Экономические науки/2.

Финансовые отношения

Postgraduate student Shevchenko I. A.

Simon Kuznets Kharkov National University of economics, Ukraine

THEORETICAL

PRINCIPLES OF STATE FINANCIAL AUDIT OF BUDGET PROGRAMS (AUDIT OF EFFICIENCY)

Today there is an increasing role of the state financial control in terms of building a

democratic, social and constitutional state that

should ensure the transparency and efficiency of public

administration.

The issue of building a modern system of state financial

control and implementation of internal and external state financial audit in

Ukraine is considered in the

works of such scientists as Butynets M.T. and Butynets F.F.,

Dikan L.V., Maximov V.F.,

Slobodyanyk J.B. and many others. However,

it should be noted that still we observe many unsolved problems related to methodological support and building

common concept of public financial audit in Ukraine, which requires new

theoretical rethinking of these

issues and determines the relevance of the chosen research topic.

The aim of the research is to outline the theoretical foundations of the state financial audit of

budget programs.

The research found that one of the main principles of state financial control is a

priority of the external state control over internal

one. This external state control can not be submitted to

the executive authorities directly involved into public resources managments, because it is a violation of the principles of independence and

objectivity [1, c.201].

However, note that the most progressive form of state

financial control is state financial audit that

helps achieve an objective and independent public assessment

of socio-economic development of state.

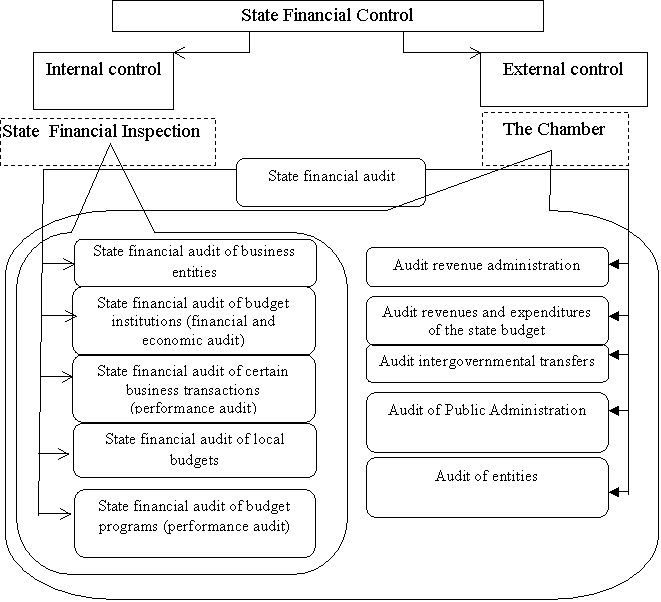

It should be noted that today in Ukraine there are about

a dozen forms of financial audit consisting of the State Financial Inspection and / or Accounting Chamber of Ukraine

(Fig. 1).

![]()

Fig. 1. Forms of financial audit and their subjects

For this research the most interesting is a form of state financial control as state

financial audit of budget programs or performance audit that is conducted by the supreme body of state financial

control Accounting Chamber of Ukraine.

As noted in the standards

of ISSAI 100 audit of efficiency - an independent, objective and reliable test

of compliance with the

principles of economy, efficiency and effectiveness of business management,

organization, institution (or system operations, programs, events) and identifying opportunities for

their improvement. [2].

Audit of

efficiency greatly expands the subject of state financial control.

Thus, it is intended to provide new information, analysis or contemplations, if necessary - recommendations for improvement.

According to the author, the audit of efficiency objectives are:

1) analysis and evaluation of the use of state and

regional budgets of regional and other state resources;

2) development of substantiated recommendations and suggestions for

improving the use of state resources, and optimizing

the activities of the executive.

It

should be noted that the basis of audit of efficiency is the theory of "three E", the main elements

that characterize the state management of state resources:

1)

economy - thrift, providence, the degree of cost minimization

given the quality of the product ("spend less");

2)

efficiency

- performance, the usefulness of consumption to create the product ("spend

well");

3)

effectiveness - efficiency, a level of achieving the

goal ("spend wisely").

In

general, the objective of the audit of efficiency is to improve management and accountability in

the public sector through effective research.

Thus,

the theoretical foundations of the state financial audit of budget programs are revealed by

determining its nature, objectives and the main elements.

References:

1.Slobodyanik YB Formuvannya Sistemi sovereign Audit Ukraїnі [Text]:

monografіya / YB Slobodjanik. - Sumi: FOP Nataluha

AS, 2014. - 321 p.

2. http://www.intosai.org/about-us.html