FEATURES OF ORGANIZATIONAL AND ECONOMIC

M&A MECHANISM OF COMMERCIAL BANKS IN RUSSIAN FEDERATION

A.V. Grishanova, candidate of economic sciences,

Siberian Institute of Management of the

Russian Academy of National Economy under the RF President

D. A. Brigida ,

I.V.Talalaev

Novosibirsk state University of Economics and

management "NINH"

ABSTRACT

The article examines the processes of consolidation of the banking sector in the period a crisis in Russia. Mergers and acquisitions in the banking system

Russia. Advantages and disadvantages of different forms consolidation and integration of regional and federal credit institutions.

Keywords: Bank management, association of banks , commercial bank, consolidation, integration, organizational and economic mechanism.

The consolidation of the banking sector of Russia due to the increase of number of M&A is observed against decrease in margin bank profit, increased competition from multinational banks and non-banking institutions.Increased competition, decline of profitability of operations in the financial markets and the tightening policy of the Central Bank in developing the capital base, have made many and, above all, small banks face with a choice of consolidation by M&A or bankruptcy. Decisions on the consolidation of commercial banks is determined by the logic of development: any Russian bank which has survived the financial crisises in recent years, has inevitably come to the need to rethink its place in the fast-growing market and to find new approaches to the development of business.Analysis of the banking system over the past 5 years confirms the conclusion that banks achieve significant growth in its business through the consolidation. The only really implemented in practice form of consolidation of banks is their mergence in which one of the banks is liquidated and all his authority is transferred to another bank.

Having analyzed the motivation of management of banks, it should be noted that one of the reasons for the consolidation of business is to obtain a synergistic effect as a result of mergers and acquisitions. Business diversification in the context of the stabilization of cash flow and reduce risk is also among the reasons of M&A.

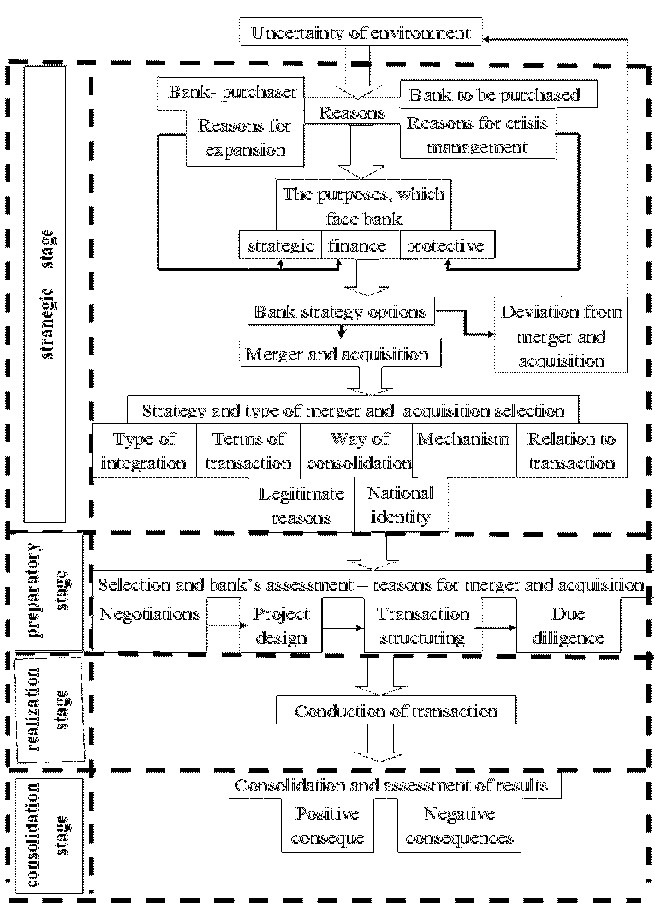

For example, in situation when interest income are highly cycled, acquisition of specialized financial institutions which main source of income are the commissions, may have a positive impact on the trend of profitability[2]. Among the reasons for M&A also include the desire to improve the quality and efficiency of management, the less efficient and worse managed banks are usually acquired. The reason can also be the personal ambitions of management if the goal of mergence is rather associated with the scale than to the results of the bank's performance. The ability to use surplus resources is also an important reason. For example, a regional located in the area with large financial resources but with limited for some reason opportunities for their placement bank, may be interesting to large bank operating nationwide. Practice of banking has shown that it is cheaper to buy a regional bank and convert it into a branch then open a new branch. It is intersting for large banks that acquired organization can have a special tax benefits that are not fully used for some reasons. Strategic plans for the development of new geographical markets in the activity of banks in Russia are essential for making management decisions on consolidation. The ability to adapt to changes in macroeconomic factors and needs of customers allow commercial banks to develop business. The consolidation of the bank's business has become possible due to the successful implementation of marketing strategies. Improvement of position of bank in the market by successful promotion of banking services provides growth of volume of demanded banking services and increase of efficiency of the rendered services. Such business development has often its advantages because it is based on highly skilled managers of the bank and on the well functioning mechanisms of banking[3]. Nevertheless, opportunities for internal growth have their limits. For example, new markets may not be available because of the imperfection of technology, inability to operate internationally, insufficientcy of the bank's liquidity. In addition, the capital base can be insufficient to quickly expand activities in accordance with the appeared opportunities. In this situation a progressive solution for the consolidation of the bank's business can be a merger or acquisition which will allow to acquire the necessary capabilities, technology or market share. Rapid access to new markets, expansion the range of services, provision of maximum service approach to a potential client can be achieved by acquisition. In this case there are certainly difficulties caused by the clash of corporate cultures, financial risk and other problems of acquired commercial bank. To be success in solving such issues, bank’s management has to carry out highly qualified financial and organizational structuring of the transaction and strategic approach at the same time, implement effectively the procedures and management of the integrated bank and carefully monitor the process of integration of the acquired financial institution. Organizational and economic mechanism of the M&A process of commercial banks should be developed as Figure 1shows, for example.Mergers of JSC Sibacadembank and JSC Uralvneshtorgbank in 2006 and of JSC URSA Bank and OJSC MDM Bank in 2009 are successful examples of consolidation. It resulted in strengthening of the position of the merged bank in 2006 and taking 18th rank in terms of assets and in 2009-2014 "MDM Bank" had become one of the top ten banks in Russia in terms of assets. Nevertheless the reorganization of the commercial banks in Russia with the participation of banks in Novosibirsk region has been continueing.

In 2015 shareholders of “MDM Bank” and “Bin Bank” concluded an agreement on purchase of shares of “Bin Bank”. This mergence will lead to creation a significant finance resourced and favorable competitive positioned bank in Russian market.

The integrated bank will become the large-scale financial organization having profound expert knowledge and the saved-up experience of conducting banking business, and its financial sustainability and a position in the market will allow to provide the first-class services to all range of clients — from large corporate to small enterprises and individuals.

In 2016 the Central Bank

of Russian Federation introduced a final set of normative measures to simplify

the procedure of merger of commercial banks, so M&A process in the banking

system has to get new prospects.

Bibliography:

1. Arkhipov A.E., Sevrjukov I.Y. Priority of marketing communications in the context of economic globalization/ The problems of the modern economy . 2015. ¹ 1 ( 53 ).,C. 163-165.

2. Gomanova T.K., Lukyanova Z.A.Strategy of development of the credit market taking into account the requirements of the banking system/ Sustainable economic development of regions ed. by L. Shlossman., Vienna, 2014., C. 3-18.

3.Grishanova A.V., Savinykh V.N.Strategy formation a price advantage of the commercial bank / Interexpo Geo-Siberia . 2008. T. 2 , ¹ 2.,C. 183-185

4. Nyurenberger L.B., Arkhipov A.E., Klimova E.N.The service component of strategic development/ Theoretical and applied aspects of modern science . 2015. ¹ 7., C. 22-26 .

Figure 1. Organizational-economic mechanism of the merger and

Figure 1. Organizational-economic mechanism of the merger and

absorption of commercial banks