P.h.D. Kryuchin O.V.,

Kryuchina E.I.

Tambov State University named after G.R. Derzhavin

Parallel algorithms training

artificial neural networks for exchange rates forecasting

The aim of this paper is to predict exchange rates between Euro and US

dollar using an artificial neural network. To achieve this aim, several tasks

have to be solved. These tasks are the training of artificial neural networks (ANN)

structure witch consider time series of currency pair quotations; the check of ANN-model adequacy based on this

structure; the forecasting result of technical and neural networks analysis

comparison; to formulate a corollary about the possibility to use ANN for

predication [1].

We will

use two networks. First of these it a multilayer perceptron (MLP) which is a

structure in which each neuron in each layer (except output layer) is connected

to all neurons of the next layer. Weight coefficients is are calculated by

formula ![]() where NL is

layers count,

where NL is

layers count, ![]() is the number of neurons in i-th

layer [2-3]. The second structure is a Volterra network which is a dynamic

network for the nonlinear adaptation of array of signals belated for each

other. The vector

is the number of neurons in i-th

layer [2-3]. The second structure is a Volterra network which is a dynamic

network for the nonlinear adaptation of array of signals belated for each

other. The vector ![]() from equation

from equation  activates the network at moment m.

Here

activates the network at moment m.

Here ![]() is the vector of currency values at

moments

is the vector of currency values at

moments ![]() , L is the Volterry level and w

is the weight coefficients vector. This polynomial degree is called the

Volterra series degree [4].

, L is the Volterry level and w

is the weight coefficients vector. This polynomial degree is called the

Volterra series degree [4].

The

predication and its checking consist of several steps:

1.

the algorithm starts at time t=t0, and sets the test

index to k=0;

2.

the pattern is formed [5];

3.

weight coefficients are trained by a gradient algorithm of steepest

descent [5];

4.

the ANN input vector ![]() is formed and the ANN calculates

the output output value yN+1 ;

is formed and the ANN calculates

the output output value yN+1 ;

5.

the quotation change ![]() is calculated and used for

calculation of value

is calculated and used for

calculation of value

where ![]() is the swap value.

is the swap value.

6.

the time t is changed (t = t + c) and the test index is

incremented (k = k + 1);

7.

the algorithm goes to step 2.

These tests show the probability of obtaining the correct direction of

the quotation change. For multilayer perceptron it is 72% and for a Volterra

network it is 76%. The technical analysis [5] allows to forecast the direction

of change with probability value of about 65%. So the neural network analysis

using a Volterra network is efficient.

Table 1

shows values of sufficiency coefficient for ANN-models (calculated by formula ![]() using a multilayer perceptron (

using a multilayer perceptron (![]() ) and a Volterra network (

) and a Volterra network (![]() ) where IT is the number of experiments.

) where IT is the number of experiments.

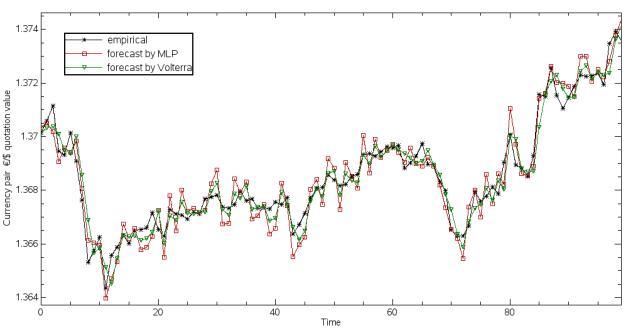

Figure

1 shows series of currency pair quotations, both empirical and forecast (by the

multilayer perceptron and the Volterra network).

Tab.1. Values of sufficiency

of ANN-model.

|

|

ANN-model sufficiency |

|||||||

|

Coefficient of discharging

c |

15 min |

30 min |

60 min |

120 min |

||||

|

Predication rating L |

|

|

|

|

|

|

|

|

|

8 |

69 |

73 |

69 |

71 |

67 |

70 |

65 |

65 |

|

9 |

70 |

73 |

70 |

72 |

69 |

71 |

65 |

67 |

|

10 |

71 |

73 |

71 |

73 |

71 |

72 |

65 |

69 |

|

11 |

72 |

75 |

72 |

73 |

69 |

73 |

66 |

69 |

|

12 |

72 |

76 |

72 |

75 |

70 |

73 |

66 |

70 |

|

13 |

72 |

75 |

72 |

75 |

70 |

71 |

67 |

72 |

|

14 |

72 |

75 |

71 |

74 |

70 |

70 |

67 |

73 |

|

15 |

70 |

75 |

70 |

73 |

70 |

72 |

66 |

72 |

|

16 |

69 |

74 |

69 |

73 |

70 |

72 |

67 |

70 |

Pic.

1. Empirical exchange rates, exchange rates forecast by multilayer perceptron

Pic.

1. Empirical exchange rates, exchange rates forecast by multilayer perceptron

and by Volterra.

It

follows from the experimented results that a Volterra ANN with four layers and

twelve inputs allows to predict the correct direction of the quotation change

with a probability of 76%. So such a structure can be used for forecasting of

exchange rates.

Literature

1.

Крючин О.В.

Использование технологии искусственных нейронных сетей для прогнозирования

временных рядов на примере валютных пар // Вестн. Тамб. ун-та. Сер. Естеств. и

техн. науки. – Тамбов, 2010, Т. 15, Вып. 1, С. 312.

2. Rosenblatt,

Frank. x. Principles of Neurodynamics: Perceptrons and the Theory of Brain

Mechanisms. Spartan Books, Washington DC, 1961

3. Rumelhart,

David E., Geoffrey E. Hinton, and R. J. Williams. “Learning Internal Representations

by Error Propagation”. David E. Rumelhart, James L. McClelland, and the PDP

research group. (editors), Parallel distributed processing: Explorations in the

microstructure of cognition, Volume 1: Foundations. MIT Press, 1986.

4. Osowsky S.

Sieci neuronowe w ujeciu algorytmicznym // Warszawa. 1996.

5. Kryuchin

O.V., Arzamastsev A.A., Troitzsch K.G. The prediction of currency exchange

rates using artificial neural networks [Электронный ресурс] — Электрон. дан. //

Arbeitsberichte aus dem Fachbereich Informatik Nr. 4/2011. Koblenz. 2011. 12 p.

— http://www.uni-koblenz.de/%7Efb4reports/2011/2011_04_Arbeitsberichte.pdf