Nevmerzhitskiy

Konstantin Anatolievich

postgraduate,

Information Technology department

People’s

Friendship University of Russia

THE STRUCTURAL COMPONENT OF MARKET

OF MULTIMEDIA CONTENT

The active development of

mobile communication technologies and the gradual transformation to the network

of the 4th generation has caused the gain of collateral data pass

velocity and the permanent interest to mobile Internet. The Russian market of

mobile technologies and services as well as the market of multimedia content

don’t stand separately from world tendencies of the development. The matter is

that the spectrum of services is widening, they are becoming more various,

cheep and available. At the same time the most part of them belongs to VAS

(Value Added Services).

VAS is any service besides

traditional service of transmitting the voice, offered to users by the mobile

operator or his service / content partner [1; 2]: SMS, MMS, chats, RBT-services

(for example, melodies instead of usual tones), file exchange, news and entertainment

services and different supplements, on-line games, informing sent to mobile

gadgets, etc.

Although multimedia content

transmission is closely connected with VAS and a share and role of mobile

services is constantly growing (like consumed traffic and average earnings),

the mobile and multimedia content market can be generally called quickly

growing, perspective and innovative. That’s why the accent on the mobile

Internet market prevails because it is the most gaining one today covering 40

%, in spite of the fact that the segment of content services has grown

immensely since the last year [3; 4].

In general the market of multimedia

content includes creation, delivery, distribution and commercialization of such

kinds of content as video, audio, pictures (drawings), texts and books,

documents, supplements, games, software, interactive programmes, etc. This

market is actively and dynamically developing. It has already had major players

and different decisions’ providers. The important component of such a market is

continually becoming popular and widening the market of mobile content. The

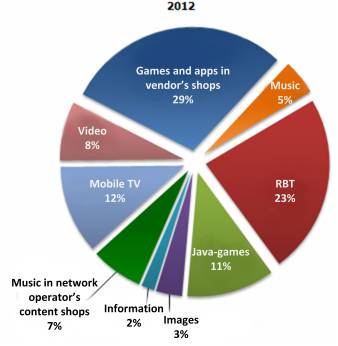

structure of mobile content in Russia is shown on the fig. 1.

Fig.

1 Mobile content market in Russia

Besides, due to the reports

of analytical agencies (J’son & Partners, AC&M, etc.), the market of

additional services (VAS) has grown unprecedentedly at 27 % only during the

last quarter of 2012 year. It is vital to notice that in 2011 the volume

services of the mobile Internet in Russia has exceeded 75 billion of rubles and

practically formed the sum of nearly 81 billion of rubles at the market of

fixed wideband access [4].

The basis of the key players

of multimedia content activity can be displayed briefly in the following way.

- Network operators – provide services of transmitting traffic (traditional

communication services) but they don’t limit themselves to the above mentioned

preferring to develop multiplatform decisions (news own and entertainment

portals available from different gadgets) and sites for legal entertainment

content distribution (for example, Omlet from MTS, Trava from Megafon, Zabava

from Rostelekom, local entertainment portals from Bilain).

- OTT-sites – the so-called companies which

suggest you audio and video content on the technology OTT (Over the Top),

independently from the provider, operator and others. (in differ from

IPTV-service and the alike), and have their own distribution sites, for

example, ivi.ru, zoomby.ru, video.ru, zerx.ru, etc. The sites selling content,

i.e. providers in the broad sense: supplements, games, texts, images, pictures,

etc. are also included in this group.

- Owners of the content

– the real owners and creators of content components. They can arrange in one

access point of the service-provider all their content and then make it

available for content-providers and operators at last.

- Creators and integrators – this means

companies which deal with creation, granting and / or introduction of technical

decisions in the sphere of multimedia content distribution and providing VAS.

This group also includes companies suggesting management decisions on content,

delivering of it to the users, for example, WINGS-platform creators.

- Advertising agencies,

SMI – companies creating mobile market strategies and mobile advertising (advertising

SMS, MMS, Java-supplements, IVR-menu, etc.). They are also busy in spreading

services and servers or realizing their own VAS-projects through partners’

programmes with the other participants of the market.

- Corporative clients,

consumers (abonents, users). Mid-range participants are those who provide

services on aggregation of content and giving different services and servers

for operators. They also deal with owners of the content. Integrators and

creators should be included into this group because they are moderators between

the operators and owners of the content offering different technological

platforms and other decisions on delivery and distribution of content, services

and servers.

- Content-providers – those, who have some content in their disposal

(including mobile one), which is provided for the abonents, communication

operators and other organizations. As a rule they make contracts with operators

and can offer the so-called off-portal or on-portal services. It is important

to mention that on-portal services is a model of providing entertainment, news

and other services and content by the operator himself which are available for

the abonents from his portal.

Note that from the user point of

view, this model may restrict the choice of content and complicate the

procedure of sale/purchase. However, according to studies, network operator’s

services showing growth (also due to the subscription business model) and

almost equal to the yield of the off-portal services. Off-portal services – it’s

a model of providing services and content not by network operator but by his

partners (content and service providers, aggregators, etc.).

- Service providers – specialize mainly in

providing various services and VAS, with responsibility for technical interaction

of network operators with content providers and maintain a RBT, WAP, Web and

other services. They also manage the service, marketing it and aggregate

content for it from various content providers.

- Content aggregators – participants

of business model who increase network operators revenues by summing traffic from

all partners, from all subscribers, by creating catalogs of content for

operators, etc. Content aggregators massively contract with right holders, content

providers and offer cheaper and more varied content for operators.

In general, the market of multimedia

content main trend is focus on mobile devices: both from the side of formats

and types of content and from technical realization of platforms, applications,

portals etc. At another point, sales are high in the first place, video

(digital and pay-TV, VoD, online videos), applications and games (especially

online), less popular audio (due to the many illegal sources), books, pictures.

References

1. Рокотян А. Несколько

соображений о перспективах развития телекоммуникационного бизнеса. URL: http://www.tssonline.ru/articles2/focus/neskolko-soobrajenij

2. Контент-провайдеры, агрегаторы и

сервис-провайдеры России и СНГ. Определения URL: http://www.mforum.ru/analit/_content_dict.htm

3. МоСО-2011: Оксана Панкратова, AC&M.

Мобильный контент и сервисы-2011.Новая реальность. URL: http://www.mforum.ru/arc/20110613_MoCO2011_Pankratova_ACM.pdf

4. МоСО-2012: Оксана Панкратова, AC&M. Рынок VAS-услуг, российская действительность и

мировые тренды. URL:http://www.content-review.com/articles/19282/AC&M,_Oksana_Pankratova,_Rynok_VAS_uslug,_rossiiskaya_deistvitel_nost__i_mirovye_trendy.pdf