Antoniuk O.P.

Associate

Professor of National Mining University, Dnepropetrovsk

Using simultaneous equations for Modeling of the

interrelationship of basic macroeconomic indicators of Ukraine

A simplified

model of macroeconomics was proposed in [1], which was based on

the following assumptions: consumption was an increasing function of the

available income; investments

were an increasing function of national

income; national income was the sum of consumer

spending, investments and government procurement of

goods and services. A mathematical model that related the above mentioned macroeconomic indicators was built on the basis of these provisions.

Based on this, a

simplified model of the main macroeconomic indicators

of Ukraine has been proposed, which in contrast

to [1] has not considered state

regulation of the economy; has accounted

external borrowings and payments on

foreign loans. The model represents

the following system of three equations:

![]() ,

, ![]() (1)

(1)

![]() ,

, ![]() (2)

(2)

![]() ,

, ![]() (3)

(3)

In the above equations ![]() is consumption,

is consumption,

![]() is investment,

is investment,

![]() is national income,

is national income,

![]() is government purchases of goods

and services,

is government purchases of goods

and services, ![]() – is income tax in the

– is income tax in the ![]() year;

year; ![]() and

and ![]() – are random variables with respect to which the standard assumption

is given about their centredness (expectations are zero) and noncorrelatedness

for different time periods

– are random variables with respect to which the standard assumption

is given about their centredness (expectations are zero) and noncorrelatedness

for different time periods ![]() ,

, ![]() .

.

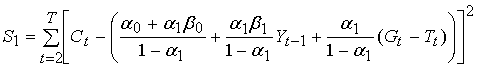

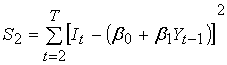

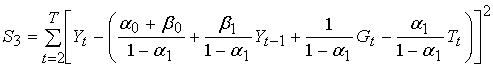

Estimation of structural coefficients

has occurred in two stages. At the first stage, due to lack of information about the error variance in the regressions (1) – (3) it was

assumed that they were the same, which led to the problem of estimating

![]() , (4)

, (4)

where the minimization was

performed by ![]() ,

, ![]() ,

, ![]() and

and ![]() ,

,

, (5)

, (5)

,

(6)

,

(6)

. (7)

. (7)

In (5)

– (7) ![]() is the duration of

the observation period, in our case

is the duration of

the observation period, in our case ![]() years.

years.

As the result of solving the problem of estimating (5) – (7), estimates

of structural coefficients ![]() =0,02;

=0,02; ![]() =0,68;

=0,68; ![]() =5,55;

=5,55; ![]() =0,21 have been obtained. They satisfy

a priori restrictions on the coefficients of the model in structural form

=0,21 have been obtained. They satisfy

a priori restrictions on the coefficients of the model in structural form ![]() . Moreover, the relative errors

for the three regression equations are

e1=5%; e2=8%; e3=3%. These errors have

been defined as the ratio of the

average values

. Moreover, the relative errors

for the three regression equations are

e1=5%; e2=8%; e3=3%. These errors have

been defined as the ratio of the

average values ![]() ,

, ![]() ,

, ![]() for the range

for the range ![]() to the standard deviation of the residuals in

the corresponding regressions (4) – (7).

to the standard deviation of the residuals in

the corresponding regressions (4) – (7).

The residues have been

determined by the formulas

![]() ,

, ![]() ,

, ![]() ,

, ![]() . (8)

. (8)

In the paper, the estimates parameters of the

model for determining the national income as the sum of consumer spending,

investment and government procurement of goods and services were determined.

The direction of future research is

to test the quality of the

resulting model, to make the statistical analysis of the

accuracy of the constructed model and to identify ways to improve it.

References.

1.

Johnston J., DiNardo J. Econometric Methods. – McGraw-Hill, Inc. 1997. – 514 ð.

2.

Statistical Yearbook of Ukraine for 2012 / Ed. O.H.

Osaulenko. / State

Statistics Service. – K.: 2013.

– 552 p. (in Ukraine).

3. Statistical

Yearbook of Ukraine for 2005

/ Ed. O.H. Osaulenko. / State Statistics Service. – K.: 2006.

– 576 p. (in

Ukraine).

4.

Magnus Y.R., Katyshev P.K., Peresetskii

A.A. Econometrics. – 6th ed. – M: Delo,

2004. – 576 p. (in Russian).

5.

Christopher D.

Introduction to Econometrics – 4h ed. – Oxford: Oxford

University Press, 2011.

– 560 p.

6.

Korkhin A.S. Modeling

of Economic Systems with a

Distributed Lag. – Ì.: Finansy i

statistika, 1981. – 160 p. (in Russian).

7.

Demidenko E.Z. Linear and Nonlinear regression. – M.: Nauka, 1981. –

302 p. (in Russian).

8. Knopov P.S., Korkhin A.S. Regression Analysis Under A Priori

Parameter Restrictions. – Springer, 2012. – 244 p.