Ph.D student Uskenbayeva Assiya

L.

Gumilyov Eurasian National University, Kazakhstan

The transmission mechanism of the Monetary Policy in

Kazakhstan

In this article is considered the interaction between financial and

real sector through influence of the transmission mechanism of the monetary

policy to dynamics of fixed investments. The redistribution of investment funds

from financial to real sector lies in the base of balance economic development.

As a rule, the financial institutes redistribute the finance, and the

effectiveness of these institutes depends from the transmission mechanism of

the Central Bank monetary policy.

One of the main Kazakhstani

Government Policy’s priorities is to increase the level of fixed investments in

the real sector. The most attractive branch for fixed investments in Kazakhstan

remain the mining industry, accordance to the official data investment ratio to

the mining industry makes up 31.1% (1).

Theoretical basis of the research

totaled Keynes, John Maynard, F. Mishkin, J. Tobin. The empirical bases of

research totaled data were published in the information materials of the Agency

of the Republic of Kazakhstan on Statistics. National Bank of Kazakhstan and

the Agency of the Republic of Kazakhstan on regulation and supervision of

financial market and financial organizations.

Practical contribution of

research. The results can be used in the teaching of subjects «Economic

Policy», «State Investment Strategy», by state authorities in the formation of

the priority areas of the monetary and investment policy.

The role of monetary policy in

the process of interaction of financial and real sectors of economy, first of

all, is shown in support of optimum value of money

supply that is in conformity of the money offer from financial sector to

effective demand from economic agents of real

sector. In this case costs from storage of money are minimum, and, with other

things being equal, in economy the maximum effect is reached, that is the offer

of money provides manufacture and realization of gross

domestic product and, accordingly, its growth.

Excess of money offer over effective demand can make active inflationary

processes and lead to demand inflation. In situation when the offer of money

below real effective demand, in the conditions

of unfavorable conjuncture can lead to decrease in level of financing of

long-term industrial investments, and in conditions of high expected

profitableness from capital investments usually leads to progressive

development of monetary sector.

As it is known, industrial

investments play the leading part in economy development. The low offer of

monetary resources, even in case when investors have desire to invest, can

break investment process. The role of financial sector as source of long-term

investments becomes stronger in this case. Readiness of investors to incur the

high expenditures connected with reception of

tools of financing, induces financial

institutions to expand the list of financial services, including directed on

accumulation the free money resources. «Offer growth «long» money forms

foundation for financing of those investment projects which otherwise would not

be implemented» (3)

Summarizing the aforesaid, it

is possible to draw the conclusion that monetary and credit regulation,

providing the optimum monetary offer should be directed on creation of

favorable conditions for increase in profitableness of industrial investments

The concept of transmission mechanism is not new in the economic theory; initially it was

presented in Keynes analysis. According to the scientist, the transfer

mechanism is the system of variables through which the offer of money

influences to economic activity, by influence towards investment demand, under

condition of change of psychological situation in the monetary market, directed

for decrease of percent norm.

Financial structure of economy makes the great influence the mechanism of transmission of monetary and credit policy, and also macroeconomic conditions. Along with it, efficiency of transmission of monetary

policy also is defined by degree of intervention of a state into processes of

functioning of the financial markets.

The world practice uses some

channels of transmission of monetary policy, the cores among them are:

interest rate

channel of which leads to change of investments’ level, savings and cumulative

demand, through change of limiting costs of loan;

exchange rate

channel, influences through cumulative demand (changing pure export) and the

cumulative offer (changing internal cost of import);

asset price

channel, influences financial assets, real estate;

credit

channel, «operates through non-price rationing of credit, caused by the

dissymmetric information and (or) target crediting».

Let us consider the mechanism of action for the percentage channel of transmission of monetary policy.

According to the economic theory, usually the percentage channel of

transmission means «the set of economic variables reflecting interrelation

between the correcting impulse (change of the interest rate, one or several), generated

by the central bank and transferred to real sector of economy with the help of

tools of monetary policy» (4). As a rule, interest rate change involves change

of preferences of economic agents concerning time structure of savings and

consumption that finally influences to level of investments into the fixed

capital. This principle was presented in due time to IS-LM curve of Keynes

model.

Essence of the transmission mechanism consists in average interest rate defined by the central

bank which plays an essential role in establishment of equality of supply and

demand on the monetary market. Change

of volumes of consumption and investments is caused by change of costs for

using debt financing resources in which basis growth or decrease in the real

rate of percent lies.

The channel for assets’ prices. According to the monetarists, traditional Keynes model

IS-LM does not consider influence on investments the changes on prices of other

assets, such as real estate.

The expansion monetary policy

leads to growth of the monetary offer, economic agents have possibility surplus

of money to direct to the security market that causes growth of demand for

stocks and their prices. According to the theory of choice of by J.Tobin,

investors aspire to make capital investments as high risky, and less risky

financial tools. The problem of provision on diversification of portfolio is

more priority problem for the investor, rather than reception of high profit.

The coefficient q by Tobin is parity

of market capitalization of the companies to regenerative cost of the capital.

At high value of this factor, the companies perform additional issue of stocks

and involve with that the capital for financing of investments (6).

Real estate costs also influence dynamics of

investments. Expansion leads

to growth of demand and, accordingly, increases in prices for habitation. The

increase in costs of habitation rises its cost in comparison with regenerative

cost that positively influences growth of volumes of building.

The channel on crediting. Fluctuations of investment expenses is impossible to explain only by

change of level of interest rates owing to what there was theory which suggests

to consider asymmetry of the information in financial markets (7). The given

theory considers availability of the bank credit to the companies which are

incapable to involve resources from the financial markets.

The credit channel can operate

through potential volume of credits of banks which depends upon the monetary

policy of the Central bank, and the credit policy of banks which in turn,

varies under the influence of the offer of money.

Change of bank

crediting volume depending on kind of monetary policy. At expansion monetary policy of the Central

bank, it occurs growth of monetary base, volumes of bank deposits that allows

banks to increase crediting volumes grow. Thus, investment expenses of

companies in parallel grow. However, this channel is not characteristic for the

countries with the developed financial market as banks, for example, can invest

funds, at increase of monetary base, not in deposits but also in other

financial resources.

Credit policy of banks in

connection with change of monetary policy of the Central bank. This approach is

actual for developed financial markets where the risk of “unfavorable"

(false) choice increases. The monetary policy influences for investment policy

of banks in several ways.

1.

At expansion monetary and credit policy, market

evaluation of actions go up, capitalization of companies increases, risk of

false choice decreases, volume of crediting by banks increases that leads to

growth of investments, monetary and credit restriction leads to opposite

results.

2.

Change of

volume of monetary offer leads to change of nominal interest rates that is

reflected in investment activity of the companies. At monetary expansion

nominal interest rates under credits decrease, expenses of the companies on

debt service decrease that leads to growth of well-being of the companies.

Improvement of the financial status of companies reduces credit risks

(asymmetry of information decreases), in this connection, banks increase

volumes of crediting which goes for financing of investments. And, on the

contrary, at restriction politician, there is return situation.

The channel of the

exchange rate. Countries with

undeveloped financial market and high level dollarization of economy this

channel is the basic channel of transmission. As a rule, monetary and credit

restriction leads to growth of the exchange rate, to decreasing of import and net

export cost, and as consequence, output volume.

At

expansion monetary policy

decrease in interest rates conducts to reduction in demand of investors for

assets in national currency and to decrease of real exchange rate, increase in

net export and cumulative demand.

In

order to make econometrical model of the

transmission mechanism of monetary policy we were based on the following

factors:

fixed investments per capita (thousand tenge) – Invfpc (th. TGZ);

the nominal rate of interest on credits in national currency (%) –

RNATCUR (%);

interest rate on credits in USA dollars(%)

– RDOL (%);

interest rate on credits in EURO (%)

– REURO (%);

credit volume on economy per capita (thousand tenge) – Creditspc (th. TGZ);

real estate cost (cost for new buildings) in dollars – AssCost (USD);

net export per capita per capita (thousand dollars) – Netexportpc (th. USD);

official

exchange rate (1 tenge/ USA dollars) - exchrate (1KZT/USD).

official

exchange rate (1 tenge/ USA dollars) - exchrate (1KZT/USD).

We research how the transmission mechanism works on the Kazakhstani market. Information about used indicators was

obtained from the statistical yearbooks of the Kazakhstan Statistics Agency

National Bank of Kazakhstan.

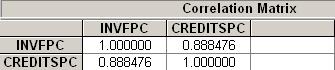

With

the view to expose the degree connectivity (closeness) make up the correlated

matrix between: fixed investments per capita and the

nominal rate of interest on credits in national currency and the interest

rate on credits in USA dollars and the interest rate on credits in EURO.

In this connection, in our

further analysis we shall evaluate only the value of the nominal rate of

percent on credits in the national currency. The based Method of Least Squares

we estimate the model’s coefficients:

![]()

The results presented in the table1:

|

Dependent Variable: INVFPC |

||||

|

Method: Least Squares |

||||

|

Date: 02/04/10 Time: 22:36 |

||||

|

Sample: 2000:1 2007:4 |

||||

|

Included observations: 32 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

226.4024 |

37.15085 |

6.094137 |

0.0000 |

|

RNATCUR |

-16.57626 |

5.987967 |

-2.768261 |

0.0096 |

|

R-squared |

0.203468 |

Mean dependent var |

127.4076 |

|

|

Adjusted R-squared |

0.176917 |

S.D. dependent var |

62.77585 |

|

|

S.E. of regression |

56.95272 |

Akaike info criterion |

10.98278 |

|

|

Sum squared resid |

97308.35 |

Schwarz criterion |

11.07439 |

|

|

Log likelihood |

-173.7245 |

F-statistic |

7.663270 |

|

|

Durbin-Watson stat |

0.186652 |

Prob(F-statistic) |

0.009566 |

|

![]()

Small

value R-squared=0.203468 shows that basically, the achieved model in an investigated time interval in

Kazakhstan does not work. It is caused,

according to the implementer, that investments into the fixed capital in Kazakhstan

are formed in a greater degree at the expense of own funds of the enterprises

(31 %) and foreign investments (25%). Thus, the rate of market percent does not

stimulate growth in real sector of economy and crediting crushing terms

(average 20 % annual) do not allow economic agents to develop business at the

expense of extra funds of the bank system of Kazakhstan.

The Factor of pair

correlation between investments into the fixed capital per capita and credits

per capita shows close connection between them:

Estimate the model’s

coefficients:

![]()

The results presented in the table 2:

|

Dependent Variable: INVFPC |

||||

|

Method: Least Squares |

||||

|

Date: 02/04/10 Time: 23:04 |

||||

|

Sample: 2000:1 2007:4 |

||||

|

Included observations: 32 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

78.91876 |

6.907321 |

11.42538 |

0.0000 |

|

CREDITSPC |

0.415442 |

0.039178 |

10.60392 |

0.0000 |

|

R-squared |

0.789390 |

Mean dependent var |

127.4076 |

|

|

Adjusted R-squared |

0.782369 |

S.D. dependent var |

62.77585 |

|

|

S.E. of regression |

29.28549 |

Akaike info criterion |

9.652523 |

|

|

Sum squared resid |

25729.21 |

Schwarz criterion |

9.744132 |

|

|

Log likelihood |

-152.4404 |

F-statistic |

112.4432 |

|

|

Durbin-Watson stat |

0.121689 |

Prob(F-statistic) |

0.000000 |

|

![]()

Thus, increase in credits

volumes per capita do not lead to increase of investments into the fixed

capital per capita. In fact, average 55% goes for replenishment of circulating

assets.

As the market of corporate

securities in Kazakhstan is not developed, the transmission channel through the

prices practically does not operate. 95,98 % of performed transactions on KASE

are for non-government securities admitted to the auctions on KASE under the

official list of the category “A”. This fact grows out of that assets of the

basic investors of securities market – Cumulative pension funds, banks and

insurance (re-insurance) organizations are subject to placing of the emitters

in securities, included in KASE official lists on category “A” (8). Demand in

the country on the action depends not only the monetary offer, it also depend

upon demand from institutional investors and foreign investors.

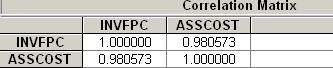

In

this connection, implementers in order to make model referred to the prices for real estate

(AssCost). In comparison

with the above-stated channels, the closest linear communication with

investments factor into the fixed capital per capita is observed at factor of

the prices for real estate. Cost increase for real estate in Kazakhstan

stimulated investments into habitation building. Besides, cost increase for

habitation was supported by additional investments from bank sector side.

During the investigated period the volume of such kinds of bank products, as

mortgage and consumer crediting has been increased. So, within 2007 consumer

credits were grown up by 55,5 % up to 1208,1 billion tenge, mortgages credits

were increased by 72,6 % to 683,6 billion tenge (9).

The based Method of Least

Squares we estimate the model’s coefficients:

![]()

The results presented in the table 3:

|

Dependent Variable: INVFPC |

||||

|

Method: Least Squares |

||||

|

Date: 02/04/10 Time: 23:07 |

||||

|

Sample: 2000:1 2007:4 |

||||

|

Included observations: 32 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

27.36119 |

4.271715 |

6.405200 |

0.0000 |

|

ASSCOST |

1.268267 |

0.046320 |

27.38052 |

0.0000 |

|

R-squared |

0.961523 |

Mean dependent var |

127.4076 |

|

|

Adjusted R-squared |

0.960241 |

S.D. dependent var |

62.77585 |

|

|

S.E. of regression |

12.51733 |

Akaike info criterion |

7.952567 |

|

|

Sum squared resid |

4700.506 |

Schwarz criterion |

8.044175 |

|

|

Log likelihood |

-125.2411 |

F-statistic |

749.6929 |

|

|

Durbin-Watson stat |

0.393104 |

Prob(F-statistic) |

0.000000 |

|

Thus

we get next equation:

![]()

Let us go for consideration the model of dependence

the volume of net export from exchange rate. The dependence of volume of net

export per capita from exchange rate are presented on the Figure 1:

Figure 1.

Let us go to estimate statical model using the MLS:

![]()

The simulation results presented in the table 4:

|

Dependent Variable:

NETEXPORTPC |

||||

|

Method: Least Squares |

||||

|

Date: 02/02/10 Time: 21:33 |

||||

|

Sample: 2000:1 2007:4 |

||||

|

Included observations:

32 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

1.283811 |

0.101125 |

12.69526 |

0.0000 |

|

EXCHRATE |

-0.008384 |

0.000723 |

-11.59348 |

0.0000 |

|

R-squared |

0.817528 |

Mean dependent var |

0.114281 |

|

|

Adjusted R-squared |

0.811446 |

S.D. dependent var |

0.092019 |

|

|

S.E. of regression |

0.039957 |

Akaike info criterion |

-3.541554 |

|

|

Sum squared resid |

0.047897 |

Schwarz criterion |

-3.449945 |

|

|

Log likelihood |

58.66486 |

F-statistic |

134.4088 |

|

|

Durbin-Watson stat |

1.226980 |

Prob(F-statistic) |

0.000000 |

|

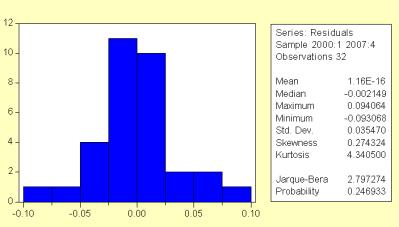

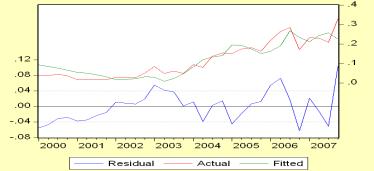

The figure of residual

values is presented on the Figure 2:

It

is found out here obvious autocorrelation of some of the rests which proves to be true by

statistics of Durbin-Watson about presence of positive correlation (0

<1,2270 <dl=1,3734). Thus, we do not deal with statistic model but we

consider dynamic model.

Let

us go for consideration of the dynamic model ADL (1,1,1) – models with

autoregressive distributed delays:

|

Dependent Variable:

NETEXPORTPC |

||||

|

Method: Least Squares |

||||

|

Date: 02/02/10 Time: 22:06 |

||||

|

Sample: 2000:1 2007:4 |

||||

|

Included observations:

32 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

0.661163 |

0.272827 |

2.423378 |

0.0221 |

|

NETEXPORTPC1 |

0.515195 |

0.205146 |

2.511356 |

0.0181 |

|

EXCHRATE |

-0.005290 |

0.001771 |

-2.987363 |

0.0058 |

|

EXCHRATE1 |

0.000995 |

0.001608 |

0.618987 |

0.5409 |

|

R-squared |

0.851418 |

Mean dependent var |

0.114281 |

|

|

Adjusted R-squared |

0.835498 |

S.D. dependent var |

0.092019 |

|

|

S.E. of regression |

0.037322 |

Akaike info criterion |

-3.622011 |

|

|

Sum squared resid |

0.039002 |

Schwarz criterion |

-3.438794 |

|

|

Log likelihood |

61.95218 |

F-statistic |

53.48253 |

|

|

Durbin-Watson stat |

1.640041 |

Prob(F-statistic) |

0.000000 |

|

The analysis of residual values:

- is not find out here autocorrelation (Ð-criteria Breush-Godfrey

ÀR(1) alternative 0,69)

|

Breusch-Godfrey Serial Correlation LM

Test: |

|||

|

F-statistic |

0.162881 |

Probability |

0.689697 |

|

Obs*R-squared |

0.191886 |

Probability |

0.661351 |

- is not find out here departure from the

normality of distribution et (P-criteria

Jarque-Bera=0,247)

-

is not find

out here the

heteroscedasticity (Ð-criteria White = 0,09):

|

White

Heteroskedasticity Test: |

|||

|

F-statistic |

2.059493 |

Probability |

0.094834 |

|

Obs*R-squared |

10.58498 |

Probability |

0.102082 |

Summarizing,

it is possible, based on the above-stated data, to use the theory of

statistical conclusions and on its basis to use the results obtained at

application of t and F-criteria. Factor at exchrate1

statistically is not sufficient. Thus, have received model of dependence of

volume of net export from the exchange rate:

The

given equation shows inverse relationship between the exchange rate and volume

of net export, thereby theoretical conditions are observed.

So, the given work investigated influence of the

transmission

mechanism of monetary policy on

dynamics of investments into the

fixed capital. Interaction of financial and real sectors

of economy is shown through the transmission mechanism allowing the central bank to

influence to the level of demand and offer in the country through interest

rates.

As a result theoretical preconditions about influence

of analyzed factors have been confirmed by empirical calculations and presented

as econometrical models which can be used by researchers for performing of

economical analysis.

At the same time, the prices for the real estate and

access to crediting make the greatest influence dynamics of investments among

the considered four channels of the transmission mechanism of the monetary and

credit policy.

Structure and functions of process of the monetary

transmission on the percentage channel are presented by stage transfer of

regulating impulses through the chain of interest rates by the principle from

short-term to the long-term rate.

For achievement of final goals of monetary and credit

regulation of the central bank activity should be directed for dynamical

process of price adaptation of banks in the market of interbank credits.

List of sources

1.

Statistical yearbooks of the Kazakhstan Statistics

Agency// http://www.stat.kz;

2.

Bank for

international Settlements (2001b) Modeling aspects of the inflation process and

the monetary transmission mechanism in emerging market countries, BIS Papers,

No8, November

3.

Rumyanceva O.

Monetary regulation and the questions of money supply optimization // Bank

bulletin, 2006, Feb, p. 104-108, P. 105

4.

Brishtilev A.

Interest rate channel of transmission mechanism of monetary policy// Bank

bulletin, Jan., 2007, p. 35-41, P. 36.

5.

Tobin J.

Monetary policies and the economy: the transmission mechanism // Southern

Economic Journal, 44, 1978, pp. 421-431.

6.

Bernanke, Ben

S., Mark Gertler Inside the Black Box: The Credit Channel of Monetary Policy

Transmission // Journal of Economic Perspectives, Fall 1995, 9, p. 27-48.

7.

Agency of the Republic of Kazakhstan on regulation and supervision

of financial market and financial organizations// http://www.afn.kz

8.

Annual

Report of National Bank of Kazakhstan, 2007, http://www.nationalbank.kz