P.h.D. Kryuchin

O.V., Kryuchina E.I.

Tambov State University

named after G.R. Derzhavin

Forecasting the currency exchange rates

using technical analysis and artificial neural

networks

As we know the

currency exchange rates system condition is characterized by time series ![]() . For simulating

the time series it is necessary to discover the function

. For simulating

the time series it is necessary to discover the function ![]() . The flavor of

function

. The flavor of

function ![]() is unknown so in simulation this function is

changed to approximate function F which is defined for minimum

difference between empirical currency

is unknown so in simulation this function is

changed to approximate function F which is defined for minimum

difference between empirical currency ![]() and forecast currency

and forecast currency ![]() in equation

in equation ![]() . Here c is

discharging coefficient which defines the length of the forecasting period. So

the target of forecasting currency exchange rates is to detect the parameters F,

L and c by minimizing the value

. Here c is

discharging coefficient which defines the length of the forecasting period. So

the target of forecasting currency exchange rates is to detect the parameters F,

L and c by minimizing the value ![]() [1].

[1].

Artificial neural

networks (ANN) are actively used by institutional investors which work with a

large amount of information and which need to make allowances one currency to

other. The difference to technical analysis is the possibility to find optimal

factors and to use them in forecasting [2-3].

The aim of this

paper is to predict exchange rates between Euro and US dollar using an

artificial neural network and technical analysis. It needs to train ANN

structure witch consider time series of currency pair €/$ quotations, the check of ANN-model adequacy based on this structure,

the forecasting result of technical and neural networks analysis comparison and

to formulate a corollary about the possibility to use ANN for predication.

ANNs are

mathematical instruments which are computer models of biological neural

networks, which can be trained using log-normal observations and can be used

with information dearth or its noisiness. This instrument is very flexible and

this property allows to consider different log-normal red observations using

the change of structure and of manager parameters of model [4].

If technical

analysis is used, then the time series of quotations ![]() usually is broken into intervals. First and

last values of each interval are the open cost (

usually is broken into intervals. First and

last values of each interval are the open cost (![]() ) and close cost (

) and close cost (![]() ) and the highest (

) and the highest (![]() ) and the lowest (

) and the lowest (![]() ) within each

interval are defined.

) within each

interval are defined.

The most popular

tool of technical analysis is the moving average (MA) which calculates the mean

value of cost in a strict time interval. So this tool is method of smoothing of

cost factors which are cumulated for several periods. The MA can be calculated

for each serial data array such as open and close cost, maximum and minimum

quotations, trade size or value of other indicators (for example MA itself).

There are several

kinds of MA:

·

simple

MA ![]() ;

;

·

exponential

MA ![]() ;

;

·

smoothed

MA ![]() ;

;

Here ![]() ,

, ![]() are costs of open and close in time moment

are costs of open and close in time moment ![]() , m is the

length of smoothing period,

, m is the

length of smoothing period, ![]() is cost participate coefficient.

is cost participate coefficient.

An other used tool is a stochastic oscillator which builds two series. The first series values are calculated by formula

|

|

(1) |

and the second is the MA of first. Often

a third series is added which is MA of the second. The crossing of smoothed and

non-smoothed means changes the direction of the moment of the quotations. It

the smoothed curve crosses the non-smoothed curve from below means growing

start and othersize from above means growing end [5].

There are different

strategies of using the MA and the stochastic oscillator approach.

Best results of

forecasting of currency pair €/$ (Euro and US

dollar) were got using a stochastic oscillator with periods 5, 3 and 3.

Quotations values were calculated correctly with a probability of 0.65.

We will use two ANN

models. First of these it a multilayer perceptron (MLP) which is a structure in

which each neuron in each layer (except output layer) is connected to all

neurons of the next layer. Weight coefficients is are calculated by formula ![]() where NL is layers count,

where NL is layers count, ![]() is the number of neurons in i-th layer

[1]. The second structure is a Volterra network which is a dynamic network for

the nonlinear adaptation of array of signals belated for each other. The vector

is the number of neurons in i-th layer

[1]. The second structure is a Volterra network which is a dynamic network for

the nonlinear adaptation of array of signals belated for each other. The vector

![]() from equation

from equation  activates the network at moment m. This

polynomial degree is called the Volterra series degree [2].

activates the network at moment m. This

polynomial degree is called the Volterra series degree [2].

The testing consists of several steps:

·

the

algorithm starts at time t=t0, and sets the test index to k=0;

·

the

pattern is formed;

·

weight

coefficients are trained by a gradient algorithm of steepest descent [3];

·

the

input vector ![]() is formed and the ANN calculates the output

output value yN+1 ;

is formed and the ANN calculates the output

output value yN+1 ;

·

the

quotation change ![]() is calculated and used for calculation of

value

is calculated and used for calculation of

value

·

the

time t is changed (t = t + c) and the test index is incremented (k

= k + 1);

·

the

algorithm goes to step 2.

These tests show the probability of obtaining the

correct direction of the quotation change. For multilayer perceptron it is 72%

and for a Volterra network it is 76%. The technical analysis allows to forecast

the direction of change with probability value of about 65%. So the neural

network analysis using a Volterra network is efficient.

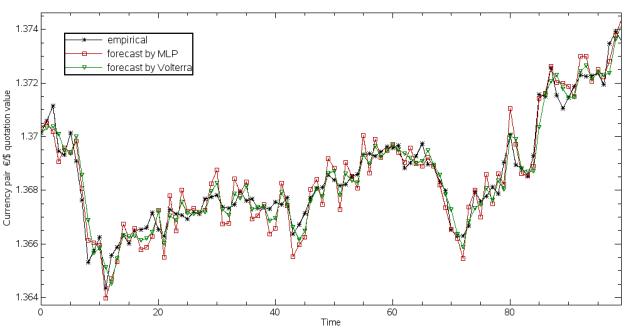

Figure

1 shows series of currency pair quotations, both empirical and forecast ( by

the multilayer perceptron and the Volterra network).

It

follows from the experimented results that a Volterra ANN with four layers and

twelve inputs allows to predict the correct direction of the quotation change

with a probability of 76%. So such a structure can be used for forecasting of

exchange rates.

Pic.

1. Empirical exchange rates, exchange rates forecast by multilayer perceptron

and by Volterra.

Pic.

1. Empirical exchange rates, exchange rates forecast by multilayer perceptron

and by Volterra.

(1)

(1)

Literature

1.

Кузнецов С.П. Динамический хаос. // Москва,

1994. – 274 с.

2.

Бэстенс Д.Э. ван ден Берг В.М. Вуд Д.

Нейронные сети и финансовые рынки: принятие решений в торговых операциях. //

Москва: ТВЦ. 1997. – 236 с.

3.

Вострокнутова. А.И. Модели прогнозирования

курсов акций российских нефтяных компаний // Извесия Санкт-Петербургского

университета экономики и финансов. \textnumero3), СПб. 2000. –

C. 126-144.

4.

Зенкова Н.А. Моделирование на основе

аппарата искусственных нейронных сетей как метод исследования в психологической

науке. // Вестн. Тамб. ун-та. Сер. Естеств. и техн. науки. Тамбов: 2009. Т. 14,

Вып. 3. – С. 577-591.

5. Osowsky S. Sieci

neuronowe w ujeciu algorytmicznym // Warszawa. 1996.

6.

Kryuchin O.V., Arzamastsev A.A., Troitzsch K.G. The

prediction of currency exchange rates using artificial neural networks [Электронный ресурс] — Электрон. дан. // Arbeitsberichte aus dem Fachbereich Informatik

Nr. 4/2011. Koblenz. 2011. 12

p. — http://www.uni-koblenz.de/%7Efb4reports/2011/2011_04_Arbeitsberichte.pdf