8.Ìàòåìàòè÷åñêèå

ìåòîäû â ýêîíîìèêå

Nickolay Zosimovich, Olga Kozhushko

National Aviation University, Institute of

International Relations (Kiev, Ukraine)

Modeling interbranch balance in a country with Leontief model

Summary. Analysis of the

sources on the task of input-output model was made by means of Mathcad with Leontief model. For a visual demonstration of the Leontief model, calculate balance for the state of Washington in 2002 (USA). Calculations show that if one of the indicators is large enough then the end result will be even higher.

Key words: economic

analysis,

balance, economic sector, industry, product, mathematical simulate, data, equilibrium, matrix, dynamic model, production

capacity.

I. Introduction.

The historical precursors to input-output

analysis were in evidence as far back as the first half of the XVII-th-century.

Most economic historians cite Francois Quesnay's (1694-1774) Tableau Economique

as the earliest recorded examples to depict the importance of mutual

interindustry flows or, in more modem parlance, systematic economic

interdependence (Addition 1). The model Quesnay created consisted of three economic movers [6]:

1. The “Proprietary” class, which consisted of just the landowners.

2. The “Productive” class, which contained all agricultural laborers.

3. The “Sterile” class, which contained artisans (craftsmen) and merchants.

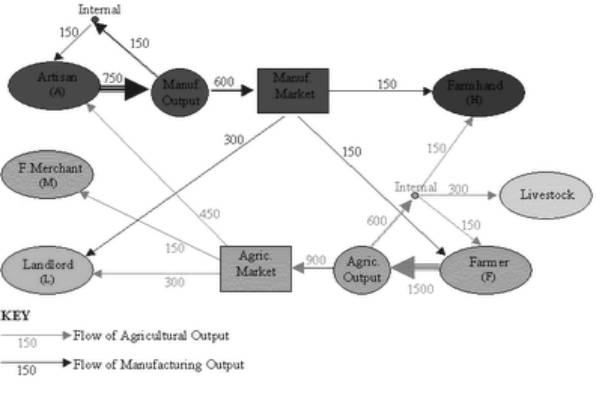

The flow of production and/or cash between the three classes started with the

Proprietary class because they own the land and they buy from both of the other

classes. The process has these steps (Fig. 1):

1. The farmer produces 1500 food on land leased from the landlord. Of that

1500, he retains 600 food to feed himself, his livestock, and any laborers he

hires. He sells the remaining 900 in the market for $1 per unit of food. He

keeps $300 ($150 for himself, $150 for his laborer) to buy non-farm goods

(clothes, household goods, etc) from the merchants and artisans. This produces

$600 of net profit, to which Quesnay refers as product net.

2. The artisan produces 750 units of crafts. To produce at that level, he needs

300 units of food and 150 units of foreign goods. He also has subsistence need

of 150 units of food and 150 units of crafts to keep himself alive during the

year. The total is 450 units of food, 150 units of crafts, and 150 units of

foreign goods. He buys $450 of food from the farmer and $150 of goods from the

merchant, and he sells 600 units of crafts at the market for $600. Because the

artisan must use the cash he made selling his crafts to buy raw materials for

the next year’s production, he has not net profit.

Fig. 1. Production Flow Diagram for Quesnay’s Tableau [6]

3. The landlord is only a consumer of food and crafts and produces no

product at all. His contribution to the production process is the lease of the

land the farmer uses, which costs $600 per year. The landlord uses $300 of the

rent to buy food from the farmer in the market and $300 to buy crafts from the artisan.

Because he is purely a consumer, Quesnay considers the landlord the prime mover

of economic activity. It is his desire to consume which causes him to expend

his entire lease income on food and crafts and which provides income to the

other classes.

4. The merchant is the mechanism for exporting food in exchange for foreign

imports. The merchant uses the $150 he received from the artisan to buy food

from the market, and it is assumed that he takes the food out of the country to

exchange it for more foreign goods [6].

II. Statement of the problem. Suppose an economy has n industries each producing a single unique

product. (There is a generalization of input output analysis, called activity analysis, in which an

industry may produce more than one product, some of which could be pollutants.)

Let the product input requirements per unit of product output be expressed as

an ![]() matrix A. Let X be

the n dimensional vector of outputs and F the n dimensional vector of final

demands. The amounts of production used up in producing output X is AX. This is

called the intermediary demand. The total demand is thus AX+F. The supply of

products is just the vector X. For an equilibrium between supply and demand the

following equations must be satisfied [2]:

matrix A. Let X be

the n dimensional vector of outputs and F the n dimensional vector of final

demands. The amounts of production used up in producing output X is AX. This is

called the intermediary demand. The total demand is thus AX+F. The supply of

products is just the vector X. For an equilibrium between supply and demand the

following equations must be satisfied [2]:

The equilibium production is then given by

A viable economy is one in which any vector of

nonnegative final demand induces a vector of nonnegative industrial

productions. In order for this to be true the elements of ![]() must all be positive. For this to be true

must all be positive. For this to be true ![]() has to satisfy

certain coditions.

has to satisfy

certain coditions.

A minor of a matrix is the value of a

determinant. The principal leading minors of an ![]() matrix are evaluated

on what is left after the last m rows and columes are deleted, where m runs

from (n-1) down to 0.

matrix are evaluated

on what is left after the last m rows and columes are deleted, where m runs

from (n-1) down to 0.

The condition for the ![]() matrix of

matrix of ![]() to have an

inverse of nonnegative elements is that its principal leading minors be

positive. This is known as the Hawkins-Simon conditions [2].

to have an

inverse of nonnegative elements is that its principal leading minors be

positive. This is known as the Hawkins-Simon conditions [2].

Synthesizing knowledge about reproduction theory of

Marx and Engels, cybernetics, Norbert Wiener and the economic and mathematical

model of input-output balance (IOB) Leontief, as well as a huge personal

experience as a mechanical engineer and an organizer of production at different

levels of management corporation of the USSR, the creator of the first

Automated Control Systems (ACS), founder of the school strategic planning

Veduta Nikolai Ivanovich (1913-1998) developed a dynamic model of the IOB which

suggests the inclusion of the impact of the market

(equilibrium prices) to determine the proportions of the plan.

In the scheme of IOB for the first time systematically

coordinated balance of revenues and outlays of producers and consumers - the

state (inter-state block), households, exporters and importers (the external

economic balance). A dynamic model of IOB his method of economic cybernetics.

It is a system of algorithms, effectively linking the tasks of end users with

capabilities (material, human and financial), producers of all forms of

ownership. Based on the model is determined by the effective allocation of

productive government investment. Introducing a dynamic model of IOB, the

government is able to adjust the mode «online» for development based on

refinement of the production capacity of residents and demand dynamics of end

users to meet the requirements of national and global security [3].

III. Simulation methodics of Leontief model. For a visual demonstration of the Leontief model, calculate balance for the state of Washington. From the "input-output" table of Washington in 2002 [1] choose the input data for calculations (Table 1).

Table 1

The input data for task

|

|

Mining |

Electric Utilities |

Gas Utilities |

Air Transportation |

Inter-industry subtotal |

Total final demand |

|

Mining |

0,8 |

124,8

|

14,2

|

0,0 |

139,8 |

139 |

|

Electric Utilities |

10,5

|

1773,0 |

0,4 |

3,2 |

1787,1 |

14,1 |

|

Gas Utilities |

2,8 |

134,1

|

1,0 |

0,3 |

138,2 |

137,2 |

|

Air Transportation |

0,2 |

5,6 |

0,7 |

0,2 |

6,7 |

6,5 |

|

Total

intermediate input |

14,3 |

2037,5 |

16,3 |

3,7 |

2071,8 |

|

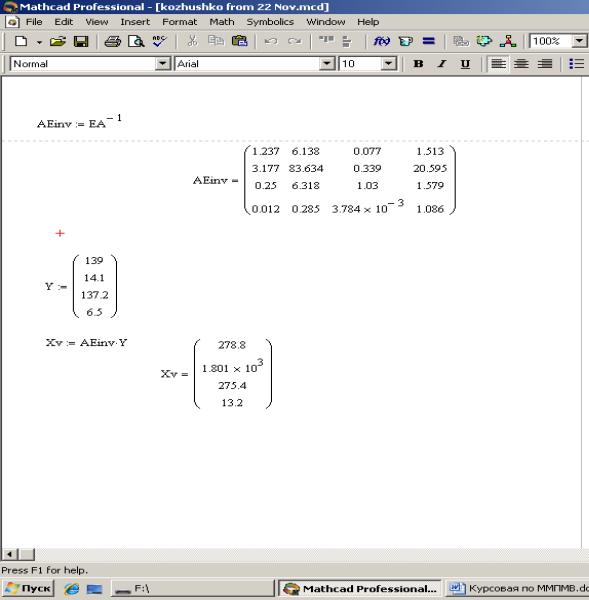

Fig. 2. Results of Table 1

calculation

For the final demand

Y=(139;14,1;137,2;6,5) total output for Mining is 278,8, Electric Utilities – 1.801õ103

, Gas Utilities – 275,4, Air Transportation – 132 (Fig. 2). Because of too much the end

result of Electric Utilities, reduce

its input rate by 2 times and then change the vector of final demand

(Table 2).

Table 2

A modified input data for task

|

|

Mining |

Electric Utilities |

Gas Utilities |

Air Transportation |

Inter-industry subtotal |

Total final demand |

|

Mining |

0,8 |

124,8

|

14,2

|

0,0 |

139,8 |

139 |

|

Electric Utilities |

10,5

|

886,5 |

0,4 |

3,2 |

1787,1 |

900,6 |

|

Gas Utilities |

2,8 |

134,1

|

1,0 |

0,3 |

138,2 |

137,2 |

|

Air Transportation |

0,2 |

5,6 |

0,7 |

0,2 |

6,7 |

6,5 |

|

Total

intermediate input |

14,3 |

2037,5 |

16,3 |

3,7 |

2071,8 |

|

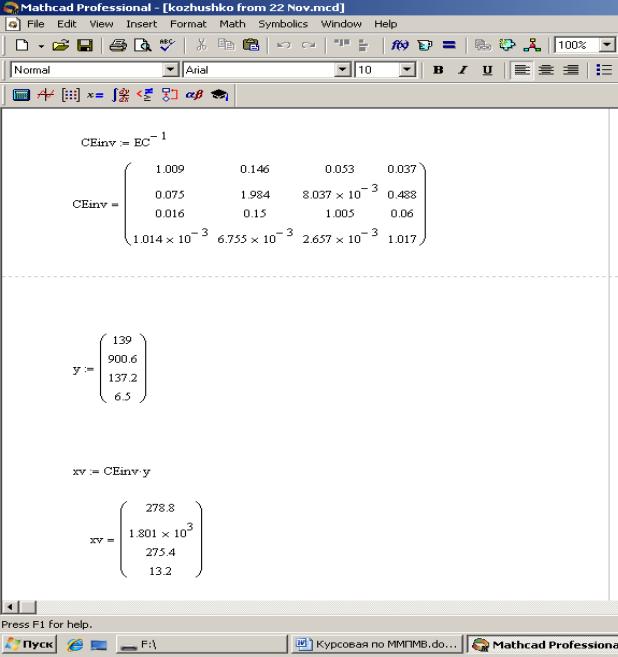

Fig. 3. Results of Table 2

calculation

Repeating calculation with a

reduced rate Electric Utilities 2 times showed

that this significant reduction caused a small variation of

certain parameters, but the end result is not affected. It means that for the final demand Y=(139;900,6;137,2;6,5) total output is the same: Mining – 278,8, Electric Utilities – 1.801õ103

, Gas Utilities – 275,4, Air Transportation – 132 (Fig. 3).

IV. Conclusions. Leontief model has a strong historical background which shows that interest in the issue of interbranch relations in the economy concerned scientists for many years.

1. There are related methods that specify the calculations and give a more accurate result.

2. Leontief model is very useful because it includes the important factors that significantly affect the economy as a

whole.

3. Calculations show that if one of the indicators is large enough then the end result will be even higher.

4. If this indicator reduce significantly the end result does not change. In the

calculation process certain parameters change only.

The calculations produced above have a illustrative

purpose. In order to trace the significant changes and get more specific and accurate results it is necessary to make

a matrix which will include a greater number of industries. Here it

is necessary to change indicators separately to follow the trend. In practice use an additional parameters such as value

added, imports, total employment etc.

References

1.

http://www.ofm.wa.gov/economy/io/2002/default.asp

- Office of Financial Management.

2.

http://www.sjsu.edu/faculty/watkins/inputoutput.htm#INTRO

- San José State University

Department of Economics.

3.

http://ru.wikipedia.org/wiki/ - Ìåæîòðàñëåâîé_áàëàíñ.

4. http://en.wikipedia.org/wiki/Tableau_%C3%A9

– economique.

5. http://www.referenceforbusiness.com/encyclopedia/Inc-Int/Input-Output-Analysis.html

- Reference for Business. Encyclopedia

of Business, 2nd ed.

6.

http://econ-thought.blogspot.com/2010/01/francois-quesnays-tableau-economique.html

- Modern Economic Thought.