Bondarevskaya Valeriya

Kharkiv

banking institute University of banking

National

bank of

Modern technologies of the bank mortgage crediting

Credit

operations occupy the determine place in the brief-case of bank assets. That’s

why the correct organization of the mortgage process, development of the

efficient and flexible control system by mortgage credit operations is the

basis of financial and market stability of bank institutions. It is comparative

with foreign experience of the mortgage programs realization, now the Ukrainian

mortgage market is in the „first stage”, this fact says that for

![]() (1)

(1)

where ![]() - gross

premium

- gross

premium

![]() - interest rate in the moment of credit

registration;

- interest rate in the moment of credit

registration;

![]() - annual level of inflation;

- annual level of inflation;

![]() - term

of loan.

- term

of loan.

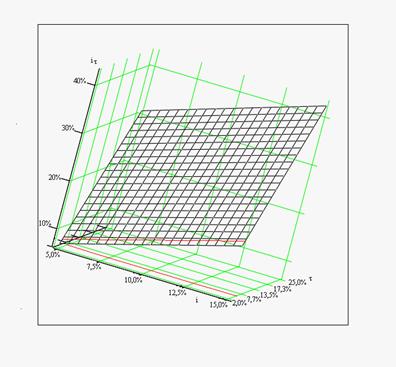

Dependence of

interest rate on inflation it is possible to represent graphically by the

resources of calculation-mathematical product MATHCAD, on the base of which the

mathematical model of dependence of interest rate on mortgage credit from

inflation have been given.

Pic. 3. Function of the gross premium

On this graph

the size of interest rate is limited by an interval from 5% to 25%, it means that

value![]() , is within the limits of interval:

, is within the limits of interval: ![]() . Inflation rate

. Inflation rate ![]() are

limited by an interval from 2% to 25%, it means that

value

are

limited by an interval from 2% to 25%, it means that

value![]() , is within the limits of interval:

, is within the limits of interval: ![]() . The term of crediting makes 3 years for construction of this mathematical

model. The red line on this graphic model marks the level of inflation – 6,2%. This

method of gross premium estimation gives possibility to forecast how

the gross premium will change depending on inflation for the certain periods of

time. This method of gross premium estimation is useful for prognostication of interest

rate value depending on inflation, taking into account a long-term character of

mortgage credit and risks, which inherent to the mortgage credit.

. The term of crediting makes 3 years for construction of this mathematical

model. The red line on this graphic model marks the level of inflation – 6,2%. This

method of gross premium estimation gives possibility to forecast how

the gross premium will change depending on inflation for the certain periods of

time. This method of gross premium estimation is useful for prognostication of interest

rate value depending on inflation, taking into account a long-term character of

mortgage credit and risks, which inherent to the mortgage credit.

In the turn

it will give to the banks the possibility to manage their credit brief-case in

a high and efficient level, to create the adequate risks control system, to

satisfy the necessities of the clients and, as a result, to provide profitable

activity.