Zhitnikov S.A., Yemelina N.K.

Karaganda economic university of Kazpotrebsojuz, Kazakhstan

THE

ANALYSIS AND THE FORECAST OF THE CONSUMER DEMAND OF CENTRAL KAZAKHSTAN MARKETS

Abstract

Studying the consumer demand, factors determing

its volume and structure, forecasting of potential market capacity is the most

important task for the formation of strategy of the commercial activity of

retail commercial enterprises. This task is to determine the optimum food stock and to carry out a price policy

for the most uantity satisfaction of the consumer demand.The research of consumer

demand and motives by which they are guided, purchasing, is carried out with

the aid of uantity these processes.

In connection with the urgency of stated

problem, the research of the foodstuffs and manufactured goods has been done by

us in a number of cities of the Central Kazakhstan such as Karaganda,

Ekibastuz, Stepnogorsk, Temirtau. The

given research has been directed on studying of the dependence of population

demand for foodstuffs (including tobacco products) and manufactured goods, on family

purchasing funds and other factors.

Introduction

Income usually used as an indicator for the consumption

estimating. For example A.Karapetyan used average income of household per

capita as the main indicator determined the population’s consumption. By the

opinion of the other researcher A.Surinov this indicator should be the

aggregate income, that means in the terminology of the system of national

accounting the disposable national income that includes the consumption of free

and benefit services.

In the modern period of development of economy there is a number of the reasons on which the objective income information of housekeeping is inaccessible: Management of statistics has no information on income received as a result of self-employment, from selling or letting the property and so on. In market condition exists the tendency to conceal the income from revenue because people don’t want to pay the tax. Besides, private businessmen use in some cases part income of the other members of their families for the circulating assets replenishment of their own enterprise, in others, on the contrary, they turn a part of their profit to household budget.

We consider that purchasing funds are more adequate

figure, defining the demand of the population, than the figure of the income. Family

purchasing funds include all commodity expenses, i.e. total expenses on foodstuffs

and manufactured goods.

Methods

For the consumer demand modeling we use the population questioning that was developed by us. That was the questioning among the retail network consumers by a method of questioning of a representative sample. The questionnaire developed by us allows to obtain the objective data since we did not ask about household’s income but only about the expenditures for some products and some other goods.

We used correlation-regressive modeling

as a method of the factorial analysis. The multiple correlation-regressive

model has been deduced to study the dependence of the demand of the population for

foodstuffs from several factors, which includes the following factors:

-an average monthly purchasing funds on the basis of one member of the

family (õ1);

-an average monthly expenses on manufactured goods on the basis of one

member of the family (õ2);

- an expenses on municipal service

(the gas, heating, hot and cool water, electric power, removal of the rubbish, communal

economy) at month for one member of the family (õ3);

- an average monthly expenditure for education (õ4).

The average monthly expenses

on foodstuffs was taken as dependent

variable on the basis of one member of the family (y).

Substituting value of the exerpts we have got unknown equation of multiple

regression:

![]() (1)

(1)

The coefficient of determination for given model is:

R2=0,9.

This shows that the given model

adequately describes the connection between considered factorial and effective

sign.

Results and Discussion

From equation is seen that value of

average monthly expenses on foodstuffs

was taken on the basis of one member of the family:

·

on average expenses will rise by 341 tenge when the purchasing fund increase

by 1 thousand tenge under other equal.It’s possible to judge about the close

connection with the help of the coefficient of correlation -![]() the connection is close enough.

the connection is close enough.

·

will be cut down on average on 943 tenge

when the expenses

on manufactured

goods increase by 1 thousand tenge under other equal. In other words in

view of the fixed income the spending spree on manufactured goods is the result

of decreasing of foodstuffs consumption. The coefficient of correlation

between the expenses on foodstuffs and manufactured goods is: ![]() .

.

·

will increase on average on 53 tenge when the expenses on municipal service

increase by 1 thousand tenge under other equal. There is no connection between

the expenses on foodstuffs and municipal

service. The expenses increase uantitytion irrespective of each other. It can

be illustrated by the coefficient of correlation:![]()

·

will decrease on 97 tenge when the expenses on education increase by 1thousand tenge under other equal, thereby educational

costs occupy the definite place in family expenses. That’s why the increase in

tuition practically will not influence on the foodstuffs consumption at all.

This fact can be confirmed by the obtained coefficient of correlation between given

data: ![]() .

.

On the ground of analysis of aforecited

results of calculation, we can draw a conclusion that the only one of

considered factor õ1 (the average monthly

purchasing funds on the basis of one member of the family) exerts essential

influence upon resulting sign y (the expenses on foodstuffs on the basis of one

member of the family). The rest selected factors can be ignored.

The multiple correlation-regressive

model has been deduced to study the dependence of the expenses on manufactured goods upon demographic factor, which includes

the following factors:

- an average monthly purchasing

funds on the basis of one member of the family (õ1);

-a part of working family members in gross amount (õ2);

-a number of children under age (õ3);

-a number of the adult members of family (senior 16 years) female ((õ4).

The resulting sign (ó) is the average monthly

expenses on manufactured goods on the basis of one member of the family.

The multiple regression equation

was deduced after uantitytion of the given excerpts

![]() (2)

(2)

The coefficients of the equation

mean that value of the average monthly expenses on manufactured goods on the

basis of one member of the family:

·

will increase on average on 350 tenge if the purchasing funds increase on

1 thousand tenge under other equal;

·

will increase on the average on 390 tenge if the part of working members of the family increases in gross

amount by 1% under other equal;

·

is growing on the average on 68 tenge if the number of the children

under age increases on 1 person under other equal;

·

increases on 109 tenge if the

number of the adult female members of

the family increases on 1 person under other equal.

The coefficient of determination for given model is:

R2=0,58.

According to the following

coefficients of correlation: ![]() we can

consider about the closeness of connection of each factors with resulting sign.

we can

consider about the closeness of connection of each factors with resulting sign.

Either as in previous model the close

connection exists only between resulting sign.It means that connection exists

between the expenses on manufactured goods and purchasing funds of the family. The connection with the rest considered factors is too loose so it

can’t be taken into account.

It is seen from equations that if

purchasing funds of the family increase on1 thousand tenge, the expenses on foodstuffs

will increase on 341 tenge, but the expenses on manufactured goods rise on 350 tenge

on the basis of one member of the family

at month. Thereby, with growing of the means, population of Central Kazakhstan

buys more expensive foodstuffs such as

meat, sausages, fish product; the range of food increases. At the same time,

growing of the purchasing fund of the family leads to increasing of average monthly expenses on manufactured

goods. It is quite possible that population buys more expensive household chemical goods (powder,

shampoo, etc.), or there is an increase in the number of clothes, which they

buy.

F – statistics of the coefficient of determination in equation (1) is F=1336 in equation (2) is F=205,7.

As the obtained values are higher

than Fisher’s critical points of distribution when the significance level is 1%.

All this confirms statistical value of coefficient.

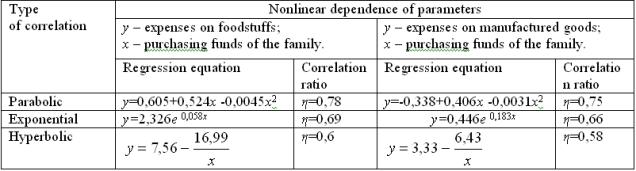

Some types of nonlinear correlation

have been considered to study the dependence between average monthly expenses

on foodstuffs and manufactured goods and purchasing funds of the family (Table

1):

Table 1.

Judging from correlation

ratio, the parabola describes the connection between factorial and resulting

sign in the best way.

Judging from correlation

ratio, the parabola describes the connection between factorial and resulting

sign in the best way.

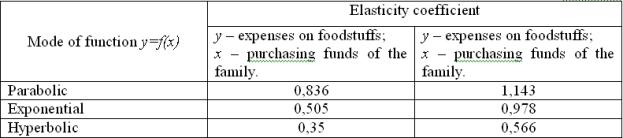

Elasticity coefficients have

different data.They show how y changes if the factor increases by 1%. It depends on the type of correlation between the demand for foodstuffs and manufactured goods and purchasing

funds of family (Table 2).

Table 2.

On the ground of the fact that

parabolic correlation is more acceptable

for forecasting the demand for foodstuffs and manufactured goods, elasticity

coefficients show that if the purchasing funds increase by 1% demand for foodstuffs

increases in average by 0,84%, but expenses on manufactured goods will grow on

1,2% at the average.

The demand for goods depends not

only on purchasing power of the consumers, but also on the price of the

product. If the prices are high, the demand for goods is low and vice versa. So

it is important to define, how the change in price can influence on demand. We

use index of demand price flexibility to forecast the purchaser demand of the

consumers. Price elasticity of demand shows how the uantity demanded for goods

will change in percentage if its price changes on 1%.

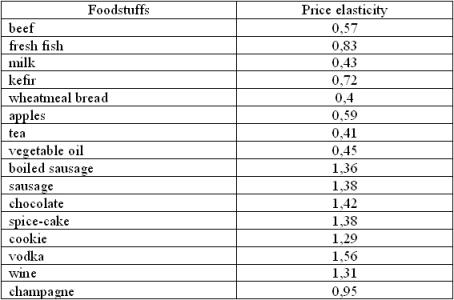

Having calculated the elasticity

coefficients (table 3) , we have got the numerical attributes of price elasticity

demand of the separate food.

Table 3.

Given in table 3 data demonstrate

that demand for daily food (milk, bread, tea, vegetable oil) is inelastic. The

percentage change of volume demand for these goods is less, than percentage

change in price. At present bread and milk are main food and increase in price

will not reflect on volume demand for given foodstuffs.

The demand for products,

which are more expensive such as sausage, chocolate, alcohol drinks is more flexible.

In other words, change in price will lead to the greater quantitative change in demand.

The reaction of the consumers on

the price- level change on goods interests the producer from the point of view

of the receipts, which provides the rise in efficiency of production and receipt receiving.

The notion of cross elasticity demand is used to determine severity

of exposure to quantity demanded for these goods if there’s the change in price

of other goods. The coefficient value of cross elasticity depends on the

concerned goods if it’s interchangeable or complementary. For instance, if meat

goes up in price on 10% the demand on fish will increase by 1,4% or, for

example, rise in price on tea on 20%

brings to demand reduction for lemons on 0,8%.

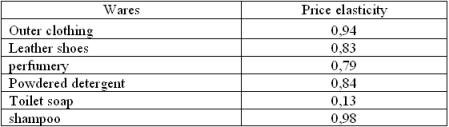

Results of the analysis of price elasticity of some manufactured

goods are presented in table 4.

Table 4.

From the table 4 we see that demand

for outer clothing, shampoo possesses average sensitivity to change in the

prices. If the price on shampoo increases by 10% demand for it will decrease in

9,8%.

There is a little change in demand for

the toilet soap. It denotes a high consumer usefulness of this goods. It’s

interesting that demand for perfumery comparatively is inelastic. If there is increase

in the prices on perfume or eau-de-colognes population of Central Kazakhstan

will not shorten buying of this type of goods.

Conclusion

In the terms of market economy

producer constantly keeps up with the level of borrowing power of his production.

Making one time capital inputs and using the theory of price elasticity demand he

can determine both the bottom price selling product and its volume with raised

level of borrowing power. All these actions help producer to obtain the proper

efficiency level. Studying the elasticity of demand for separate goods and market

demand on the whole allows us to forecast market change as a result of carrying

out one or another price policy.

References:

1. Karapetyan A.H. (1980). Incomes

and the Consumption of the USSR Population. Moscow, Russia.

2. Surinov A.E.

(2000). The Experience of the Quantitative Measurement of the Personal Incomes.

The Finances and Statistics, Moscow, Russia.