Economics/11.Logistics

dr.

sci. Pistunov I.M.

State

Higher Educational Institution “National Mining University”, Dnipro, Ukraine

Order Quantity Optimization

Economic activity of an enterprise may involve

concentration of major part of its financial resources in inventory holdings.

Inaccurate demand appraisal can cause conservation of firm's cash in the

inventory balance as well as inefficient warehouse usage. Therefore, effective

order planning is to become one of the most important issues for operation manager.

Optimal order quantity determination should be based on analysis of current

order plan with taking into account other factors, such as: season, storage

capacity, duration of delivery etc. Effective order quantity plan enables

enterprise to forecast firm’s financial indicators, to plan material and

technical foundation development, to project costs with remote in time income

and to build business relationships with customers and suppliers, banks and

other parties. Thus, none investor, creditor or bank would loan the enterprise

which cannot give a clear prediction of its financial condition for the period

up to repayment.

Wilson

EOQ Model

The classical Wilson EOQ Model

determines order quantity that minimizes the total holding costs and

ordering costs. The framework is limited when it comes to quantity discounts

and storage deficit. Assumptions of the model: demand quantity for the period

is known, order period is constant, unit shipment is instant. Optimal order

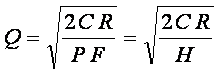

quantity is estimated by the formula:

![]()

,

,

where Q –

optimal order quantity, C – fixed

cost per order, R – demand quantity, P – purchase unit price, F

– interest rate, H – annual holding cost per unit.

Statistical

approach

Cumulative was build in order to distribute a whole

range of possible values of random variable observations on the d intervals. Interval's upper limit of a

random variable is estimated as:

dmax(i)

=xmin +(xmax – xmin)i/d,

where, i -

number of interval [1, d]; xmax,

xmin - the largest and the smallest value of a random variable in

the sample, respectively. Upper limit of interval i is also the lover limit (i + 1) interval. Lower limit for 1-st

area equal to xmin,

while upper limit of the last interval

is equal to - xmax.

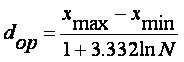

Tentatively, the number of intervals or bins can be

defined as:

.

.

Offered

approach

The

optimal order quantity can

be estimated using the methods of economic-mathematical

modeling. Software package MS Office

Excel and its Solver add-on were used to implement set task for “UPK Invest Dnipro”.

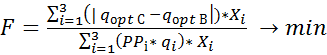

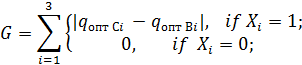

Optimization problem will be set as follows:

.

.

Constrains:

where OC–

warehouse capacity, ÇÑ –

remains of stock, qopt C -

optimal order quantity according to statistical method,

qopt B -

optimal order quantity according to Wilson EOQ model, Xi

- deficit matrix

of product i (1 - yes, 0 - no)

(matrix size 1x3), PÐi - profit on product i sales, qi - the optimal order quantity for product i.

To estimate the elements of the deficit matrix condition

"if" was used to automatically determine the need. For example, if

the remains of the composition is less than 1500 kilo or 25 bags, the order is

obligatory (Xi =1) .If

remains exceed 1500 kilo, the order is not required (Xi=0"). Provided that the calculation of order

requirement will be driven automatically, by means of MS Excel order

requirement is calculated as follows: =IF(Xi<150;1;0).

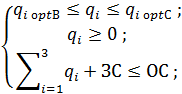

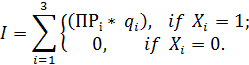

To implement this optimization model, it was decided to use the formula

"if" because of certain difficulties in MS Excel usage in practice,

so look for future models of its construction will be as follows:

![]() ,

,

To calculate the lower limit of the optimum order

volume Wilson's model used, and the statistical method to determine the upper

limit. The main advantage of the proposed model is the possibility to choose

product to order (matrix needed) and composition taking into account.