Economics/4.

Investment activity and stock markets.

dr. of sci.

Pistunov I.M.

HEI “National Mining University”, Ukraine

Model of investment

portfolio optimization

Many researchers and practitioners traders investigate the problem of

optimal portfolios formation. This method is an effective tool for filtering

incoming data on securities volatility. As for research works relevant for CIS

countries, a significant contribution to the theory of optimal investment

portfolio.

Despite the existing variety of scientific and practical approaches to

formation of investment strategy and risk management, classical Markowitz and

Sharpe models are widely applied for direct distribution of funds among the

assets.

The aim of this study is to improve the investment portfolio optimization model by combining existing Markowitz and Sharpe models.

Pistunov-Sitnikov

risk-revenue model.

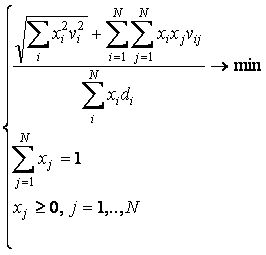

The model was created as a solution to multicriteria optimization task ensuring

risk minimum and profit maximum. As a result convolution of two Markowitz

criterion was formed. Whereby the criterion of "minimum" was placed

in the numerator and the criterion of "maximum" - the denominator.

Also, the numerator was added to the weighted average variance portfolio. The

main idea of this model was to unite the Markowitz model with maximum rate of

return and minimum risk.

Its advantage over the previously described models is that there is no

need to determine the acceptable level of risk and income. This model requires

the same statistical calculations as Markowitz model. This model works great

with small number of assets and with relatively volatile stock market (1).

Integrated

Pistunov-Sitnikov-Sharpe model.

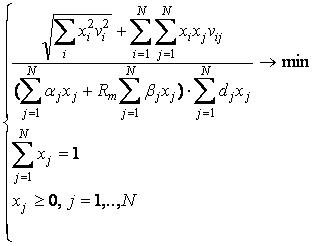

We use the Pistunov-Sitnikov approach, that allows assembling two Markowitz models into one

by putting the rate of return into numerator and the risk into the denominator.

(1)

(1)

where di – average rate of return of asset i, vi– variation

(standard deviation) rate

of return on asset i, vij

– covariance of profitability of

assets

j and i, ![]() xi,j – the share of capital spent on the purchase of

securities i and j.

xi,j – the share of capital spent on the purchase of

securities i and j.

Considering the Sharpe model we have Rf

– rate of return on the risk-free asset. Elimination of this parameter provides

us with portfolio level of profitability i.e.

maximum aiming function.

But there is a rate of return index in the denominator of Pistunov’s

optimal portfolio model.

This

inequality ensures the implementation of the premise that the risk of the

portfolio should not exceed pre-specified risk frontier. The counterpart of this constrain

is also present in the Markowitz model, as well as set beforehand expected portfolio return. But the

model Pistunov-Sitnikov allows to omit the definition of such values

as predefined profit and risk. On the top of that, the index that

characterizes risk (βi)

is present in the denominator. Therefore, the Sharp’s model constrain is discarded

completely. So a simplified version of the denominator is multiplied by the

denominator of Pisunov’s model and the numerator remains unchanged.

Thus, Integrated Pistunov-Sitnikov-Sharpe model is

(2).

The model was tested on real

data of equities of the energy sector, traded on the New York Stock Exchange

with next results (table 1). Especially for this comparison

criterion of relative riskiness was developed, that is calculated according the

formula:

Vr = R/M,

where R

– risk,

à M – rate of return of asset.

(2)

(2)

Table 1 - Comparison of calculations on optimization models

|

Model |

A |

AE |

DTEE |

EI |

En |

PSEG |

Vr |

|

Developed

integrated model |

23% |

34% |

23% |

6,6% |

1,7% |

13% |

0,0007 |

|

Pistunov-Sitnikov

model |

23% |

43% |

25% |

3,1% |

0,0% |

6,9% |

0,0008 |

|

Sharpe model |

0,0% |

0,0% |

23% |

52% |

25% |

0,0% |

0,0472 |

|

Markowitz (risk

minimization) |

92% |

8,5% |

0,0% |

0,0% |

0,0% |

0,0% |

0,1028 |

|

Markowitz

(profit maximization) |

21% |

79% |

0,0% |

0,0% |

0,0% |

0,0% |

0,1036 |

Legend for

corporations: A – Ameren, AE – American electric, DTEE – DTE Energy, EI – Edison

international, En – Enbridge, PSEG –

Public Service Enterprice Group,

The

obtained results indicate that the developed integrated model is the most

effective among models considered on the rate return criteria. This conclusion

is supported with the criterion of relative riskiness that was developed

specially for this study. The relative riskiness (0.000702) is minimal for the

portfolio formed on integrated model.