D.R. Turarov1, M.N. Sultanova2

1c.e.s., senior lecturer in the department of Economics

1Master of Al-Farabi Kazakh National University, Kazakhstan, Almaty

dauren.83@mail.ru

Application of tools for the performance evaluation of

the Single Accumulative Pension Fund

Abstract. The current stage of the

Republic of Kazakhstan pension system development is characterized by a number

of peculiarities and problems. Today, many alternative ways of development are proposed for the further

improvement of pension system. Given the demographic and macroeconomic

prospects for the next decades, reliance on a full-capitalization system is

unnecessary and problematic, as the experience since 1998 has demonstrated.I

propose a method of system dynamics to predict changes in pension savings and

pension payments, to analyze their dynamics and for decision-making in the

pension policy and to check with the help of System Dynamics is the introduction of the 5% notional component positively affect on the pension system.

The set of

simulation models of the pension system helps to investigate the pension system

as an integrated dynamic system, study the synergistic effect of the

interaction of its elements, influencing factors and control solutions,

including elements of social behavior of people as for selecting the method of

forming a funded pension.

Keywords. Pension System, Single

Accumulative Pension Fund, System Dynamics, Simulation Model, Kazakhstan.

Òhe modern pension system of Kazakhstan dates

back to 1997 when the Kazakh Government approved the Concept of reforming the

country’s pension security system and the “Kazakhstan Pension Security Act” was

adopted. The innovation consisted in developing the basics of a cumulative

pension system and gradually abandoning the old, distributive, pension system [1].

The pension

security of Kazakhstan is currently a three-level system combining mechanisms

of pay-as-you-go system and accumulative system.

Level

One is a pay-as-you-go pension system inherited by

Kazakhstan from the USSR after its collapse where the state budget provided

pension payment source at the expense of tax liabilities of working population

and other receipts. The amount of pension payments is based on the years of

work. Pension payments for those whose period of work by the retirement date as

of January 1, 1998 made at least six months are currently formed within the

frameworks of such level.

Level

Two is a mandatory accumulative pension system with fixed

10% amount of mandatory pension contributions of monthly income for Kazakhstan

residents, foreign nationals and stateless persons who have permanent residence

in Kazakhstan and 5% of mandatory occupational pension contributions at the

employer’s expense of employees’ monthly income and in favour of those

employees whose jobs are provided in the list of activities, jobs and

professions as determined by the Government of the Republic of Kazakhstan

Level

Three is an accumulative system based on voluntary pension

contributions (VPC). VPC amount, payment procedure and further payment shall be

as agreed by the parties to the agreement for pension security at the expense

of VPC [2].

Therefore, the population of the Republic of

Kazakhstan engaged in the pension system shall be responsible for their income

level after retirement as savings generated on their individual pension

accounts will become the source of pension payments.

Every citizen is offered a possibility of increasing

their savings at the expense of voluntary pension contributions and thereby of

providing a higher income after retirement.

The current stage of the Republic of Kazakhstan pension system development

is characterized by a number of peculiarities and problems. Today, many

alternative ways of development are

proposed for the further improvement of pension system. Given the demographic

and macroeconomic prospects for the next decades, reliance on a

full-capitalization system is unnecessary and problematic, as the experience

since 1998 has demonstrated. Making use of a set of simulations that compare

full-capitalization, pay-as-you-go and notional account systems, it is argued

that a system of notional accounts should be the basis of the pension system,

and that the conditions are ripe for adopting it. Individual accounts would

continue, with their returns determined not by market interest rates, but by a

notional rate of return consistent with financial sustainability of the system

over the long term. The notional accounts system would be complemented with a

citizen (universal) pension for all Kazakhs in retirement age. Our task is to

propose a method of system dynamics to predict changes in pension savings and

pension payments, to analyze their dynamics and for decision-making in the pension

policy and to check with the help of System Dynamics is the introduction of the notional component

positively affect on the pension

system.

The set of simulation models of the pension system helps to investigate the

pension system as an integrated dynamic system, study the synergistic effect of

the interaction of its elements, influencing factors and control solutions,

including elements of social behavior of people as for selecting the method of

forming a funded pension. The simulation models’ parameterization is based on

the results of socio-economic processes monitoring.

The developed set of the pension system models can be used by the government to analyze functioning and

formation of a long-term development strategy of the pension system, especially

when justifying the development programs. A final caveat must be kept in mind:

the results presented in this work are subject to biases due to incomplete data

and to the simplified nature of the simulations.

-System dynamics was created during the mid-1950s[3]

by Professor Jay Forrester of the Massachusetts Institute of Technology. His

seminal book Industrial Dynamics (Forrester 1961) is still a significant

statement of philosophy and methodology in the field. Within ten years of its publication, the span of applications

grew from corporate and industrial problems to include the management of

research and development, urban stagnation and decay, commodity cycles, and the

dynamics of growth in a finite world.

It is now applied in economics, public policy, environmental studies,

defense, theory-building in social science, and other areas, as well as its

home field, management. The name

industrial dynamics no longer does justice to the breadth of the field, so it

has become generalized to system dynamics.

The modern name suggests links to other systems methodologies, but the

links are weak and misleading. System

dynamics emerges out of servomechanisms engineering, not general systems theory

or cybernetics (Richardson 1991).

The system dynamics

approach involves:

• Defining problems dynamically, in terms of

graphs over time.

• Striving for an endogenous, behavioral view

of the significant dynamics of a system, a focus inward on the characteristics

of a system that themselves generate or exacerbate the perceived problem.

• Thinking of all concepts in the real system

as continuous quantities interconnected in loops of information feedback and

circular causality.

• Identifying independent stocks or

accumulations (levels) in the system and their inflows and outflows (rates).

• Formulating a behavioral model capable of

reproducing, by itself, the dynamic problem of concern. The model is usually a computer simulation

model expressed in nonlinear equations, but is occasionally left unquantified

as a diagram capturing the stock-and-flow/causal feedback structure of the

system.

• Deriving understandings and applicable policy

insights from the resulting model.

• Implementing changes resulting from

model-based understandings and insights.

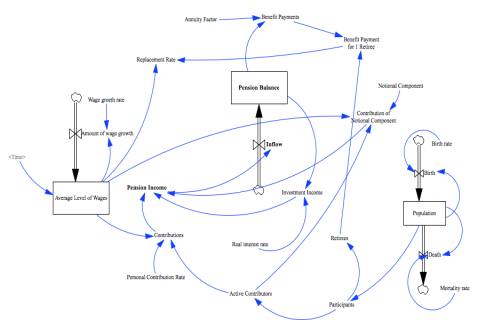

Figure 1. Major elements

in System Dynamics model [from the program Vensim]

The method of System

Dynamics is widely used in different fields such as Physics, Medicine,

Economics, Transport Modeling, Risk Management and etc. System dynamics also

successfully has been applied to some problems of the pension system in several

countries. For example, Dynamics Simulation Approach in Analyzing Pension

Expenditure

of

Malaysian Pension Fund by Hasimah Sapiri, Dynamic Simulation Of Russian Pension

System Development Processes by Lychkina, Dynamic Stochasticity in the control

of liquidity in Asset and Liability Management (ALM) for pension funds by

Ricardo Matos Chaim, Study on China's Pension Gap Based on System Dynamics by

Wei Shao.

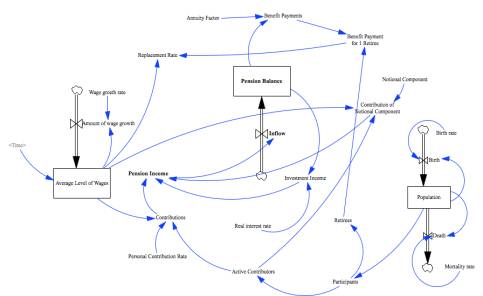

After analysis of the pension system, we have defined the factors having an

impact on the pension income and expenditure. Also we have identified the

relationship between factors and the degree of influence on each other. And in

the end, all the data have been

translated into a computer model using the program Vensim. Statistical data

necessary to calculate the equations are taken from the Single Accumulation

Pension Fund.

This model mainly involves the structure of involving

population on-the-job, pay level, the age structure of pensioner population and

wages. Balance of pension fund is a very important variable, and pension income

and expenditure is the key to the research. Therefore, two subsystems of the

pension income and expenditure are analyzed in the study.

Pension income mainly comes from enterprises payment and individual payment

and the investment income of pension fund. The relationship between them and

their respective are as follows: Firstly when payment rate is set, higher

worker average wage and more of involving workers on-the-job, the more

enterprice payment and individual payment. Secondly, it is positive to the

relationship between the total population

and the involving workers, the larger the total population, the more

involving workers. Thirdly, the higher the return on investment, the higher the

income, investment income and pension income is positive correlation between.

Retiree pension is mainly used to join the pension treatment, mainly

influenced by the worker average wage and factors as pension replacement rate.

The relationship between them and their respective are as follows: Firstly, the

higher the replacement rate, the more pensions, pension replacement rate and

pension spending is positive correlation. Secondly, when the replacement is

set, pensions are positive to the relationship between worker average wage and

the insured number of retired. The higher the retired worker average wage, the

more insured workers, the more pensions.

Now directly about the model itself. Our model will examine the dynamics of

income and expenditure of SAPF. As we mentioned above to build the model, we

used the method of system dynamics. Software Vensim was a tool to build. The model

is designed to support decision-making related to the reform of the pension

system, to the changes in economic factors that have an impact on costs and

revenues of the pension system in the long run.

In the model of

the dinamics of income and expenditure of SAPF the next factors should be

described:

= Conditions for

retirement:

- The rate of

pension contributions,

- Mechanism for

calculating pensions.

= Performance

indicators of SAPF;

- Accumulated balance

- Fund's investment activity

= Population,

namely those who have the need for provision of pensions (pensioners) and the

resources for it (the working population), the level of fertility, mortality;

components of the

pension system: contribution rate, rate of the notional component;

= The level of

wages, which are directly related to pension income.

Let us examine

each component of the model. The Balance of the Pension System is the most

important indicator, and receipts and payments for pension system are the key

factors of the model. Let us consider

them separately.

Figure 2. Model in Vensim

[from the program Vensim]

This article addressed the issue of applying

system dynamics in pension system of Kazakhstan with the aim of developing a

system. To achieve this purpose, the project sets three objectives that

constitute its scope.

Firstly, it covers the current pension situation

in Kazakhstan. Starting from 2013 all pension funds combined to one

accumulative single pension fund. In our research we are viewing two factors of

pension fund: mandatory accumulative pension system with fixed 10% amount and

engage notional component with fixed 5%.

Secondly, in order to to build the model, we

found factors influenced on the pension system, and in the model we viewed 9

scenarios in comparison with the baseline scenario.

Third, in order to know effectively apply system dynamics in the pension

system, and whether it really play. We simply test how the relative indictors,

factors like replacement ratio will be influence by the introduction of nominal

notional component. Of the above scenarios can be seen that it is necessary to

engage national component, because it is a good effect on the overall pension

balance, average level of wages, investment income and etc. We have seen that

the Vensim software facilitates a realistic assessment of the pension system in

all parameters.

Finally, all the objectives were achieved and

the diploma project came to conclusion that the simulation model was tested.

Figures:

Figure 1. Major elements

in System Dynamics model (from the program Vensim)

Figure 2. Model in Vensim

[from the program Vensim]

REFERENCES:

1. http://www.pnhz.kz/ru/?id=1560;

01.02.2016 11:28

2. Official website ENPF - www.enpf.kz;

01.02.2016 12:06

3. System dynamics; Articles of the experts and employees of the TORUS

Center; http://bigc.ru/publications/other/metodology/system_dinamic.php

4. Lychkina N.N., Morozova Y.A., Shults

D.N. Stratification of Socioeconomic Systems Based on the Principles of the

Multi-modeling in a Heterogeneous Information-analytical Environment // 2nd.

International Multi-Conference on Complexity, Informatics and Cybernetics,

Orlando, Florida, USA: International Institute of Informatics and Cybernetics,

March 27th - 30th, 2011. pp. 97-100.

5.

These Official Site of the National Bank of the Republic of Kazakhstan,

http://www.nationalbank.kz, 02.02.2016 18:40

Application

form

|

Surname |

Sultanova |

Turarov |

|

Name |

Muldir |

Dauren |

|

Scientific

degree |

Bachelor |

Candidate of

Economic Sciences |

|

Academic

rank |

- |

Senior

teacher |

|

Position

and Department |

Master

|

Senior

teacher ofEconomic department |

|

The official

name of the workplace |

Al-Farabi Kazakh National University Kazakhstan Republic, 050040, Almaty, al-Farabi

St.,71 t: +77077333038 |

Al-Farabi Kazakh National University Kazakhstan Republic, 050040, Almaty, al-Farabi St., 71 t: +77074939951 |