Pil E.A.

Academic

RANH, dr. sc., professor, Saint-Petersburg

GDP CALCULATION WITH ONE VARIABLE HAVING A NEGATIVE VALUE

This article examines an issue of calculation of the gross domestic

product under influence of four variables, one of which has a negative value.

The calculations served as a basis for plotting 2D and 3D graphs.

The article below shows how the negative values of one parameter out of

four influence the GDP, while other parameters have positive values, grow or diminish by a factor of 10 times. In our

calculations, the variable X4 has negative values. Thus, at issue is the GDP

change Vsu (GDP) = f (Õ1, Õ2, Õ3, Õ4). Here

GDP is understood as the volume of the economic shell Vsu. In

this case, the values of the variable X4 may be viewed as a key rate or

taxes, because their values may not equal 1. In our example, let's assume

hypothetically that the variable X4 is a key rate. The State may theoretically

adopt negative taxes, though there was no such precedent in practice.

Recently, articles on negative interest rates have

appeared online, where such rates are referred to as the 'key rate' [1, 2, 3, 4]. This article treats

calculations related to the theory of economic crises.

Figure 1 shows a 2D graph which was plotted with the following

values of variables: Õ1 = Õ2 = Õ3 = 1, Õ4 = 0.99…–0.99, i.e. the value of the variable Õ4 was

accepted from +0.99 to –0.99. In order to adopt a negative key rate, the State

must, in parallel with the Central bank and commercial banks and large-scale

businesses, represented by the oligarchs in the first place, share some of its

wealth accumulated in a way not always consistent with law, with small and

medium businesses, as well as with the people [5, 6]. This also correlates to

the closure of all offshore zones in the world. This question was raised after

the onset of the world crisis in 2008. As such, the Russian companies and

oligarchs, according to some sources, hoard from 45% to 75%

nation's GDPs offshore [7, 8, 9, 10]. This can mitigate the degree of discontentment

with a big gap between the rich and the poor and raise the wealth of the

latter, help incentivize the market to buy goods and services and hence change

the vector of the GDP trend.

|

Fig. 1. Vsu (GDP) = f(Õ1, Õ2, Õ3, Õ4) Õ1 = Õ2 = Õ3 = 1, Õ4 = 0.99…–0.99 |

As the symmetrical Fig. 1 shows, the Vsu (GDP) curve goes down at first to its minimum value Vsu (GDP) = 5.25 units3

in the point 5 while the values of variable Õ4 diminish, and further, with increase in negative

values of X4, the plotted part of the Vsu (GDP) curve mirrors the part of

the curve with positive values of X4. This figure interprets the situation in a

country in an economic crisis, when banks begin to lower key rates in an

attempt to invigorate the economic situation. The calculations showed

that the theoretical value of the Vsu (GDP) under influence of external pressure, for example

with Õ4 = –0.99

equals Vsut (GDP) = 98.12. The

volume of a spherical economic shell is calculated by using a formula Vsu = 4pRsu3/3 = 4.19Rsu3, units3.

Thus, if the radius of a spherical economic shell Rsu equals '1' (Rsu = 1), we shall get Vsu = 4.19 units3 calculating its volume Vsu, i.e.

less than the value of Vsut. Therefore, here we can introduce the notion

of a singular volume of the spherical economic shell Vsusv,

i.e. when the value of Vsusv

= 1 units3. This is the starting value for every country's economy.

In terms of our example, the theoretical value Vsut = 98.12 units3 with Õ4 = 0.99, and Vsut = 5.23 units3 with X4 = 0.09, i.e. it

decreased by a factor of 18,76 times,

while the value of variable X4 is decreased by a factor of 11 times. Figure 1

leads to a conclusion that when a negative key rate is used, the Vsu (GDP) of a country begins to grow.

Now we

must mention that the calculated values of the amount of the Vsu (GDP) depend on the accuracy we apply in calculating them. The value of the

variable X4 greatly affects accuracy of the calculation, as shown in Table 1.

This Table shows that along with increase in values of X4 from –0.9 to –0.999999, i.e. by a factor of 1.11111

times, the

values of the GDP increase from 18.07 to 97756.52, i.e. by a factor of 5409.88

times.

|

Table 1. The combined

table of values of X4 and of the Vsu (GDP) with

values of X4 increasing |

||||||

|

¹ |

1.

|

2.

|

3.

|

4.

|

5.

|

6.

|

|

Value of X4 |

-0.9 |

-0.99 |

-0.999 |

-0.9999 |

-0.99999 |

-0.999999 |

|

Value of Vsu (GDP), units3 |

18.07 |

98.12 |

549.93 |

3091.45 |

17383.90 |

97756.52 |

The

similar Table 2 may be obtained when the values of the variable X4 decrease

from –0.9 to –0.000009, i.e. by a factor of 100000 times, and the values of the Vsu (GDP) decrease only by a factor of 3.48 times. In other words, it is safe

to draw a conclusion here that if the values of the variable X4 decrease, the

lower limit of the volume of economic shell of the Vsu (GDP) may be assumed as 5.199.

|

Table 2. The combined

table of values of X4 and of the Vsu (GDP) with

values of X4 decreasing |

||||||

|

¹ |

1.

|

2.

|

3.

|

4.

|

5.

|

6.

|

|

Value of X4 |

-0.9 |

-0.09 |

-0.009 |

-0.0009 |

-0.00009 |

-0.000009 |

|

Value of Vsu (GDP), units3 |

18.07 |

5.23 |

5.199 |

5.198982 |

5.1989792 |

5.1989791 |

On the basis of calculations presented in Tables 1 and 2 two curves have

been plotted, shown on Fig. 2 and 3 respectively.

|

Fig. 2. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = Õ3 = 1, Õ4 = –0.9…–0.999999 |

Fig. 3. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = Õ3 = 1, Õ4 = –0.9…–0.000009 |

Additionally, the values of the Vsu (GDP) for the curve plotted in Figure 2 may be calculated

using a simpler formula by means of employing the following exponential

equation of the Vsu (GDP) = 3,178e1,7211Õ4, as the correlation coefficient R2 in this case equals 1 (R2

= 1).

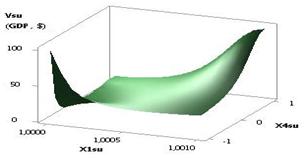

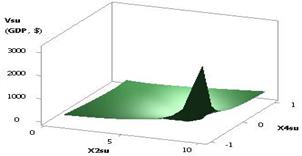

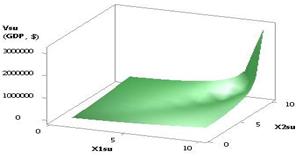

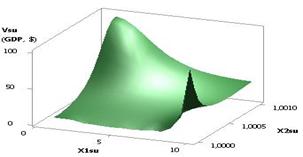

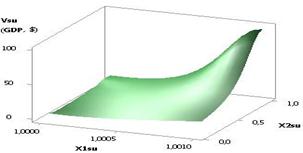

The following Figure 4 depicts a 3D graph for a

2D curve on Figure 1, which gives a more illustrative presentation of how a

calculated parameter of the Vsu (GDP)

changes.

|

Fig. 4. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1, Õ2 = Õ3 = 1, Õ4 = 0.99…–0.99 |

In view of the fact

that theoretical values Vsutmin > 0 and obviously diverge from practical values which can equal zero (Vsupmin

= 0), a diminution coefficient for Ksumin = 8.06E–11 can be introduced here.

This coefficient helps render minimum theoretical values of Vsutmin into minimum practical Vsupmin according to the formula Vsutmin = Ksumin Vsupmin. Here we can offer a similar coefficient of

increase for the maximum theoretical value of Ksumax which allows for rendering the maximum theoretical values Vsutmax into the maximum practical Vsupmax according to the following formula Vsutmax = Ksumax Vsupmax.

|

Table 3. The combined

table of values of Õ4 and maximum theoretical values of Vsutmax with values of Õ4 increasing. |

||||||

|

¹ |

1.

|

2.

|

3.

|

4.

|

5.

|

6.

|

|

Value of Õ4 |

-0.9 |

-0.99 |

-0.999 |

-0.9999 |

-0.99999 |

-0.999999 |

|

Value of Vsutmax, units3 |

1.241 |

1.241 |

1.241 |

1.241 |

1.241 |

|

In the following two tables 3 and 4 there are the maximum theoretical

values of Vsutmax, while values of the variable X4 increase and

decrease. Table 3 shows that the values of Vsutmax, don't change and have the same amount of Vsutmax, = 1.241.

It can be seen from Table 4 that in the event of decrease in values of

the variable Õ4 from –0.9 to –0.000009, i.e. by a factor of 100000 times, the values of Vsutmax, decrease from 4.31 to 1.24080647, i.e. by a factor of 3.47 times.

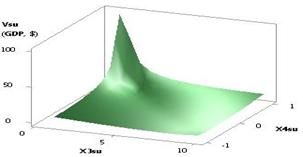

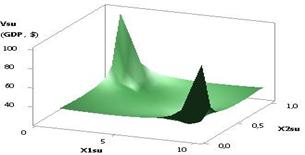

The following Figure 5 presents the Vsu (GDP) curve with the following variables: Õ1 = Õ2 = 1, Õ3 = 1…10, Õ4 = 0.99…–0.99. As

seen on the figure, the plotted curve plummets from 98.12 to 3.61

between the points 1 and 2, and continues to decrease to its minimum 0.3 in the

point 8, and then increases to 3.1, i.e. by a factor of 10.31 times. Figure 6

below shows the same curve using 3D graph.

|

Table 4. The

combined table of values of X4 and maximum theoretical values of Vsutmax with values of Õ4 decreasing |

||||||

|

¹

|

|

|

|

|

|

|

|

Value of Õ4 |

-0.9 |

-0.09 |

-0.009 |

-0.0009 |

-0.00009 |

-0.000009 |

|

Value of Vsutmax, units3 |

4.31 |

1.24839 |

1.24088 |

1.240807 |

1.24080648 |

1.24080647 |

|

Fig. 5. Vsu (GDP) = f(Õ1, Õ2, Õ3, Õ4) Õ1 = Õ2 = 1,

Õ3 = 1…10, Õ4 = 0.99…–0.99 |

Fig. 6. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = 1, Õ3

= 1…10, Õ4 = 0.99…–0.99 |

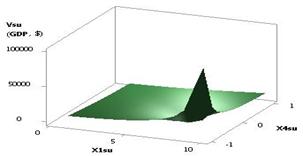

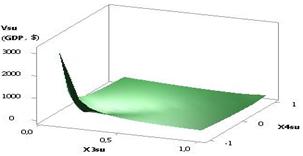

Further, in Figure 7 the Vsu (GDP)

dependency is illustrated with the variables Õ1 = 1, Õ2 = Õ3 = 1…10, Õ4 = 0.99…–0.99. It's noteworthy that the

plotted curve has its minimum 28.85 in the point 2, and then the values of the Vsu (GDP) grow to 3102.97, i.e. by a factor of 105.55. Now, if we compared the

calculated values of the Vsu (GDP), we would come up with the

following values: with Õ4

= 0.11 the

values of the Vsu (GDP) = 58.66, and with Õ4 = –0.11 they jump to Vsu (GDP) = 77.11. Thus, this option is acceptable in terms of economy's recovery from

the crisis with the key rate having negative value. Figure 8 shows a

three-dimensional picture of this curve.

|

Fig. 7. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1, Õ2 =

Õ3 = 1…10, Õ4 = 0.99…–0.99 |

Fig. 8. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1, Õ2 =

Õ3 = 1…10, Õ4 = 0.99…–0.99 |

If all three first variables are increased by a

factor of 10, Õ1 = Õ2 = Õ3 = 1…10 with Õ4 = 0.99…–0.99, then the values of the Vsu (GDP) will be increased from 98.12 to a larger amount of the Vsu (GDP) = 98124.68, i.e.

by a factor of 1202.39, as

shown in Figure 9. This option should be employed during a country's recovery

from the economic crisis, as under any negative values of the variable Õ4 the

amount of the Vsu (GDP) only grows.

Here, the plotted curve has its minimum 81.62 in the point 2 and therefore the values of the

variable Õ1 = Õ2 = Õ3 = 2, Õ4 = 0.77 shouldn't be applied. Figure 10 shows a

three-dimensional picture of this dependency which in no way differs in appearance

from the previous one in Figure 8.

|

Fig. 9. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = Õ3 = 1…10, Õ4 = 0.99…–0.99 |

Fig.10. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = Õ3 = 1…10, Õ4 = 0.99…–0.99 |

|

Fig. 11. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = 1…10, Õ3 = 1, Õ4 = 0.99…–0.99 |

Fig. 12. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = 1…10, Õ3 = 1, Õ4 = 0.99…–0.99 |

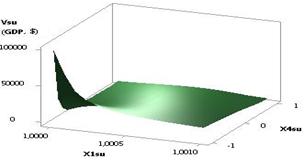

If we apply the following values of the variables Õ1 = Õ2 = 1…10, Õ3 = 1, Õ4 = 0.99…–0.99, the parameter Vsu (GDP) will then be big too, increasing from 98.12 to 3.10E+06, i.e.

by a factor of 31622.38 times, as

shown in Figure 11. Therefore, this option is also recommended for use in

selection of a way for a country's recovery from the crisis. Here, for example

with Õ4 = 0.11 the value Vsu (GDP) = 7332.44, and with Õ4 = -0.11, the Vsu (GDP) will equal 16655.74, i.e. 2.3 times.

Calculations served as a basis for a 3D graph, presented in Figure 12.

The following Figure 13 was plotted with Õ1 = Õ3 = 1, Õ2 = 1…10, Õ4 = 0.99…–0.99 and

is analogous to Fig.9. As we can see here, the values of the Vsu (GDP) do also reach a significant amount, from 98.12 they grow to 98124.68, i.e.

by a factor of 1202.39 times.

Here, the plotted curve has its minimum 81.62 in the point 2. Thus, the values of the variables

where the Vsu (GDP) = 81.62 shouldn't be selected during a country's

recovery from the economic crisis. Figure 14 shows the influence two variables

exert over the calculated amount of the Vsu (GDP).

|

Fig. 13. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ3 = 1,

Õ2 = 1…10, Õ4 = 0.99…–0.99 |

Fig. 14. Vsu (GDP) = f(Õ1, Õ2, Õ3, Õ4) Õ1 = Õ3 = 1,

Õ2 = 1…10, Õ4 = 0.99…–0.99 |

If we use the following values of the variables Õ1 = Õ3 = 1…10, Õ2 = 1, Õ4 = 0.99…–0.99 when

we plot a curve of the Vsu (GDP), we

will get a curve presented in Fig.15, which is absolutely analogous to the

curve in Fig.1. Therefore, here we can make the same conclusion. In

Fig.16 below we see a three-dimensional interpretation of a two-dimensional

graph in Fig.15.

|

Fig. 15. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ3 =

1…10, Õ2 = 1, Õ4 = 0.99…–0.99 |

Fig. 16. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ3 =

1…10, Õ2 = 1, Õ4 = 0.99…–0.99 |

Earlier, we had figures where the values of

the variables Õ1,

Õ2,

Õ3 grew by a factor of 10 times. Now we are going to

look at the options where the variables Õ1, Õ2, Õ3 will decrease, as

illustrated in Fig.17 with Õ1 = Õ2 = 1, Õ2 = 1…0.1. As the figure demonstrates, with the variable X3 decreasing by a

factor of 10 times, the calculated values of the Vsu

(GDP) grow to the maximum value 3102.97, and the plotted curve has its minimum 9.52 in the point 3. Thus, this option is also suitable

for a country's recovery from the economic crisis, excluding only the

variables' values where the Vsu (GDP) = 9.52. Figure 18

shows the 3D graph of the Vsu

(GDP).

|

Fig. 17. Vsu (GDP)= f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = 1,

Õ2 = 1…0,1, Õ4 = 0.99…–0.99 |

Fig. 18. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 = 1,

Õ2 = 1…0,1, Õ4 = 0.99…–0.99 |

If we calculate the parameter of the Vsu (GDP) with the following values of the variables Õ1 = 1, Õ2 = Õ2 = 1…0.1, Õ4 = 0.99…–0.99, we will get a

diminishing curve which has its minimum 0.91 in the point 9, and then grows to

3.1 in the point 10 (Fig.19). The obtained calculations served as a basis for a

3D graph, presented in Figure 20.

|

Fig. 19. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1, Õ2 =Õ2

= 1…0,1, Õ4 = 0.99…–0.99 |

Fig. 20. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1, Õ2 =Õ2

= 1…0,1, Õ4 = 0.99…–0.99 |

|

Fig. 21. Vsu (GDP) = f(Õ1, Õ2, Õ3, Õ4) Õ1 = 1…10,Õ2 =

Õ2 = 1…0,1, Õ4 =0.99…–0.99 |

Fig. 22. Vsu (GDP)= f(Õ1, Õ2,

Õ3, Õ4) Õ1 = 1…10,Õ2 =

Õ2 = 1…0,1, Õ4 =0.99…–0.99 |

Figure 21 demonstrates that the plotted curve of the Vsu (GDP) with Õ1 = 1…10, Õ2 = Õ2 = 1…0.1, Õ4 = 0.99…–0.99 imitates

Fig. 1 and 15 by form and, naturally, the same conclusions also apply to it. It

is noteworthy here that with these variables the minimum value of the Vsu (GDP) equals 27.26. Figure 22 clearly demonstrates

the look of this curve when its three-dimensional picture is used.

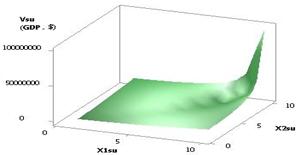

The last Figures 23 and 24 show 2D and 3D dependencies of the Vsu (GDP) when the variables were the following: Õ1 = Õ2 = 1…10, Õ2 = 1…0.1, Õ4 = 0.99…–0.99. The

calculations data show that with these variables the values of the Vsu (GDP) were the biggest, increasing from 98.12 to 9.81E+07, i.e. grew by

a factor of 1000000. This option is, thus, the

most favourable for use in terms of recovery of a country's economy from the

crisis.

|

Fig. 23. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 =

1…10, Õ2 = 1…0,1, Õ4 = 0.99…–0.99 |

Fig. 24. Vsu (GDP) = f(Õ1, Õ2,

Õ3, Õ4) Õ1 = Õ2 =

1…10, Õ2 = 1…0,1, Õ4 = 0.99…–0.99 |

We have the combined Table 5 below containing all

the calculations referred to above. Their number is somewhat bigger as some

parameters of the Vsu (GDP) had both minimum and

maximum values during calculations. Besides, all values of the Vsu (GDP) parameters were sorted by a degree of diminution. Here, the values of Vsub and Vsuf denote starting and ending values of the Vsu (GDP) parameter, obtained by

calculation. The ratio Vsuf / Vsub characterises the extent of increase (decrease) of the last value of the

parameter Vsuf in relation to the starting Vsub. This

enables us to single out such values of the variables Õ1, Õ2, Õ3, Õ4, where the Vsu (GDP) grows even in the times of

the economic crisis.

|

Table 5. Options of

changing values of the variables X1 X2, X3 è X4, as well as

calculated data Vsub and Vsuf and

their ratio Vsuf / Vsub |

||||||

|

¹ |

Õ1 |

Õ2 |

Õ3 |

Õ4 |

Vsub…Vsuf (GDPsub… GDPsuf, $) |

Vsuf / Vsub (GDPsuf / GDPsub) |

|

1.

|

1…10 |

1…10 |

1…0.1 |

0.99…–0.99 |

98.12…9.81E+07 |

1.00E+06 |

|

2.

|

1…10 |

1…10 |

1 |

0.99…–0.99 |

98.12…3.10E+06 |

31622.78 |

|

3.

|

1…10 |

1…10 |

1…10 |

0.99…–0.99 |

81.61…98124.68 |

1202.39 |

|

4.

|

1 |

1…10 |

1 |

0.99…–0.99 |

81.61…98124.68 |

1202.39 |

|

5.

|

1 |

1 |

1…0.1 |

0.99…–0.99 |

9.52…3102.97 |

325.95 |

|

6.

|

1 |

1…10 |

1…10 |

0.99…–0.99 |

28.85…3102.97 |

107.55 |

|

7.

|

1 |

1 |

1 |

0.99…–0.99 |

5.24…98.12 |

18.70 |

|

8.

|

1…10 |

1 |

1…10 |

0.99…–0.99 |

5.25…98.12 |

18.70 |

|

9.

|

1 |

1 |

1…10 |

0.99…–0.99 |

0.30…3.10 |

10.31 |

|

10. |

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

24.63…98.12 |

3.98 |

|

11. |

1 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

0.91…3.10 |

3.40 |

|

12. |

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

24.63…27.26 |

1.11 |

|

13. |

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

27.26…24.63 |

0.90 |

|

14. |

1…10 |

1…10 |

1…10 |

0.99…–0.99 |

98.12…81.61 |

0.83 |

|

15. |

1 |

1…10 |

1 |

0.99…–0.99 |

98.12…81.61 |

0.83 |

|

16. |

1 |

1…10 |

1…10 |

0.99…–0.99 |

98.12…28.85 |

0.29 |

|

17. |

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

98.12…24.63 |

0.25 |

|

18. |

1 |

1 |

1…0.1 |

0.99…–0.99 |

98.12…9.52 |

0.097 |

|

19. |

1 |

1 |

1 |

0.99…–0.99 |

98.12…5.24 |

0.05 |

|

20. |

1…10 |

1 |

1…10 |

0.99…–0.99 |

98.12…5.25 |

0.05 |

|

21. |

1 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

98.12…0.91 |

0.009 |

|

22. |

1 |

1 |

1…10 |

0.99…–0.99 |

98.12…0.30 |

0.003 |

The last table 6 is in fact a modified table 5, where only ratios Vsuf / Vsub ≥

1 are left. By doing so, we got the final Table 6 which combines all the values

of the variables Õ1, Õ2, Õ3, Õ4, which can help us to drive the country out

of the economic crisis. It's important to note here that an emphasis must be

made during the selection of variables from Table 6 on those rows which have

the maximum quantity of ones. In our example this happens with two values of

the variables, highlighted in bold. In such case, only two variables should be

changed, which is certainly easier than three or four.

|

Table 6. Options of changing values of the variables X1 X2, X3, X4, as

well as calculated data Vsub and Vsuf

and their ratio Vsuf / Vsub

with Vsuf / Vsub

≥ 1 |

||||||

|

¹ |

Õ1 |

Õ2 |

Õ3 |

Õ4 |

Vsub…Vsuf (GDPsub… GDPsuf, $) |

Vsuf / Vsub (GDPsuf / GDPsub) |

|

1.

|

1…10 |

1…10 |

1…0.1 |

0.99…–0.99 |

98.12…9.81E+07 |

1.00E+06 |

|

2.

|

1…10 |

1…10 |

1 |

0.99…–0.99 |

98.12…3.10E+06 |

31622.78 |

|

3.

|

1…10 |

1…10 |

1…10 |

0.99…–0.99 |

81.61…98124.68 |

1202.39 |

|

4.

|

1 |

1…10 |

1 |

0.99…–0.99 |

81.61…98124.68 |

1202.39 |

|

5.

|

1 |

1 |

1…0.1 |

0.99…–0.99 |

9.52…3102.97 |

325.95 |

|

6.

|

1 |

1…10 |

1…10 |

0.99…–0.99 |

28.85…3102.97 |

107.55 |

|

7.

|

1 |

1 |

1 |

0.99…–0.99 |

5.24…98.12 |

18.70 |

|

8.

|

1…10 |

1 |

1…10 |

0.99…–0.99 |

5.25…98.12 |

18.70 |

|

9.

|

1 |

1 |

1…10 |

0.99…–0.99 |

0.30…3.10 |

10.31 |

|

10.

|

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

24.63…98.12 |

3.98 |

|

11.

|

1 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

0.91…3.10 |

3.40 |

|

12.

|

1…10 |

1…0.1 |

1…0.1 |

0.99…–0.99 |

24.63…27.26 |

1.11 |

List of references:

1. Negative rates in mortgage. Now it's doable (in

Russian).// http://www. vestifinance.

ru/articles/52690

2. The Central Bank of

3. Negative interest rate (in Russian)//

http://sverigesradio.se/sida/artikel.aspx? programid

=2103&artikel=6091650

4. Negative interest rates (in Russian).//

http://consulting-finance.com/stati/ otricatelnye-procentnye-stavki.html

5. Billions for charity: in

6. The moneybags are asked to cede half of their wealth (in Russian). //

http://www.mixnews.lv/ru/world

/news/43138_boga4ej-prosyat-otdat-polovinu-nazhitogo/

7. Laura Keffer. Throughout 15 years in

8. Offshores in five graphs: trillions hidden

from eyes of the beholder. // https://news.mail.ru/society/31625187/

9. The Russians hold 62 trillion roubles or 75% of the national income

in offshores (in Russian). // https://newdaynews.ru/finance/612444.html

10. Olga Sorokina. Return to the

motherland: how