D.e.s

Dulambaeva R.T., Akynbayeva M.E.

Kazakh National University

named by Al-Farabi, Kazakhstan

Problems of agricultural insurance

development in the Republic of Kazakhstan

Despite all the advances achieved in science and technology, the most

important industry for the humankind– agriculture- is still remained dependent

on the vagaries of nature. Heavy rains or prolonged frosts could serve as a

real disaster for farmers. Insuring the

risks in agricultural production is a globally important system’s element in

provision of finance and credit support to agricultural producers. [1]

Taking

into account a fairly justified risk in crop insurance, insurance (reinsurance)

organizations are not interested in compensation of most likely agricultural

losses as it extracts the major part of savings. Although the mechanisms for the final formation of the agricultural

insurance system - creation of a state farm insurance company

"Kazagropolis" (1996.), Mandatory insurance of agricultural

production (1997.), The adoption of the Law "On obligatory insurance in

crop" (2004.), the adoption of the Law "On mutual insurance"

(2006). - have been brought in our

country, it was observed that the country, according to the Committee on

Statistics of the Republic of Kazakhstan (Table 1),has a low level of activity

of the insurance business in the mandatory insurance of agricultural sector.

Table

1. Number of contracts between insurance companies and agricultural producers

of Kazakhstan (2007 - 2014gg.)

|

|

2007 |

2008 |

2009 |

2010 |

2014 (until 09.01) |

|

Number of contracts (000’s units) |

25,446 |

33,957 |

32,165 |

17,389 |

14525 |

|

thereof MIS(Mutual insurance companies) |

738 |

5792 |

8292 |

9953 |

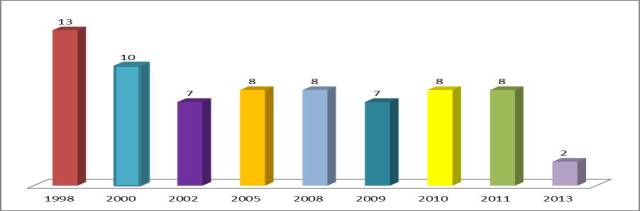

Additionally, the low level of intense activities

among insurance companies, licensed as the mandatory insurance providers, can

be evidenced by the official figures that clearly depict a lack of interest of

insurance companies to this type of insurance and their unwillingness to take

responsibility for the risks in agricultural production occurring throughout

Kazakhstan. (Figure 1)

Figure1.

Number of insurance (reinsurance) companies licensed as the mandatory insurance

providers for agricultural production

Problems of the insurance industry in the agricultural

sphere consist of several systematic problems in this area:

1) The presence of systematic risk

Kazakhstan is in the zone of risky husbandry. The

probability of adverse natural phenomena depends largely on regional factors.

As a result, the frequency of droughts over the years in the whole country is

up to 40% (2 out of 5 years), as for the west of the country, it is up to 60%

(3 out of 5 years).

Unprofitableness also depends on agricultural producers themselves that

do not seek to improve production technology, and in some cases even a slight

deterioration of weather conditions could lead to a loss of a crop due to an

inconsistency of compliance of agricultural technologies at seeding. Besides,

the risk specificity of agriculture gives a rise to make additional

requirements to insurers, such as: the development of the agency network in the

regions or the presence in the state of experts in the technology of growing

crops. All of this requires additional investments that, in return, do not

generate adequate returns. As a result, there is a downward trend of active

players in this segment of market.

The presence of the high risks in this type

of insurance makes it unattractive to insurers. For example, in 2010 there were

six insurance companies that had the relevant licenses for the above type of

insurance, whereas in current days only three insurance companies and 38 mutual

insurance companies carry out operation on mandatory insurance in plant

cultivation.

It should be noted that this type of insurance is

unprofitable though 50% of the insurance payments are compensated by the

government. In this regard, in Kazakhstan mandatory insurance annually on the

average covers only 74% of acreages.

2) The

inadequacy of applicable insurance rates

Law "On obligatory insurance in crop" set

the minimum and maximum rates for groups of crops. Generally, the amount of

insurance premiums is calculated on the minimum insurance rate, which will not

allow generating a sufficient reserve for insurance payments and will lead to

financial instability of insurance companies if insured events occur.

3) Imperfect

settlement system of losses

The existing ban for insurers in terms of the request

to comply with agricultural technology equivalent to a ban on the insurance

investigation, which actually creates a lack of possibility of denial of

insurance benefits, even in the face of clear, demonstrable fraud.[3]

In order

to resolve problematic issues Ministry of Agriculture of the Republic of

Kazakhstan proposes the following measures:

1. Changes in the mechanism

of support of crop insurance by switching from subsidizing insurance payments

to subsidizing insurance premiums based on the experience of the main-crop

producers (Canada, USA, EU).

It is envisaged that state support of mandatory crop

insurance will be implemented by subsidizing insurance premiums paid by the

insured to the insurer under the contract of mandatory insurance.

2. Establishment

of a mechanism of reinsurance of financial risks in the crop insurance by

creating a reinsurance fund of insurance payments in crop - an organization with

one hundred percent involvement of the state and /or national management

holding company created by the government, operating on reinsurance of

financial risks in crop insurance.

For the financial sustainability of the Fund at the

initial stage it is advisable to allocate funds for its capitalization.

3. Clarification

and differentiation of insurance rates by actuarial calculations.

The introduction of more accurate gradation of

insurance rates on climatic zones, taking into the account the frequency of

adverse natural phenomena on the basis of statistics and agent actuarial

calculations, is envisaged.

4. Exclusion of

mutual insurance companies from the system of mandatory insurance in crop.

The need to exclude mutual companies from the system

of mandatory crop insurance is caused by the problems of the practical

realization of the Law "On mutual insurance" and low efficiency of

their operations.

5. Extension of

crop species covered by insurance (with the inclusion of vegetables and melons,

potatoes, fodder crops)

In accordance with the policy of crop diversification

of melons, potatoes, fodder crops areas will be significantly expanded in the

future. This requires taking the measures to cover these crops by agricultural

insurance.

In the description of the

existing problems, it was correctly pointed out that the unprotifableness

depends on agricultural producers themselves that do not

seek to improve production technology, and in some cases even a slight deterioration

of weather conditions could lead to the loss of a crop due to the inconsistency

of compliance of the agricultural technologies at seeding. Then, it is worth

adding that in current days there is no certification of arable land (i.e.

information about which crops can be sown in considered land) on the basis of

which the insurer could determine insurance risks of any farmer in terms of the

non-compliance of agricultural technologies. [4]

Moreover, as the insurance amount is determined in the sum value of the

crop (on average yield for the area) and costs of agronomic measures, in the

case of crop losses at the stage of germination agricultural producers will be

better off if they hide the fact of the occurrence of insured event. That is,

insured event increases the amount of insurance payments. This takes a place

because there are no objective means of monitoring agronomic measures under

which the insurer could determine the actual losses under a separate contract

of insurance or identify fraudulent activities on the part of the insured. As

these important issues were not reflected in the current version of the law,

the unscrupulous agricultural producers could directly take a part in

fraudulent activities to obtain insurance payment again.[5]

In general, there are a

lot of problems in agricultural insurance and approaches to their solutions

should be systematic, analytical, accounting on consequences of changes to be

applied on the insurance legislation.

References:

1. Bakirov AF On the method of subsidizing the damage

for insurance in agriculture // Economics of agricultural and processing

enterprises. 2012.

2. Nikitin convergence programs of agricultural

insurance .// Agroinsurance and lending.

3. Problems of development of agricultural insurance,

Magazine "The insurance market«

http://www.allinsurance.kz/index.php/chto-poseesh-to-i-pozhnyosh.html

4. Tereshenkov D. Improving the system of agricultural

insurance .// agribusiness economics, management. 2006.

5. Prospects for the development of agricultural

insurance market. Irina Sokolova http://www.kgau.ru/img/konferenc/62.doc