Yakubova

D.R. Financial University under the government of the Russian Federation

Supervisor:

ass.prof.of “IE&IER” Silantieva E.A.

The reasons for capital

imports and exports (for example in China).

The article is devoted to the analysis of the capital flows, imports and

exports. The country chosen for the analysis is People’s Republic of China.

The significance of the article is composed on the qualitative

assessment of the capital flows in and outside China, main goals of import and

export, future perspectives of investing in China and analyzing the current

position of the People’s Republic of China in the international economic

relations.

Key words: foreign investment (èíîñòðàííûå êàïèòàëîâëîæåíèÿ), FDI (ïðÿìûå

èíîñòðàííûå

êàïèòàëîâëîæåíèÿ), ODI (îòòîê

ïðÿìûõ

èíâåñòèöèé), hot money (ñïåêóëÿòèâíûå, ðèñêîâàííûå

äåíüãè), China

For everybody interested in the development of international economy it

is not a secret, that nowadays Chinese economy gains momentum in the world’s

trade. China is now the world’s third largest external creditor, although much

of its wealth is held in the form of foreign reserves, as opposed to foreign

direct investment like the other large international investors (namely Japan and

Germany). Thus, it is obvious that this work collects the analyzes of two types

of capital flows: inflows and outflows. Firstly, we will examine capital inflow

in China, as the People’s Republic of China nowadays is seen as a perspective

country for future investments, most world economies are interested in the

discussion of the features of capital imports in this country.

China’s FDI (Flow direct investment): capital import and its features.

China quickly recovered from the global financial crisis in 2007. In

2010 China’s GDP grew 10.3 percent, current account surplus and foreign

exchange reserve reached $305.4 billion and $2.847 billion respectively, and

FDI reached $105.74 million, increased 17.4 percent from 2009. According to the

reports of United Nations Conference on Trade and Development, China rose to

second place by the level of FDI after the USA in 2009, entering the top 20

investors of the world. The growth trend continued in 2011, according to the

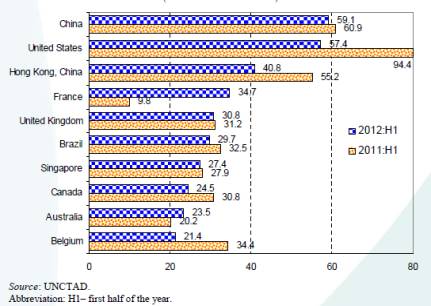

Figure 1. In the first half of 2012, developing and transition economies

continued to absorb more than half of global FDI flows. For the first time,

developing economies alone accounted for a half of the global total. Despite a

slight decline in FDI inflows, China became the largest recipient country in

the first half of 2012, followed by the United States.[10]

Figure 1. Global FDI inflows: top

10 host economies, 2011:H1–2012:H1

(Billions of US dollars)

Let us apply to the researches

of the Chinese people themselves and to their estimation of the happening

economic growth of their country and increasing significance on the world

market of capital. While doing my investigation, I have seeked to some

statistical work of Logan Wright (a Beijing-based analyst at Stone &

McCarthy, an economic-research firm). The problem reported in his discussion is

that in most official sources reserves exclude the transfer of foreign capital

from the People’s Bank of China to the China Investment corporation, the

country’ sovereign-wealth fund, which seeks to control capital imports and

exports in the country. [6] This corporation is thought to engage in

building influence for the government by buying up significant stakes in

companies that have influence in western governments and in the target firms

that have heavily invested in China. This organization helps the government to

influence the policies of multinational companies and to protect China’s

interests in international spheres. This fact inclines to the opinion, that to

invest money in China seems not as easy and possible, as it could be; it also

indicates about the reason not to import capital in the People’s Republic of

China. But won’t be so thoughtless. Some economists use this as a possibility

for hot money inflows, which already takes place in China. The term “hot money”

is commonly used to refer to the “flow of funds (or capital) from one country

to another in order to earn a short-term profit on interest rate differences

and/or anticipated exchange rate shifts”.

Analysts point the two key

reasons for such inflows:

1.

The relative interest rate in China and the United States;

2.

Expectations for the future appreciation in the value of China’s

currency, the renminbi (RMB). [2]

Over the last years, they are 2010 and 2011 years, the interest rates in

China and the United States have been moving in the opposite direction: while

in the USA the rates were lowered, the People’s Republic of China raised its

interest rates at the same time. The reversal in the interest rates of two nations

has created an incentive for investors to move their deposits from the U.S. to

China in order to earn a higher rate in return. In

addition to the attraction of the interest rate difference, speculators are

moving “hot money” into China because of the general expectation that the RMB

will continue appreciate in value against the U.S. dollar and other

currencies. Li Yang, a financial

researcher at China’s Academy for Social Sciences, in 2008 calculated that “hot

money” speculators can obtain profit rates of over 10% per year with little

investment risk. However, the big Western Funds find it hard to move money into

China. Trade and investment offers as big loophole for Chinese and foreign

firms, as individuals can use the 50,000$ annual limit for bringing money into

China from abroad. Today it is obvious that China needs to reduce the incentive

for shattering capital inflows, rather than block the channels…

The reasons for developing

of FDI and ODI cannot be examined separately, as they both while interacting

composes the picture of investment climate in the China. Thus, another part of

this research work is devoted to the Chinese ODI and its features.

China’s ODI (Outflow direct investment): capital export and its

features.

Compared to inflows, China’s outflow direct investment (ODI) is quite

small. However, the past of the ODI development in China has been quiet

positive, and its indicators increase from year to year. In sum, since China opened up in 1978, the ODI policy has evolved

together with other economic reform policies. Specifically, the ODI strategy

has been transformed from a purely political devise to a more market-oriented

operation. [1] In terms of the group of players, it has expanded

from mainly state-owned enterprises to a mix of state-owned and commercial

entities. Nevertheless, there is still a heavy state involvement in ODI

activity; at least, this is what is perceived by the rest of the world. Thus,

the absolute magnitude of China’s ODI is quite small compared with other

sources of FDI.

The main question of my issue in the terms of exports

is: Why does China invest abroad? What are the motives?

According to the Ministry of Commerce of the PRC, in

first half of 2012, Chinese investors made direct investment in 2,163 overseas

enterprises in 116 countries and regions. Total non-financial direct investment

overseas amounted to USD 35.42 billion, up by 48.2% year-on-year. The turnover of China's overseas contracted projects

reached US$ 50.35 billion in first half of 2012, up by 18.4% year-on-year; and

the value of newly-signed contracts was US$ 66.76 billion, up by 0.9%

year-on-year. However, let us first switch to the history of development of

outward direct investments in China and examine it in details.

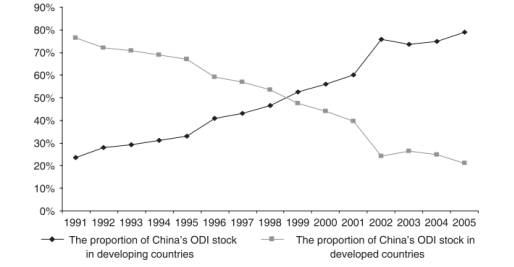

Figure 2. The distribution of China’s overseas direct

investment among developing and developed countries

Figure 2. The distribution of China’s overseas direct

investment among developing and developed countries

Source: Almanac of China’s Foreign Economic Relations and Trade, various

issues

One interesting feature of China’s outward investments is the

concentration on developing countries. Let us look at Figure 2 and consider the

distribution of China’s overseas investments. Through yeas the wave of

investments changed its direction from developed countries to developing. This

tendency causes reflections about the reason for replacement of priorities, and

makes sure the belief that China is intensifying its economic investment in

developing countries. To find the reason for such replacement I have analyzed a

report of Y.W.Cheung and X.Qian “Empirics of China’s outward direct

investment”, in which countries, which had long-term investment relations with

China from 1993 to 2008, were analyzed. The separate examination of developed

and developing countries, to which China continues the distribution of direct

investment, takes place in the report because of the difference in the

indicators in the countries.

The empirical findings confirm that China displays

different types of investment behavior across developed and developing

countries. Subject to the differences between developed and developing

countries, the results suggest 4 types of the development of the Chinese ODI:

1)

the presence of

market-seeking and resource-seeking motives;

2) that Chinese exports to developing countries tend to

induce China’s ODI;

3) that the recent surge in the Chinese holding of

foreign exchange reserves promotes its ODI in developed countries;

4) that Chinese capital displays different types of

agglomeration behavior across developed and developing countries.

Figure 3. Chinese

Investment in Pictures

Closer to nowadays the situation with the

geographical distribution of China’s overseas investments has changed, however,

in general, it stayed the same, and the main change is that the priority

countries are now opened economies, such as Australia and U.S. For more

detailed overview let us examine Figure 3. The Heritage dataset clarified the

geographic areas of concern. Approximately 40 percent of PRC investment from 2005-2009

was in OECD (Organization for Economic Co-operation and Development) countries.

Sub-Saharan Africa and West Asia (including Iran) attracted another 35 percent,

combined. East Asia, Latin America, and the Arab world lagged in attracting

Chinese investment. Over the last five years 2005-2010, the U.S. has been the second-largest destination of non-bond

investment, at $21.2 billion total.

It is

illuminating, as well as unsurprising, that the largest destination for Chinese

non-bond investment is also an open economy - Australia. Another such economy -

Britain - is the fifth-largest destination. A second set of target countries

has received a good deal of attention: resource-rich economies with closed or

otherwise troubled political systems. For energy, the Heritage dataset confirms

that Iran is the leading example; in metals, it is the Democratic

Republic of the Congo (DRC). The DRC exemplifies China's willingness, when

particular assets are in play, to do business with little regard for local

conditions or global sentiment. The other countries, which are not included in

the top 5 countries, in which China invests, are also the same, and Iran and

DRC are – I mean, they are rich of resources, which China is poor in. this fact

makes obvious the opinion, that the investments of People’s Republic of China

abroad is access to resources, especially those China lacks.

It is

illuminating, as well as unsurprising, that the largest destination for Chinese

non-bond investment is also an open economy - Australia. Another such economy -

Britain - is the fifth-largest destination. A second set of target countries

has received a good deal of attention: resource-rich economies with closed or

otherwise troubled political systems. For energy, the Heritage dataset confirms

that Iran is the leading example; in metals, it is the Democratic

Republic of the Congo (DRC). The DRC exemplifies China's willingness, when

particular assets are in play, to do business with little regard for local

conditions or global sentiment. The other countries, which are not included in

the top 5 countries, in which China invests, are also the same, and Iran and

DRC are – I mean, they are rich of resources, which China is poor in. this fact

makes obvious the opinion, that the investments of People’s Republic of China

abroad is access to resources, especially those China lacks.

Taking everything into account, it is obvious that

nowadays China is actively promoting its investment activity abroad. In

addition to the ‘going global’ policy, China is posed to increase its portfolio

investment capacity in overseas markets. The conclusion of my research work is

the view in the future development of investment climate in China: hoping that

the government of PRC would lower control of capital flows in the country,

leading to lowering the levels of hot money inflows, which damage the rapidly

growing economy, makes me be more sure, that China is the world leader in

economy for future decades. For sure, more attention is paid to the capital inflow

as the world economy develops rapidly and “needs” such country, as China – in

investing sphere and not only, that is why for the rest of the world the

development and improvement of circumstances for less complicated process of

capital inflow in China. The other point, which stays important for the economy

of PRC, is outflow direct investment. This sphere today is only gaining

momentum, however, the policy of capital outflow is already based on the

principle, which became clear to us – resources, and consequently the only need

is to increase the quality and quantity of capital outflow to the rest of the

world and concentrate more on those countries, which are efficient to invest

in.

References:

1.

B.Dong, G.Guo, “A model

of China’s export strengthening outward FDI”, 2012, p.1-4

2.

M.F.Martin,

W.M.Morrison, “China’s “Hot Money” Problems”,

2008, p. 1-4

3.

Can Huang, Mingqian

Zhang, Yanyun Zhao and Celeste Amorim Varum, “Determinants of exports in China:

a microeconomic analysis”, 2008

4.

Y.W.Cheung, X.Qian, “Empirics of China’s outward direct investment”,

2009

5.

Global investments trend monitor

(UNCTAD) ¹7, 2011

6.

“The economist”

journal, “Hot and bothered”, 2008

7. M.J. Herrerias, Vicente Orts,

“Imports and growth in China”, 2011

8. Kuang-Hann Chou, Chien-Hsun Chen, Chao-Cheng Mai, “The impact of

third-country effects and economic integration on China’s outward FDI”, 2011

9. Priscilla Liang,

“Uniqueness of speculative capital flows and monetary policy responses in China

(2007-2010)”, p. 1-6

10. Global

investments trend monitor (UNCTAD) ¹10, 2012

11. Derek Scissors, Ph.D., “Chinese Outward Investment:

Better Information Required”, 2010

12. Electronic source “Ministry of Commerce of the

people’s Republic of China”, HTTP: http://english.mofcom.gov.cn/statistic/statistic.html, date of view: 16.11.2012