Ýêîíîìè÷åñêèå íàóêè / 12. Ýêîíîìèêà ÀÏÊ

Chudovskaya V.

The Institute of Agroecology

and Environmental Management, Ukraine

FINANCIAL SUPPORT FOR THE

ORGANIC PRODUCTION INVESTING

Investments, as an essential factor of the economic efficiency improving,

are capable to ensure the development of an organic management type by updating

the fixed assets, realization of promising projects, the implementation of

appropriate technologies, etc. As an increase of fund amount invested as well

as selection of the most effective ways and areas of investment play a crucial

role for the the economic efficiency growth of the organic production in the

process of investing. However, the practical implementation of the investment

program or project is impossible without a proper financial provision, that

plays a particular role for the agricultural sector. In this regard, a research

in the field of financial support of the organic production investment

development is a topical objective of both Economic and Ecological sciences.

Works by a lot of well-known domestic scholars are dedicated to

investment in the modern agricultural science. These primarily are À. Haidutskyi,

S. Hutkevych, Î. Datsiy, Ì. Kisil, Ì. Koretskyi, Y. Krupka,

H. Laik, Ì. Malik, H. Pidlisetskyi, À. Chupis, Î. Ulianchenko,

Î. Shkuratov, V. Yurchyshyn. A great attention to the organic production development issues is

also given in the works by S. Antonets, V. Artysh, N. Borodacheva, Î. Borodina,

Ò. Zaychuk, N. Zinovchuk, Ì. Kobets, Y. Mylovanov, V. Pysarenko,

V. Pidlisnyuk etc. However, despite the multidimensional nature of scientific

research, the issue about an investment support of organic production is hardly

highlighted.

One of the earliest and greatest challenges that arises in the field of the

financial investment activity is to mobilize the necessary volume and

composition of financial resources. Thus, it is necessary to note that the

structure and principles of the financial resources formation at various levels

of the economic hierarchy (macro and micro levels) differ significantly among

themselves, therefore the problem of determining of investment sources and its

formation should be considered from two perspectives: from the standpoint of Macroeconomics

– as the primary task of the state investment strategy, and from the standpoint

of Microeconomics – as one of the most important tasks of the investment

strategy of enterprise [2, p. 50–51].

Traditional sources of funding for capital investments were own

borrowed, attracted and budgets. Fewer budget funds, however, are allocated for

capital investments at Agricultural in recent years, due to the unstable

economic situation in the country. In particular, there is a need to invest the

organic agricultural production, that becomes a significant relevance due to

environmental degradation of the country and increasing of ecological

consciousness of the society. Therefore, noncentralized capital investments,

defined and approved by the organizations independently, have become as increasingly

important.

According to the Law of Ukraine "On investment activity"

funding sources of investment activity include [1]:

·

the investor's own financial resources;

·

the investor's loan financial

resources;

·

funds involved in financial investment;

·

investment budget allocations;

·

grants and charitable contributions,

donations from organizations, businesses and citizens.

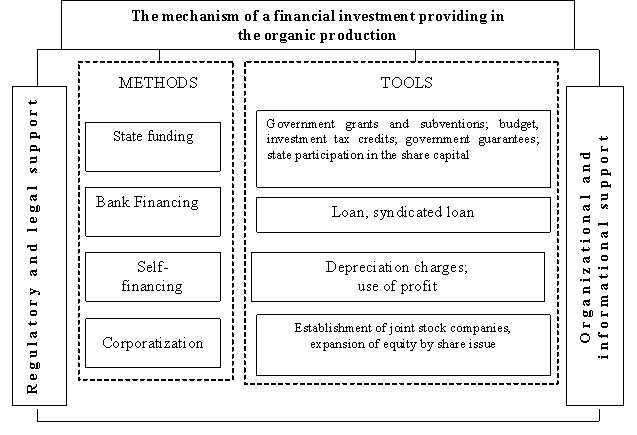

Given the above, Fig. 1 shows the structure of the mechanism of

financial support for the organic production investing. These methods and

tools, combined with regulatory and legal, organizational and information

support for the mechanism, in our opinion, have the greatest impact on the

basic criteria of investment attractiveness of this management type that ultimately should provide revenues in

required amount and composition of financial resources.

Fig. 1. A structure of the mechanism of financial

support for the organic production investing

Fig. 1. A structure of the mechanism of financial

support for the organic production investing

Current approaches on providing the financial provision of investment

activities predict that business entities can use different funding instruments.

Within the context of this study, the choice of instrument for financing of the

investment activity is quite limited. It is caused by several reasons.

First of all, the main economic activity, wherein investments are

implemented, is organic farming. This type of management is characterized by

poor performing for the first few years of production maintaining due to the

presence of the transition period. This is reflected in opportunities of both the formation of its own financial resources and

borrowing facilities in the loans and credit forms.

Secondly, the organic production has a lot of features reflected in the

scale of economic. Major enterprises that manufacture organic products have various sizes – from large joint stock

or business partnerships to small farms. It imposes appropriate marks on the

internal and external financial capacity of such households. Large organic

businesses can afford to use their own and borrowed funds, receive grants from

the state or local governments, whereas the farm enterprises can rely on bank

loans as well as certain repayment of interests after them at the expense of

the state budget.

Thirdly, state and local finances condition can not adequately provide

financial support to producers of organic agricultural products, in a contrast

to developed countries where such business entities get various grants from the

state. General hope lies with the search for private investors, including

foreign, who would be interested to invest financial resources into investments

of the organic agricultural production.

References:

1. Law of

Ukraine "On investment activity" ¹ 1560–XII September 18,1991

– [electronic resource]. – access profile: http://zakon.rada.gov.uà/

2. Î.².

Shkuratov The investment activity development in the Agricultural sector

of Ukraine: [the monograph] / Î.². Shkuratov , N.V. Kyurcheva. –

Ê.: Ltd. «Kondor», 2011. – 338 p.