Ïèëü Ý.À.

Àêàäåìèê ÐÀÅ, ä.ò.í., ïðîôåññîð

THEORY OF THE FINANCIAL CRISES (PART III)

Earlier in his articles the author has shown that in

order to describe the economic processes that occur in the economy of a country

it is possible to apply the shell theory, in its application to the spheres [1,

4]. Besides, the author has also described in the articles the boundaries of

existence of economic shells of small-, medium- and big-sized businesses which

may be influenced by both external and internal forces [2, 3]. The author

suggests in the following article to employ ellipsoidal economic shell, and, to

be more specific - its volume which will make it

possible to use six different variables during calculation of the GDP.

Gross domestic product can be calculated by the three

following methods:

1.

as the sum of gross value added (production method);

2.

as the sum of end-use components (end-use method);

3.

as the sum of primary income (distribution method).

In this case the various variables may be used in the

calculation, in particular such as: consuming capacity, investments,

governmental expenditures, exports, imports and the like. In the material

presented below the calculation formula of volume of the economic shell Veu was

used, to which corresponds the GDP of the country, that is Veu (GDPeu)

= f(Õ1, Õ2,

Õ3, Õ4, Õ5, Õ6). Here Õ1, Õ2, Õ3,

Õ4, Õ5 and Õ6 are the variables which have an impact on the GDP of the country.

By analysing the formula it

is possible to identify the variables' characteristics which influence on the Veu (GDPeu),

and which will be as follows:

·

where the Õ1

variable is increased, the economic shell volume Veu GDPeu

increases too;

·

where

the Õ2

variable is increased, the economic shell volume Veu (GDPeu)

increases more profoundly compared to the increase of variable X1;

·

where the Õ3

variable is increased, the economic shell volume Veu (GDPeu)

decreases;

·

where the Õ4

variable is increased, the economic shell volume Veu (GDPeu)

increases. In such a case the X4 variable may approach to numeral one only asymptotically;

·

where the Õ5

variable is increased, the economic shell volume Veu (GDPeu)

decreases;

·

where the Õ6

variable is increased, the economic shell volume Veu (GDPeu)

increases less profoundly compared to the increase of variable X4. In such a

case the X6 variable may approach to numeral one only asymptotically.

It should immediately be noted that during calculation

and plotting of construction drawings, the parameters Õ1,

Õ2, Õ3, Õ4, Õ5 and Õ6 could be constant values, increase or decrease by 10 times. On the basis

of the calculations made, 82 graphics were built, which can be divided into the

four following groups:

parameter values Õ1, Õ2, Õ3, Õ4, Õ5

and Õ6

increase and are constant;

parameter values Õ1, Õ2, Õ3, Õ4, Õ5

and Õ6

decrease and are constant;

parameter values Õ1, Õ2, Õ3, Õ4, Õ5

and Õ6

decrease and increase;

parameter values Õ1, Õ2, Õ3, Õ4, Õ5

and Õ6

are constant, they decrease and increase.

It is worth mentioning here in this context that the

number of the graphs that may be plotted with the six variables is

significantly greater. Therefore the author has selected such options of the

variables' values which will more precisely show the variables' influence onto

the GDP calculation.

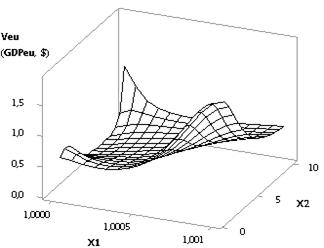

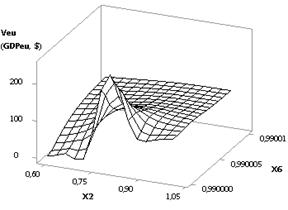

Figure 1 shows the 2D graph of Veu (GDPeu)

dependency with Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

10, Õ4 = Õ6 = 0.1

0.99 from which it is

clear that the Veu

values initially decrease by 11.42 times, and afterwards increase by 6.77

times. The minimal value of the Veu (GDPeu) falls on point 7, and is equal to 0.16.

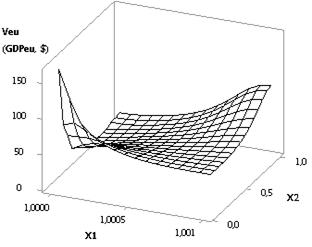

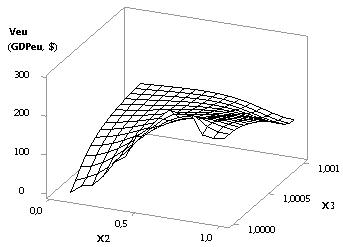

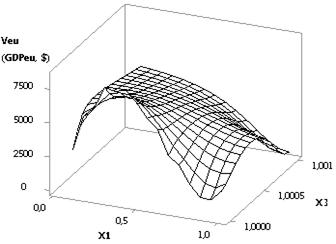

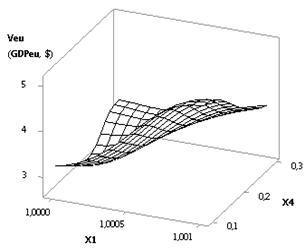

Figure 2 shows two 3D-graphs which give the possibility to more illustratively

present the changes in the Veu. In this particular case it is essential to

have the values of the extreme points, since with such values the Veu

value, and finally the GDPeu, will be maximal.

Fig. 1. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

10, Õ4 = Õ6 =

0.1

0.99

|

a |

b |

Fig. 2. 3D-graphics: a - Veu (GDPeu) = f(Õ1, Õ2); b - Veu (GDPeu) = f(Õ2, Õ4)

when Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

10, Õ4 = Õ6 = 0.1

0.99

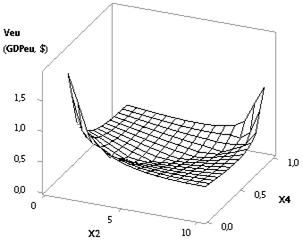

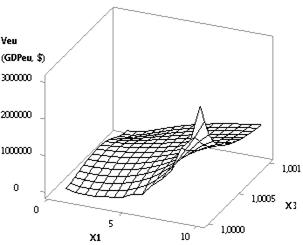

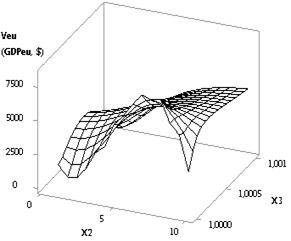

Fig. 3. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = Õ2 = 1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 =

0.99

|

a |

b |

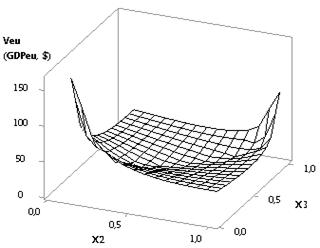

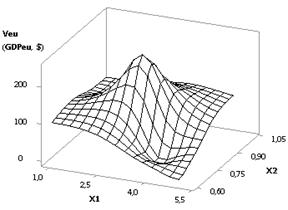

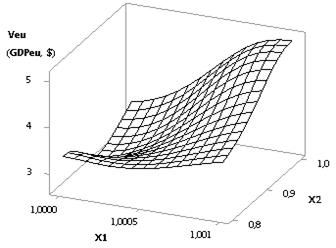

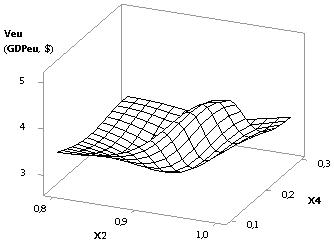

Fig. 4. 3D-graphics: a - Veu (GDPeu) = f(Õ1, Õ2); b - Veu (GDPeu) = f(Õ1, Õ3)

when Õ1 = Õ2 = 1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 =

0.99

Fig.

5. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = Õ6

= 0.99

0.1

From the next Figure 3 it is

clear that when Õ1 = Õ2 =

1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 = 0.99 the plotted curve Veu grows in full

swing from the value 95.27 up to 3.01Å+06, that is - it increases by 31622.78 times. Figure 4 shows

two types of the present dependency in way of 3D-graphs. Such option is the

most preferred one, since the biggest increase of the values Veu (GDPeu)

takes place under the influence of external forces.

In Figure 5 we may see that the Veu curve plotted has also the minimum of 14.08 in

point 4, after which its values increase. This figure was plotted under the

following values of the variables: Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = Õ6 = 0.99

0.1. Here, it is also important to select the variables in extreme points,

since in this case the economy of the country in question will have the maximal

values of the Veu.

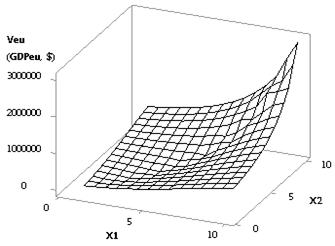

The depicted Veu

curve plotted in Figure 5 is presented by two 3D-graphs in Figure 6.

|

a |

b |

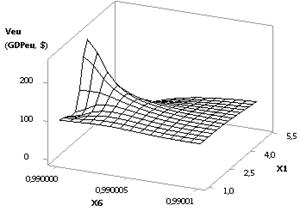

Fig. 6. 3D-graphics: a - Veu (GDPeu) = f(Õ1, Õ2); b - Veu (GDPeu) = f(Õ2, Õ3)

when Õ1 = 1, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = Õ6

= 0.99

0.1

Fig.

7. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1

10, Õ2 = 1

0.1, Õ3 = Õ5 = 1, Õ4

= Õ6 = 0.99

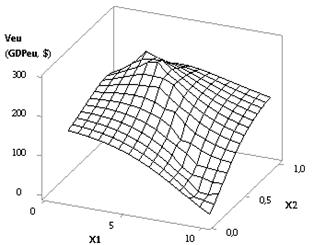

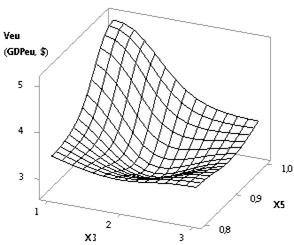

Figure 7 depicts the Veu curve which has

its maximum of 261.41 in point 4. Consequently, use of the following values of

variables Õ1 =

1

10, Õ2 =

1

0.1, Õ3 = Õ5 = 1, Õ4 = Õ6 = 0.99 is quite expedient at the

values which are close to the maximal ones. Figure 8 shows three examples of

3-dimensional surfaces Veu

(GDPeu)

= f(Õ1, Õ2,

Õ3, Õ4, Õ5, Õ6).

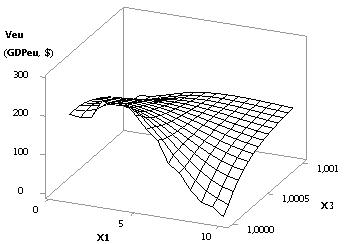

As it is clear from Figure 9, here the Veu

values have their minimum of 80.18 in point 2, after which they grow up to

246.73, and then drop down to zero, since the Veu calculations have

no solutions with the subsequent values of the variables. During plotting of

Figures 9 and 10 the following variables were used: Õ1 = 1

10, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = 0.99

0.1, Õ6 = 0.99. Here, the four types of

3D-graphs are shown, which are presented in Figure 10.

|

a |

b |

|

c |

|

Fig. 8. 3D-graphics: a - Veu (GDPeu) = f(Õ1, Õ2); b - Veu (GDPeu) = f(Õ1, Õ3)

c - Veu (GDPeu) = f(Õ2, Õ3)

when Õ1 = 1

10, Õ2 = 1

0.1, Õ3 = Õ5 = 1, Õ4

= Õ6 = 0.99

Fig.

9. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1

10, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = 0.99

0.1, Õ6 = 0.99

|

|

|

|

|

d |

Fig. 10. 3D-graphics: a - Veu (GDPeu)

= f(Õ1, Õ2); b - Veu (GDPeu)

= f(Õ6, Õ1);

c - Veu (GDPeu) = f(Õ3, Õ2); d - Veu (GDPeu) = f(Õ2, Õ6);

when Õ1 = 1

10, Õ2 = Õ3 = Õ5 = 1

0.1, Õ4 = 0.99

0.1, Õ6 = 0.99

Fig.

11. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1

0.1, Õ2 = 1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 = 0.99

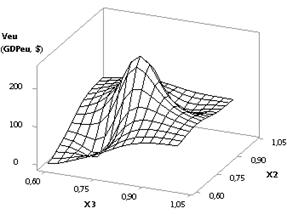

From the following Figure 11 it is obvious that the

plotted Veu

- curve has its maximal value of Veu = 8266.58 in point 7. This particular Figure

was plotted with Õ1 = 1

0.1, Õ2 = 1

10, Õ3 = Õ5 =

1, Õ4 = Õ6 = 0.99.

The two Figures 12 show the way how the presented Veu-curve changes in

the three-dimensional space.

|

a |

b |

Fig. 12. 3D-graphics: a - Veu (GDPeu) = f(Õ1, Õ3); b - Veu (GDPeu) = f(Õ2, Õ3)

when Õ1 = 1

0.1, Õ2 = 1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 = 0.99

Fig.

13. Dependence Veu (GDPeu) = f(Õ1, Õ2, Õ3,

Õ4, Õ5, Õ6)

when Õ1 = 1, Õ2 = Õ5 = 1

0.1, Õ3 = 1

10, Õ4 = 0.1

0.99, Õ6 = 0.99

The following Figure 13

represents the Veu (GDPeu) curve when Õ1 = 1, Õ2 = Õ5 = 1

0.1, Õ3 = 1

10, Õ4 = 0,1

0.99, Õ6 = 0.99. From this 2D-graph it is seen that the

plotted curve has its minimum of 2.7 in point 2, after which is gets its

maximum of 3.34 in point 3, and next their values drop down to zero. The last

Figure 14 displays the four types of three-dimensional surfaces Veu (GDPeu) for

the curve plotted in Figure 13.

After the calculations were completed, their results

were combined into the summary table, which gave totally 109 lines, in spite of

the fact that only 82 two-dimensional graphs have been plotted. This resulted

from the fact that a number of the plotted graphs had their maximums and

minimums. The relationships were introduced into this summary table as the

following:

Veub

Veuf, where Veub

- is the initial volume value of financial shell, unit3; Veuf - is the final value of the volume of financial shell, unit3;

Veuf/Veub

- is the relation of financial shell final volume value to its initial

value.

|

a |

b |

|

c |

d |

Fig. 14. 3D-graphics: a - Veu (GDPeu)

= f(Õ1, Õ2); b - Veu (GDPeu)

= f(Õ1, Õ4);

c - Veu (GDPeu) = f(Õ2, Õ4); d - Veu (GDPeu) = f(Õ3, Õ5);

when Õ1 = 1, Õ2 = 1

0.1, Õ3 = 1

10, Õ4 = 0.1

0.99, Õ5 = 1

0.1,

Õ6 = 0.99

The ratio of finite volume of the economic shell Veuf to the initial Veub

shows by how many times the volume of the economic shell increased (decreased),

that is Veu (GDPeu), under the influence

of various external forces onto the one. Hence, by obtaining these data we may

choose such values of variables Õ1, Õ2, Õ3, Õ4, Õ5 and Õ6, with which the volume

of the economic shell remains invariable, or even grows further under influence

of external forces. This means that in case of economical crisis, the selected

values of the variables will make it possible to stay on the previous level, or

even to increase the GDP of the country. After the Table had been plotted with

its 109 lines available, it was converted in the following way, by having left

only those values where Veuf/Veub ≥ 1. On the basis of such conversion

the final table had been obtained, which contained 62 lines, which then was

shortened down to 40 lines where the values of the ratio Veuf/Veub

in column 8 were located in descending order (refer to Table 1). As it is seen

from the calculated data in Table 1 the ratios Veuf/Veub ≥ 1 start with 53 and end up with

1.4. This indicates that for the example in question the economy may maximally

increase even under the pressure onto the ellipsoidal economic shell as by

53376.24 times, as compared to the initial state with the following values of

the variables, being Õ1 = Õ2 =

1

10, Õ3 = Õ5 = 1, Õ4 = Õ6 = 0.99. Yet maximal growth of

the economic shell will take place in this particular case with 1.49 at Õ1 = 1, Õ2 = Õ3 = 1

0.1, Õ4 = 0.1

0.99, Õ5 = 1

10, Õ6 = 0.99.

The next Table 2 was plotted on the basis of Table 1

in which the data obtained were split into groups by the number of variables

used. As it is seen

from Table 2 the data presented in it were grouped into 6 groups, starting from

the group with one variable, and ending up with the group where all the

variables were used. It is also seen from this table that the biggest group was

presented by the group containing four variables.

Due to the fact that variable X2 characterises the thickness of the economic shell it means

that if it was accepted as the single unit (Õ2 = 1) then Table 2 will change into Table 3 where

there will be only 15 lines instead of 40. The X2 variable may be characterized as the ratio of national

currency exchange rate to a currency used in international settlements (US

dollar, Euro, etc.).

As a result the following conclusions may be made:

1.

Utilization of different

values of the variables makes it feasible to increase the GDP of the country,

and in a number of instances to increase quite significantly and to lift the

economy out of crisis;

2.

During selection of the

variables' values it is necessary to select such group in which the number of

variables under consideration is minimal;

During selection of the variables' values it is

necessary to select such variables which are less subject to changes.

|

Table 1. Statistics

of theoretical relation Veuf /Veub, where Veuf /Veub

≥ 1 in descending order |

||||||||

|

No.

in sequence |

Õ1 |

Õ2 |

Õ3 |

Õ4 |

Õ5 |

Õ6 |

Veub

Veuf (GDPeub

GDPeuf. $) |

Veuf / Veub (GDPeuf / GDPeub) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

1. |

1

10 |

1

10 |

1

0.1 |

0.99

0.1 |

1 |

0.99 |

95.27

5.08E+06 |

53376.24 |

|

2. |

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

95.27

5.08E+06 |

53376.24 |

|

3. |

1

10 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

3.01E+06 |

31622.78 |

|

4. |

1 |

1

10 |

1

0.1 |

0.99 |

1 |

0.99 |

95.27

3.01E+06 |

31622.78 |

|

5. |

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

95266.87 |

18734.93 |

|

6. |

1

10 |

1

10 |

1

10 |

0.1

0.99 |

1 |

0.99 |

5.08

95266.87 |

18734.93 |

|

7. |

1

0.1 |

1

10 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

9.5E+04 |

18734.93 |

|

8. |

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

27568.22 |

14778.39 |

|

9. |

1 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

26.51

1.61E+05 |

6065.80 |

|

10.

|

1

10 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

64.02

1.61E+05 |

2511.77 |

|

11.

|

1 |

1

10 |

1

10 |

0.1

0.99 |

1 |

0.1

0.99 |

1.87

3012.60 |

1614.95 |

|

12.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

0.1 |

0.99

0.1 |

2.03

3012.60 |

1481.61 |

|

13.

|

1

10 |

1 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

1875.78 |

1005.54 |

|

14.

|

1 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

95266.87 |

1000.0 |

|

15.

|

1 |

1 |

1 |

0.99 |

1

0.1 |

0.99

0.1 |

95.27

95266.87 |

1000.0 |

|

16.

|

1

10 |

1

10 |

1

10 |

0.99 |

1 |

0.99 |

95.27

95266.87 |

1000.0 |

|

17.

|

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

34.95

24559.53 |

702.73 |

|

18.

|

1

10 |

1 |

1

10 |

0.99

0.1 |

1 |

0.99 |

3012.60 |

592.45 |

|

19.

|

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

20.67

5084.99 |

246.05 |

|

20.

|

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.99 |

5.08

916.0 |

180.14 |

|

21.

|

1

10 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

54.66

5084.99 |

93.03 |

|

22.

|

1

0.1 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

8266.58 |

86.77 |

|

23.

|

1 |

1 |

1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

127.63 |

68.42 |

|

24.

|

1

10 |

1

10 |

1

10 |

0.99

0.1 |

1 |

0.99 |

95.27

5084.99 |

53.38 |

|

25.

|

1 |

1 |

1 |

0.99 |

1

0.1 |

0.1

0.99 |

34.95

1738.10 |

49.73 |

|

26.

|

1 |

1

0.1 |

1

10 |

0.1

0.99 |

1

0.1 |

0.99 |

5.08

176.28 |

34.67 |

|

27.

|

1 |

1 |

1

0.1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.034

1.10 |

32.72 |

|

28.

|

1 |

1

10 |

1

10 |

0.99 |

1 |

0.99 |

95.27

3012.60 |

31.62 |

|

29.

|

1

10 |

1

0.1 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

95.27 |

18.73 |

|

30.

|

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

8.38

113.70 |

13.57 |

|

31.

|

1 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

14.08

160.80 |

11.42 |

|

32.

|

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

10 |

0.99 |

5.37

58.99 |

10.98 |

|

33.

|

1 |

1

10 |

1

10 |

0.1

0.99 |

1

10 |

0.99 |

0.16

1.11 |

6.71 |

|

34.

|

1 |

1 |

1

10 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

1.42

7.74 |

5.44 |

|

35.

|

1

10 |

1

0.1 |

1

0.1 |

0.99 |

1 |

0.99 |

95.27

495.02 |

5.20 |

|

36.

|

1 |

1 |

1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.0075

0.03 |

4.61 |

|

37.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

10 |

0.1

0.99 |

0.00031

0.001 |

3.59 |

|

38.

|

1

10 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99 |

80.18

246.73 |

3.08 |

|

39.

|

1 |

1 |

1 |

0.99 |

1 |

0.1

0.99 |

34.95

95.27 |

2.73 |

|

40.

|

1 |

1

0.1 |

1

0.1 |

0.1

0.99 |

1

10 |

0.99 |

0.0007

0.0011 |

1.49 |

|

Table 2. The statistics of variable

parameters for Veuf

/Veub,

where Veuf /Veub ≥ 1 in

descending order for groups |

||||||||

|

No. in sequence |

Õ1 |

Õ2 |

Õ3 |

Õ4 |

Õ5 |

Õ6 |

Veub

Veuf (GDPeub

GDPeuf. $) |

Veuf / Veub (GDPeuf / GDPeub) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

1

variable |

||||||||

|

1. |

1 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

95266.87 |

1000.0 |

|

2. |

1 |

1 |

1 |

0.99 |

1 |

0.1

0.99 |

34.95

95.27 |

2.73 |

|

2

variables |

||||||||

|

3. |

1

10 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

3.01E+06 |

31622.78 |

|

4. |

1 |

1

10 |

1

0.1 |

0.99 |

1 |

0.99 |

95.27

3.01E+06 |

31622.78 |

|

5. |

1 |

1 |

1 |

0.99 |

1

0.1 |

0.99

0.1 |

95.27

95266.87 |

1000.0 |

|

6. |

1

0.1 |

1

10 |

1 |

0.99 |

1 |

0.99 |

95.27

8266.58 |

86.77 |

|

7. |

1 |

1 |

1 |

0.99 |

1

0.1 |

0.1

0.99 |

34.95

1738.10 |

49.73 |

|

8. |

1 |

1

10 |

1

10 |

0.99 |

1 |

0.99 |

95.27

3012.60 |

31.62 |

|

3

variables |

||||||||

|

9. |

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

95266.87 |

18734.93 |

|

10.

|

1

10 |

1

10 |

1

10 |

0.99 |

1 |

0.99 |

95.27

95266.87 |

1000.0 |

|

11.

|

1

10 |

1 |

1

10 |

0.99

0.1 |

1 |

0.99 |

3012.60 |

592.45 |

|

12.

|

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

20.67

5084.99 |

246.05 |

|

13.

|

1 |

1 |

1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

127.63 |

68.42 |

|

14.

|

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

8.38

113.70 |

13.57 |

|

15.

|

1

10 |

1

0.1 |

1

0.1 |

0.99 |

1 |

0.99 |

95.27

495.02 |

5.20 |

|

16.

|

1 |

1 |

1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.0075

0.03 |

4.61 |

|

4

variables |

||||||||

|

17.

|

1

10 |

1

10 |

1

0.1 |

0.99

0.1 |

1 |

0.99 |

95.27

5.08E+06 |

53376.24 |

|

18.

|

1

10 |

1

10 |

1

10 |

0.1

0.99 |

1 |

0.99 |

5.08

95266.87 |

18734.93 |

|

19.

|

1

0.1 |

1

10 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

9.5E+04 |

18734.93 |

|

20.

|

1 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

26.51

1.61E+05 |

6065.8 |

|

21.

|

1 |

1

10 |

1

10 |

0.1

0.99 |

1 |

0.1

0.99 |

1.87

3012.60 |

1614.95 |

|

22.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

0.1 |

0.99

0.1 |

2.03

3012.60 |

1481.61 |

|

23.

|

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.99 |

5.08

916.0 |

180.14 |

|

24.

|

1

10 |

1

10 |

1

10 |

0.99

0.1 |

1 |

0.99 |

95.27

5084.99 |

53.38 |

|

25.

|

1 |

1

0.1 |

1

10 |

0.1

0.99 |

1

0.1 |

0.99 |

5.08

176.28 |

34.67 |

|

26.

|

1 |

1 |

1

0.1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.034

1.10 |

32.72 |

|

27.

|

1

10 |

1

0.1 |

1

0.1 |

0.1

0.99 |

1 |

0.99 |

5.08

95.27 |

18.73 |

|

28.

|

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

10 |

0.99 |

5.37

58.99 |

10.98 |

|

29.

|

1 |

1

10 |

1

10 |

0.1

0.99 |

1

10 |

0.99 |

0.16

1.11 |

6.71 |

|

30.

|

1 |

1 |

1

10 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

1.42

7.74 |

5.44 |

|

31.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

10 |

0.1

0.99 |

0.00031

0.001 |

3.59 |

|

32.

|

1 |

1

0.1 |

1

0.1 |

0.1

0.99 |

1

10 |

0.99 |

0.0007

0.0011 |

1.49 |

|

5

variables |

||||||||

|

33.

|

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

95.27

5.08E+06 |

53376.24 |

|

34.

|

1 |

1

10 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

27568.22 |

14778.39 |

|

35.

|

1

10 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

64.02

1.61E+05 |

2511.77 |

|

36.

|

1

10 |

1 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

1875.78 |

1005.54 |

|

37.

|

1 |

1

10 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

34.95

24559.53 |

702.73 |

|

38.

|

1 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

14.08

160.80 |

11.42 |

|

39.

|

1

10 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99 |

80.18

246.73 |

3.08 |

|

all the variables |

||||||||

|

40.

|

1

10 |

1

0.1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

54.66

5084.99 |

93.03 |

|

Table 3. The statistics of variable

parameters for Veuf /Veub, where

Veuf /Veub ≥ 1 and Õ2 = 1 in descending order

for groups |

||||||||

|

No. in sequence |

Õ1 |

Õ2 |

Õ3 |

Õ4 |

Õ5 |

Õ6 |

Veub

Veuf (GDPeub

GDPeuf. $) |

Veuf / Veub (GDPeuf / GDPeub) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

1

variable |

||||||||

|

1. |

1 |

1 |

1 |

0.99 |

1 |

0.1

0.99 |

34.95

95.27 |

2.73 |

|

2 variables |

||||||||

|

2. |

1 |

1 |

1 |

0.99 |

1

0.1 |

0.99

0.1 |

95.27

95266.87 |

1000.0 |

|

3. |

1 |

1 |

1 |

0.99 |

1

0.1 |

0.1

0.99 |

34.95

1738.10 |

49.73 |

|

3 variables |

||||||||

|

4. |

1

10 |

1 |

1

10 |

0.99

0.1 |

1 |

0.99 |

3012.60 |

592.45 |

|

5. |

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

20.67

5084.99 |

246.05 |

|

6. |

1 |

1 |

1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

127.63 |

68.42 |

|

7. |

1 |

1 |

1 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

8.38

113.70 |

13.57 |

|

8. |

1 |

1 |

1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.0075

0.03 |

4.61 |

|

4 variables |

||||||||

|

9. |

1 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

26.51

1.61E+05 |

6065.8 |

|

10.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

0.1 |

0.99

0.1 |

2.03

3012.60 |

1481.61 |

|

11.

|

1 |

1 |

1

0.1 |

0.1

0.99 |

1

10 |

0.99

0.1 |

0.034

1.10 |

32.72 |

|

12.

|

1 |

1 |

1

10 |

0.99

0.1 |

1

0.1 |

0.1

0.99 |

1.42

7.74 |

5.44 |

|

13.

|

1 |

1 |

1

10 |

0.1

0.99 |

1

10 |

0.1

0.99 |

0.00031

0.001 |

3.59 |

|

5 variables |

||||||||

|

14.

|

1

10 |

1 |

1

0.1 |

0.99

0.1 |

1

0.1 |

0.99

0.1 |

64.02

1.61E+05 |

2511.77 |

|

15.

|

1

10 |

1 |

1

0.1 |

0.1

0.99 |

1

0.1 |

0.1

0.99 |

1.87

1875.78 |

1005.54 |

REFERENCES

1.

Pil E. A. Use of the shells' theory for purposes of description of

processes taking place in economy // Àëüìàíàõ ñîâðåìåííîé íàóêè è îáðàçîâàíèÿ (Almanac of modern science and

education). 2009. ¹3. P. 137-139

2.

Pil E. A. Influence of different variables onto economic shell of the

country // Àëüìàíàõ ñîâðåìåííîé íàóêè è îáðàçîâàíèÿ (Almanac of modern science and

education). 2012. ¹12 (67).

P. 123-126

3. Pil

E.A. Variants of macroeconomics development after being affected by different

forces // Materials of the XII International scientific and practical

conference, «Prospect of world science - 2016», 30 July 7 August. 2016 Volume

2. Economic science. Governance. Sheffield. Science and education. LTD. UK

100 p. P. 1732

4.

Pil E.A. Theory of the financial crises // International Scientific and

Practical Conference. Topical researches of the world science (June 2021,

2015) Vol. IV Dubai, UAE. 2015 Ð. 4456