Shapovalova O.,

Gnuchуkh L., Hozyaenova J.

Kharkov National University of civil engineering and

architecture, Ukraine

Modeling the

dynamics of the currency rate

For

Ukraine, which undergoes

the economic reforms, the issue of forecasting developments in the foreign exchange market is particularly important both at the macro and at micro levels. Almost

every citizen of the country observes the exchange rates.

Current values and leading national currencies are the first things which are reported about in any economic sector of the news today. The stabilization of exchange rates has become one of the main topics during the discussion

of issues related to the global economy

in international negotiations.

When

forecasting such integrated indicators as exchange rate,

economics identifies two basic set of methods:

fundamental and technical analysis. Fundamental

analysis involves the examination of trends in pricing, based on the basic factors of the

economy, which include, in particular, interest

rates, taxes, unemployment, state

budget, inflation, the stability

of the political system and so on.

The basis of technical analysis is the fact that the

behavior of prices has already taken

into account all the existing factors.

In general terms, technical analysis expects the accumulation of real history of price changes and conclusions’

building concerning likely future trend. Thus, the sequence of time-ordered data forms

a time series.

Works

of N.D. Kondrateva, Schumpeter, Dzh.M. Keyns, R. Harrod, Y. Domar, R. Solou are dedicated to the

problems of modeling and forecasting

of economic and financial series.

There are some Interesting approaches

proposed in the papers of Russian scientists A.N. Zinin, D.S. Lityn, L.R. Bolotov,

S.V. Smirnov.

Today

the majority of experts agree that

the most suitable method to analyze

operational daily constantly changing information under the circumstances of limited amount of time is technical analysis with

all its advantages and disadvantages. Model ARIMA, where the current value is expressed as a linear finite set of previous

values of the process, is used within the technical analysis approach to describe the time series. This model is characterized by three types of parameters: d is the number of nonseasonal

differences, p is the number of

autoregressive terms, q is the number of lagged

forecast errors in the prediction equation, and is denoted by

ARIMA (p, d, q).

In this model, the current value of the process is expressed by a linear finite set of

values of the previous process. In other words, dependent random variable regressed

on itself, id est

autoregression. Model ARIMA of p-order is as follows:

![]() .

.

Parameters of the model are calculated according to the method of least

squares, taking into account the complexity of the model or according to the

method of adaptive filtering.

The identification of the model, id est

determining of p, d,

q order, is carried out on the

basis of analysis of the autocorrelation function (ACF), which describes the

magnitude of the correlation dependence on the delay factor ![]() lag, and partial autocorrelation function

(PACF), determined by the correlation coefficient between two random variables:

the first, which is determined by a series

lag, and partial autocorrelation function

(PACF), determined by the correlation coefficient between two random variables:

the first, which is determined by a series![]() , and the

second by the series

, and the

second by the series

![]() .

.

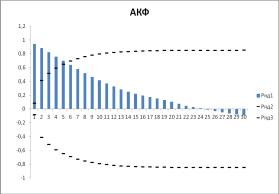

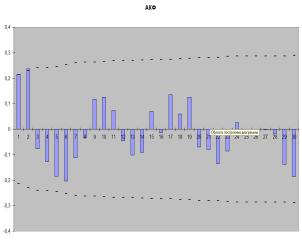

During the analysis of statistics changes in market value of the US dollar

against the Ukrainian hryvnia in the first half of 2014 was built

autocorrelation and partial autocorrelation functions of the sample and a

series of first differences

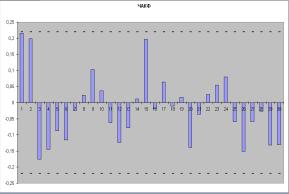

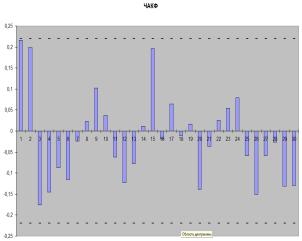

(fig.1-2) and according to their appearance such models were identified:

ARIMA (1,1 , 0), ARIMA (0,1,2), ARIMA (1,1,2). Calculations were carried out in

MS Excel, using a macro to build ACF and PACF.

Fig. 1 – ACF and PACF.F for the initial sample.

Fig. 2 – ACF and PACF. for a number of first differences.

The

calculations of the parameters

of the model ARIMA (1,1,0) were conducted

by the method of least squares using

MS Excel add-in Solver.

The model ARIMA (1,1,0) is

![]() .

.

The model ARIMA(0,1,2) is

![]() ,

,

where ![]() model’s error for level t-1, i.e. the difference between real and model values

model’s error for level t-1, i.e. the difference between real and model values![]() .

.

Autoregression model and integrated fluid medium ARIMA (1,1,2) combines the

properties of the above two models and has the form

![]()

Dispersions of the three discussed

models are equal to ARIMA (1,1,0) – 4,894855; ARIMA (0,1,2) – 4,110223; ARIMA

(1,1,2) – 3,968714. The model with the lowest variance – ARIMA (1,1,2) is

chosen for the prediction.

Point and interval forecast of exchange rate for the model ARIMA (1,1,2)

has been compared to the real data (tabl.1). Error forecast was 2.3%, which is

quite acceptable.

Table 1 – Comparison with the real value of the course

|

Period of forecast |

Point forecast |

The interval of the

forecast with theoretical frequency of 95 % |

Real

value of exchange rate |

|

|

27.05.2014 |

11.57711 |

11.00552 |

12.1487 |

11.4673 |

|

28.05.2014 |

11.64003 |

11.06843 |

12.21162 |

11.4635 |

|

29.05.2014 |

11.70691 |

11.13532 |

12.2785 |

11.4648 |

|

30.05.2014 |

11.77379 |

11.2022 |

12.34539 |

11.4271 |

|

31.05.2014 |

11.84068 |

11.26909 |

12.41227 |

11.3999 |

As a result of work autoregressive models were constructed and implemented

short-term forecast error of 2.3%, based on an initial sample of the dynamics

of the exchange rate of US dollar against the Ukrainian hryvnia for a fixed

period of time.

Reference

1. ARIMA Models

and the Box–Jenkins Methodology. Asteriou, Dimitros; Hall, Stephen G/ Applied Econometrics, 2011. Palgrave

MacMillan. pp. 265–286.

2. Time series techniques for economists. Terence C. Mills/ Cambridge University Press in Cambridge,

New York. 1990, 377p.

3. Spectral analysis for physical applications multitaper and conventional univariate techniques. Donald

B. Percival and Andrew T. Walden/ Cambridge University Press in Cambridge, New York, NY, USA,

1993, 583 p.

4. Time series

analysis: forecasting and control. Box, G.E.P., and G. M. Jenkins/ Holden Day,

San Francisco, CA, 1970, 652 p.

5. Brockwell,

P.J., and Davis, R. A. Introduction to time series and forecasting/ Springer,1996,

452 p.

6. Литинский Д.С.

Статистическое прогнозирование для построения эффективных торговых стратегий на

валютном рынке. Автореф. дисс. канд. экон. наук. Москва, 2003. – 23 с.