activity, tenges

Figure 5 – Forecast of the

dynamics of changing the average month nominal salary of workers at large and middle, as well as

small enterprises of mining industry of the cluster which do not exercise

entrepreneur activity, tenges

Figure 6 – Dynamics of

changing the average month nominal salary of

workers at large and middle, as well as small enterprises of processing

industry of the cluster which do not exercise entrepreneur activity, tenges

Figure 7 – Forecast of the

dynamics of changing the average month nominal salary of workers at large and middle, as well as small

enterprises of mining industry of the cluster which do not exercise

entrepreneur activity, tenges

On the whole, there can be made the following conclusions:

1.

The number of employees in the cluster,

beginning with September 2008 decreases sharply which testifies that the

cluster has been subjected to the world economic crisis as an integral part of

the world market of mining and metallurgical industry.

2.

According to forecasts, made up by the expert

commission of the Research Institute of regional development, based on statistical data, the growth of the

number of employees in mining-and-metallurgical cluster will begin not earlier

than in February 2010.

3.

Today the demand for highly qualified working

personnel, in spite of the wave of dismissing, is about 300 persons. In the

terms of the branches the greatest deficit is observed in the mining branch

(54%) of the total demand, 37% - in machine building, 8% - in construction and 2% - in metallurgy.

4.

In the connection with the world economic

crisis, the level of workers’ month average nominal salaryin processing and

mining industry decreased about 30%.

5.

On the whole, judging by the number of

employees and the month average salary and the expert commission forecasts, it

can be concluded that the mining-and-metallurgical cluster in in crisis and,

according to forecasts, will leave it not earlier than in January-February

2010.

Literature: