Економічні

науки/7. Облік і аудит

PhD, Associate Professor, Manachynska Yu.

Chernivtsi

Trade and Economic Institute Kiev National Trade and Economic University,

Ukraine

Actuarial accounting: managerial

aspect

J. Rishar notes that each of the types of accounting provides useful and

varied information. Actuarial accounting provides information about the market

value of invested capital, as well as information about the internal rate of

overall return (IRR). But actuarial accounting does not provide reliable data

on the rate of return on a particular period [1, p.121]. The

internal rate of profitability (TIR – taux

interne de rentabilite) is calculated by

the following formula:

![]() (1.1)

(1.1)

![]() cash flows from the project at the time t,

n – number

of time periods,

cash flows from the project at the time t,

n – number

of time periods, ![]() internal rate of return. We can see that IRR or

internal rate of return is the interest rate at which the present value of all

cash flows of the investment project (NPV) is zero. This means that at such a rate of

interest, the investor will be able to repay his initial investment [2]. The

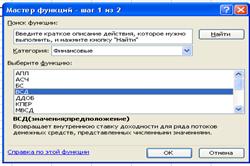

easiest internal rate of return can be calculated by using MS Excel, fig.1

internal rate of return. We can see that IRR or

internal rate of return is the interest rate at which the present value of all

cash flows of the investment project (NPV) is zero. This means that at such a rate of

interest, the investor will be able to repay his initial investment [2]. The

easiest internal rate of return can be calculated by using MS Excel, fig.1

Fig.1 Method of calculating the internal rate

of return (IRR) using MS

Excel

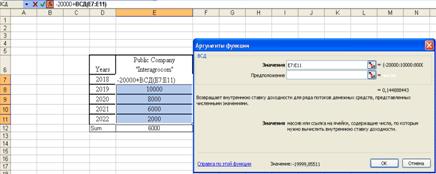

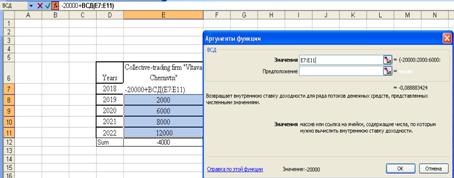

We will compare the internal rate of return for two projects of PC «Interagrocom» and CTC

«Vltava-Chernivtsi», Fig. 2 and

Fig. 3.

Fig. 2

Internal rate of return (IRR) of PC «Interagrocom»

On the Figure 2, we can see that the internal rate of

profitability (IRR) for PC «Interagrocom» is

14,49%.

Fig. 3

Internal rate of return (IRR) of Collective-trading firm

«Vltava-Chernivtsi»

On the Figure 3, we can see

that the internal rate of profitability (IRR) for Collective-trading firm «VLTAVA-Chernivtsi» is about

8,89%.

The managerial aspect of actuarial accounting is that it allows you to

choose an effective way of investing. An information base for evaluating

investment projects is actuarial financial statements.

Literature:

1. Рішар Ж. Бухгалтерский учет: теория и практика / Ж. Рішар. – пер. с фр. /

под. ред. Я.В. Соколова. – М. : Финансы и статистика. – 2000. – 160 с.

2. Внутренняя норма доходности. Формула расчета IRR

инвестиционного проекта // [Электронный ресурс]. – Режим доступа: http://msfo-dipifr.ru/vnutrennyaya-norma-doxodnosti-formula-rascheta-irr-investicionnogo-proekta/