Economics

/6.Marketing and Management

Ph.D. in Economics F.I.Bokizhanova,

Ph.D. in Economics E.B.Romanko

Buketov Karaganda State University, Kazakhstan

Methodology of the project management.

We may

say for sure that today project management methodology (PM) has proven its

right to be one of the most highly effective methods of successful projects. In

many countries around the world view of project planning, the general concept

of determining the content and boundaries of the project, scheduling, cost control,

tracking the progress of the project have become part of everyday life of

managers working in various application areas. However, the market is not

static, and the increasing competition is forcing companies to seek new and

more effective ways to improve the success of ongoing projects and the quality

of products and services. Increasingly, the attention of project managers and

their managers drawn to methods of allowing not only to successfully plan and

implement the project within the available budget and schedule, but skillfully

avoid all the "reefs", seemingly stemming from uncontrollable

factors. So, the article is dedicated to the project management section, called

"risk management". Risk Management (RM) - is a set of knowledge and

skills which allows planning and implementing actions to respond to negative or

positive developments that have a certain degree of probability of occurring

during the project in case of budget implementation and project schedule.

Worldwide,

RM exists as a separate discipline - just like many other disciplines, united

in a common project management methodology. Thus, all components of the PM

methodology are not the know-how. Furthermore, we undertake to say that the

novelty of this methodology is to integrate a variety of methods and fields of

knowledge, eventually describing all aspects of a managed project. That it is

the basis of a project management "miracle", which allows to be

called as the most successful methodology for projects implementation. Therefore,

risk management will be considered in connection with other major parts of

project management. It should be said that in one article, we certainly will

not be able to touch all parts of the PM methodology, which may be considered

in relation to risk management. To create a complete picture we would have to

rebuild the project management knowledge. Therefore, we will focus on several

examples that, in our opinion, illustrate all said above very well. Based on

the definition of project management, Project Risk Management consists of four

main components: risk identification, risk assessment, risk develop responses

and risk control. Risk identification is- a process carried out in the first

place and then accompanies the management of the project until its completion.

Various methods of group work (brainstorming, nominal group and Delphi), as

well as an analysis of similar projects in similar areas with the participation

of external or internal company experts are recommended to be used its

implement and other manuals on project management. But the logic of the

integrated project management teaches us that to determine the risk we have to

use mechanisms that are relevant to other PM areas. One such mechanism is the

project work breakdown structure or WBS. Formally, it refers to the management

of content and scope of the project, but in fact widely used in almost all

other areas of PM knowledge and has become a PM methodology "visit card

". Indeed, what other logical ways we can determine as accurately as all

possible project work related to the manifestation of certain risk events? It

is known that at the stage of project planning completion all the project work

defined by WBS, should describe the project content and its scope to 95%. This

gives us a chance to determine all the potential "points of risk

manifestation” with a high degree of probability. However, WBS – is not just

the diagram shown on a paper. It is a virtual map of meetings with the

participation of project stakeholders, with these or other expertise skills on

the project content and its boundaries.

Thus

while WBS discussing and developing, we can successfully get a large amount of

expert confirmed information regarding project risks. Finally, the WBS logical

structure gives us the ability of organized and progressive review of all

project components on the potential risks’ subject. Risk and project budget:

the cost of risk and risk management cost in management project, we are faced

with the risk analysis of the project budget at the very first stage. Indeed,

in the drafting project plan process including the priority of operations at

the end of its work is initiated in the process of developing detailed project

budget, which is formed due to the valuation of WBS work. Moreover, if we are

aimed to maximize the quality and accuracy of our estimates, we should

undertake a statistical analysis according to a method similar to the analysis

of the project duration. Let’s put in remembrance that when we use this analysis,

we calculate the end date of the project in accordance with the dates of its

work completion as a kind of gap values corresponding to the average length of

± 2 standard deviations. According to statistics, the actual date of project

completion has to get into this gap with a 95.5 percent chance. To calculate

the standard deviation (sigma, σ) and mean (X), we use the empirically derived

formula:

X = (X1 + 4*Õ2 + Õ3) /6, σ = (ÕÇ-Õ1) /6,

Where X1-optimistic

value, X2- the most probable value, X3- pessimistic value.

In assessing works the value optimistic, pessimistic and most probable

values - these are three independent variables provided by project team members

who are responsible for budgeting. What principles do we use in determining

three independent values of the cost? Obviously, in the

case of an optimistic value, we consider the rare case when the entire project

goes well. Pessimistic value corresponds to situations in which the performers

manage to step on every rake. In forming the most

probable value, we assume that some of the problems evidenced in the project,

as part of the work has not been implemented. In other words, these three

cases, we estimate the cost for a given task based on the analysis associated

with this task. We describe a method for obtaining

quantitative estimates of optimistic, pessimistic and most probable values of

the project works cost. It is known that the risk is the same work project, as

well as any of the WBS components, in a case that the work might appear, and

may not appear in the course of its implementation. Thus, each risk corresponds to a certain probable value of its

manifestations. In the case of risk manifestations, it becomes a work which

should be performed and is associated with a certain magnitude of cost value -

this value is called "impact risk". In order to further risk analysis and ranking them in importance to the

company and the project, we introduce the third value - the so-called expected risk

value: PI = probable * impact (money units.). Probability of the risk impact

and the expected risk value are used to the compilation of the “estimates of

multiple values". In calculating the

cost of a pessimistic value, we use the magnitude of the effect of all the

risks associated with this work. In calculating the value of an optimistic, we

assume that certain risks in this study will not show up, i.e., the probability

value is 0. In assessing the most probable value, we use

the expected risk value, suggesting that in a real project the risks will be identified

to implement in full effect, some will not occur or will be partially neutralized

to take positive risks (“opportunities”). Turning to a further stage of planning cost, to the budget formation,

we will use the knowledge and presenting of the risks project. In particular,

on the base of the expected risk value, budget for incidental costs develops.

According to the PM methodology, it is the main part of the overall budget project.

Another part of the budget project, the so-called management reserve, put into

the budget in case of manifestation of the unknown (not identified) risks of the

project. It should be emphasized that these risks are necessarily present in

every project, and their proportion depends on which particular area of the

project is implemented. Further management

risk principles are used and the implementation phase of the project - in the

course of tracking the development of the project with the help of favorite

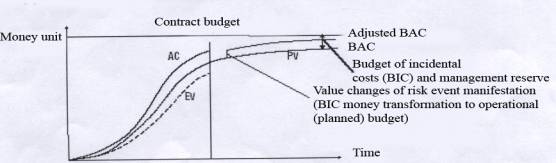

project managers on earned value report. In the classical method of earned

value, we consider the three curves (see Fig. 1), corresponding to three types

of collected data - AC (actual cost), PV (planned value) and EV (earned value).

It is considered that the collected data refers only to two curves - AC and EV,

and projected price is deferred on the basis of the original project plan.

However, as the project is carried out and other risks are implemented or

upcoming, budgeted money of contingency costs and which is shown on the graph

as a fixed quantity of end-point PV curve (budget at completion point),

transferred in the operating budget and is added to the PV curve, showing its

step increase. As a result, changes in the total amount, operating budget and

the position of the point BAC are adjusted.

Figure 1. Reports on the earned value

One could consider many other interesting convergence points of risk

management and management cost project. In particular, methods researching of

the project are based on the so-called cost-benefits analysis and reduced to

the analysis of risk tolerance of the company in financial terms for a project

with different levels of profits and other benefits.

At this

place, we would like to stop the argument about the cost characteristics of the

project and proceed to more unconventional aspects of risk management – to the

risks schedule project. Time Management and Project Risk Management: Risk and

scheduling, at first we think of value, that is, monetary risks while reviewing

the project risks. But we should not forget that the on time project

implementation involves certain risks, which in this case can be expressed in

terms of schedule.

Above

we have considered methods of risks account in the final budget for the

project. Whereas we have already postulated integrality of project management

as a methodology, it is easy to assume that such techniques should also exist

in terms of time management.

And

indeed, such methods exist; they are so-called buffer mechanisms for developing

schedules, or buffered schedules. The logic behind this methodology is simple.

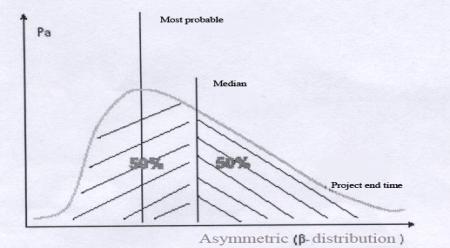

From the viewpoint of probability theory to various possible values of the end

of the project corresponds to a probability distribution of occurrence of these

values. If we assume that it is normal, its mode will be located at the point

corresponding to the most probable time of project completion (Fig.2). More

often we use this quantity to promise our clients this or that date of the

project end. However, it is easy to see that for the normal distribution mode

coincides with the median.

Fig.2

Standard deviation and probability

However,

in real projects the probability distribution of both cost and time of project

completion- usually does not correspond to normal, and is asymmetric to the

right (see Fig. 3). The reasons are obvious: there are much more random factors

leading to a rise in the cost project and increase the duration of its

implementation than the factors working in opposite direction. In other words,

the total value of the "negative" risk is always greater than the

"positive" risks, i.e., "opportunities".

Fig.3

Probable schedule (or budget) distribution.

In this

case, the most probable value is on the left of the median which is usually

represented to our client. Accordingly, the probability of the project

completion after the deadline becomes higher than 50%. Increase depends on the

shape of probable distribution. By analogy with the described above method of cost

project determining, instead of choosing the most probable value, we will focus

on the value that will give us a 95

percent instead of 50 per cent probability that we will be right – viz.,

average + two standard deviations. However, it would be irrational to leave

this extra time at the end of the project. In the case of inevitable

manifestations of these or other risks, all schedules will have to be remade from

the very beginning. Firstly, it becomes difficult for a sufficiently long

duration of the project and a large number of participants, and secondly, it undermines

team’s faith in the manager’s ability of making schedules. For solving this

problem, schedule with the buffer was offered. This method is simple. Float

which neutralized a certain risk events is distributed over the work of the

project in any way. As a base of the buffer allocation is a frequent

probability of risk in a particular work and the degree of exposure. The

Israeli manager Goldratt offered a pretty way in his critical chain theory.

Goldratt’s critical chain – is a standard critical path of the project with

limited resources, i.e., the sequence of project operations, delay

implementation of any of them will postpone the date of n of the project

completion, showing the allocation resources for these works.

All

other works, Goldratt presents in the form of incoming (feeding -

"nursing") chains of the project. In contrast to the standard distribution

method of the buffer on the tasks of the critical path, Goldratt also offers to

calculate the total value 2 & sigma: for each incoming chain. Further it is

offered to plan the schedule according to the dates of the late start and

finish, that is very late dates of the beginning of the work without changing

the time the project ends. According to Goldratt, it gives us the opportunity

to spend much time studying the problem and gathers information before

starting, and thus reduces the potential risks that we may face in carrying out

these works. It’s important to include the planned end date and beginning on

the part of the buffer chain, allocated to this work, in order not to

compromise the work performance of the critical path associated with one or

other input chain. Goldratt's method considers not only risks, breaking

deadline periods of the critical path, but also takes into account the

possibility of delays due to work performance of incoming chains. As the

example of risk management communication, and other project management areas,

we consider one of the most well-known and rather old methods of quality

management. Control diagrams: the use of quality management methodology to

identify the unknown risks of the project during its implementation.

Considering the correspondences between the methods of risk management and

other areas of project management, we touched on identifying, assessing and

responding to risk events. One of the interesting risk management aspects,

which still has not been touched in this article - is a risk control, or

rather, the risk event mechanism of advance notice. Indeed,

we know that risks can be divided into known and unknown.

Resources,

which are necessary to "manage" the emerging risks initially

classified as unknown, are placed in reserve management project. However, it

becomes obvious that the unknown risks let drift and we respond to them only as

the manifestation- approaches are expensive. How to lead events and to obtain information about potential manifested unknown

risks in advance, when there is a possibility to adjust the process without

repeating a number of works? One technique that is applicable in the presence

of an element of the project with a number of relatively repetitive works is

one of a very heavily used method of quality control. Method of control

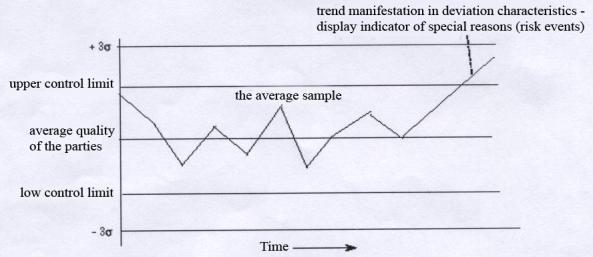

diagrams in its classical form is used to detect specific factors influencing

the course of repeating the process for some time before the actual

manifestation of these factors and, consequently, the waste in the products. The

observation is based on tracking deviations of fixed characteristics of the

product process from pre-defined intervals, deviations, calculated for a priori

normal process. If the deflection characteristics observed during the receipt

of another batch of the product begin to go beyond certain limits (Fig. 4), or

demonstrate the trend, pointing to the emergence of a factor from the category

of special causes, must adjust the process, prefixing the most negative

consequences. It’s easy to observe that this methodology gives the possibility

of unknown risk exposure, which should be revealed at any project strip, but

the place of its manifestations in advance is unknown. Such risk occasion may

become a reason producing defined changes of the process.

Fig. 4 Example of a control diagram.

We would like to accentuate the basic idea that we have tried to put in

a brief overview of this small article. Project management – is deeply

integrated body of knowledge, characterized by internal interdependence of all

its component parts. Therefore, any work done, connected with budget, schedule,

determining the content and boundaries of the project would inevitably

eventually affect also risk management of the project. If the work in all

aspects of project management done correctly and accurately enough, you will

inevitably have to come to an integrated project plan and to the process it

controls. Any changes made in one of his branches, would affect all the others,

and the data obtained by different independent methods of managing cost,

schedule, quality, project risk would be clearly consistent with each other.

Methods and tools for risk management are associated with complex math

calculations, in fact, can be extremely simple and require a minimum of

additional time and resources.

List of used literature:

1. V.V. Sheremet, B.M.Pavluchenko, V.D. Sharipo and others Upravlenie

inverstisiami: V2.T.1.-M.:Visshaya shkola,1998.-416s.

2. M.I.Knish, B.A.Perekatov, U.P. Strategicheskoe planirovanie

investisionnoi deatelnosti: Uchebnoe posobie.- SP.:Izdatelskii dom

“Bizness-Pressa”,1998.-315s.

3.S.U.Surov, N.U.Surova Investisionnii menegment:Uchebnoe posobie.-M.

“Prrior-izdat”,2004.-144s.