Skvortsov E.N.

Ogarev Mordovia State University, Russia

CONSTRUCTING OF EFFECTIVE SYSTEM OF ACCOUNTS

RECEIVABLE MANAGEMENT IN THE ORGANIZATION

The liquidity of the current assets is the main

determinant of the risk of investing in working capital. Accumulated assess of feasibility

of different types of working capital over a long period of time can determine

the probability of risk of investments in these assets. In order to minimize

the risks associated with accounts receivable, the organization needs a comprehensive

approach for accounts receivable management.

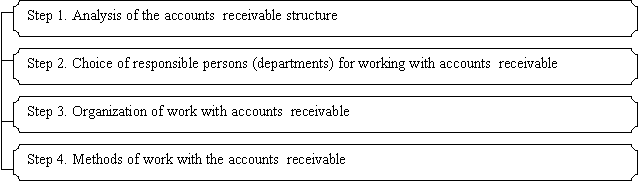

Construction of such system in the organization

should consist of four stages (Figure 1).

Figure 1 -

Stages of constructing of accounts receivable management system in organization

Step 1. Analysis of accounts receivable (next -

AR) structure. At this stage, the focus should be on common approaches of AR analysis

of organizations, common sharing of AR in structure for understanding the “state”

of AR and decisions on further work. At specified intervals specialists of organizations

should analyze accounts receivables of personal list of counterparties, terms

of formation

|

|

|

and size; control settled payments deferred or overdue, assess the tangibility

of presence of the accounts receivables, to determine ways of accelerating

demand debt and reducing bad debt.

The analysis may include an evaluation of the

absolute and relative indicators of the structure and movement of accounts

receivables.

Additional information may be taken from

rankings of accounts receivables depending on terms of its origin, such as the

30-day intervals, and analysis of its change. To do this, it should be selected

the share of bad debts and its dynamics considered. The growth will indicate the

increasing of risk of non-repayment of accounts receivables and the possibilities

of overdue debts formation.

Operational information about the current debt,

including the period overdue debt, the history of relationship with the

customer, the amount and regularity of their ongoing purchases, its share in

revenues and gross profit, the number of violations of the terms of payment in

the previous periods is very important.

And finally, it should be calculated the actual

accounts receivable with the rate of inflation and depreciation during the late

payment, collection period, losses from not collected payments and write-offs.

The analysis of accounts receivable should be

considered when company plans its future activities.

It is recommended to create some reports in CRM,

1C or simply analyze arrays debtors on the Excel for the analysis of AR. Basic

information: the date of conclusion, date of payment, the amount of contracts, customer

category, etc.

Step 2. Choice of responsible persons

(department) for work with AR. At this stage, the attention should be paid to

choosing of the company`s organizational structure to work with the AR: the

pros and cons of the various responsible persons; the motivation for action; the

control center for work with the AR.

Step 3.Organization of working with the accounts

receivable. At this stage the attention should be focused on the transition

from the issues of deciding who work with AR to how the work will take place at

the organizational level, at the mechanism level, rules of interaction, at the

methods regulation and control:

a) the creation of business processes, policies

and procedures for managing the AR;

b) the formation of a balanced indicators of performance

units (next - IPU);

c) the development of schemes of motivation

based on the IPU, the creation of job descriptions, training of staff

responsible for working with the AR;

d) the creation of system of control and internal

management reporting in CRM for financial analysis and evaluation of the work

of specialists: the choice of performance indicators for the analysis of

responsible staff ('the impact of calls ", the number of calls and

meetings, written letters, paid bills, etc). Ideal option for company will be

the situation when the supervision of staff and indicators of AR could be

carried out automatically by means of reports in CRM systems.

Step 4. Methods of work with the AR. This step includes:

customer calls, writing letters, the interaction with accountants of company to

prepare the documents for the client, meeting with clients, negotiating,

recording information about working with AR. Benefits of prejudicial settlement

of debt - is the lack of additional costs associated with going to court

without prejudice for reputation and partner`s relationship. The financial methods

of influence on the debtors with delay in payment include: the application of

penalties, proposals for offsets, debt restructuring, sale of debt, initiation

of bankruptcy proceedings, etc.

In case of futility of all reasonable actions

the organization can collect the debt through the court. Usually going to court results breaking of the

partnership, but also can be the beginning of a constructive dialogue with the

debtor. In the future, new debtors, knowing that the debt provider always

resolves disputes through the court will try to avoid delay in payment.

Summing up, it should be noted that the increase

in the liquidity of current assets organization can be achieved by constructing

of system of accounts receivable management, this work should be carried out in

stages: stage 1 - analysis of the structure of the accounts receivable; stage 2

- the choice of responsible entities (departments) to work with accounts

receivable 3 stage - organization of work with accounts receivable; stage 4 - methods

of work with the accounts receivable.